Litecoin is often thought of as digital silver and Bitcoin as digital gold. Litecoin has many similar attributes to Bitcoin and is one of the oldest cryptocurrencies in the upper echelon of market capitalization.

After Bitcoin took the world by storm, several altcoins came afterward that tried to prove the efficacy of digital currency and improve on what Bitcoin had set out to do. Some cryptocurrencies complement Bitcoin, existing alongside the leading digital assets, much like silver sits next to gold. As an industry experts, we will provide insights in this article to help you determine if investing in Litecoin is a wise decision for your portfolio.

This guide will explain why Litecoin investment is wise and why any investment in Litecoin is worth it when you consider the long-term growth potential for not only Litecoin but digital payments in general. We will explain how to invest in Litecoin, the pros and cons of Litecoin investing, and much more.

Litecoin Investing: What Is It?

Litecoin is a cryptocurrency token trading under the ticker symbol LTC. It has been a top-performing altcoin since its inception in 2011, created by Charlie “Satoshi Lite” Lee. Charlie Lee was an engineer at both Google and Coinbase and had extensive experience in technology.

The Litecoin Foundation works with developing and adopting Litecoin, forming partnerships, funding opportunities, and the like. One example is in agreement with the Ultimate Fighting Championship to become the official cryptocurrency of the UFC.

Litecoin is often a leading indicator of the rest of the cryptocurrency world. As the community claims, “Litecoin lights the path that leads the way to alt season.” Traders will watch the price of LTC, even if they choose not to trade it. When Litecoin starts to take off, risk appetite spreads, and many smaller markets are about to have explosive gains.

The computer code behind Litecoin is almost identical to the code for Bitcoin. Litecoin has a fixed supply and a halving like Bitcoin does. This means that as time goes on, the reward for mining blocks will be smaller. Litecoin is proof of work, much like Bitcoin.

Litecoin has four times the supply of Bitcoin, with a cap of 84 million LTC. Litecoin also lowered the block generation time to just 2 ½ minutes versus 10 minutes on the Bitcoin network, making it a faster solution for sending and receiving. While crypto has struggled in 2022, the Litecoin market has shown that it can weather the storm multiple times, as crypto has seen a lot of volatility since its inception. Because of this, as soon as this low is put in, Litecoin is once again a good investment for those willing to take the plunge.

Is Litecoin A Good Investment? How It Performed In 2021

Litecoin failed to perform the way Bitcoin does after its halving, typically seeing Bitcoin rise in demand due to reduced supply. However, confidence in Litecoin rose with the rest of the market in 2021, resulting in a massive spike to reach a high of $255.79 in April. However, Litecoin has fallen, along with the rest of the crypto market, to lose over 80%.

That being said, Litecoin has had these massive selloffs in the past, as any cryptocurrency has over the last decade or so. It has shown its resiliency in the past, and there’s no reason to think that it will not in the future.

Investing In Litecoin In 2022? Is It A Good Idea?

Litecoin has plummeted over 80% over the last 12 months, making the assets enter “crypto winter” along with many other coins. Interestingly, we have seen this happen multiple times, but it is worth noting that Litecoin has always recovered. This does not mean that you should jump in right away, but this also does not mean that Litecoin investing is bad. Litecoin may have a substantial risk-to-reward ratio compared to other financial assets.

The crypto markets are extraordinarily volatile. To begin with, you need to be cautious about investing too much in one shot. Much of this will come down to your investing strategy as to how much you put into the market at a time. Luckily, Flurex Option offers the CFD market, or the contract for difference market, for Litecoin. This means you can trade both long and short of the market and with leverage. In other words, you do not need to risk massive amounts of money to take advantage of volatility.

Litecoin Fundamental Analysis

Developer activity continues to hold steady with Litecoin. Litecoin is often used as a testbed for Bitcoin development, so this is another reason to believe that people will still flock to the ecosystem. The close relation to Bitcoin and its limited supply makes Litecoin valuable.

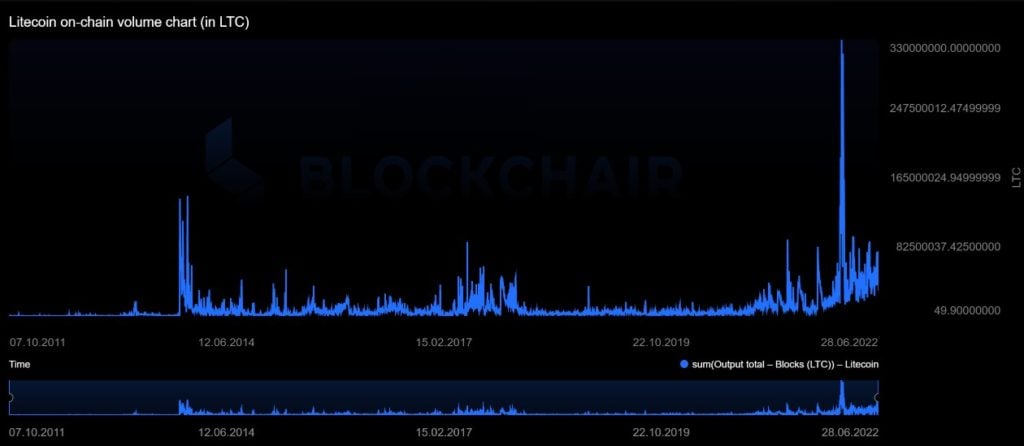

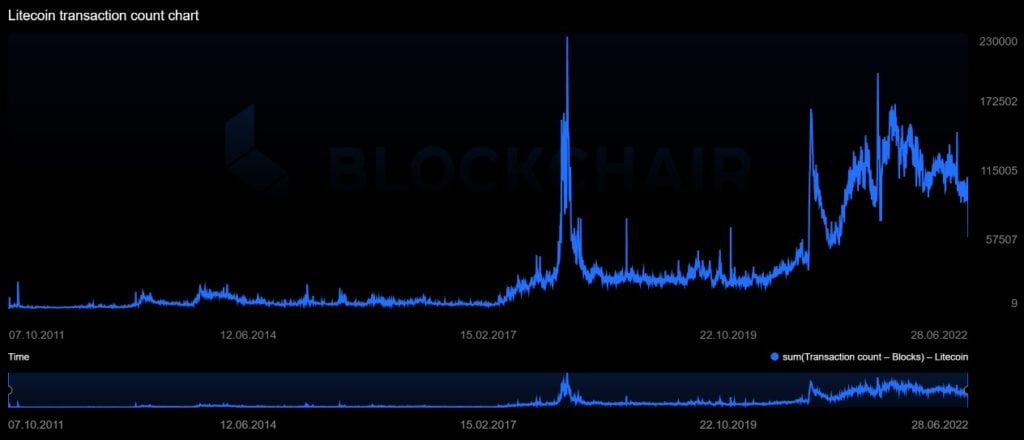

As time goes on, Litecoin has shown remarkable consistency in on-chain volume. It’s worth noting that on-chain volume has plummeted since the bubble in late 2021, but it is now at a more consistent level than we have seen in the past, meaning that we are probably closer to the bottom than the top. Furthermore, transaction count has fallen in terms of blocks on the Litecoin ecosystem. However, it remains well elevated from historical norms, suggesting that Litecoin has a significant interest in it and the ability to survive going forward. Both are relatively bullish and indicate that we will eventually see Litecoin spike again.

Litecoin has over 150,000 active addresses and processes roughly 50,000 transactions every 24 hours.

Learn more about Fundamental Analysis

Litecoin Technical Analysis

Litecoin technical analysis looks like the rest of crypto as if it’s trying to build some type of base. Finding a bottom is often arduous, so you will need to be cautious about “jumping all in” into the Litecoin market. Luckily, we have significant history near the $20 level showing market interest, so that might be an area where Litecoin attracts a lot of inflow.

Furthermore, using the CFD market, you can “scale into the position” with tiny increments of money, taking advantage of leverage to benefit from the swing to the upside. The time for shorting Litecoin is probably in the rearview mirror, although the price certainly can continue to fall. (The “easy money” to the downside has already been made as Litecoin has dropped over 80%, along with other altcoins.)

Learn more about Technical Analysis

Litecoin Sentiment Analysis

Litecoin sentiment analysis is very poor in 2022, as is the rest of the cryptocurrency markets. Quite frankly, when sentiment becomes very poor, that is typically when the most money can be made. After all, it is often “darkest before dawn,” and that is true in all financial assets.

Keep in mind that Litecoin follows Bitcoin, so you should pay close attention to what Bitcoin is doing. If it starts to rally again, it will drag the rest of crypto up with it, with Litecoin being relatively quick to react. You should also pay close attention to the US Dollar Index because it is a mathematical expression of risk appetite. When risk appetite is poor, the US dollar tends to strengthen. For crypto to rise, risk appetite has to be strong.

Monetary policy coming out of central banks will also have much to do with what sentiment does. A tightening monetary policy out of the Federal Reserve and other major central banks has major institutional players pulling money out of the markets. Suppose the central banks begin to loosen monetary policy again. In that case, money will flow from the stock market to currencies, commodities, and Bitcoin, and then to the rest of the cryptocurrency markets.

You can also look for the amount of social interaction on Twitter and Instagram. However, you should note that the more you see social interaction, the more likely you are closer to the top than the bottom. The exact opposite can also be true as well, for when the average retail trader has no interest in a market, it’s likely that you are closer to the bottom.

Expert Expectations and Litecoin Price Predictions

Litecoin has several experts jumping in to make predictions about its price, as the volatility in the coin’s utility makes it an attractive investment.

Dan Gambardello, Youtuber and Founder of Crypto Capital Venture, is looking for a “massive run to $1,000+” after the current crypto winter ends. Originally slated to happen sometime in 2024, he now believes it may be closer to 2027 by the time Litecoin breaks $1000.

GalaxyTrading, a well-known trading desk and technical analysis team, believes Litecoin could hit $1000 by the end of 2023, making it one of the most bullish firms.

Penguin Capital, a crypto fund, joined the conversation suggesting that they believe Litecoin could reach as high as $2200 by the end of the decade.

Ways To Invest In Litecoin

Investing in Litecoin can be done by mining or buying LTC online in a few simple clicks on a platform or exchange that offers cryptocurrency. Once you have Litecoin, you can decide on several different ways to invest in the market. Here are some of the most common Litecoin investment strategies.

Buy and Hold

Buying and holding a cryptocurrency like Litecoin and other altcoins involves purchasing the asset on a spot exchange and moving it to a web wallet or a hardware wallet for safekeeping. Buying and holding a cryptocurrency takes the least effort and expertise and forgoes a lot of significant risks. Whatever you pay for the crypto is what you will be risking overall.

This type of investing can be profitable over the longer term, but one must be willing to sit through extreme volatility. For example, in 2019, Litecoin rose from just under $20 to the $140 level. The following year, it dropped to just under $40. Those who bought and held would have missed massive profit opportunities by not getting out once it started to fall again. The following year, Litecoin reached $255 but has since fallen to lose over 80%.

Trading

Instead of buying and holding an asset, investors can trade and try to profit from price swings. There are two main trading methods: spot trading and derivatives trading.

Spot trading involves buying an asset at low prices and selling it when prices rise. The idea is to gain as much as possible for each swing. This is how most people think about the stock market when they say, “buy low and sell high.” However, one of the major issues is that you cannot profit from drops in price. When spot trading, the best thing you can do is run to cash when markets get negative.

If a trader were to buy Litecoin at $20 and sell it at $140, it would have $120 in profit. However, when Litecoin fell back to the $20 range, they could have bought it back and still had $100 to spare.

Derivatives trading involves an alternative to spot trading that lets traders get both long and short an asset, and often with leverage, allowing the gains to be amplified. This allows markets no matter which way the market turns but also increases risk, so money management is crucial.

Using a platform like the one offered at Flurex Option, traders could have profited from both when Litecoin climbed from $20 to $140 and again from $140 down to $20. Using 100 × leverage, the two $120 price swings and volatility could have gained the trader as much as $24,000. Clearly, you can make much more using the CFD platform.

Pros And Cons of Litecoin

Investing and trading in Litecoin has been highly profitable for those who were early in the market. Several signs point to a repeat in the power of a massive breakout for the entire crypto market, and Litecoin has shown itself to be a survivor. That being said, you should know the pros and cons of Litecoin investing.

Pros

- Transactions are much faster than Bitcoin.

- Litecoin has extremely low fees.

- Has proven itself to be reliable and a survivor.

- Litecoin has had explosive returns in the past.

Cons

- Charlie Lee once sold a massive amount, tarnishing some investors’ confidence.

- Recent crypto sentiment has been horrible.

- Halving doesn’t have the same impact as it does on the Bitcoin network.

How Much To Invest In Litecoin?

Litecoin is an extraordinarily volatile asset, just like every other cryptocurrency. Litecoin is divisible by up to eight decimal places, so smaller portions of Litecoin are possible to invest in and can be purchased in any increment. The more money you invest, the more potential return on investment. However, it’s important to remember that you should never invest more than you can comfortably lose.

As volatile as crypto markets tend to be, losses will be much more uncomfortable than you may be used to. Profits are also just as shocking, so it does end up being worth the risk in the long term for those who apply sound money management.

Is Day Trading Crypto Profitable?

Day traders who have traded Litecoin from the 2018 bottom to the 2019 top, then back to the 2020 bottom before reaching the 2021 top, have made a small fortune. Those utilizing the CFD cryptocurrency platforms like the one at Flurex Option could have amplified profits even further.

Why Choose Crypto Over Traditional Investments?

Crypto is much more volatile than other assets, making them a highly profitable venture if you can navigate the markets correctly. Furthermore, crypto is still a new technology, so the future is unknown but seemingly somewhat unlimited.

Is It Worth It To Invest In Litecoin?

This guide provides many details that will make Litecoin worth investing in, but you still need to do additional research online or elsewhere on this site to consider whether or not Litecoin is right for you. That being said, it is worth noting that there have been explosive moves to the upside in this market multiple times.

Is It Smart To Invest In Litecoin?

Considering the substantial Return on Investment that Litecoin and other cryptocurrencies are capable of, it is wise to have some exposure to these assets. Crypto is a way to get away from some of the traditional correlations of financial markets and, therefore, should be thought of as another venue to make returns.

Is Litecoin A Good Investment?

Litecoin has proven multiple times that it is a good investment and is easily researched for fundamental and technical signals, as it is widely available online. The cryptocurrency market has dropped into a “crypto winter” in 2022, typically when the “smart money” comes into the marketplace and accumulates again.

How To Invest In Litecoin?

Investing in Litecoin can be done quickly, with just a few clicks on a computer. There are multiple exchanges and trading platforms to choose from, but not all will allow anything beyond spot trading.

Flurex Option is a Bitcoin-based margin trading platform that allows traders to take advantage of both long and short opportunities with leverage. Flurex Option first requires a purchase of Bitcoin, which can be done on-site. Users can then open up positions on the platform using Litecoin CFDs for profit opportunities.

What Is The Minimum To Invest In Litecoin?

The minimum amount you can invest depends on your risk appetite in your personal preference, but you can get started with a few dollars in most cases. Litecoin is currently under $50, so one token is a good place to start. Flurex Option requires a minimum deposit of just 0.001 BTC to start trading, be it Litecoin or any other available markets.

Should I Invest In Litecoin Now?

As with most things, there is no time like the present. However, you should also recognize that crypto markets tend to be extraordinarily volatile, so it’s not to say that the market will go in your direction immediately. Because of this, you must only trade or invest which you can afford to. Being early for the next bullish run is a great way to make a lot of money, but timing it is a real challenge.

Where To Invest In Litecoin?

Flurex Option is a great place to invest in Litecoin. The award-winning Bitcoin margin trading platform offers CFD markets for crypto, commodities, stock indices, and forex on one platform. Leverage and the ability to go both long and short allow traders to maximize their profit regardless of the price.

Registration is free and takes less than 60 seconds to get started. Users of the platform can either deposit a minimum of 0.001 BTC or buy Bitcoin directly from the platform offered by Flurex Option to fund their trading account.

After the account is funded, traders can take positions in Litecoin and prepare for the next move. The platform is reliable and has a reputation for providing deep liquidity. Order execution is lightning fast, with little to no slippage. The platform also supplies technical analysis software, a full peer-to-peer copy trading module, and several other tools that make investing in Litecoin exciting and potentially wildly profitable.