Flurex Option offers wide range of assets to trade with leverage straight from your BTC-settled account. In order to provide transparency and help our traders better understand the Oil contract pricing we have prepared this guide.

Oil is commonly traded as a Futures Contract – where a buyer and seller agree on a price now and exchange assets for cash at a future date. If the investor is only interested in speculating on the price and never wishes to take delivery of the underlying asset, they must close any positions before the contract’s expiration date.

Flurex Option Oil trading as a spot instrument has many advantages for investors who are only interested in price speculation. We offer a hassle-free trading access to this contract with no need to worry about the expiration and ‘rollover’ to the next month.

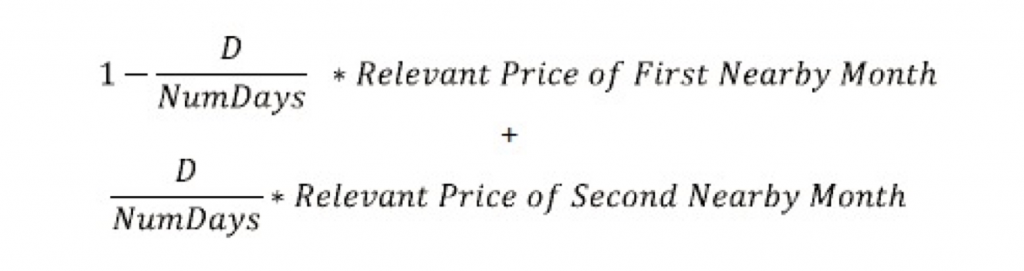

The Spot Oil price is derived as a combination of the first and second nearby month future contract. The spot price for each of these instruments is derived from a weighted average between the 1st and 2nd month Future Contracts (explained in further detail below) and follows the business day convention from New York.

1 contract is equal to 100 barrels (bbl).

This pricing method diminishes the level of volatility when the first nearby futures contract is near expiration, since there is often lower liquidity. Furthermore, rolling your position from the 1st to 2nd nearby month happens in smaller daily increments, instead of paying the full difference when close to expiration.

- PRICING OF PRIMEXBT SPOT OIL

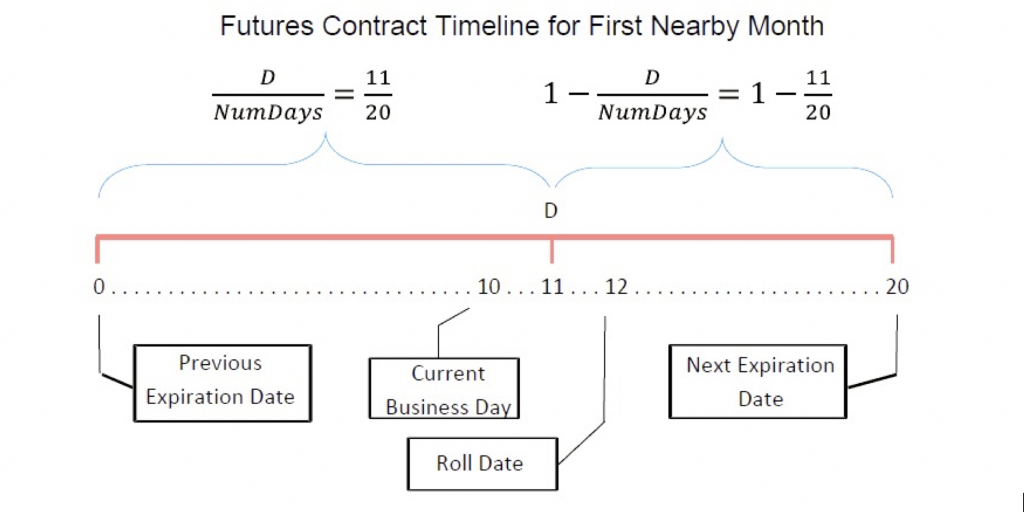

| D | The number of Commodity Business Days from, and including, the Previous Expiration Date to, but excluding, the Roll Date. |

| NumDays | The number of Commodity Business Days from, and including, the Previous Expiration Date to, but excluding, the Next Expiration Date |

| Business Day | 18:00 to 17:00 New York |

| Next Expiration Date | The date of expiration of the First Nearby Month |

| Previous Expiration Date | The date of expiration of the Previous Nearby Month that expired Immediately prior to the Roll Date. |

| Roll Date | The second Commodity Business Day after the current Business Day |

| Relevant Price | The price determined in accordance with the following. |

| Commodity Reference Price | The Commodity Reference Price shall be OIL-WTI-NYMEX (West Texas Intermediate light sweet crude oil). |

| Specified Price | The settlement price. |

- EXAMPLE OF PRICING

D = 11

NumDays = 20

Relevant price of First Nearby Month = 20

Relevant price of Second Nearby Month = 25

FX Spot Price = (1 – 11/20) * 20 + (11/20 * 25)

= 0.45 * 20 + 0.55 * 25

= 9 + 13.75

= 22.75

- FINANCING CHARGES OF SPOT OIL

The Spot Oil is a margined product; therefore, the traded value is financed through an overnight ‘financing’charge. If a position is opened and closed within the same trading day, the account will not be subject to overnight financing charges.

More info on fees: https://primexbt.com/fees