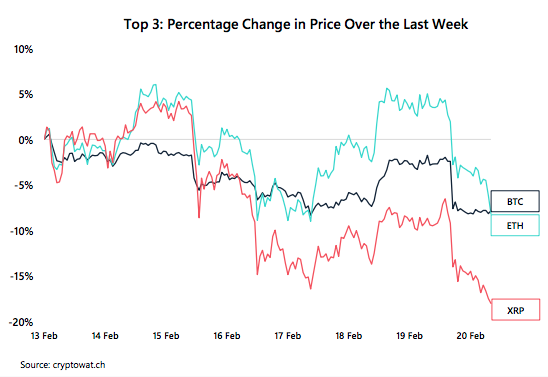

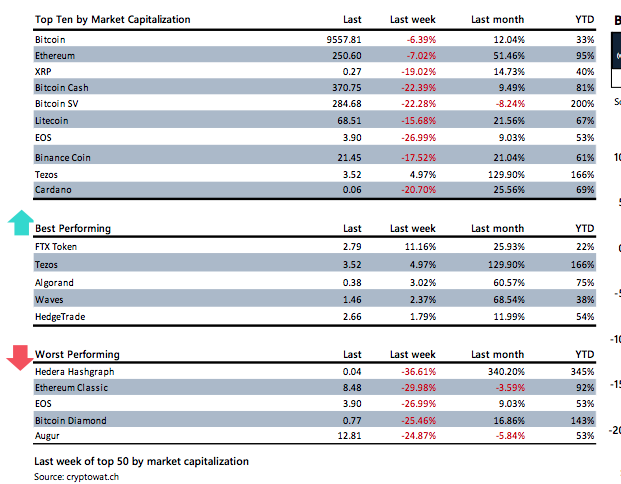

This week saw a first for the Price of Bitcoin in 2020. It was a red week, meaning that the coin’s value failed to grow, week-on-week, for the first time. In fact, it’s growth as compared to last week was down 6.39 percent.

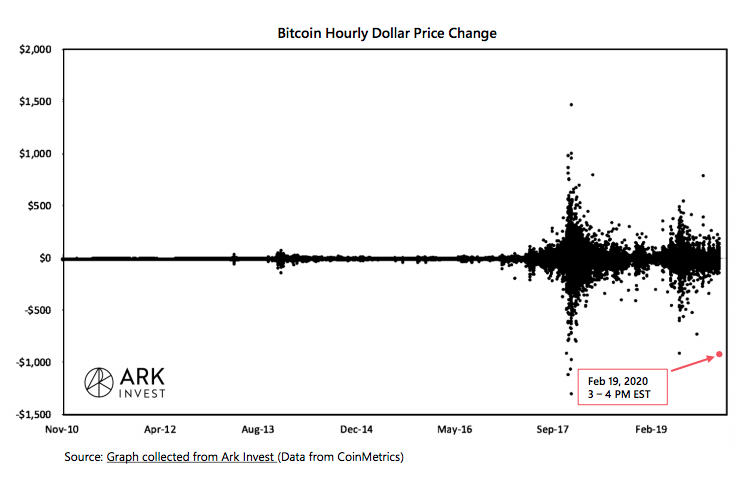

The major reason for this fall in the price of Bitcoin comes down to a flash crash on Wednesday that saw almost $1,000 wiped off the value of the major cryptocurrency in just over an hour. This hourly dollar price change represented the fifth-largest in the coin’s history.

The rapid fall in price emerged as Bitcoin looked to be climbing higher above the $10,000 mark and has left many investors a little stunned – especially those who were banking on a big bull run heading towards the reward halving in May of this year.

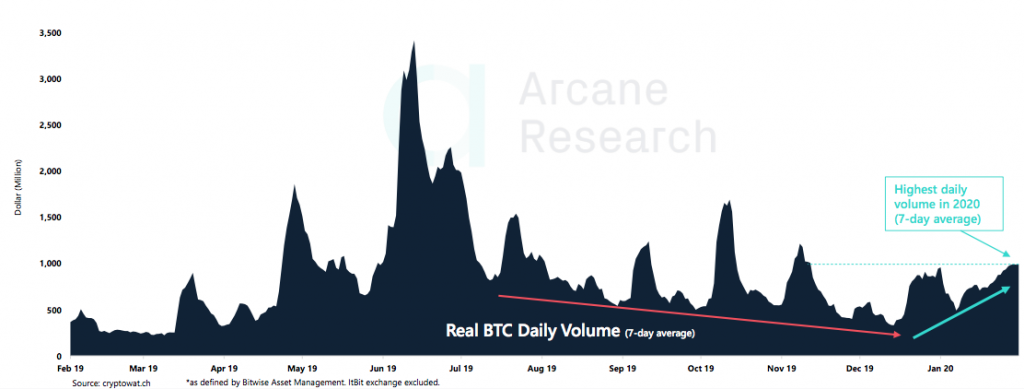

It has affected the Fear & Greed Index, sliding the needle heavily to fear, but it is not all bad news. There are indications that this price drop is more of a healthy pull-back, and has helped quell the Greed side of the Index, especially with the price starting to recover back towards $10,000 again on Friday. More so, the seven-day average real trading volume has continued to rise this week even amidst the price drop.

Elsewhere in the cryptocurrency industry, DeFi applications were put to the test in two flash loan attacks on bZx, a decentralized margin-trading platform. In the altcoin market, Bitcoin is still trailing in regards to performance, and this is despite altcoins getting hit harder in the recent price pullback.

Bitcoin Sees Rapid Pullback

Bitcoin has had an up and down week this week. It finished last Friday above $10,200 before falling just under the all important $10,000 market through last weekend. It began the week as low as $9,500 before fighting to a high of $10,180. From here, it rapidly crashed to $9,600.

This rollercoaster of a week for the price means that it was the first time this year that there has not been growth week-on-week. However, it is important to note, in the third week of February, there is still 12.04 percent growth from last month – and that Bitcoin is up 33 percent year to date.

To put the price drop into perspective, and to show just how rapid it was, the hour period where Bitcoin’s price fell was recorded as the fifth largest hourly price drop in Bitcoin’s history, measured in dollars.

The last time such a large price drop was seen was when Bitcoin was summiting its December 2017 highs towards $20,000, and when it rapidly declined after that. This metric makes it seems that this rapid price drop is something to take note of, however, it can also be looked at as a measure of percent price change, which paints a much more practical picture.

The same drop that ranked fifth for hourly dollar drop actually only measured as a 9.1% drop in price percentage. In context, this makes it the 122nd largest in Bitcoin’s history. It is pertinent to remember that the bigger percentage drops were pre the 2017 high and this 9.1 percent ranks as the largest since Bitcoin was priced at $20,000.

Still A Week Of Positives For Bitcoin

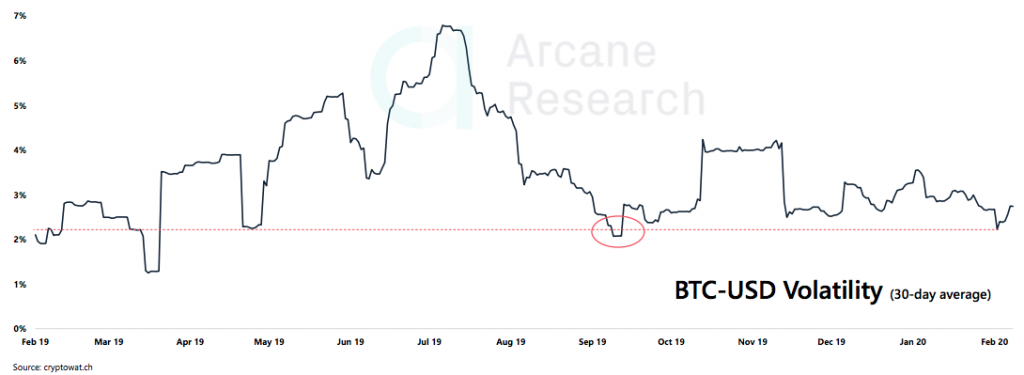

While this week represents the first negative growth one for the year, there are still a number of large positives to take away from the Bitcoin market. For starters, Bitcoin volume is up, and volatility is down. These are both factors that contribute to a lively and robust market as they show interest in trading the coin, as well as a stable and dependable market in which to enter.

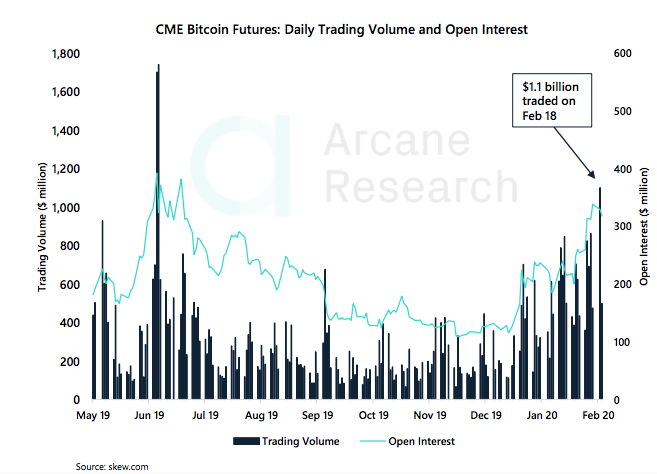

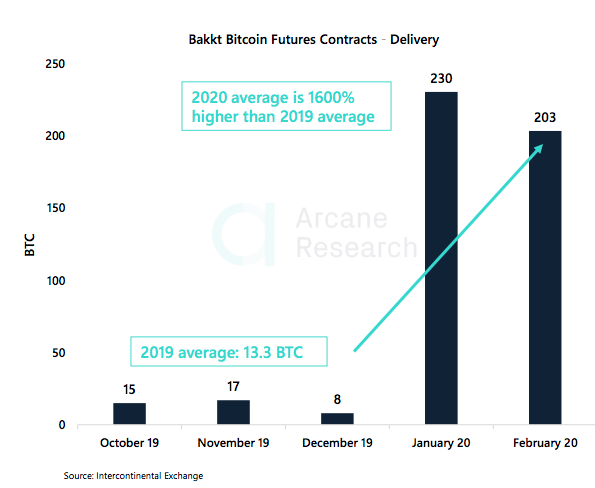

There is also continued good news from the institutional investment sphere, which is far less influenced by relatively small price drops. CME, the institutional futures trading platform showed trading volume of over $1 billion. At the same time Bakkt, the physically-settled Bitcoin futures trading platform saw the amount if contracts held to expiry in February were much higher than the 2019 average.

The Real BTC Daily Average (a seven day average) has been on a slow downward trajectory since July of last year, however, it has changed course since the beginning of the year and this week topped a 2020 record of $1 billion.

Despite the rocky week in terms of the price of Bitcoin going up and down, the volatility touched a low level that has not been seen since September last year. That being said, the effect on the sudden price drop has caused the volatility levels to jump again and now back within range of what we have seen this past month.

But probably the most positive sign for Bitcoin seen this week is the ‘Golden Cross’ which presented itself this week. This happens when the 50-day moving average crosses over the 200-day moving average.

This is a bullish indicator and is a strong confirmation of a change in trend. The last time this happened was April 23rd, 2019 at $5,400. Back then, the price had a similar pullback as we have seen this week before continuing upwards over 50 percent the following month.

Increasing Institutional Interest

CME, since entering the Bitcoin space at the same time the coin was reaching its all time high, has become a good measure of the interest from institutional investors in the digital asset. The company has seen increased growth in its contracts, and this year has proved to be no different.

It is once again clear from the graph below that CME’s Bitcoin futures daily trading volume and Open interest has been climbing since the year began, and this last week saw it cross the important $1 billion mark – a level not seen since June last year.

The open interest is also at the highest level since last summer, touching $338 million earlier this week. Compared to the leading futures exchange, BitMEX, CME is much closer to its previous volume highs. BitMEX saw over $14 billion in daily volume during the peak in 2019, but the volume is now closer to $4 billion.

A look at the growth of interest at Bakkt paints a skewed story. The open interest dropped again this week with the expiry of February contracts on Feb 20 – a common observation in the futures market with physical delivery.

However, After a dip about a month ago, the number of open contracts have been pushing to new highs – topping out at 1,861 BTC last week. This is an increase of 270 percent since the beginning of the year.

There were also 203 concluding contracts delivered on Thursday representing just below $2 million in notional value.

ED&F Man Capital Markets is still accounting for a significant part of the delivered bitcoin, which both Digital Galaxy and XBTO have used earlier for clearing. As Digital Galaxy launched two Bitcoin funds late last year, this may be the source of this significant increase.

DeFi Shows Its Vulnerabilities With A Double Attack

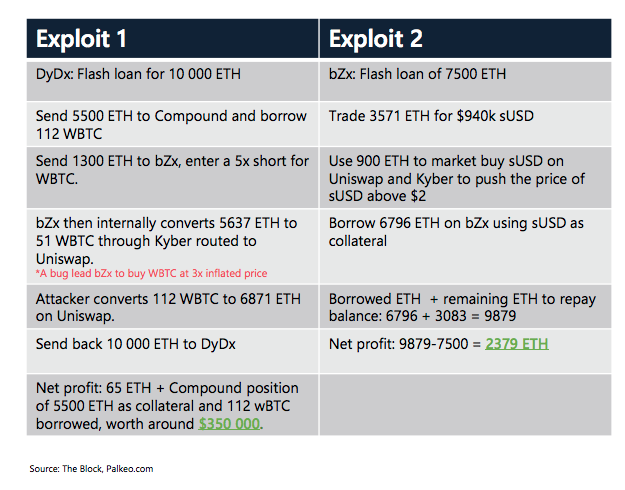

Another aspect of the cryptocurrency space that has been growing with vigour recently is that of DeFi (Decentralized Finance). However, this aspect was put under pressure when bZx, a decentralized margin trading platform was attacked twice in quick succession.

The attacks utilized bZx’s flash loan, a product that allows traders to make uncollateralized loans that are repaid in the same transaction as it’s taken out. The attackers exploited buggy code and poor liquidity in DEXs in order to manipulate various ETH-pairs, creating massive profits and leaving bZx with uncovered loans.bZx shut down Fulcrum, it’s lending platform using its administrator key and locked down the endangered funds.

These attacks highlighted two important aspects of DeFi:

In DeFi applications, the code will always be the law. Buggy code and limited price feeds based on illiquid decentralized exchanges is a challenge that needs to be solved in order for DeFi to prosper.

DeFi applications are centralized to some extent. Utilizing an admin key the developers of the applications may intervene and freeze contracts.

Altcoins Hit Hard But Still Outperforming Bitcoin

While the week saw a loss of over six percent for Bitcoin, it was one of the least affected cryptocurrencies in the market. Some top 10 coins lost as much as 22 percent while one coin – Tezos actually gained.

While 2020 has been a good year for Bitcoin, it has actually been a bit of an altcoin season. The likes of Bitcoin SV and even Bitcoin Cash out performed Bitcoin in January almost six-fold making gains of up to 180 percent in the case of Bitcoin SV.

Altcoins are still doing better than Bitcoin, as a rule, even though they were hit far harder by the mid-week dip that was seen across the entire marketplace. The pullback has affected nearly all of the top 100 coins, with small cap coins losing as much as half of their February gains. They are now down to only 20 percent return this month.

In comparison, Bitcoin’s gains in February, despite a smaller loss, sits only at a mere 2.2 percent. However, this has helped the major cryptocurrency by market cap gain back some market dominance; it is up to 62.4 percent this week.

ETH is another that has also seen some good gains in dominance as it continues to add to its total market share this week. ETH has gone from seven percent market share to over 10 percent so far in 2020. That equals around $14 billion added to its total market capitalization.

This Week’s Biggest News Stories

Norwegian Air to Launch Cryptocurrency Payment Solutions

Norweigan Air is set to allow customers to pay for flights using cryptocurrency. Stig Kjos-Mathisen, Norwegian Block Exchange (NBX) CEO and son-in-law of Bjørn Kjos, Founder and CEO of Norwegian Air, reportedly stated that his crypto trading platform has successfully developed payment infrastructure that will allow customers on Norwegian Air to purchase tickets with digital assets.

bZx’s DeFi Flash Loan Attack Points To Vulnerabilities

bZx, the eighth-largest decentralized finance project according to DeFi Pulse, suffered two attacks last weekend following the introduction of “flash loans,” a new DeFi feature that limits a trader’s risk while improving the upside.

Coinbase Becomes First ‘Pure’ Crypto Firm Approved as Visa Principal Member

Coinbase, the San Francisco-based cryptocurrency exchange, has been made a Visa principal member. Announcing the news on its blog Wednesday, the firm said the news marks it as the “first pure-play crypto company” to be approved by the credit card giant.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Flurex Option. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Flurex Option recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.