A pump-and-dump scheme is a crime in which criminals accumulate a commodity or financial asset over time and artificially inflate the price by spreading misinformation before selling off what they bought to the unsuspecting public. The “pumping” often comes from media hype, fraudulent accounting, and lies. The “dumping” is when the original owners start selling into the marketplace to an unsuspecting public after interest has jumped.

Pump-and-Dump Scheme – How Does It Work in Cryptocurrency?

Pump-and-dump schemes and cryptocurrency go together far too often. This makes sense as cryptocurrency is a relatively new form of finance, and the general public is aware of how much some of the larger coins have exploded, making literal billionaires out of some holders in a few years.

The types of cryptocurrency pump and dump schemes are numerous, but they almost always involve some kind of “guru” or “influencer.” The person will tout huge gains and show an extravagant lifestyle on a platform such as Instagram, YouTube, or Telegram. Often, they will have private groups you can join, pushing some type of minor crypto as “going to the moon.”

There have been as many as 200,000 people when some of these private groups focused solely on the idea of a cryptocurrency gaining in value, yet not thinking about whether it will have any type of actual use. After all, for something to have value, people must want to own it. These groups all focus on the greed of the group, not the use of the project.

One of the most common schemes is that group leaders will claim that a pump will be taking place at a particular time and on a specific exchange, telling members to get ready. They will announce the coin shortly after that, which is after they have bought quite a bit. Pumps have lasted for as little as five minutes, trapping the rest of the group in the position, as the originators are out before it falls again.

Nonexistent projects, false news stories, fake partnerships, or even fake celebrity endorsements have all been part of the pumping phase, separating unsuspecting group members or the public from their money.

Examples of Pump-and-Dump Schemes in Cryptocurrency

Multiple pump-and-dump schemes have shown themselves in cryptocurrency over the last couple of years. Some of them were rather obvious, while others were a bit more convoluted. Unfortunately, many of these scams focus on some of the most base of human fallacies: greed.

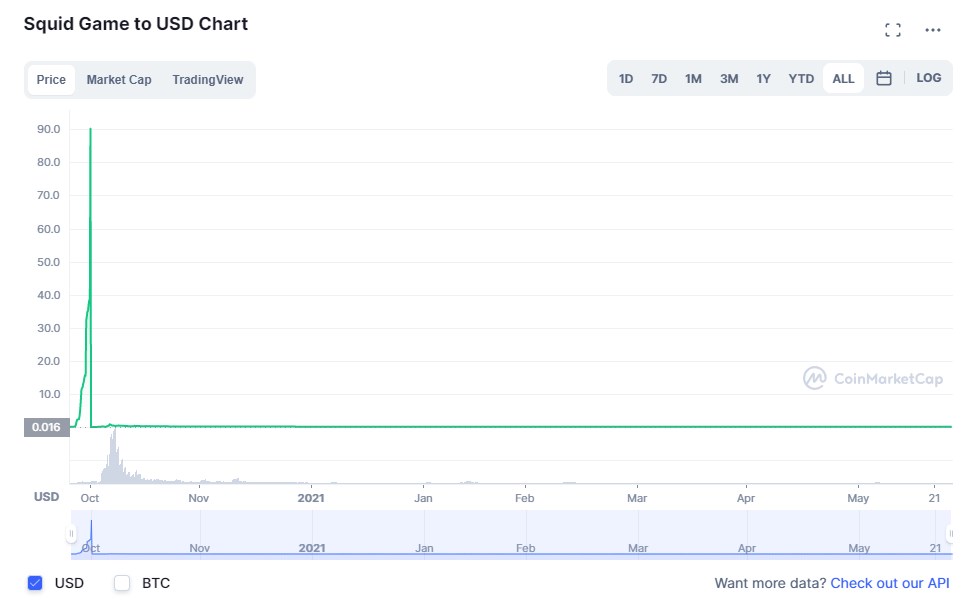

One of the most ridiculous scams came in the form of Squid Game. It was named after the hit Netflix show Squid Game. The coin had no ties whatsoever with Netflix or the show itself, but people jumped into the market based on hype, causing the value to go from $0.01 to a level near $2800 and then to free-fall back down to pennies just moments later. The scammer behind the coin made $2 million in just a few moments. Almost everybody else lost money. Quite often, just paying attention to the name of a coin can show you how little it has to offer.

There have been celebrities involved in pump and dump schemes, be they directly or hired as spokespeople. One example was EthereumMax, a coin that has no relation to Ethereum. Kim Kardashian and Floyd Mayweather were spokespeople for the coin before company executives dumped the coin for profit, leaving others who had bought the coin with massive losses. Both celebrities are now being sued.

What to Consider to Avoid the Cryptocurrency Pump-and-Dump Scheme?

While it is possible that you can still be part of a pump and dump scheme, taking a few basic steps can have a significant influence on whether or not you get stuck with one of these. Much of this comes down to simple common sense, but some steps take a little more research. You can significantly increase the odds of avoiding scams by taking a few basic steps.

What is the Investment Thesis of the Coin or Project?

Before you put any money into a market, you must analyze the investment thesis. You don’t simply throw money down a hole in hopes of the coin “going to the moon”; instead, you should put the market under scrutiny before risking your investment. Far too many people simply ignore this part of investing, looking to “make a quick buck.”

Simply hearing that the token is going up in price due to some random message on Telegram is not reason enough to buy something. It’s very easy to share false information on these common platforms, and in a small market, it’s very easy to manipulate the price if very few people are involved.

You should also avoid putting too much trust in smaller YouTube channels that specialize in small coins because they could either be run by pump and dump scammers or just those looking to do analysis, but not necessarily anything beyond the occasional “tip,” as the true goal of the channel is to get as many views as possible, to generate revenue.

Analyze the Volume of Your Market

One way to analyze a token is by looking at the volume traded. If the price is rising rapidly, you need to see whether there is a large buy over the course of a week and then very thin volume pushing the token up. That scenario suggests that somebody got ahead of everybody else and is using hype to drive the market higher. It shows that a “whale” has gotten into the position, and the retail bagholders are continuing the move.

Keep in mind that you must have the ability to exit a position. If the volume is thin, getting out of your position might be challenging if the market starts to turn around. Because of this, liquidity becomes a significant issue if the “rug gets pulled” because everybody will be trying to exit the market simultaneously. In this situation, you may find yourself holding onto something that has no value.

Check for Media Coverage of the Coin or Project

One way you can avoid a lot of trouble is to check for media coverage of the coin or the project you are looking to invest money into. Most projects will have a significant history of media coverage and company communication if they are legitimate. GitHub and Medium are some places where viable projects will have a considerable presence, so it is a good idea to look at what has recently been posted on these media portals.

In the past, there have been fraudsters buying up an old or defunct token, then running a pump and dump scheme. You must ensure that the token has a legitimate development team behind it and that there have been media releases recently. If the token hasn’t had much media presence for the last several years, that would be a huge red flag.

Who is behind on the token?

When thinking about investing in a cryptocurrency, the people involved in the project can be every bit as important as the idea they are working on. Management matters in crypto, just as it does in a corporation listing its stock.

The management team can be one of the most important and influential parts of an investment thesis, so researching who is behind the project makes quite a bit of sense. Understand that people can lie about who is working on a project, so you must do actual research to find out who the major players are.

As a general rule, most people behind viable projects come from the scientific or mathematical world, as it is relatively complex to create new crypto. Keep in mind that there are over 20,000 crypto coins now, so you also need to understand whether or not the person has any real chance at creating something unique or valuable. Even the projects that are attempting to solve real problems have competition, so finding some unique advantage through the mental capital being expended.

Risks of Investing in Pump-and-Dump Schemes

The most common way people are brought into pump and dump schemes is through the prism of getting into a project very early, allowing for the generation of huge returns. While this is theoretically true, most people who are investing in crypto forget to take into account that most companies and projects eventually fail. Capital invested in startups often disappears, which is why the occasional victory is so impressive from a return standpoint.

Venture capitalists typically have 75% of the companies they invest in fail over time. This means that the investment disappears, and it becomes a total loss. When they do get into a company early, it will make up for most of the other losses. Most crypto investors are trying to find the next Bitcoin, not focusing on the fact that thousands of other competitors have disappeared.

Some venture capitalists have invested billions of dollars in Bitcoin, Amazon, and Uber. At one point, you could have bought Ethereum for mere pennies. You can say the same thing about Bitcoin. These dreams of making huge returns continue to sucker people into these pump-and-dump scams. This is why these scams typically target unsophisticated investors, knowing that they will either not do the necessary research or not know how to do it.

A general list of things to consider:

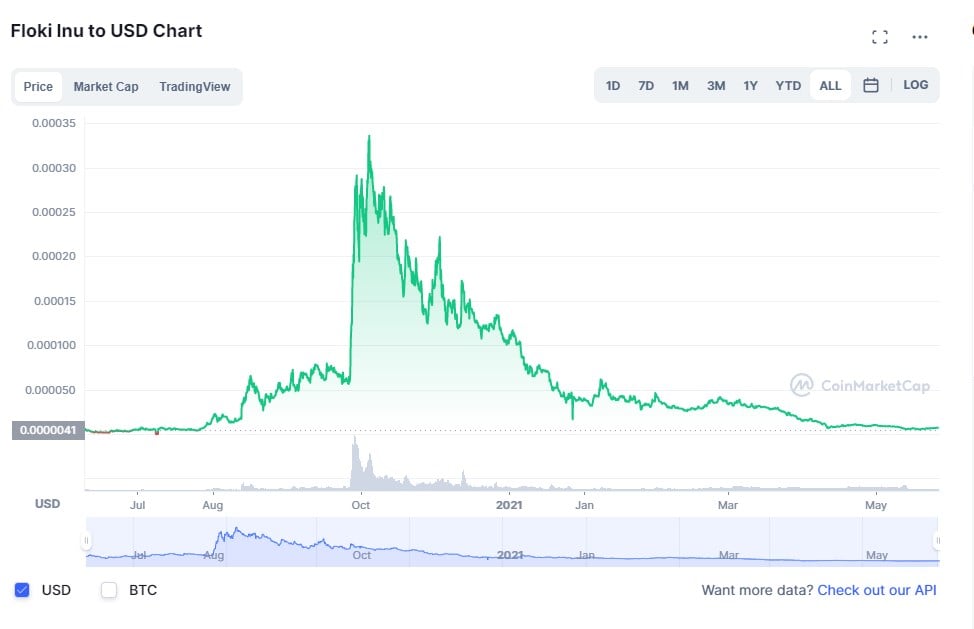

- Does the name even seem reasonable? Some crypto names have been so ridiculous it’s pretty shocking that people bought into them. “MILF coin” and “Floki Inu,” which was named after Elon Musk’s dog Loki, who is a Shiba Inu.

- Do the designers have any crypto experience? Often, new coins are minted by those who have worked on other projects such as Ethereum, Cardano, etc. These people make more sense than the occasional random person on the Internet as somebody who could be successful.

- Does the market have any real volume? You can avoid a lot of problems if the markets are liquid. After all, you need volume to get in or out, and a high-volume market is much more challenging to manipulate. If you are new to crypto, you can think of it as the difference between the S&P 500 futures market and the aluminum spot market. There are more people in the S&P 500, making it much more difficult to manipulate.

- Does it have any real-world use? Many cryptos have no real-world use-case scenario and will never see mass adoption. Most crypto is still questionable, so until the major coins see mass adoption, the minor ones certainly will not.

Conclusion

The first thing you need to remember is the adage, “If it seems too good to be true, it probably is.” Some scam coins have such ridiculous names that, shockingly, people have fallen for them. One such example was the “MILF coin.” Believe it or not, people fell for that pump-and-dump scam as well.

By doing due diligence, you can determine if a project or company is at least legitimately looking to the future for an equitable result. This does not guarantee that you won’t lose money, but it does suggest that the project will be viable in the future.

Volume and size matter. While speculating, very small coins should be just a tiny part of your portfolio. The Internet is littered with stories of investors who lost significant amounts of money on these pump-and-dump schemes. Your first job as an investor is to protect your money, and by being cautious and doing the work, you can do so.

Are pump-and-dump scams illegal?

Pump-and-dump scams are highly illegal, as they are a relatively complex form of theft. Pump-and-dump scams revolve around small markets, and people take a large portion of that market and pump up the price to sell to the unsuspecting public. The people found guilty of running pump and dump schemes are subject to heavy fines, assuming they are caught. Pump-and-dump schemes are becoming increasingly found in the cryptocurrency world instead of the stock market.

Is Dogecoin a pump and dump scheme?

Dogecoin has been accused of being a pump-and-dump scheme, although the jury is still somewhat out. The coin has seen influence from famous people such as Elon Musk and Mark Cuban on social media, driving up the price. Dogecoin has had abysmal performance after the initial boost, even with announcements that the Dallas Mavericks and Tesla are looking to accept the coin. However, there is quite a bit of competition for Dogecoin, so whether it was a pump and dump or the market simply realizing there’s almost no actual use for the coin is an open debate.

How long does a pump-and-dump last?

Pump and dump schemes can last as little as five minutes or several days. There is no actual timetable for a pump and dump scheme, but the longer they go on, the harder it is to get the reward the criminals are looking to take. The idea is to make quick money, so they generally last for just a few days.