Last week started with some action from DOGE after Elon Musk officially rebranded Twitter to X.com and used DOGE’s “D” logo in his profile, once again fanning anticipation that the new X.com would do something with DOGE. This caused the dog-themed token to surge more than 10% at a time when the rest of the market was simply coiling up waiting for the FED.

XLM also rose around 15% after a report revealed that investments in XLM-based products have increased by 62.7% this year. Notably, Grayscale’s XLM product recorded a premium of over 330%, a highest premium in all of Grayscale’s products. The Stellar team also stated on X.com that the protocol is now ranked as the top blockchain for off-ramp locations, beating even ETH.

Another event that kept traders entertained while waiting for the FED action was the listing of controversial crypto, Worldcoin (WLD) at major exchanges. The Worldcoin team touts themselves as creating an identification system that would let humans distinguish themselves from AI bots in the online community by asking humans to scan their iris via a round silver instrument known as the Orb. To encourage humans to do so, WLD tokens would be given as an incentive for anyone who successfully enrolls into the system. The launch of Worldcoin on was met with a lot of skepticism by the crypto community who are understandably uncomfortable with the concept since Worldcoin is owned by a centralised team of people who also started ChatGPT.

Finally, when the FED meeting came, there were no surprises as FED chair Powell delivered the much priced-in 25-bps rate hike. However, his comments were slightly more dovish than traders expected, which was a boon for crypto prices and prevented the price of BTC from breaking lower even when the dollar rose. In the end, BTC remained stuck between the $29,000 to $30,000 once again, coiling for the fourth month in a row.

Attention thus shifted into altcoins as neither BTC nor ETH provided interesting trading opportunities. Traders began to shift into trading altcoins like DOGE, SOL, MATIC, XLM and XRP again to try and eke out profits from 5-10% trading ranges. This phenomenon managed to move liquidity from the top two coins to altcoins, which saw volumes in altcoins like XRP, SOL and DOGE beat that of BTC and ETH.

ETH losing favour as liquidity drops

Despite the current market depth being at only half of last year’s level, the liquidity of the top 10 altcoins in USD has surpassed ETH’s for the very first time in history, in a sign that traders have started to prefer trading in altcoins.

This is actually a good sign for the market since an improvement in the liquidity of altcoins would make trading in a larger variety of coins more feasible and could bring in more traders to trade in crypto rather than simply trading on BTC and ETH.

SHIB and LINK stay strong in quiet market

One altcoin that has gained attention other than DOGE is another dog coin SHIB, which featured very strongly in the 2021 bull market. After quietening down for a significant period of time, the “DOGE killer” appears to be up to something as whale wallets holding between 10 million to 100 billion units of SHIB have been on an accumulation spree for the past two months, adding around $9 million worth of SHIB during this time.

The accumulation has resulted in a relatively stronger showing by SHIB last week, when the price of DOGE was also well supported due to expectations that Elon Musk would make greater use of the meme coin in the newly rebranded X.com.

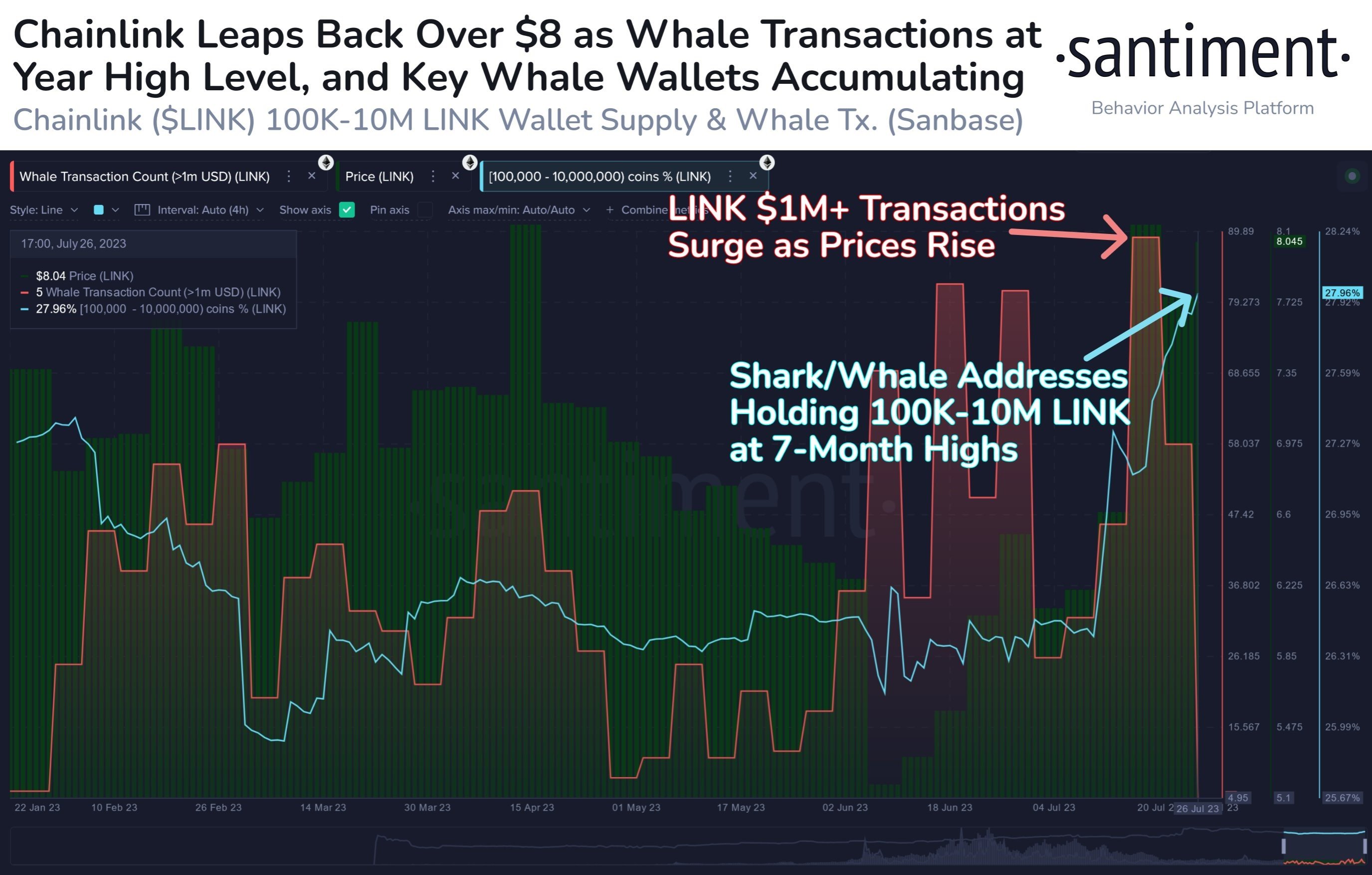

Another altcoin that has consistently outperformed the lacklustre market is LINK. Further to our LINK mention in our previous report, LINK has continued to see heavy accumulation by whales in spite of the pullback in crypto prices, with transactions of more than $1 million in value rising to its highest level this year. Wallets holding between 100,000 to 10 million LINK are accumulating rapidly as well.

Whale selling caused BTC to correct

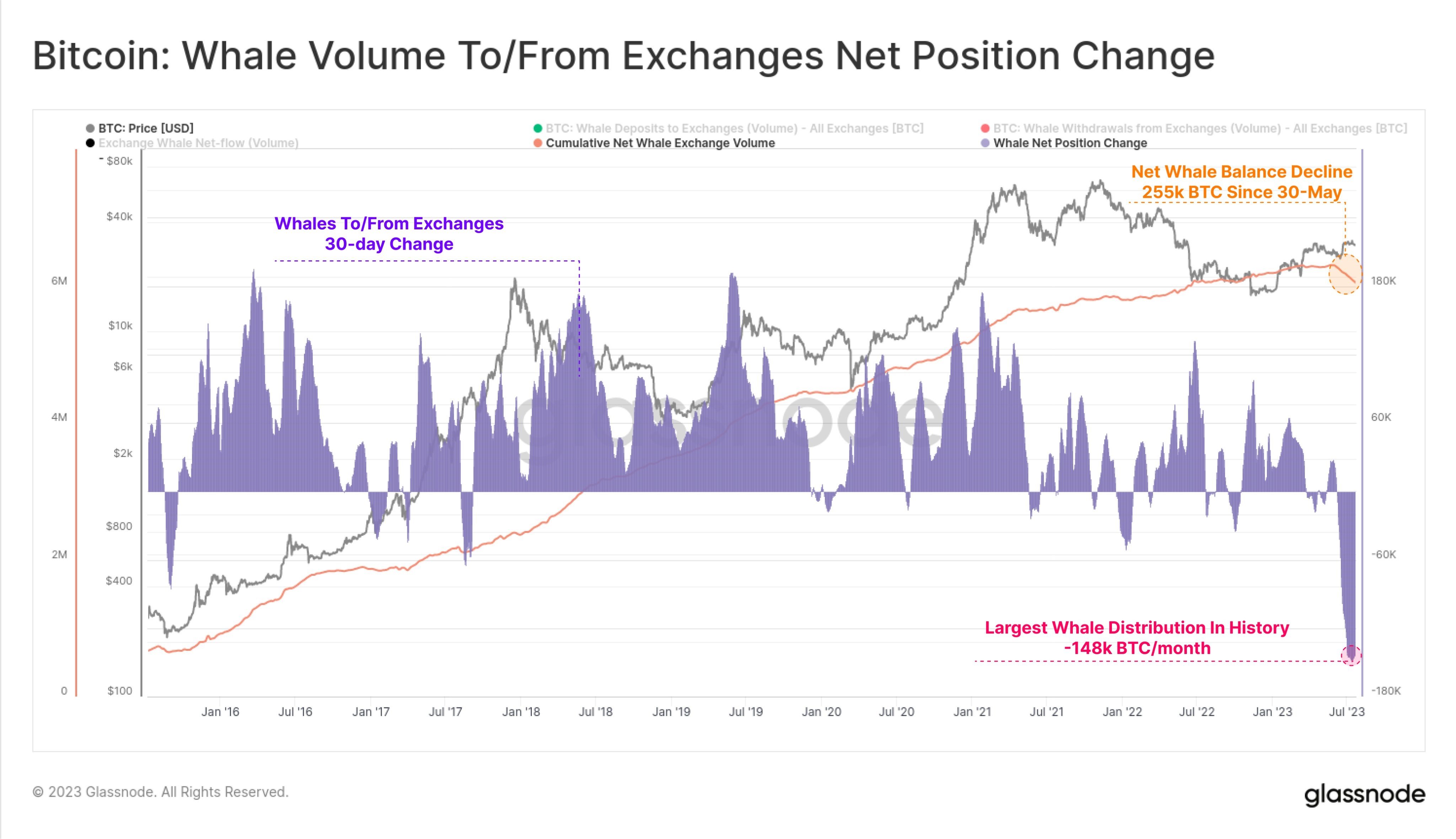

As for King BTC, price has been languishing of late, not being able to gather momentum to rise or fall. However, a look into the whale balance of BTC holders seems to suggest that some weakness could come in the near-term as whales appear to have been disposing of their stash of BTC.

For the month of July, whales have sold 148,000 units of BTC, the highest amount of sales in history. While it may not necessarily be a bearish signal, this development indicates that there are whales who are getting out of BTC and/or perhaps, the broad crypto market.

Over the past weeks, we have seen dormant wallets in both BTC and ETH waking up after long periods of inactivity and selling their respective cryptos. While the amount of crypto that they sold has not been sizable, it is rather puzzling why these wallets are disposing of their long-held crypto at this point and such actions may cast a veil of uncertainty over the market.

BOJ confused markets by conflicting action

The FED raised rates by 25-bps as expected, however, it was the more dovish comments by Powell that ignited a rally amongst risky assets in the week. Powell suggested that the FED would be data dependent from hereon and even hinted that there could be a pause in hike come the September meeting, which the markets liked. The US yields thus fell even though the FED raised rates to its highest level in 22-years.

As a result of the risk on sentiment, US stocks ended the week in positive territory, with the Dow gaining 0.5%, the S&P 0.86% higher, while the Nasdaq was the biggest winner from falling yields, rising 1.78%.

Even though US yields retreated, the dollar still eked out a gain for the week as other currencies trading against it fell more than the dollar. The DXY thus made a gain of 0.6% while at the same time, pulled down precious metals prices as Gold lost 0.1% and Silver gave up 1%.

Oil prices were the outlier once again, as expectations of demand (particularly from China) outstripping supply outweighed the rise of the dollar to send oil prices higher. The WTI gained 5.33% to trade back above $80 and Brent rose around 4.9%.

In other parts of the world, the ECB also raised rates by 25-bps as expected and also gave more dovish comments since inflation in the Eurozone appears to have peaked. Both the FED and ECB’s policy decisions did not move the markets by a large extent as they have been fully priced in.

However, the BOJ, which we had highlighted to keep a close watch on, delivered something more unexpected and confusing. While maintaining their interest rate at 0.1% and keeping their yield curve control (YCC) intact, the BOJ announced that they will be allowing more flexibility on the upside in their yield curve control from the current 0.5% top to a 1% top, which was hawkish. However, BOJ chief Ueda put a dovish spin by saying there is still a long way off towards achieving their 2% inflation target and that the central bank will not be looking to raise their interest rate target at all, and the greater upside flexibility in the YCC should not be seen as a hawkish move.

The conflicting signal shoved the yen in two directions, swinging between gain of 1.5% and loss of 1.5% on Friday, giving it an intra-day trading range of 3%, its highest since April, while the Nikkei 225 index at one point lost more than 3%. Japanese bond yields also surged to 0.57% as traders expected yields to start climbing.

It took open market operations by the BOJ to calm the market down, when the BOJ stepped in to purchase bonds and bring yields back nearer to 0.5%. This open market operation managed to bring the Japanese stock market back into positive territory before the day was over and weakened the yen dramatically as it ended the day at a 1% loss, pushing the USD/JPY back above 141 to close the week from a low of 138 made merely a couple of hours earlier.

With the BOJ intervening at the first instance to move yields back to 0.5% from only a 0.07% increase, traders are wondering why the BOJ raised the topside limit to 1% in the first place.

The start of this new week has seen a further rally in risk-on assets like stocks in the Asia region after China reported better-than-expected PMI numbers early Monday morning. On Tuesday and Thursday respectively, the Australia and UK central banks will be meeting to discuss their interest rate movements.

In terms of US data, employment numbers will be coming in as per every first week of a new month. Greater market volatility could come on Wednesday and Friday, where Wednesday will see the release of the ADP employment data, which is a private sector poll while Friday sees the release of the official government data, the non-farm employment change.

On the crypto front, LTC’s block reward halving is expected to occur on or around 03 August, this Thursday. After the halving, the LTC block reward will be reduced from 12.5 LTC to 6.25 LTC. While traders do not expect this event to have a material impact on the price of LTC, nothing is certain in trading and a surprise move in price should still not be ruled out.