The battle between the Bitcoin bulls and bears seems to be leaning towards the former as the month of October kicked off. Bitcoin has been sliding towards a more bearish trend of late, but a sudden billion dollar long position seems to have reinvigorated the bulls.

This helped the price of Bitcoin quickly rally, and also brought to surface the plethora of good news that is flooding the cryptocurrency scene. Institutional investment in the cryptocurrency space is still the primary driver of good news as the jokes of Morgan Stanley and even Elon Musk have highlighted the positives of Bitcoin.

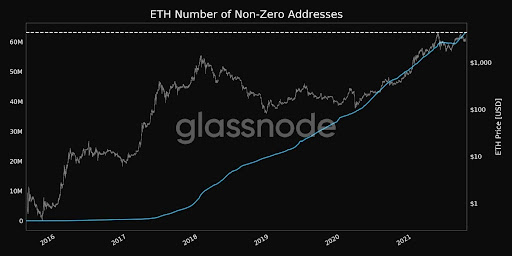

Meanwhile, smaller more individual investors look like they are moving towards Ethereum as the number of non-zero addresses for ETH has resumed its previous steady rise after pausing during the May-July consolidation. Altcoins are also in the sights of social media users with many projects, such as AVAX and MATIC, back as some of the top-discussed topics on crypto social media.

Meanwhile, in the traditional markets, US stocks pushed higher on Friday as investors shook off a rough Sept amid news of a new oral treatment for Covid-19 boosted shares of companies tied to an economic recovery. The going wasn’t as rosy before Friday as Wall Street came to a tumultuous Sept end on the back of inflation fears, slowing growth and rising rates.

Comments from FED Chair Powell mid-week, calling inflation ‘frustrating’ and seeing it running into next year gave investors some jitters which caused stocks to fall. The USD rose sharply, with the DXY rising from 93 to 94.50 as investors fled risky assets to the USD on the back of rising bond yields.

The market appeared to be calming down on Friday as the 10-year Treasury yield fell back to 1.47%. Yields surging to 1.55% mid-week knocked tech stocks down hard, dragging the Nasdaq lower. For the week, Nasdaq lost 3.2%, the Dow ended 1.4% lower, and the S%P fell 2.2% despite a positive Friday.

On a month-on-month basis, the indices fared worse, with the S&P 500 finishing Sept down 4.8%, breaking a seven-month winning streak. The Dow and the Nasdaq fell 4.3% and 5.3%, respectively, suffering their worst months of the year.

The FED’s admittance of rising inflation appears to be helping precious metals, with Gold and Silver managing to recoup losses incurred earlier in the week. At one point, Silver broke the important support at $22 but managed to reclaim that level after Powell’s speech on Thursday. Silver is back at $22.55 while Gold trades at $1,760.

Oil continues to inch higher albeit meeting with some profit-taking ahead of its 3 year high of $76.50. OPEC+ is back meeting today and could influence the direction of Oil price.

As with precious metals, the price of cryptocurrencies was also boosted by Powell’s comments about inflation and started the new month of October on a positive note.

The crypto market rose rapidly early Friday morning abruptly as a large BTC long position of $1.56 billion was opened on the Binance Futures Market at 6.30am NYT, which subsequently caused BTC to rise by 10% within an hour. Short liquidations exceeded $270 million as even the price of ETH, which has recently come under pressure, broke through $3,200, leading most other altcoins higher. An interesting point to note is that crypto prices are now much higher than they were when China reiterated their crypto ban on the same day last week.

Positive News Galore for Crypto

Morgan Stanley, one of the banking giants on Wall Street and a former BTC critic has added nearly 30,000 additional shares of Grayscale Bitcoin Trust ($GBTC), showing that the firm is now positively skewed towards BTC.

Meanwhile, according to a new survey by European investment manager Nickel Digital Asset Management, as many as 62% of global institutional investors with zero exposure to cryptocurrencies like BTC said they expect to make their first investments in cryptocurrencies within the next year.

El Salvador, the first country to make BTC legal tender, says they are making its first steps toward powering BTC mining with volcanic energy and has started mining BTC using volcano energy.

Elon Musk, who has been very quiet in recent days about cryptocurrencies, said in an interview at the Code Conference in Los Angeles on Tuesday that the US authorities should stand away from regulating cryptocurrencies, as their intervention could hold back growth. He suggested that the best they do is to “do nothing” and just let the industry fly since it is “impossible to stop cryptocurrencies”.

The most important news that caused BTC to rebound in the week was from SEC Chairman Gary Gensler, who spoke twice last week about his renewed support for a BTC-Futures based ETF Fund. Gensler says the existing law provides significant investor protection for mutual funds and ETFs and noted a number of open-end mutual funds invested in BTC Futures traded on the Chicago Mercantile Exchange.

The SEC is reviewing more than a dozen ETF filings for BTC and BTC-Futures products, and some could be getting their results from the middle of October. From what Gensler has mentioned, it may seem plausible that filings from BTC-Futures type of ETF could be approved, which has generated some positivity from investors.

Another positivity came from FED Chair Powell who on Day 2 of a Senate hearing explicitly assured that the USA will not clamp down on cryptocurrencies the way China did, but will instead regulate it.

As a result of the series of positive news, the price of BTC grew stronger into the close of September and rallied on the first day of October with a gain of 5% to test the $45,000 level where it fell from when the China ban came into effect just a week ago before the large order took it past $48,000.

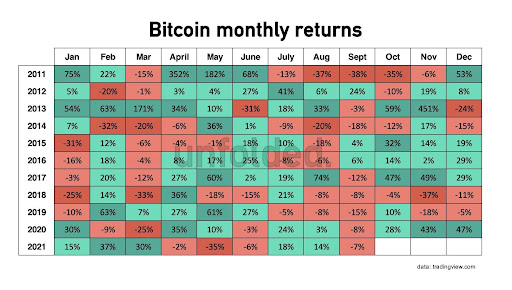

Another positivity could also simply be the fact that Sept, which traditionally has been a bad month for the price of BTC, is done and dusted with, and October, which has always been a good month for BTC, is finally here.

The bulls do not only have the calendar in their favor as the BTC net flow to exchanges is also painting a bullish picture. Since the end of July, when the price of BTC first rebounded, the net flow to exchanges has been negative (meaning more outflow than inflow), the net flow has become even more negative with the recent dip in price, suggesting that more and more BTC has been bought during the dips and withdrawn from exchanges. This is a very bullish sign for the price trajectory from now on as, during previous market tops, the exchange net flow had always been positive. This could imply that the current bull cycle has not seen its top yet.

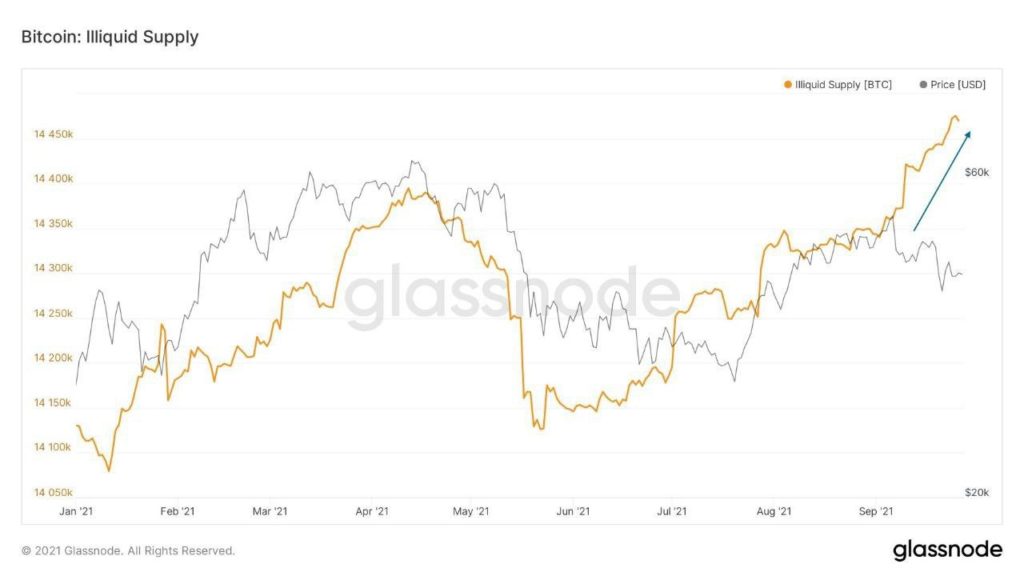

Another bullish development is the illiquid supply of BTC. Ever since the sudden collapse in price on Sept 7, the illiquid supply of BTC has been rising sharply, a sign that long-term whales with little sale history have been accumulating the Sept dip very aggressively. The last time there was a spike of this magnitude was during the dip of Jan 2021. The price of BTC subsequently almost doubled from a low of $32,000 to a high of $58,000 in the following month.

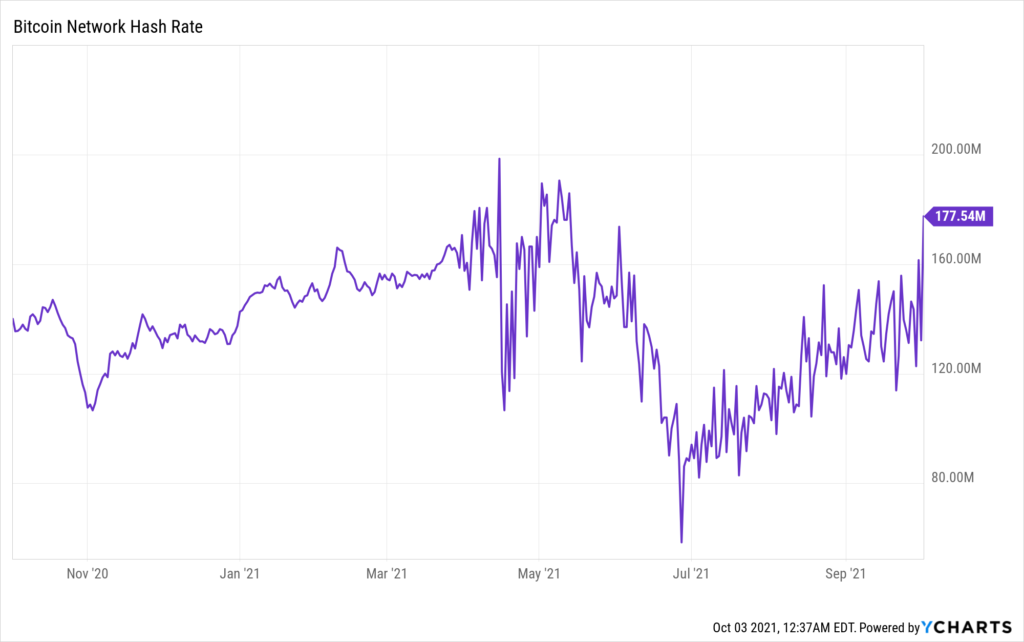

One more strong bullish indication is that the hash rate for BTC has continued to recover. The daily average hash rate has climbed to 177.54M TH/s on Oct 2. This is just 11% shy of the 200M TH/s when BTC was trading at ATH of $64,000. Could this be an early indication of the price of BTC in the coming days?

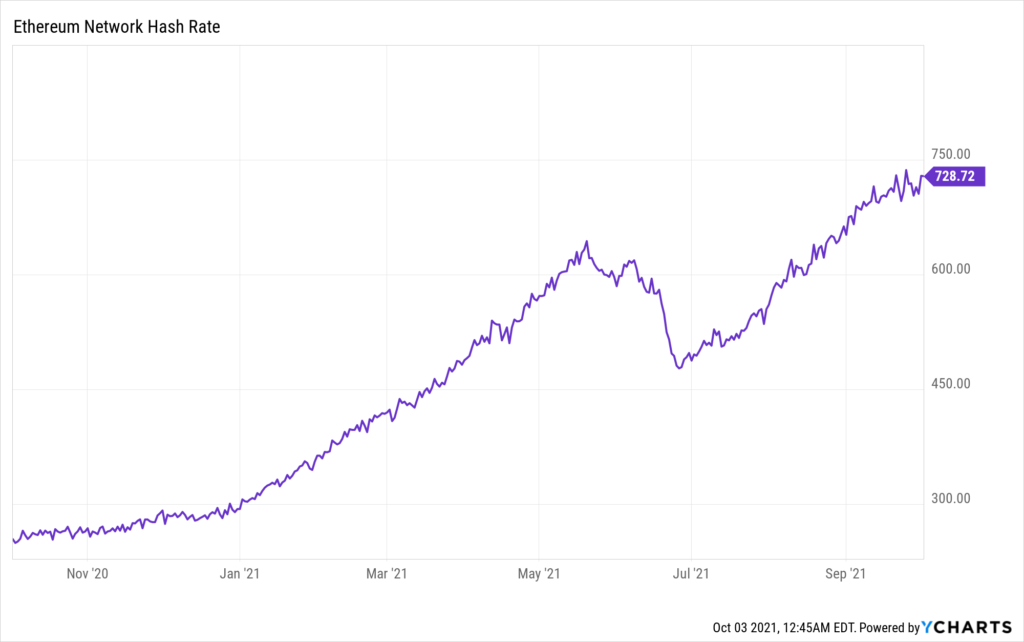

If the network hash rate is looking bullish for BTC, it is even more bullish for ETH as the ETH hash rate has surpassed the level when ETH was trading at ATH in May. Could this then mean that ETH could be breaking its ATH soon?

Small Investors Back At Stacking ETH

The number of non-zero addresses for ETH has resumed its previous steady rise after pausing during the May-July consolidation. This resumption could be related to the success of the EIP-1559 upgrade in early August, which has restored small and perhaps new investors’ confidence in ETH.

Social Media Attention Jumps For Select Altcoins

Social discussion rates began to soar for altcoins. Many projects, such as AVAX and MATIC, are back as one of the top discussed topics on crypto social media. For AVAX, this comes on the back of a Coinbase listing on Thursday. As for MATIC, the reason was because its number of active users has exceeded that of ETH.

Polygon (MATIC) overtakes ETH for the number of active addresses after a 330% surge over the past three months while that for ETH has fallen by around 12%. MATIC has a greater number of transactions at present, according to Polygonscan, with 5.7 million total transactions recorded on Wednesday compared to 1.1 million on ETH’s layer one. This can largely be attributed to ETH’s high fees, which have increased again recently. This resulted in the price of MATIC gaining 25% over the week.

In terms of cumulative unique addresses though, ETH is way ahead with 170.8 million while MATIC has around 89 million. ETH has risen around 18% in the same period after the sudden spike in the price of BTC led most altcoins to rise in tandem.

Ripple Funds NFT Initiative for XRPL

Ripple Labs is launching a $250 million fund for creators, marketplaces, and brands to explore new use cases for NFTs on the XRP Ledger. In a Wednesday announcement, Ripple said the fund would be focused on accelerating adoption in the crypto space through NFTs, and that NFT marketplaces, including MintNFT and Mintable and creative agencies, would be among the first to have access to the fund. Any proposed NFT use case would be built on the XRP Ledger, giving creators an opportunity to monetize their work. The price of XRP jumped on the news and subsequently broke above $1.00 as the market bounced.

Grayscale Adds SOL and UNI to $494 million Digital Large Cap Fund

The asset manager’s BTC-heavy fund allocated 3.24% to SOL and 1% to UNI on Friday in what it calls a quarterly asset rebalancing. The move will likely raise the profile of both tokens to institutional investors. Both tokens have traded higher post the announcement.

About Kim Chua, Flurex Option Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.