What Are We Talking About?

Divergence in forex trading is the term used to describe a discrepancy or disagreement between a currency pair’s price and a linked technical indicator. A potential bullish reversal is indicated by positive divergence, which happens when the price makes a lower low while the indicator makes a higher low. When the price makes a higher high while the indicator makes a lower high, negative divergence occurs, potentially signaling a bearish reversal. Divergence is a method used by traders to spot probable trend reversals and produce trading signals. It is a crucial idea in forex trading that aids traders in anticipating changes in market sentiment and taking trades.

Defining Divergence in Forex Trading

The Definition

Divergence is a key idea in technical analysis that aids traders in spotting probable trend continuation or trend reversal patterns. A technical indicator, usually an oscillating indicator like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or Stochastic Oscillator, is compared to the price movement of an asset.

Buyers Coming Into the Market? The Bullish Divergence Trading Signal

When the bullish divergence trading signal occurs, it is typically a sign that the sellers have overextended their welcome in the market.

Positive Divergence

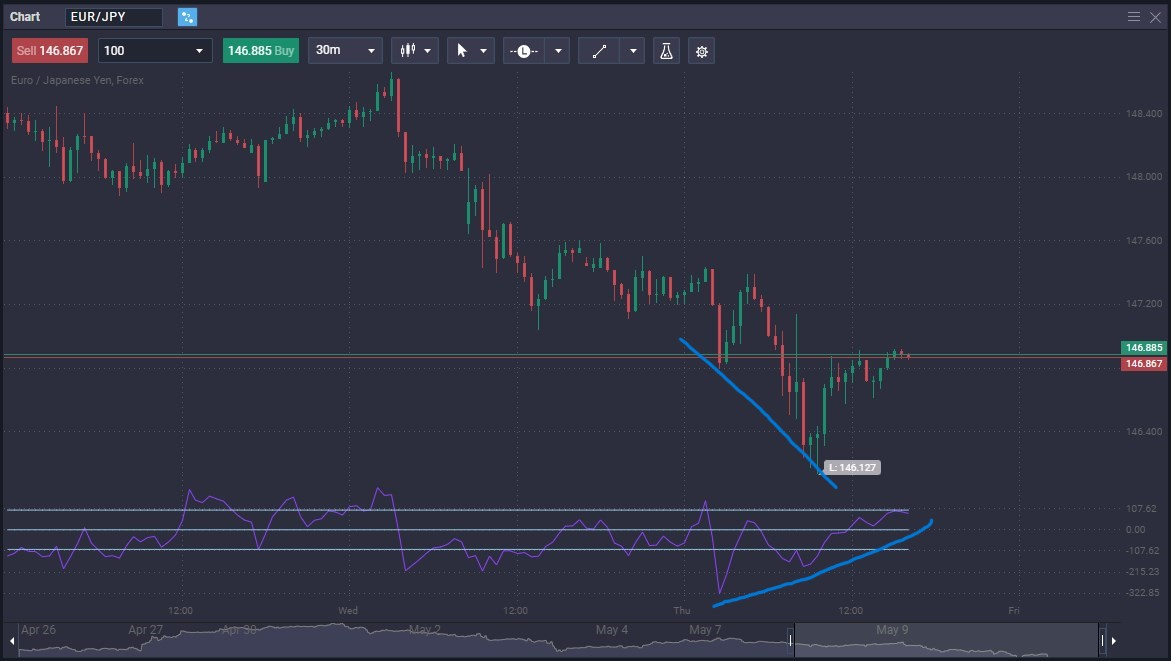

When an asset’s price makes a lower low and the associated indicator makes a higher low, there is positive divergence. Indicating a potential positive reversal or a gaining trend, it implies that the selling pressure may be easing. Positive divergence is interpreted by traders as an indication that a price increase or trend reversal is imminent.

Positive divergence is also sometimes called bullish divergence, so the two names are considered to be synonymous. Bullish divergence is something that traders jump on, especially when a market has been in a longer-term uptrend.

Sellers Coming Into the Market? The Bearish Divergence Trading Signal

Sometimes, the market has bearish divergence, which is a sign that perhaps the buyers have found themselves a bit overextended.

Negative Divergence

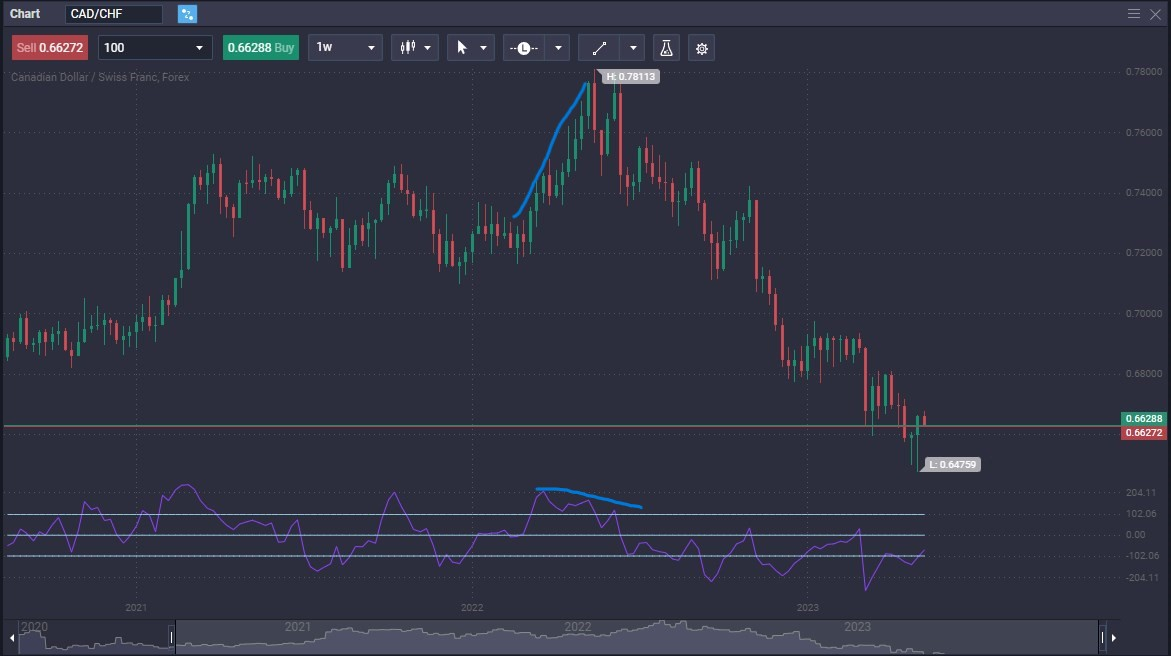

On the other side, negative divergence occurs when an asset’s price makes a higher high while the indicator makes a lower high. It suggests that the buying interest may be waning, indicating the possibility of a bearish trend reversal or trend weakening. Negative divergence is regarded by traders as a cautionary sign that the price may undergo a downward correction or a trend reversal.

A negative trade divergence suggests that buyers are running out of momentum, and this will be especially true if it is extended divergence, meaning that the market has truly ran much further than momentum should suggest based upon RSI divergence, the MACD indicator, or whatever Forex trade and oscillator you choose.

Because of this, a lot of traders pay very close attention this type of trade divergence, because it often leads the market much lower, perhaps even signaling the end of the overall trend. As with anything else technical analysis related, Forex traders are best served paying attention to the longer-term indicators on higher time frames first, and then zooming down to find trade divergence on shorter time frames.

A Trend Indicator of Reversal: Regular Divergences in Forex

Regular Divergence: Regular divergence is the movement of the price in the opposite direction from the indicator, indicating a likely trend reversal. Bullish divergences typically occur when the price makes a lower low and the indicator makes a higher low. In contrast, when a bearish divergence is normal, the price makes a higher high and the indicator makes a lower high. When they occur after a long trend, regular divergences are regarded as stronger signals.

When it’s not Obvious: Hidden Divergences in Forex

Occasionally, you hear the term “hidden divergence” by traders. While there can be both hidden bullish divergence and hidden bearish divergence, it does take a little bit more technical know-how to take advantage of these opportunities.

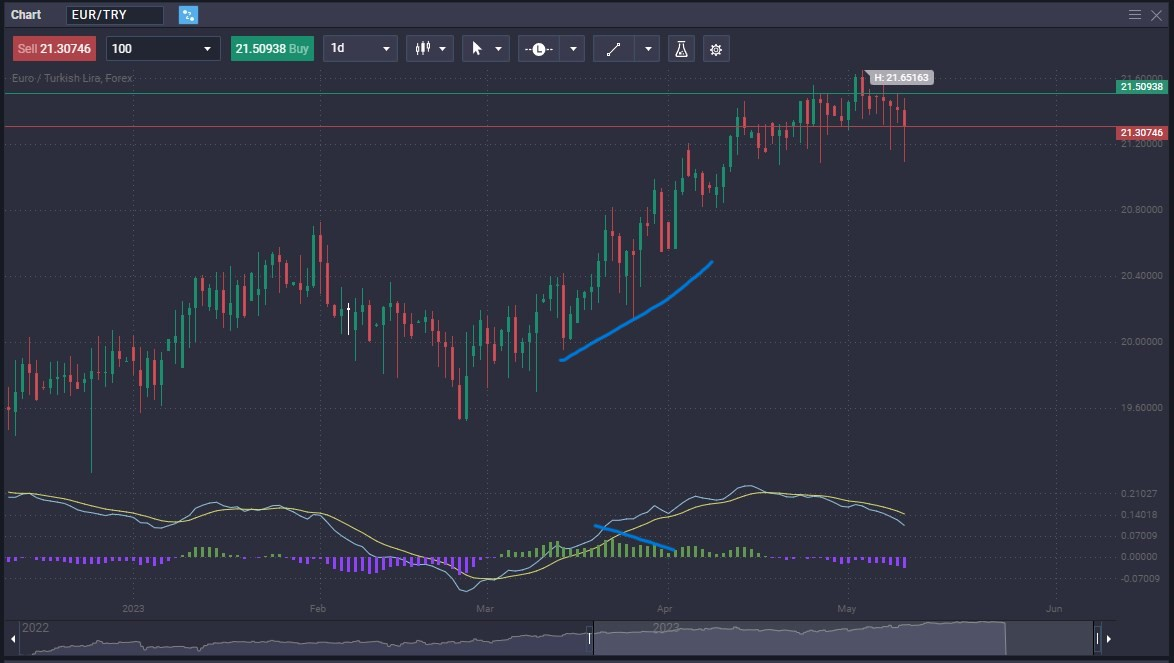

Hidden Divergence: Hidden divergence is seen in a market that is strongly trending and indicates that the trend will continue. The price makes a higher low while the indicator makes a lower low, forming a hidden bullish divergence.

Hidden divergence isn’t as common as a simple bullish divergence or bearish divergence, but it is something that Forex divergence traders use as a signal. Hidden bullish divergence and hidden bearish divergence trading is more suited for the experienced trader, but is very powerful.

This suggests that even though the price is retracing, the overall trend is still upward. In contrast, a concealed bearish divergence occurs when the price makes a lower high while the indicator makes a higher high, signaling that the bearish trend will continue.

Divergence is frequently used by traders in conjunction with other technical analysis tools as a confirmation tool to help them make well-informed trading decisions. It can produce trading signals and assist in spotting future trend continuations and trend reversals.

Divergence should, however, be utilized in conjunction with other technical indicators and analysis techniques for a thorough trading strategy. Trade divergences in Forex don’t happen everyday, but they are common enough that a lot of traders have made big gains using a strategy to trade divergences.

Identifying Divergence: Technical Indicators and Confirmation

The Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Stochastic Oscillator are popular technical indicators for spotting divergences in Forex.

Relative Strength Index (RSI):

In order to recognize overbought and oversold positions, traders frequently employ the RSI. When the price makes a higher high or lower low while the RSI makes a higher high or lower low, there is a divergence. This may indicate that the pricing trend is about to change.

Moving Average Convergence Divergence (MACD)

To spot future trend reversals, the MACD blends moving averages. When the price makes a higher high or lower low and the MACD histogram makes a higher high or lower low, a probable price direction reversal is indicated. This is known as MACD divergence.

MACD is probably one of the most common indicators that you will see people used to detect forex divergence, and is quite often the first indicator that traders use. It’s useful in both regular and hidden divergence, and as a result has been expanded beyond being used to trade regular divergences. If you plan on trading divergence in Forex, this is probably the most useful “all in one trading tool” for the markets.

Stochastic oscillator

The stochastic oscillator evaluates the relationship between an asset’s closing price and its price range over a given time frame. When the price makes a higher high or lower low while the stochastic oscillator makes a higher high or lower low, this is known as divergence and it indicates a potential trend reversal.

Price Action

Divergence indications can be verified by traders using candlestick analysis and chart patterns. One can have more faith in a prospective upward reversal, for instance, if a bullish divergence signal is reinforced by a bullish reversal pattern, such as a double bottom or a bullish engulfing candlestick.

The expectation of a downward reversal can also be strengthened by a bearish divergence signal combined with a bearish reversal pattern, such as a double top or a bearish engulfing candlestick.

Divergence signals can be used by traders to better understand probable trend reversals and help them make more informed trading decisions by combining them with chart patterns and candlestick analysis. For a well-rounded trading strategy, it’s crucial to exercise sound risk management and take into account a variety of criteria in addition to divergence indications.

Trading Divergence: Strategies and Practical Tips

In order to start using trading divergences, there are several steps in putting a trading system together. There is more to it than simply putting a momentum indicator on a price chart, and placing a trade. It’s more than just simple overbought and oversold conditions, as a divergence strategy will have multiple conditions before giving a trading signal.

Understanding Divergence: Gain knowledge of the various types of divergence, such as positive and negative, regular and hidden, as well as how to spot them using indicators like the RSI, MACD, and Stochastic Oscillator.

Furthermore, make sure you understand the difference between bullish divergence and bearish divergence, as well as hidden divergence. Depending on what type of divergence pattern you have, you will have to take specific steps in your trade. It should be remembered that trend continuation patterns are typically the most reliable, but if there are Forex divergences that allow for a counter trend trade, some traders have found them useful in maximizing profits.

Set Up Your Chart and Indicators: Set up your trading platform with the appropriate timeframe and preferred indicators for your trading strategy.

Finding Divergence signs: Use the selected indicator and the price action to compare for divergence signs. Pay attention to places where the price and indication exhibit divergent trends or disagreement. For example, two of the most common oscillators to use are the MACD indicator, and the Commodity Channel Index.

Confirm using Price Patterns: To verify the divergence indications, use candlestick analysis and chart patterns. Search for patterns of reversal that coincide with the projected price reversal suggested by the divergence.

Decide on Entry and Exit Points: Based on the divergence indication and additional confirmation from price patterns, pinpoint the exact entry and exit positions. To manage potential losses and safeguard winnings, think about using stop-loss orders and take-profit goals.

Your entry and exit points could be based upon bearish divergence, bullish divergence, hidden bearish divergence, and a whole host of other opportunities when it comes to trading divergence in forex. In general, most traders find it easier to trade with the overall price trend, and that they do better when they trade divergence is that our a continuation of the longer-term price trend itself.

Non-Technical Indicator Items

Use risk management: Decide on proper risk management strategies, such as how much of your trading money you will risk on each trade and how strictly you will abide by stop-loss levels. This aids in managing future losses and capital protection.

Without a proper risk management strategy for financial markets, trading strategies end up being useless. Staying in the markets longer-term requires that you admit when you are wrong and keep your losses to a minimum.

Practice discipline: Before making trades, watch for strong divergence signs with confirming patterns. Be diligent in sticking to your trading plan and refrain from making rash trading judgments.

Discipline is absolutely crucial when trading divergence in forex, or when you try to trade divergence is in any financial market. Remember, by its very nature you are trying to trade in the opposite direction of where the market has been recently going, so trading a divergence in forex trading takes a certain amount of skill. In order to be skillful, you need to have a significant amount of discipline, which is true with forex training in general.

Avoid Overtrading: Overtrading can result in risk exposure and emotional decision-making. Maintain your trading plan, pay attention to solid divergence signs, and refrain from engaging in excessive trading.

Overtrading, whether it be trading divergence, or any other type of pattern or system on a price chart, is without a doubt one of the most common destroyers of accounts. While trend continuation is the norm, longer-term studies suggest that perhaps sticking with the overall upward trend or downward trend is the best way to go. Trying to jump in and out of the market every time there is a slight move in one of your favorite currency pairs is a very dangerous way to trade.

Use a Demo Account: Practice trading divergences on a demo account before putting real money at risk. By doing so, you can test out many variations of the technique, become more comfortable with it, and boost your confidence in your trading abilities.

Using a demo account to learn to trade divergence is is probably the smartest thing can do. Trading divergence and forex can be very profitable, but there also are a lot of nuances that need to be learned. By learning to detect hidden divergences, analyze a bullish trend, or just to trade Forex in general, you can save yourself a lot of heartache down the road by protecting your trading capital if you are demonstrating.

Continuously improve and adapt: Keep track of your trading activity, assess your deals, and take lessons from both wins and losses. By continually practicing and learning, you can adjust your approach as necessary and hone your talents.

A couple of thoughts

Keep in mind that trading divergence includes risk and is not a guarantee. Market instability and potential misleading signals should be anticipated. Your chances of being successful when trading divergence can be increased by exercising patience, utilizing the right risk management strategies, and refraining from overtrading.

Conclusion: Mastering Divergence for Forex Trading Success

In conclusion, divergence is a formidable instrument in forex trading that creates trade signals and aids in identifying future trend reversals. Diverse types of divergence, including positive and negative, regular and hidden, can help traders better understand market dynamics and make wise trading decisions.

Setting up the right chart and indicators, recognising divergence signals, validating them with price patterns, establishing entry and exit locations, putting risk management into action, and exercising discipline are all essential when developing a divergence trading strategy. Waiting for high-quality divergence signals and refraining from overtrading are necessary in order to avoid making rash decisions.

Walk Before You Run

Before risking real money, traders should practise on demo accounts and build experience. This enables strategy improvement, variation testing, and confidence-building. This will give you an idea as to how your trading strategy works with divergence and Forex trade in, and whether or not are adept at learning to trade divergence is. It’s important to understand your Forex divergence strategy and its strengths and weaknesses before risking any money on currency pairs.

Trading Can Be Risky

It’s important to emphasize that trading divergence carries risks, and no strategy is foolproof. Long-term success therefore requires constant learning, adaptation, and the application of good risk management. Divergence has a lot of potential, and traders may take advantage of it and enhance their overall trading success by combining patience, discipline, and careful analysis.

Find Your System with a Trusted Broker

One of the best ways to practice spotting bearish divergence, bullish divergence, and other technical analysis aspects such as the price trend, and spotting a divergence signal, is to trade on a demo account from Flurex Option, with its world-class platform allowing for plenty of oscillators for use on your price chart, such as the MACD indicator, the Commodity Channel Index, the RSI indicator, and many other oscillator indicators to take advantage of not only the current trend, but extended divergences as well.