If last week was a bad one for Bitcoin, seeing as it was the first red week of the year, this week has been significantly more painful for Bitcoin investors. Bitcoin’s price has not only fallen from the important sentimental mark of $10,000, but it has also dropped below $9,000 and has started finding support at $9,500.

The price of Bitcoin is now down nearly eight percent this week, and is seeing a negative return from this time last month. However, the 2020 rally that many predicted and watched unfold through January is still on as Bitcoin is up 22 percent year to date.

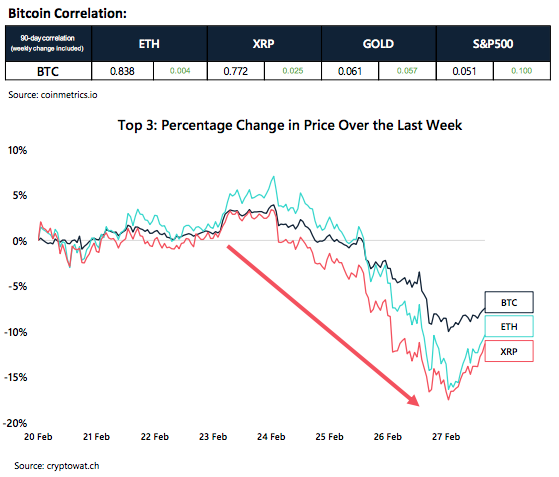

In the altcoin market, similar scenes are playing out, as is to be expected with the top three coins, Ethereum and XRP also dropping by large margins. Ethereum is down 10 percent and XRP is down 11 percent. In fact, all of the top 10 coins except Bitcoin and EOS are down double digits this week — Tezos has shed as much as 21 percent of its value.

However, it appears the shedding of the Bitcoin price is done for the week as the coin looks to have bounced off a floor of near $9,500, finding support on the 200-day moving average. This is positive news for Bitcoin investors as it may well be indicating a bottom has been reached and that a buying opportunity has presented itself during this correction.

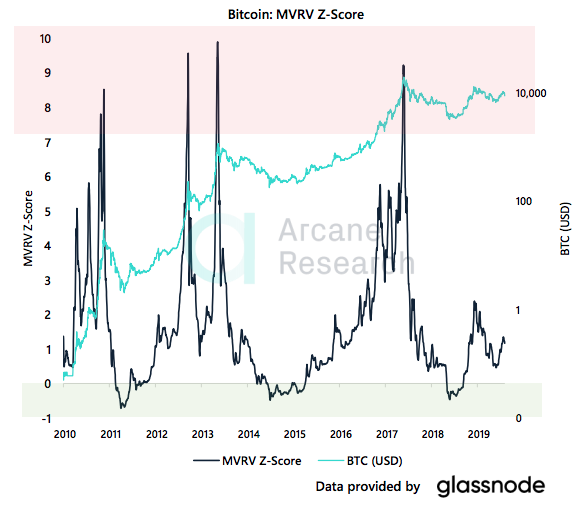

More so, while Bitcoin has been struggling to push on past the $10,000 mark for some time now, indications are that the Bitcoin price may be far from a market top based on its “fair value”. According to e MVRV Z-score of Bitcoin, the coin is still quite undervalued and there is more room for its price to grow.

Bitcoin Price Plummets

Having begun the week at just a few dollars short of $10,000 the price of Bitcoin rapidly fell all week to a low of $8,580 on Thursday. Since then, the bleeding has at least stopped and the coin has looked to try and bounce back, although nothing has been too strong as of yet.

The floor does, however, seem to be in at around $8,500 and Bitcoin’s price is trying to rebound here — but it is still rather up and down. The good news is, however, that the support at the 200DMA is strong and if it can remain above this mark, there should be little fear of continued losses.

Sentimentally, however, the impressive climb that Bitcoin was experiencing through the January and the first two weeks of February has been hit hard. The gains made over the first two weeks of February have officially been wiped out. More so, in the race against altcoin, Bitcoin is now the worst performer of the month in comparison to small, medium, and large-cap altcoins.

Even though Bitcoin’s monthly performance is now worse than most groups of altcoins, it still has lost fewer gains this week than most of the top 10 coins, and it has also gained in terms of its market domination — up 1.1 percent since last week.

Small Cap coins were up over 45 percent just two weeks ago but are now down to 3 percent gains in February. Still, this is the only index that’s trading at a higher level than at the beginning of the month.

Large Caps, Mid Caps and Bitcoin are all in the red, with Bitcoin as the worst performer – down 6 percent so far in February. But the positive is the growth in market share for the major cryptocurrency by market cap.

Now, the biggest thing to keep an eye on for Bitcoin’s continued growth is if it can hold the important support level it finds itself at currently. A look at the chart below indicates that the price sits precariously on the 200DMA, and that it has fallen below the 50DMA.

Should this level hold, it will mean that the price will look to climb to the previous support area, around $9,300, which will then likely be the next resistance level for the bitcoin price. If the current support of the 200DMA breaks, it will most likely indicate bitcoin going down to the lower $8,000 area and be a short-term bearish signal.

There is also a current buying opportunity that looks like it could be unfolding as the price continues to stay strong above the $9,500 mark. This could indicate a bottom, and a buying opportunity, which in turn could see the price reverse to an upward trend.

Other Warning Signs

The drop in the price of Bitcoin has also affected other important metrics that are worth looking at. Everything from volatility to falling volume has been noted. More so, the market is getting increasingly more fearful with institutional interest also waning and traditional safe haven assets — like gold, the ones to profit.

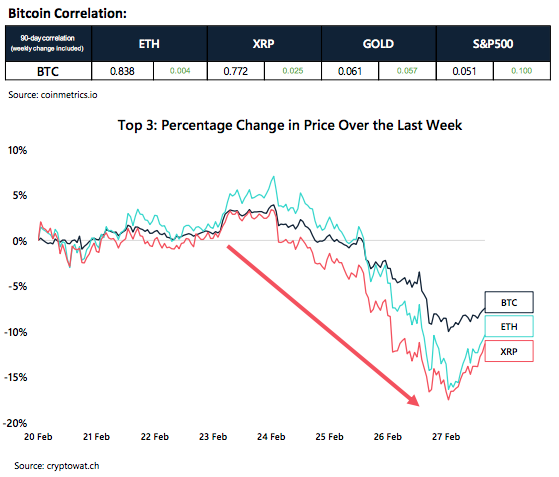

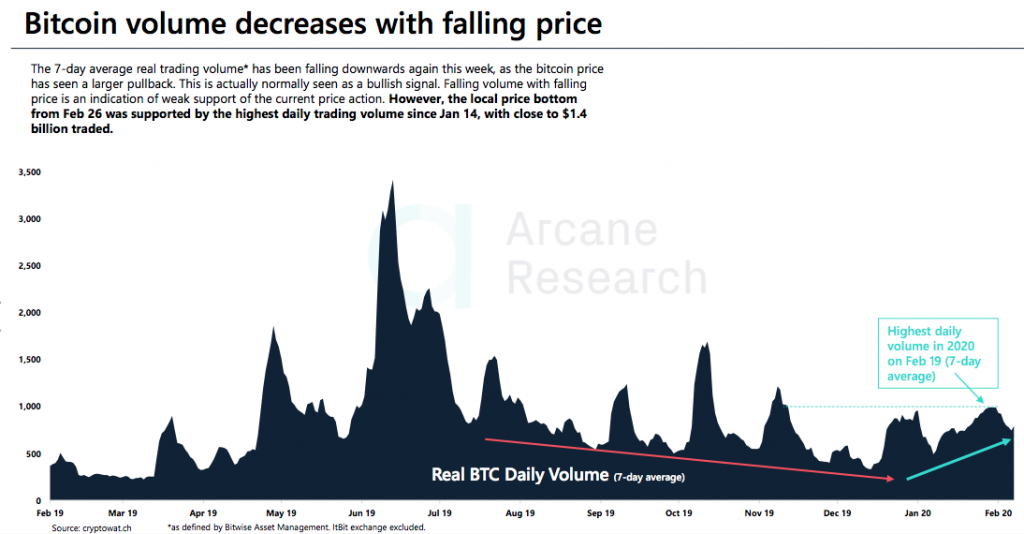

Bitcoin is now firmly considered a fearful market with the Fear & Greed Index flashing at 39, levels not seen in almost two months. With the recent pullback in the Bitcoin price, new questions arise. Is this just a small pullback or will we continue to trend downwards again?

Yet, the graph also paints a picture of there being a chance for a potential bounce back towards greed, considering the level sits in line with what we saw in August of last year.

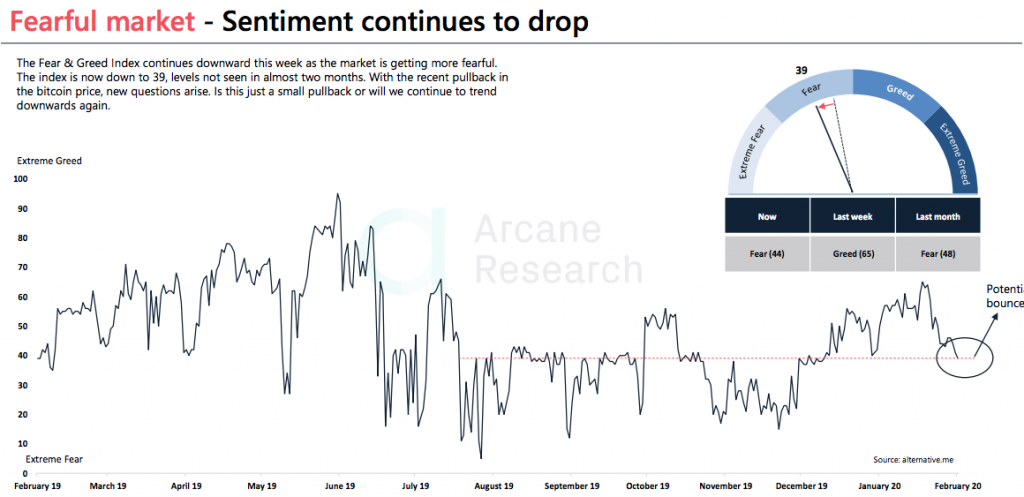

What is not as surprising to note, given the sharp fall in price, is that the Bitcoin trading volume has also taken a turn for the worst after it was showing signs of prolonged growth through the early stages of this month.

The 7-day average real trading volume has been falling downwards again this week, as the Bitcoin price has seen a larger pullback. This is actually normally seen as a bullish signal. Falling volume with a falling price is an indication of weak support of the current price action. However, the local price bottom from Wednesday, February 26, was supported by the highest daily trading volume since Jan 14, with close to $1.4 billion traded.

Bitcoin volume trading and Bitcoin price are inexorably linked as the market often shows lower interest in trading when the price dips down. This is also often a sign of what is to come as increased trading volume has been known to precede a sudden dip.

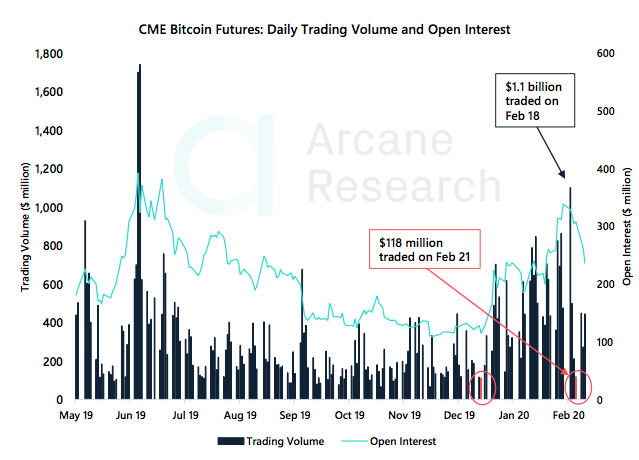

With the drop in the price of Bitcoin, there has also come a lowered interest from institutional investors on the futures trading platform from CME. This week has seen a new low be set in for 2020, and comes just a couple of days after the highest trading volume on CME since the peak in 2019.

Last Friday, the daily trading volume for the Bitcoin futures on CME was only $118 million which is only a tenth of the yearly record seen on February 18 where $1.1 billion was traded in a single day. This up and down movement seems to indicate a bit of speculation from the traditional investors in Bitcoin, but there has at least been a recovery seen this week with daily trading at $400 million.

It will be interesting to see how this price drop affects the coming week’s interest at CME and if there will be renewed trading interest on the closing week’s price, of if interest will simmer away.

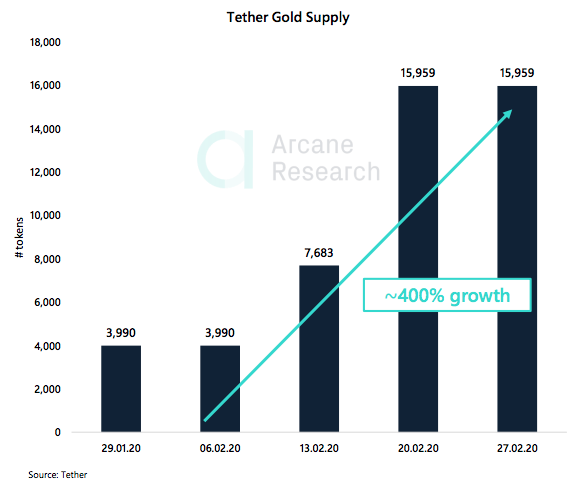

One area in the cryptocurrency market where there has been significant growth through the whole of February is in the commodity-backed gold token department. The reason for this is probably two fold, however.

The Tether Gold token (XAUT) was launched by Tether on January 24th, this year with one token representing the ownership of one troy fine ounce of physical gold, held in a Switzerland vault.

This is an attractive tokenized investment in a traditional asset, as gold is known as a safe haven commodity. But more so, current concerns over the outbreak of the Coronavirus that have been heightened in the past few weeks have seen gold grow in value.

Blockchain information for the Ethereum contract showed a supply of nearly 4,000 tokens at launch and then, one month later, the supply of XAUT had quadrupled to nearly 16, 000 tokens.

This suggests a great demand for commodity-backed tokens which perhaps could emerge as one of the major trends in the crypto space. Commodity-backed tokens gives crypto investors new opportunities within portfolio management and diversification on cryptocurrency exchanges, as more uncorrelated assets are available as trading pairs.

Bitcoin Has a Long Way to Grow

This week, following on from last week, will no doubt be putting a lot of Bitcoin investors into a precarious space as they stress about the next movement of the cryptocurrency. However, the longer term outlook for the coin is still very positive.

The returns year to date are still over 20 percent, to begin with, and looking at the actual price of Bitcoin in terms of what is known as its “fair value”, the coin is nowhere near its market top.

Looking at the MVRV Z-score, a measure that is used to determine whether Bitcoin is overvalued or undervalued in relation to its “fair value”, which in turn is put against its realized cap, there is clear room for growth.

With Realized cap, the transactions are valued upon the price when they were last moved.

A MVRV Z-Score is one that is put forward as the ratio between the difference of market cap and realized cap, against the standard deviation of market cap. This can be explained as market cap – realized cap divided against the sta date market cap.

When the MVRV Z-score is high (red zone in the graph below), this is an indication that the market is near its top. Meanwhile a lower ratio (green zone) points towards market bottoms. The current score for Bitcoin this might mean that there is still more room for the Bitcoin price to grow, and that it is actually undervalued at its current price.

However, these are just indications based on on-chain activity and do not include activity off-chain, like exchanges.

This Week’s Biggest News Stories

Bitcoin accounted for Half of Square’s Cash App Revenue in the 4th Quarter

In a recent report form payment processing app Square, it has been seen that as much as half the revenue on company’s Cash App in the fourth quarter came from Bitcoin.

The payment processor reported Bitcoin revenue of $178 million between The first of October and the end of last year with gross profits of $3 million. This is an increase of 50 percent over the prior two quarters.

The SEC has rejected another bid for a Bitcoin ETF

The US Securities and Exchange Commission (SEC) has again rejected a Bitcoin- based exchange traded fund. This time it was that of Wilshire Phoenix. The regulator wrote has reintegrated the fact that the New York-based Wilshire Phoenix has not proven the Bitcoin market is ready, or resistant enough to market manipulation.

Revolut raises $500 million as valuation skys to $5.5 billion

London based FinTech Revolut that has made big waves in the cryptocurrency space by letting its users buy and sell Bitcoin and others on its app, has raised a staggering $500 million in a Series D funding round that pits the value of the company at $5.5 billion.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Flurex Option. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Flurex Option recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.