Markets are in complete chaos over the last two weeks, as the world pauses in fear that the spread of the coronavirus may be unstoppable, or at the very least disrupt life as we currently know it.

The rapid spread of the virus has already severely impacted the economy and caused the worst selloff in stock markets since 1987.

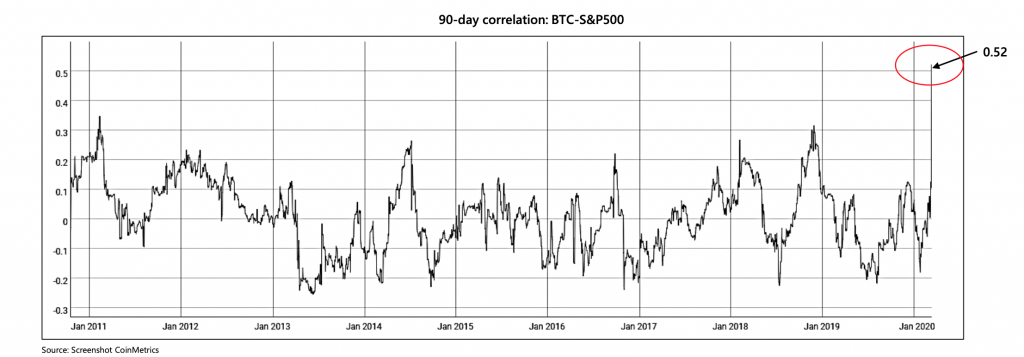

Bitcoin and cryptocurrencies followed suit with the most correlated price action in the history of the asset class.

The result was a bloodbath in Bitcoin and carnage across the crypto market.

Historic Bitcoin Price Drop Was Third Worst Ever Recorded, What’s Next?

Bitcoin, the first-ever cryptocurrency was long thought to be recession resistance or a safe haven asset, however, in the face of the first major recession since its inception, the asset has not responded as most would have expected and suffered a shocking drop over the last 48 hours.

In prior market reports, Bitcoin has been on a steady rise, growing over 60% year-to-date at its peak. The leading cryptocurrency by market cap just a month ago was trading above $10,000. This week, it fell below $4,000, not only wiping out all year to date gains but also eliminating nearly a year of price action.

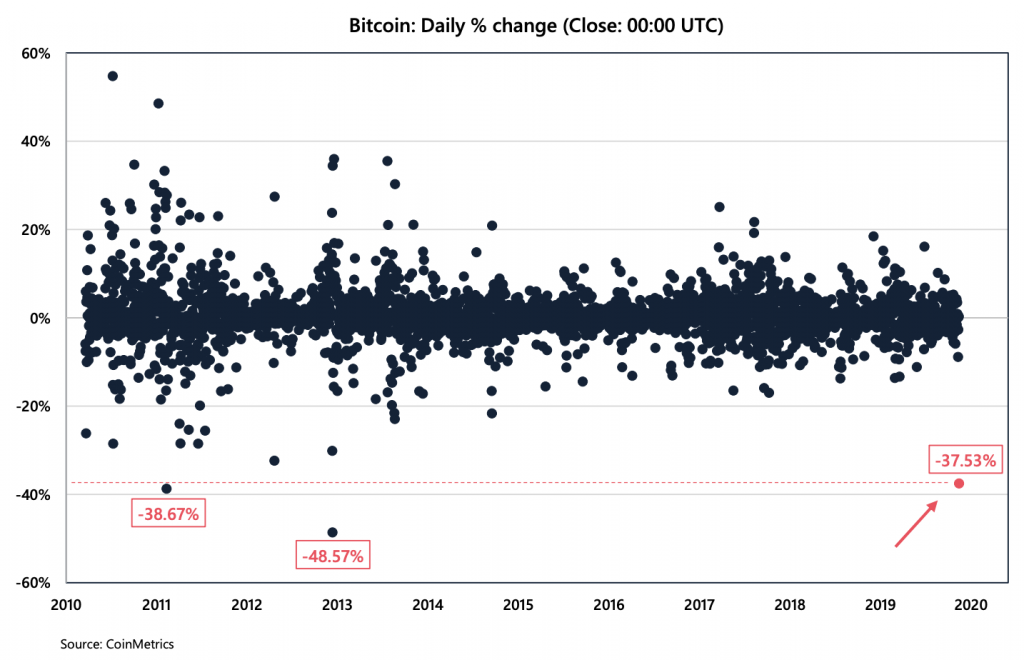

The drop was the third-largest ever recorded in the asset’s ten-year history, dropping a full 37% intraday. Even with the staggering collapse, Bitcoin remains up 36% year over year.

Fear is out of control, as is the virus, so the selloff could very well continue. But for now, Bitcoin is holding strong at the 200-week moving average – the same indicator Bitcoin bounced from back at $3,200.

Of course, it could end up being broken for the first time in Bitcoin’s history. Price did pierce through it, temporarily, but ultimately is back above it. Although given the situation, technical analysis may not be very helpful currently.

Altcoin Apocalypse: Extreme Fear Spreads As Rapidly As Outbreak

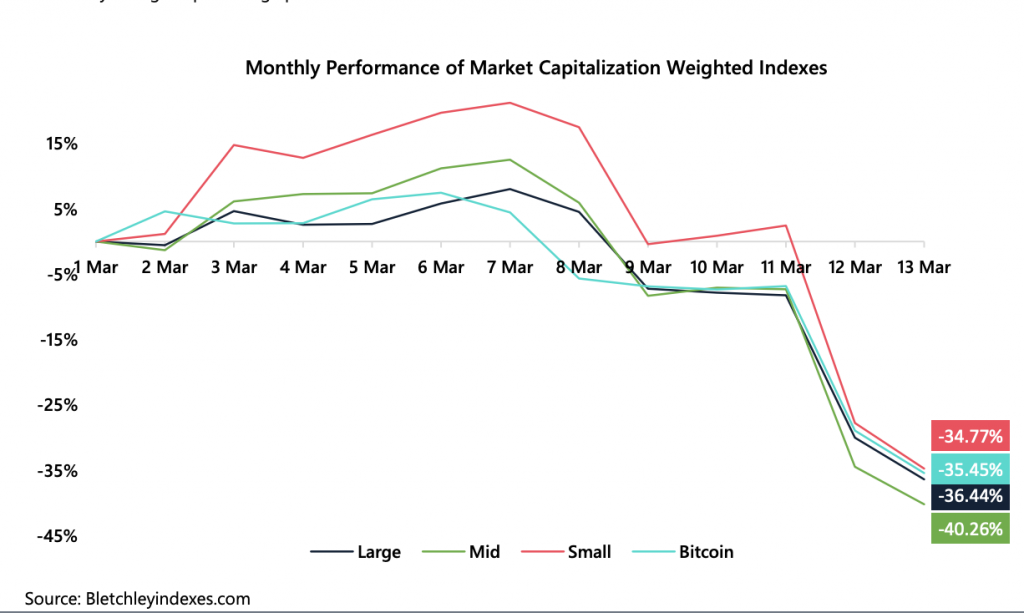

In addition to Bitcoin’s breakdown, Ethereum, Ripple, and the rest of the altcoin market was a sea of red this week, as the alternative crypto assets took an even harder beating than Bitcoin did.

Most altcoins fell by 50% or more this week, although Bitcoin dominance remained relatively stable, suggesting the entire market fell all at once.

During the chaos, mid-cap altcoins fell the hardest, with large caps right behind. Oddly, it was small-cap altcoins that fell the least during the turmoil.

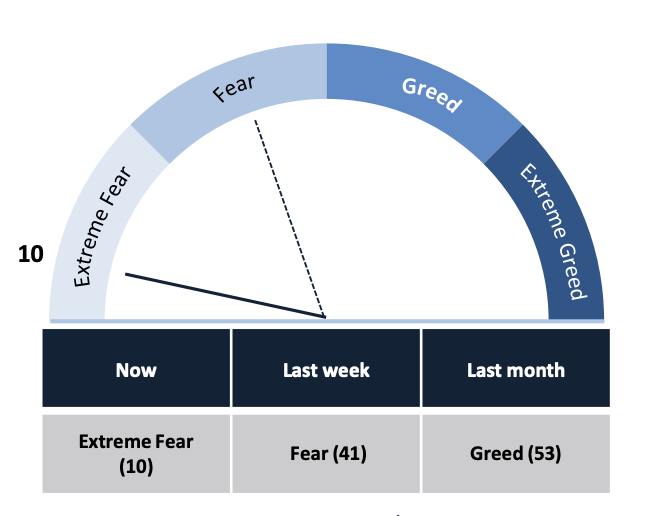

The selloff occurred just as coronavirus spilled over into the market. The combination of price action caused the crypto market fear and greed index to reach extreme fear.

Extreme fear is everywhere, and not just in the crypto market. Stocks, gold, silver and more all tumbled, and the global population is currently at the mercy of a rapidly spreading pandemic. Because the fear is so irrational and unprecedented, its difficult to say of the selloff is over or not.

PlusToken Scam, Stock Market Selloff Fuel Panic Drop

It’s that panic that caused the Dow Jones Industrial Average to set its worst daily close on record since 1987.

All major stock indices were in major trouble this week, sending valuations back years of growth.

That stock market panic also spread into Bitcoin and crypto, causing the two normally uncorrelated assets to have their highest correlation day in history.

But that’s not all that caused Bitcoin to collapse. The PlusToken Ponzi scheme continues to sell large sums of Bitcoin into the market.

Blockchain transactions showed their bad actor’s Bitcoin was on the move, then later Bitcoin fell from $9,000 to $7,500. It was that support that eventually broke down, causing the catastrophic selloff.

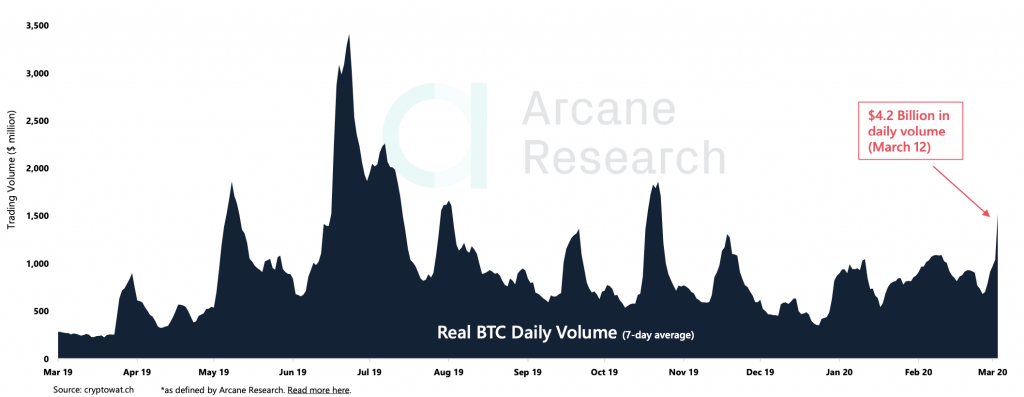

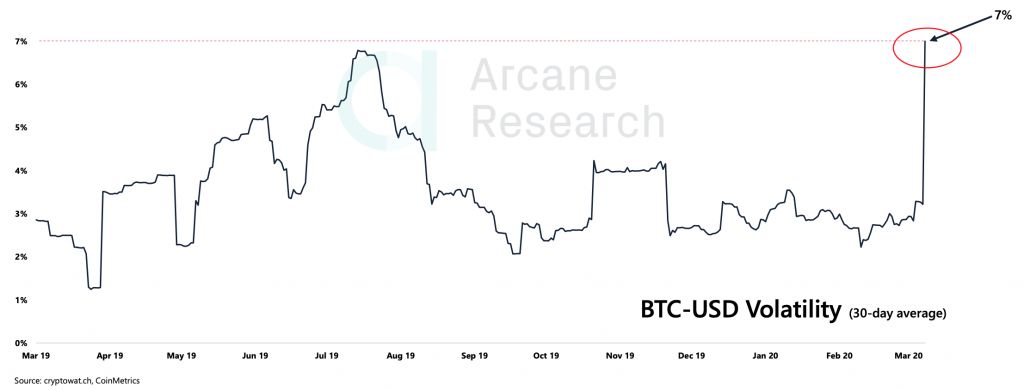

Selloff Causes Whales to Cash Out, Volatility and Volume Explode

The selloff also caused some of the earliest Bitcoin wallets, whales, and wallets that haven’t moved in a long time to cash out of the market.

When even the strongest hands give in and sell, it could signal capitulation and possible reversal. But with a black swan event like the coronavirus at the center of the global market spinning out of control, more downside cannot be ruled out.

The sell-off caused trading volume to explode – yet another sign of capitulation. Volatility also spiked to highs not seen since 2014, back when Bitcoin was $1,000. The number is also a potential target for the bottom if this downtrend continues, according to professional trader, Peter Brandt.

This Week’s Biggest News Stories

Ethereum Developer Infected with Coronavirus

According to a tweet from Afri Schoedon, an ex-Ethereum developer and programmer, he has tested positive for COVID-19, possibly contracting it at the Ethereum Community Conference 3 in France earlier in March.

Crypto Currency Act in Congress Classifies Crypto in Three Ways

A new bill in front of congress proposes that cryptocurrencies are classified officially by the government into three different types, including crypto commodities, crypto securities, and crypto currencies.

$40 Million Bond Issued on Ethereum Blockchain

A $40 million dollar bond was issued on Ethereum as part of a capital injection into the Fatburger restaurant brand, with quarterly payouts being sent directly to Ethereum wallets.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Flurex Option. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Flurex Option recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.