The world is still in the grasp of the coronavirus pandemic, and markets continue to show extreme volatility, providing opportunities to profit around every corner.

Gold has tapped a seven-year high, oil prices fell to an 18-year low, and Bitcoin has nearly doubled in value since the epic selloff last month.

The leading cryptocurrency by market cap is facing strong resistance, which could send it and the rest of the cryptocurrency market tumbling, as the recession ramps up.

Bitcoin Faces 50-Day Moving Average, Breaking It Targets $8,000, Rejection $5,000

Bitcoin price is currently contending with overhead resistance both in the form of recent price action, but also the 50-day moving average. The asset fell below the short-term moving average during last month’s record-breaking drop but quickly returned to retest it just a month later.

As of now, the 50-day MA has proven too strong and has rejected Bitcoin multiple times to lower levels. A break above could send Bitcoin price higher to test longer-term moving averages such as the 100-day and 200-day moving average, currently priced at roughly $8,800.

A stronger rejection from here could send Bitcoin price falling back toward $5,000 where support lies.

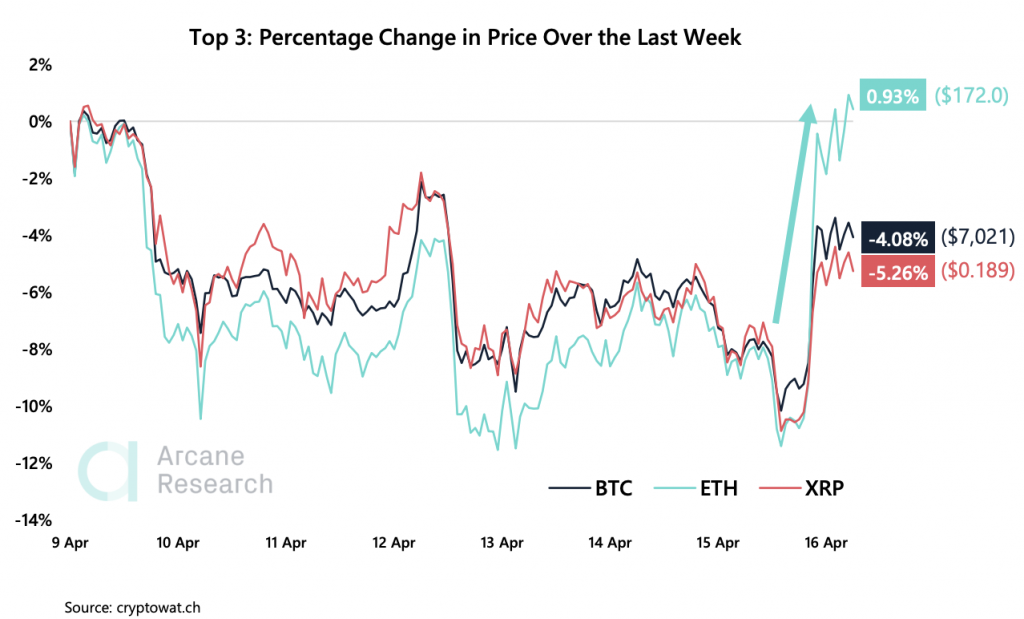

Ethereum Shows Strong Performance, But Mid-Cap Alts Outperform

While most crypto assets sank week over week, Ethereum saw nearly 1% growth. It’s especially notable due to the asset withstanding such negative sentiment across the crypto space.

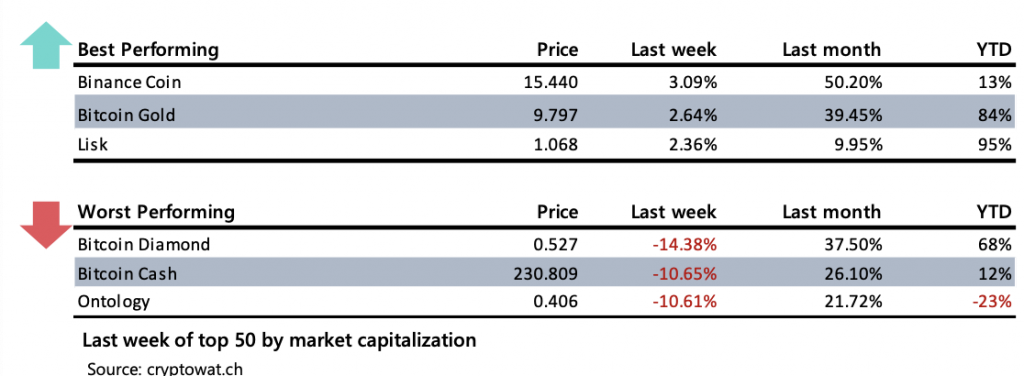

Mid-cap altcoins such as Binance Coin and Lisk, however, outperformed even Ethereum, showing gains of over 2 and 3% while Bitcoin and XRP fell by 4% and 5% respectively.

The biggest losers of the week were Bitcoin hard forks Bitcoin Gold and Bitcoin Cash. A post-halving selloff likely helped cut Bitcoin Cash down to size.

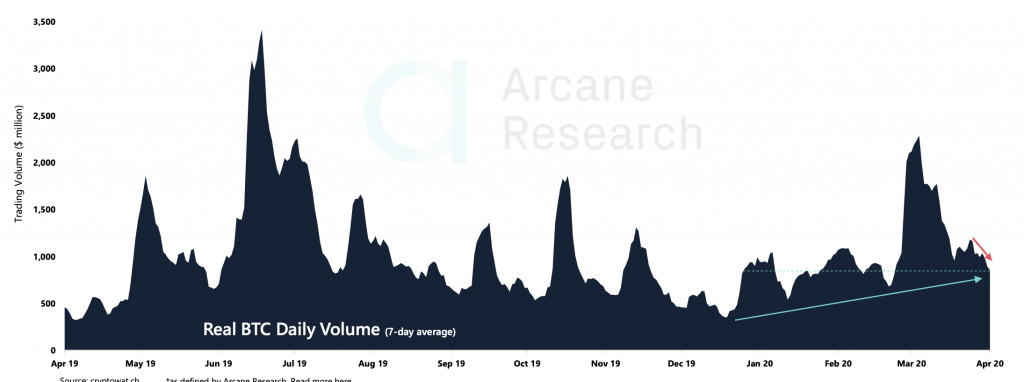

Bitcoin Trading Volume Falls to One Month Low As Traders Are to Scared To Trade

After seeing an enormous surge during the Black Thursday selloff last month, Bitcoin trading volume has been waning reaching the lowest level in over a month.

Trading volume diminishing suggests that a trend is running out of steam, meaning that the asset could soon reverse and test supports lower.

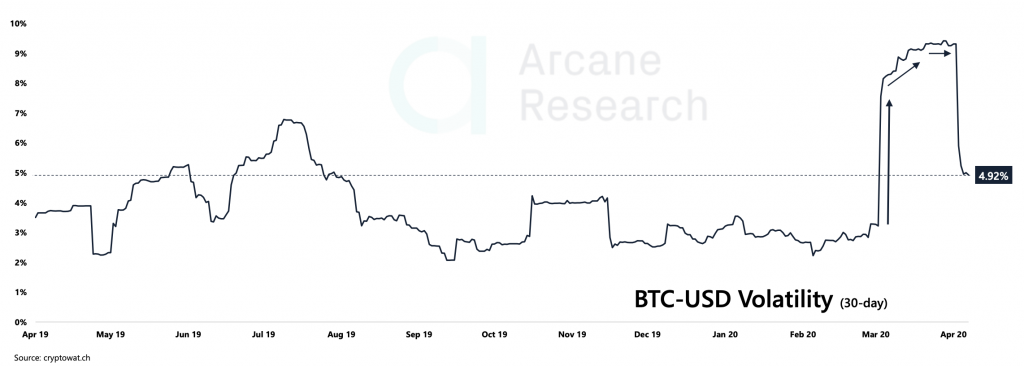

Volatility has also taken a hit, but still remains relatively high compared to the past year in Bitcoin trading across the cryptocurrency market.

Trading volume and volatility could be slowing due to just how fearful crypto traders are currently. The cryptocurrency market fear and greed index has now entered its longest stretch ever recorded of a state of extreme fear.

The fear could prevent investors and traders from taking long-term positions that may ultimately prove to be profitable and miss out on an opportunity of a lifetime.

It could also be that crypto traders have increasingly turned toward traditional markets, where volatility is stronger than ever.

Stablecoin Growth Surges Across Cryptocurrency Market

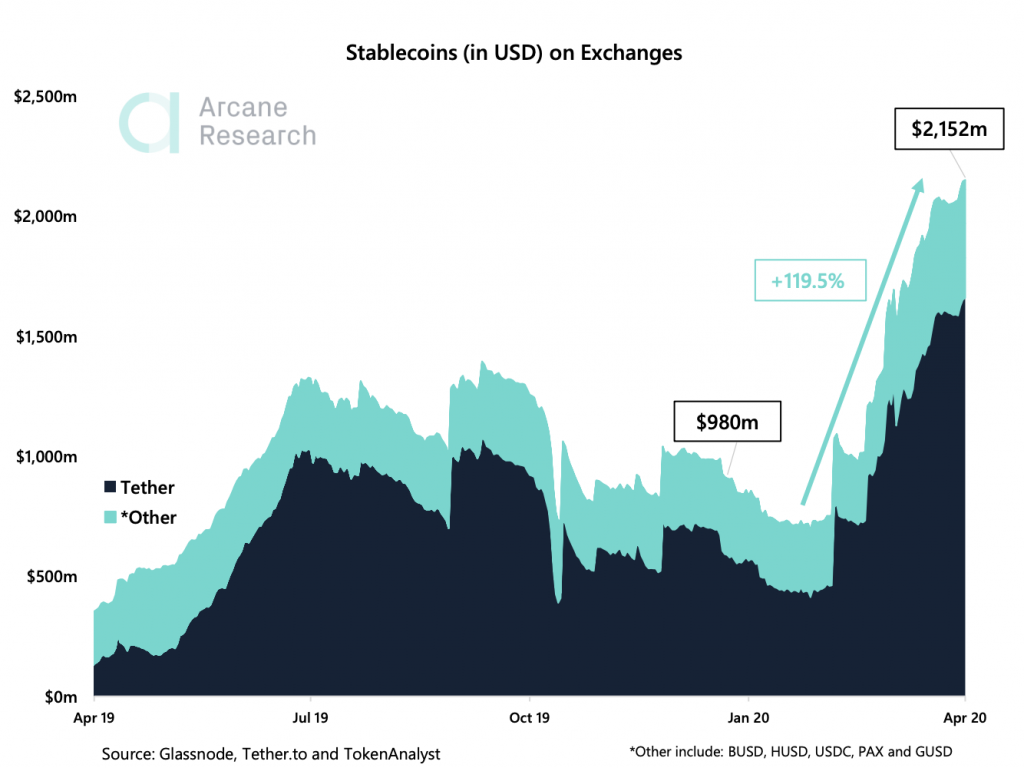

Stablecoins have been flooding the cryptocurrency market, gobbling up massive market share with each new printing of the fiat-tied supply of crypto assets.

2020 has seen an enormous surge in stablecoins entering the crypto market. The stablecoin holdings across cryptocurrency exchanges have doubled since the start of the year.

The demand could be due to traders moving out of Bitcoin and altcoins and into the stable assets to weather the coming recession and storm.

Or it could be due to these assets simply gaining traction as a superior form of money. Tether has led the stablecoin charge, but growth in USDC, Paxos Standard, and many others have also been high.

The Fed’s Stimulus Checks Used to Buy Bitcoin

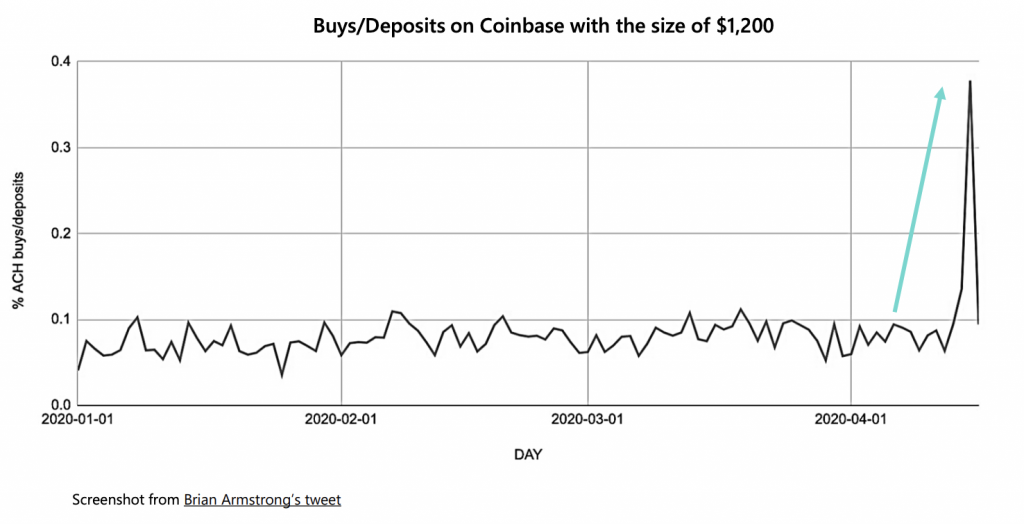

It’s not just stablecoin makers who are printing more and more supply. The stimulus checks issued by the United States Fed are finally arriving into consumer’s bank accounts.

And the money is going directly into Bitcoin, according to data.

Coinbase CEO Brian Armstrong has shared data showing that buys on the crypto platform totaling $1,200 or more spiked in the days following Bitcoin’s collapse.

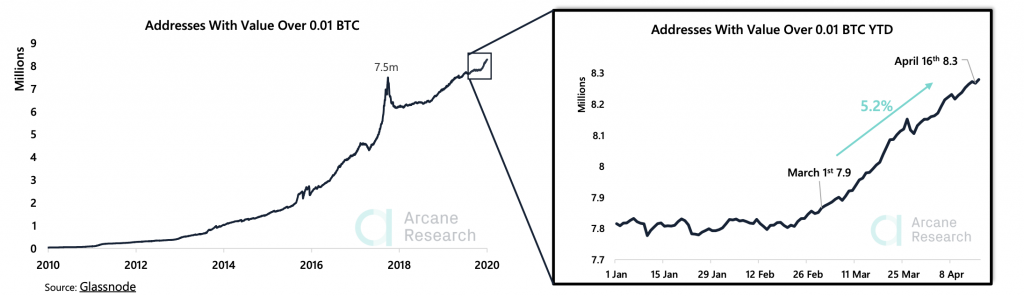

Bitcoin Adoption Picking Up Steam, Addresses With 0.01 BTC or More Grow

The number of blockchain wallet addresses with 0.01 BTC or higher in holdings has grown significantly over the last month. It’s not clear if this is due to the upcoming halving, low prices, or an expectation that fiat will soon fail, but whatever the reason, more and more people are hoarding Bitcoin.

This Week’s Biggest News Stories

Chinese Government Begins Rollout of Digital Currency This May

It’s incredible to think that Bitcoin went from relatively unknown, to major nations creating digital assets of their own that behave similarly to the blockchain asset.

Starting in May, China will begin issuing its DCEP to local government employees.

Tether Gold Continues to Grow Amid Demand

With gold supplies low and demand high, Tether has not just been printing more USDT fiat-backed stablecoins, they have also increased their supply of the XAUt Tether Gold token, which represents a physical gold bar at spot prices.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Flurex Option. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Flurex Option recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.