Copy trading can be profitable, assuming you follow the correct trader. If you find that you cannot make money trading the markets, you may choose to follow the skilled investors and ability that we offer at Flurex Option.

About Copy Trading

Copy trading is one of the many advantages that brokers offer these days. At Flurex Option, we are no exception. The idea of copy trading is to take advantage of the expertise of others. It serves many purposes, such as a way to leverage the ability of others to make a return without all of the extra work that can come with doing so.

Another reason that you may find copy trading advantageous is a way of diversifying your investments. You can take advantage of someone else’s strategy with a portion of your trading capital while using your strategy with another portion. Yet another common reason for using copy trading is to “earn while you learn.” When traders begin their journey, it can take a lot of effort and time to become profitable, which can help with your finances.

Is Copy Trading Profitable?

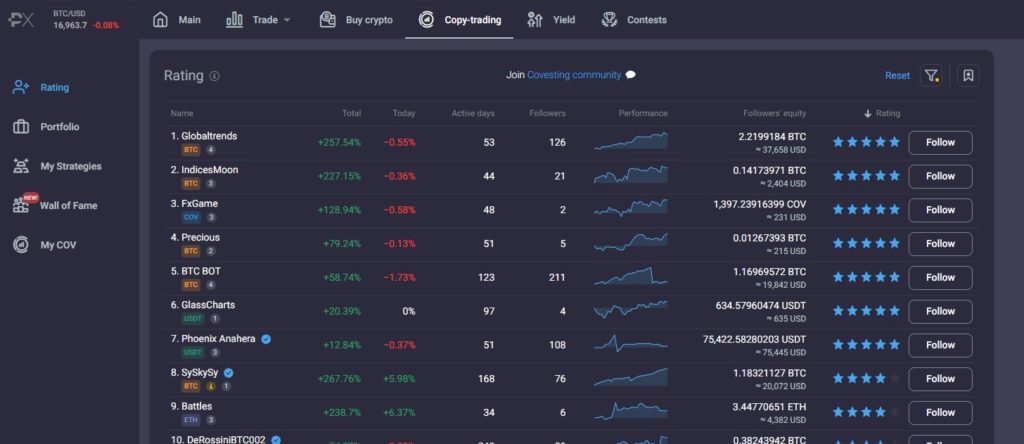

Copy trading can be profitable, but it will depend on who you follow. Because of this, Flurex Option allows you to look at the rankings of potential traders to follow. That being said, there is more to pay attention to than the total return. After all, one of the most important things to pay attention to is the risk involved.

History is littered with traders who made outsized returns for short-term gain, only to blow up spectacularly. To find profitability over the longer term, a trader you are following must be able to take small losses and let profits run. This is just like trading would work if you were doing it yourself. Protecting your account is crucial, and this is the same no matter who trades it.

When Copy Trading Works

The short answer, of course, is when you make money. However, it also needs to make sense from a time management standpoint and effort. In other words, if you choose not to put a lot of effort into trading and simply want to make a return, then it does make a lot of sense to do so via copy trading.

It also can be used to manage part of your money, allowing for instant diversification as traders will react differently and, of course, have different strategies and assets than you might have. By allowing for part of your portfolio to be managed differently, you are possibly going to be able to make money when your strategy won’t, and of course, vice versa.

When Copy Trading Doesn’t Work

Copy trading, of course, doesn’t work if you end up following someone who is not profitable. It also does not work if you follow somebody who takes too much risk. Keep in mind that even the best strategy will have losers, so following somebody who has made 100% in the last week isn’t going to be a good idea unless they can back up those kinds of outsized returns. Quite frankly, you want to see somebody who is steady in their approach and their equity curve.

It also does not work if you cannot follow a strategy, which is simply letting the trades run. If their trading strategy makes you too nervous, you may fidget with the positions and not let the strategy work out overall.

Is Copy Trading Worth Your Time?

To know whether or not copy trading is worth your time, it’s going to come down to whether the potential strategy you are following outperforms the one that you currently use. Beyond that, you also have to weigh the pros and cons of each strategy and whether or not you are comfortable letting someone else call the shots. That being said, there is a handful of things worth thinking through.

The leaderboard of potential traders to copy on the Flurex Option platform.

Is Copy Trading Right for You?

There is no “one-size-fits-all” answer to this question, but it is worth noting that the true answers will likely come from you. After all, there are many different things to think about, not the least of which is time management.

If you do not have time to analyze the markets frequently, or perhaps even don’t have enough time to learn how to trade, then this can be a way to maximize potential returns in the markets without having to put forth too much effort. However, it won’t necessarily be for you if you have plenty of time and would rather have more of a “hands-on approach” to your investing. Furthermore, they should probably think about the possibility of a mixture as well, as if you do not have enough time but also want to place longer-term trade; you may have some of your funds managed, while longer-term core holdings might be more of the “buy-and-hold” variety.

Details of a trader that is followed on Covesting, the copy trading partner of Flurex Option.

Is copy trading smart?

Whether or not copy trading is smart is going to come down to a multitude of factors. You need to remember whether you have the time commitment or desire to learn how to trade. Furthermore, you need to understand that not every trader you copy will be the same. Finding the correct one to follow is crucial.

Can I make money from copy trading?

Yes, it is certainly possible. However, you need to research and find a trader that matches your risk tolerance and has an established record of profitability.

How much does it cost to start copy trading?

To begin copy trading on the Flurex Option platform – via our partners at Covesting, you are charged a 1% entry fee. When you stop following or take profit on your orders, profits are shared between you (60%), the platform (20%), and the manager (20%).