Rectangles, triangles, and other shapes and patterns learned at an early age are some of the easiest to recognize. Interestingly, these shame shapes and patterns often form on the price charts of cryptocurrencies like Bitcoin and other financial assets, allowing analysts, investors, and traders to predict potential future outcomes of price movements.

Mastering the ability to identify and exploit these patterns is an invaluable skill. When coupled with a sound strategy, effective risk management, and appropriate trading psychology, it can pave the way to considerable success, regardless of the chosen cryptocurrency.

This guide can be used as a reference, primer, and cheat sheet all-in-one, for the most commonly found crypto chart patterns today.

Can You Pattern Trade Crypto?

Cryptocurrencies, while gaining widespread adoption, are still highly speculative and highly volatile assets, making them ideal for trading. Because human emotion drives the price behavior in these markets, crypto assets like Bitcoin and Ethereum respond especially well to technical analysis, and more specifically, chart patterns.

Speculators love to talk about which Bitcoin price patterns they see, for example, and are often subjective to the viewer. The same bullish chart pattern might develop further, and eventually turn into a larger, bearish pattern. Thus, learning as many of these patterns as possible is the most beneficial.

To make it easier, we’ve created this Crypto Pattern Cheat Sheet.

Does Pattern Day Trading Apply To Crypto?

Because cryptocurrencies respond so well to technical analysis and trades 24/7, and because all patterns appear regardless of the time frame – no matter how minor – traders can make money non-stop by day trading cryptocurrencies.

Unlike other markets that close down, the term “day” is subjecting. In crypto, the trading day never quite ends, which makes day trading much more accessible to all.

How Do You Read A Crypto Chart Pattern

Cryptocurrency price charts consist of a price ticker which shows the two symbols related to the trading pair. For example, BTCUSD is the trading pair of Bitcoin against the dollar. The first currency in the pair is called the base currency, while the second is the quote currency. This suggests that in the BTCUSD example, the price of Bitcoin is quoted in US dollars. The price line is the horizontal line which shows the most recent price the asset was traded at.

Price rises and falls depending on the trading action between the two pairs. This is usually represented as a line chart, or more commonly as Japanese candlesticks. It is the line or candlesticks that a technical analyst draws lines across to discover and highlight potential chart patterns. Most price charts also include trading volume, which along with price is what technical analysts use for data.

You can learn more about how to read crypto price charts here.

Types of Cryptocurrency Charts Patterns

Cryptocurrency chart patterns aren’t always visible immediately, and require several touches of each trend line acting as a boundary to the pattern. It is when the boundary breaks that we often discover the truth if the pattern was valid or not.

Oftentimes, patterns don’t quite react as expected, which reveals the formation of another pattern. A good technical analyst is like a detective, always using the most recent information available to them. Although these patterns are accurate more often than not, it is wise to be flexible and to look for confirmation by pairing patterns with technical indicators.

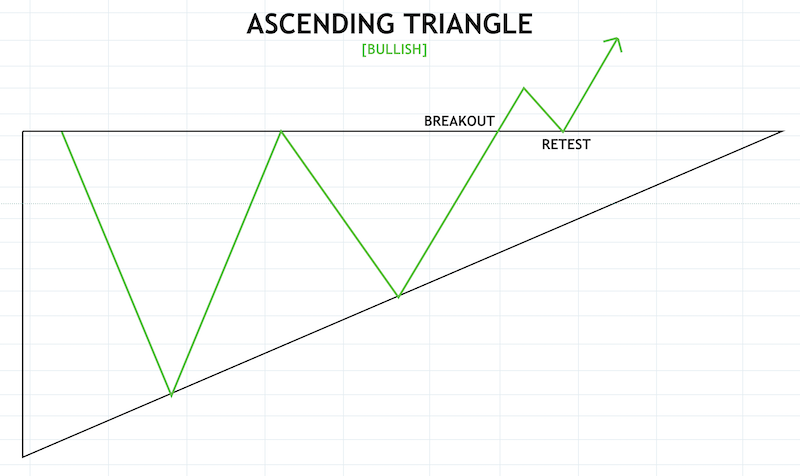

Ascending Triangle

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| ASCENDING TRIANGLE | BULLISH | CONTINUATION | BUY/HOLD |

- Description: A triangle shaped pattern with a flat upper trend line acting as resistance and a rising diagonal line acting as support.

- How To Read This Pattern: Two to three touches of each trend line are necessary for the pattern to be considered valid.

- What It Shows Happening: Buyers become more aggressive as confidence gains, eventually pushing through strong resistance and causing a surge to the upside.

- Expected Performance: Breakouts are typically bullish. Pattern targets can be found by measuring from the widest point of the triangle from resistance to support, then applying the distance to the breakout.

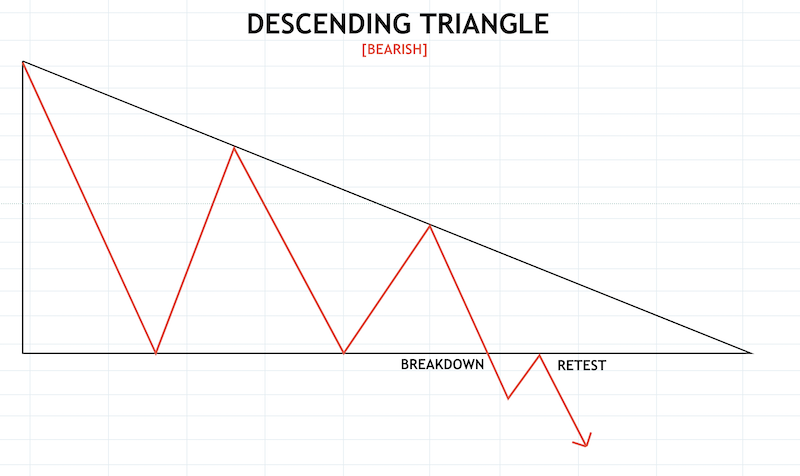

Descending Triangle

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| DESCENDING TRIANGLE | BEARISH | CONTINUATION | SELL/HOLD |

- Description: A triangle shaped pattern with a flat line for the lower trend line acting as support and a descending trend line acting as resistance.

- How To Read This Pattern: Two to three touches of each trend line are necessary for the pattern to be considered valid.

- What It Shows Happening: Sellers become more aggressive as confidence gains, eventually pushing through support and causing a breakdown to the next trading range.

- Expected Performance: Breakdowns are usually bearish. Pattern targets can be found by measuring from the widest point of the triangle from resistance to support, then applying the distance to the breakdown.

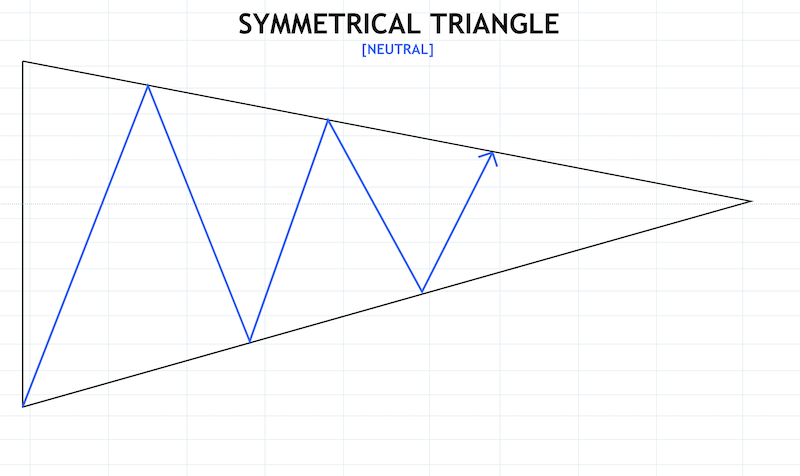

Symmetrical Triangle

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| SYMMETRICAL TRIANGLE | NEUTRAL | CONTINUATION | HOLD |

- Description: A triangle shaped pattern with a descending upper trend line acting as resistance and a rising trend line acting as support.

- How To Read This Pattern: Two to three touches of each price trend line are necessary for the pattern to be considered valid.

- What It Shows Happening: This pattern shows indecision, and an equal effort of force from bears and bulls. As resistance and support converges, a breakout occurs near the apex.

- Expected Performance: Breakouts can be bullish or bearish, making it a neutral chart pattern. Pattern targets can be found by measuring from the widest point of the triangle from resistance to support, then applying the distance to the breakout.

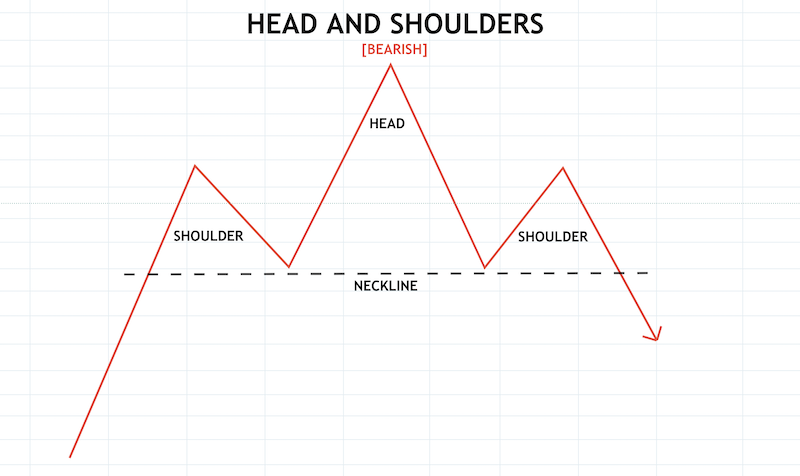

Head and Shoulders

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| HEAD AND SHOULDERS | BEARISH | REVERSAL | SELL |

- Description: A reversal pattern that typically forms at the peak of a rally, that resembles a head between two shoulders.

- How To Read This Pattern: The pattern should rise and fall to form an obvious neckline, which once passed through, often triggers the move.

- What It Shows Happening: This pattern demonstrates a tug of war between buyers and sellers, with sellers gaining the upper hand at a key level that triggers more stop losses than normal.

- Expected Performance: Head and shoulders typically reverse to the downside, but the neckline is often retested before the target is reached. The target can be found by taking the height of the head to the neckline, and applying it to the point of breakdown.

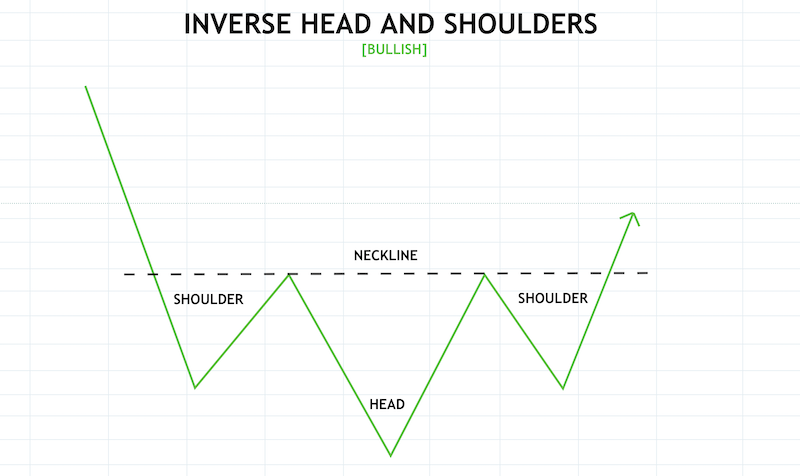

Inverse Head and Shoulders

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| INVERSE HEAD & SHOULDERS | BULLISH | REVERSAL | BUY |

- Description: A reversal pattern that typically forms at the bottom of a trough that resembles an upside-down head between two shoulders.

- How To Read This Pattern: The pattern should fall and rise to form an obvious neckline, which once passed through, often triggers the move.

- What It Shows Happening: This pattern demonstrates a tug of war between buyers and sellers, with buyers gaining the upper hand at a key level that triggers more stop losses than normal.

- Expected Performance: Inverse head and shoulders typically reverse to the upside, but the neckline is often retested before the target is reached. The target can be found by taking the height of the head to the neckline, and applying it to the point of breakdown.

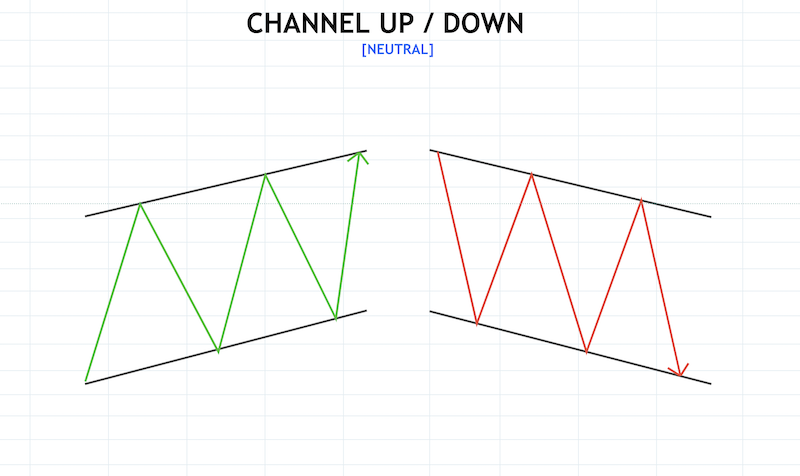

Channel Down / Up

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| CHANNEL | NEUTRAL | SIDEWAYS | HOLD |

- Description: Channels are two trend lines that act as boundaries to a larger market trend. Channels can form at the bottom, top, or mid-point of moves, making them a neutral chart pattern.

- How To Read This Pattern: Channels form during consolidation. At least three touches of each trend line is necessary for the channel to be considered valid.

- What It Shows Happening: Channels show indecision that moves in the direction of a larger trend, facilitating intraday trends to take place. Channels can look like a bull flag, with the key difference that flags only last weeks at most, while channels can last months to years at a time.

- Expected Performance: Because channels form during consolidation, they can break to the upside or downside, however, they most commonly break out opposite the direction of the slope of the trend lines.

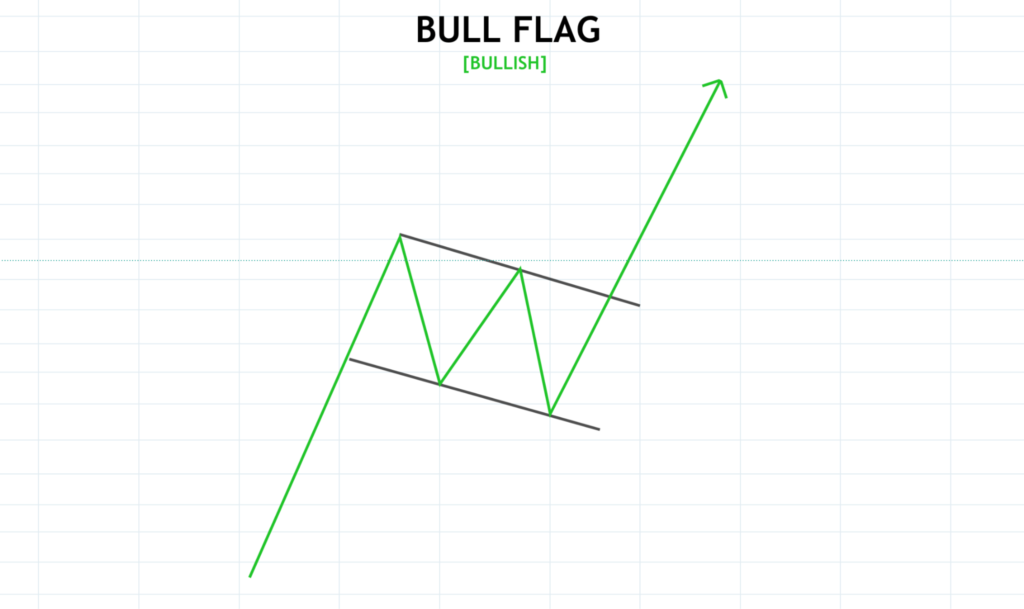

Bullish Flag

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| BULL FLAG | BULLISH | CONTINUATION | BUY/HOLD |

- Description: A bullish continuation pattern that often appears at the mid-point of impulse moves and uptrends.

- How To Read This Pattern: A large move up, forming a pole, followed by consolidation and another similar move up.

- What It Shows Happening: A pole forms when sellers are taken by surprise by the strength of bulls. When resistance is reached, a bull flag will consolidate often in the opposite direction of the initial move. Eventually, buyers push through resistance and bears are again taken by surprise.

- Expected Performance: The target of a bull flag can be measured by taking the length of the pole and applying it to the point of breakout. The second bull flag in series is often sharper than a second, due to the second flag also including sellers covering from the first flag.

Bearish Flag

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| BEAR FLAG | BEARISH | CONTINUATION | SELL/HOLD |

- Description: A bearish continuation pattern that often appears at the mid-point of impulse moves and downtrends.

- How To Read This Pattern: A large move down, forming a pole, followed by consolidation and another similar move down.

- What It Shows Happening: A pole forms when buyers are taken by surprise by the strength of bears. When base support is reached, a bear flag will consolidate often in the opposite direction of the initial move. Eventually, sellers push through support and bulls are again taken by surprise.

- Expected Performance: The target of a bear flag can be measured by taking the length of the pole and applying it to the point of breakdown. The second bear flag in series is often sharper than a second, due to the second flag also including buyer stop losses being hit from the first move.

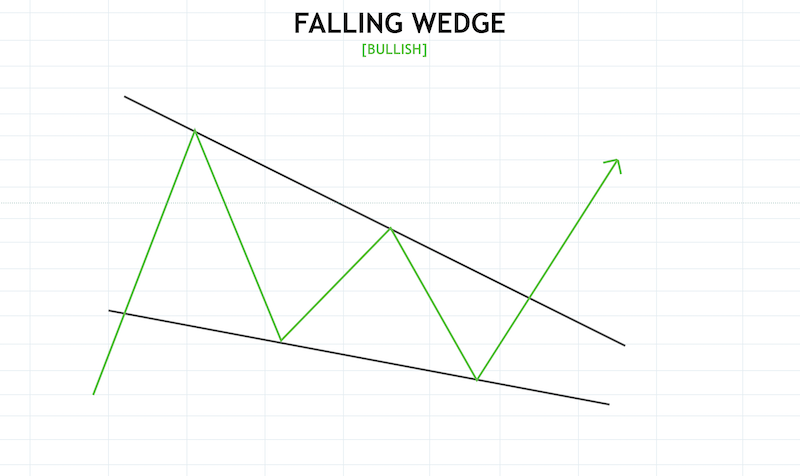

Falling Wedge

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| FALLING WEDGE | BULLISH | CONTINUATION/REVERSAL | BUY/HOLD |

- Description: A bullish reversal or continuation pattern.

- How To Read This Pattern: Two converging downward sloping trend lines that form a wedge shape.

- What It Shows Happening: A wedge shows a short-term trend change in the making, slowly bouncing off lower resistance levels and lower support levels, until a sharp reversal sends price in the opposite direction.

- Expected Performance: Wedges often retrace to at least above the second resistance line. Falling wedges appear at the bottom or mid-point of moves.

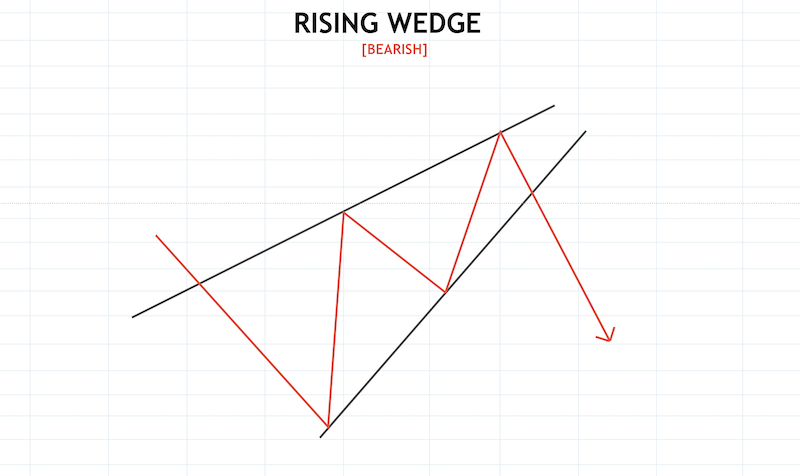

Rising Wedge

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| RISING WEDGE | BEARSH | CONTINUATION/REVERSAL | SELL/HOLD |

- Description: A bearish reversal or continuation pattern.

- How To Read This Pattern: Two converging upward sloping trend lines that form a wedge shape.

- What It Shows Happening: A wedge shows a short-term trend change in the making, slowly bouncing off higher resistance levels and higher support levels, until a sharp reversal sends price in the opposite direction.

- Expected Performance: Wedges often retrace to at least above the second resistance level. Rising wedges appear at the top or mid-point of moves.

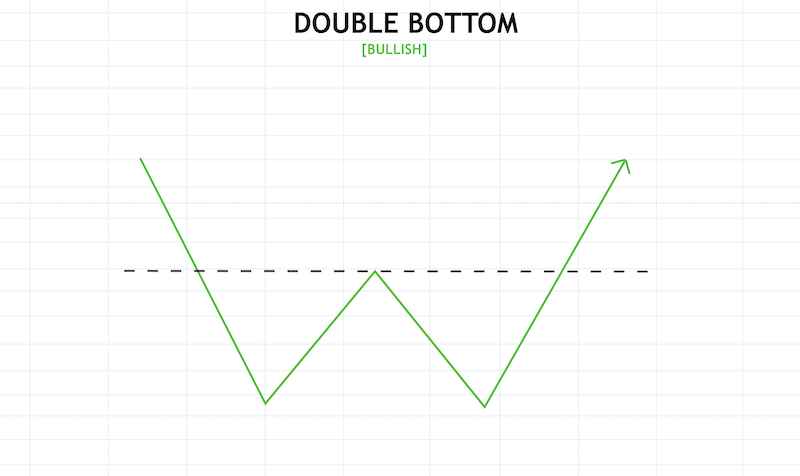

Double Bottom

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| DOUBLE BOTTOM | BULLISH | REVERSAL | BUY |

- Description: A bottoming pattern that takes more than one attempt. Also called a W-bottom.

- How To Read This Pattern: A first bounce off support fails, forming a neckline. The second bounce off support is successful with breaking through resistance and a reversal is confirmed.

- What It Shows Happening: More buyers step up to buy support at the retest, providing the strength to push through resistance that previously failed.

- Expected Performance: Targets can be found by taking the bottom of the move to the neckline and applying it to the neckline after breakout.

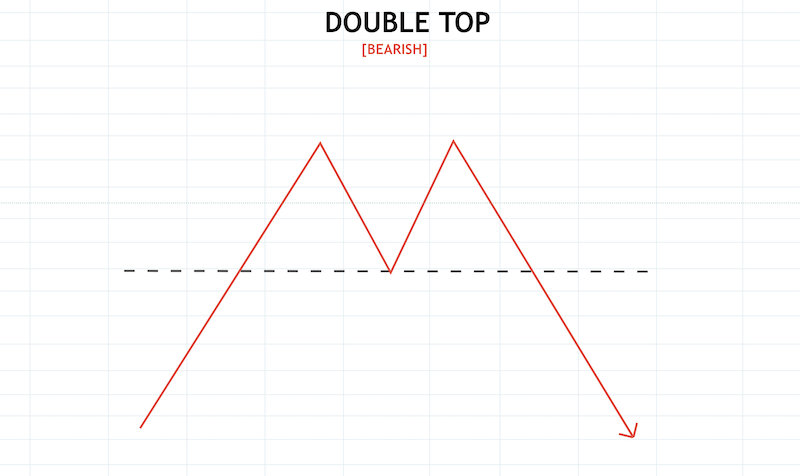

Double Top

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| DOUBLE TOP | BEARSH | REVERSAL | SELL |

- Description: A topping pattern that takes more than one attempt. Also called a W-bottom.

- How To Read This Pattern: A first attempt to pass resistance is rejected, forming a neckline. The second rejection from resistance sends price action through neckline support and a reversal is confirmed.

- What It Shows Happening: More sellers step up to sell resistance at the second test, providing the strength to push through support that previously held.

- Expected Performance: Targets can be found by taking the top of the move to the neckline and applying it to the neckline after breakdown.

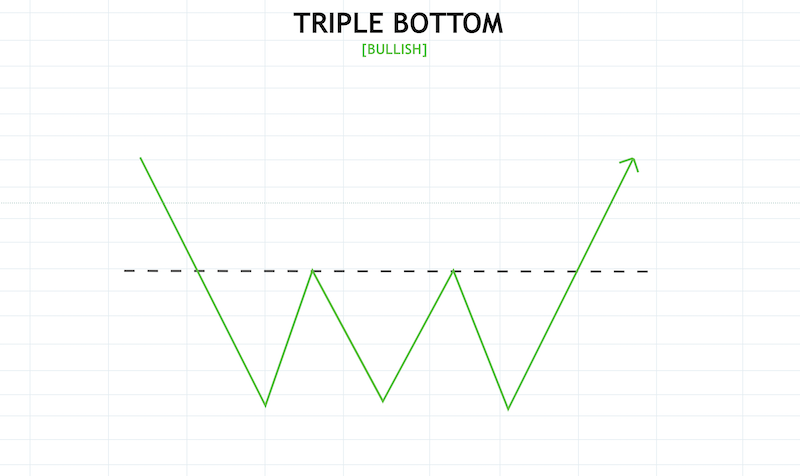

Triple Bottom

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| TRIPLE BOTTOM | BULLISH | REVERSAL | BUY |

- Description: A bottoming pattern that takes more than one attempt. It is different from an inverse head and shoulders because the three bottoms are nearly equal in distance.

- How To Read This Pattern: A first bounce off support fails, forming a neckline. The second bounce off support also fails. A third is, however, successful with breaking through resistance and a reversal is confirmed.

- What It Shows Happening: More buyers step up to buy support at each subsequent retest, providing the strength to push through resistance that previously failed.

- Expected Performance: Targets can be found by taking the bottom of the move to the neckline and applying it to the neckline after breakout.

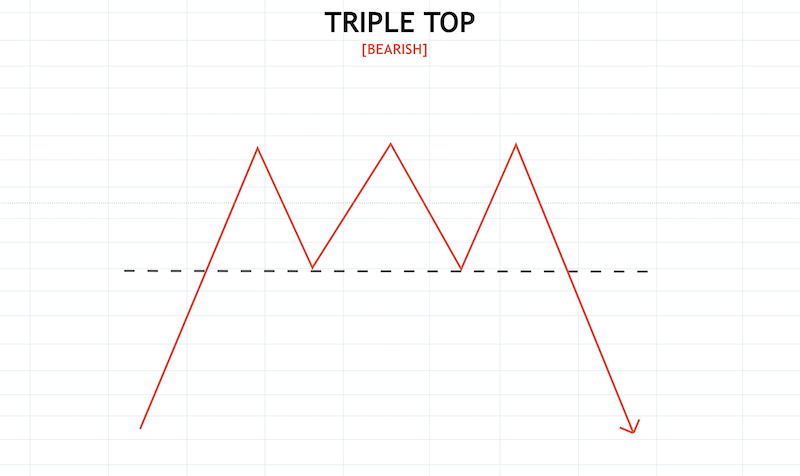

Triple Top

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| TRIPLE TOP | BEARSH | REVERSAL | SELL |

- Description: A topping pattern that takes more than one attempt. It is different from a head and shoulders because the three peaks are nearly equal in distance.

- How To Read This Pattern: A first attempt to pass resistance is rejected, forming a neckline. The second rejection from resistance also fails. However, a third sends price action through neckline support and a reversal is confirmed.

- What It Shows Happening: More sellers step up to sell resistance at each subsequent test, providing the strength to push through support that previously held.

- Expected Performance: Targets can be found by taking the top of the move to the neckline and applying it to the neckline after breakdown.

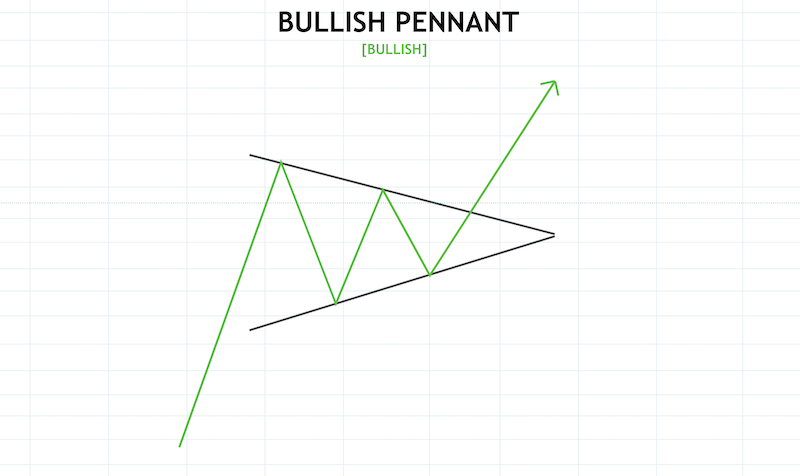

Bullish Pennant

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| BULL PENNANT | BULLISH | CONTINUATION | BUY/HOLD |

- Description: A bullish continuation pattern that often appears at the mid-point of impulse moves and uptrends.

- How To Read This Pattern: A large move up, forming a pole, followed by consolidation and another similar move up.

- What It Shows Happening: A pole forms when sellers are taken by surprise by the strength of bulls. When resistance is reached, a bull pennant will consolidate with two converging trend lines. Eventually, buyers push through resistance and bears are again taken by surprise.

- Expected Performance: The target of a bull pennant can be measured by taking the length of the pole and applying it to the point of breakout.

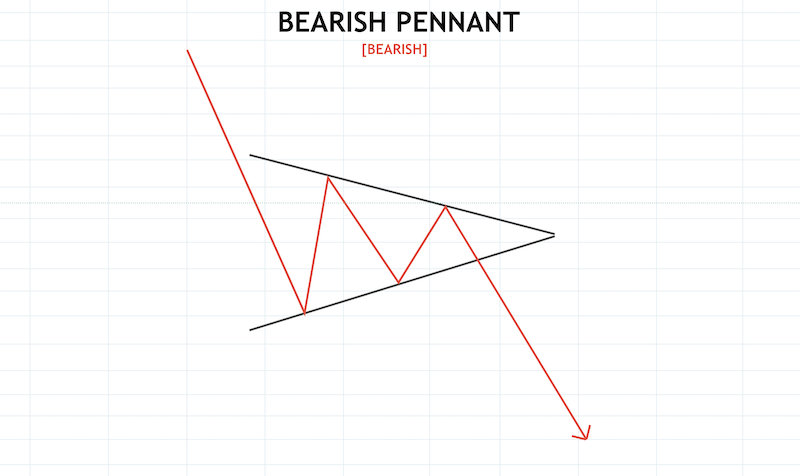

Bearish Pennant

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| BEAR PENNANT | BEARISH | CONTINUATION | SELL/HOLD |

- Description: A bearish continuation pattern that often appears at the mid-point of impulse moves and downtrends.

- How To Read This Pattern: A large move down, forming a pole, followed by consolidation and another similar move down.

- What It Shows Happening: A pole forms when buyers are taken by surprise by the strength of bears. When support is reached, a bear pennant will consolidate with two converging trend lines. Eventually, sellers push through support and bulls are again taken by surprise.

- Expected Performance: The target of a bear pennant can be measured by taking the length of the pole and applying it to the point of breakdown.

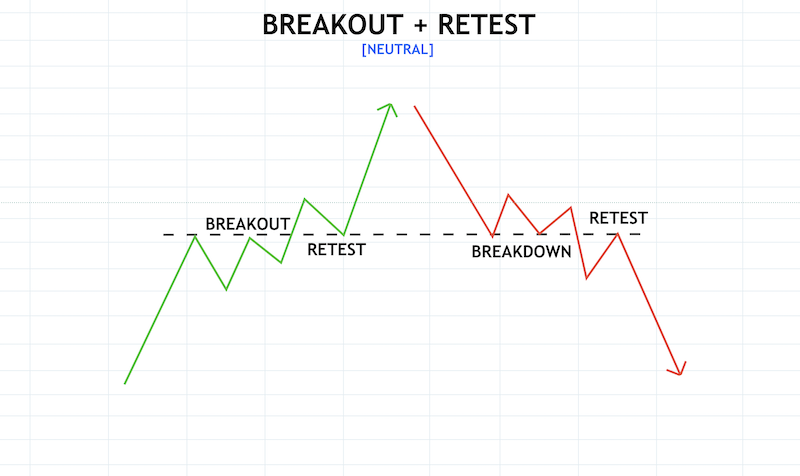

Breakout + Retest

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| BREAKOUT + RETEST | NEUTRAL | REVERSAL | BUY/SELL |

- Description: The signal that a pattern is complete and the market is ready to move to a new trading range.

- How To Read This Pattern: Support or resistance is taken, however, the market revisits the area to retest and confirm the move.

- What It Shows Happening: Ultimately, this pattern shows a decision being made by the market. To further confirm the move, price action will often retest former resistance as support, and vice-versa.

- Expected Performance: Performance should be based on the larger pattern the breakout and retest is happening on.

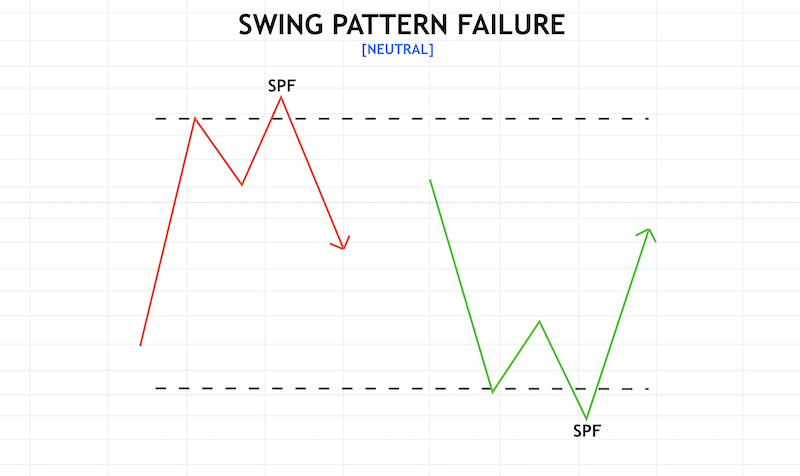

The Swing Pattern Failure

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| SWING PATTERN FAILURE | NEUTRAL | REVERSAL | BUY/SELL |

- Description: This move often completes a consolidation phase with extreme confusion.

- How To Read This Pattern: After several touches of resistance and support lines, the level will be swept briefly, before reversing.

- What It Shows Happening: A swing pattern failure is an attempt by the market to move to a new range, but is rejected sharply and with enough force to cause a trend reversal in the other direction.

- Expected Performance: A long wick or tweezer candlestick formation is often left behind a trend line, which indicates a reversal is confirmed.

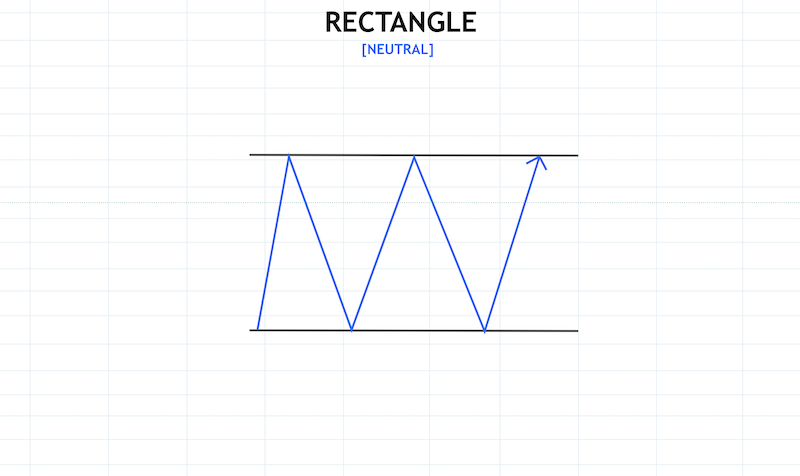

Rectangle

| PATTERN | SENTIMENT | DIRECTION | ACTION |

| RECTANGLE | NEUTRAL | SIDEWAYS | HOLD |

- Description: A sideways move channel that forms during a condensation phase.

- How To Read This Pattern: Two parallel horizontal trend lines form acting as a support and resistance barriers to a trading range.

- What It Shows Happening: Both bears and bulls are at an impasse, and have been unable to break through to a new range. Price action continues through the channel until one side gives.

- Expected Performance: Because of the lack of volatility, the resulting breakout is often powerful.

How To Use These Crypto Chart Patterns For Maximum Value

Price action is subjective, and can change at any given moment depending on the news, sentiment, or other external factors. This means that a technical analysis must always be moving around trend lines, removing and redrawing them, to make sure they are the most valid piece of the overall market picture.

Pair patterns with technical indicators, trading volume, and more can help to confirm patterns, protect capital, and improve success rates.

Summary

Flurex Option is an award-winning trading platform offering built-in technical analysis tools so traders can chart crypto price patterns right from within the platform.

The lineup of assets also includes commodities, stock indices, forex, currencies, and much more, all from a signal account. Flurex Option also has advanced order types so capital is always protected with stop losses and traders have the most flexibility with long and short positions.

Use the free Flurex Option tools to practice identifying these common crypto chart patterns.

Here are some frequently asked questions related to crypto chart patterns.

Do Chart Patterns Work For Crypto?

Chart patterns work well for crypto trading, especially when used for long term positions. It helps to find an ideal entry point at key support, by analyzing price action and gauging investor interest.

How To Read Crypto Chart Patterns?

Reading a crypto trend chart focuses on the current trading activity in the market, and finding the trend lines that form the boundaries of a pattern. Learning the patterns outlined in this guide can also help to improve success.

How To Predict Cryptocurrency Price Charts?

By using chart patterns combined with technical indicators or volume for confirmation, traders can often predict future market outcomes with some degrees of accuracy.

How Do You Identify Crypto Trends?

Frequently identifying new price patterns takes several years of active market trading experience. Learning the underlying market behavior related to each pattern can also widely improve profitability.