The market capitalization of Bitcoin as a percentage of the overall market cap of all cryptocurrencies is referred to as its dominance. It measures the importance and effect of Bitcoin on the cryptocurrency market.

The dominance of Bitcoin has a big impact on how people feel about other cryptocurrencies and the industry as a whole. Bitcoin domination indicates that traders and investors are more confident in Bitcoin as an investment option and a trustworthy store of value. On the other hand, a decline in the dominance of Bitcoin signals a rise in interest in other cryptocurrencies, or “altcoins.”

The dominance of Bitcoin affects more than just one cryptocurrency. As the performance of Bitcoin is frequently used as a gauge for the health of the entire cryptocurrency market, it can affect the mood of the market as a whole.

Defining Bitcoin Dominance

The dominant position of Bitcoin is influenced by numerous factors. First off, Bitcoin has a distinct advantage in terms of brand awareness and trust thanks to its pioneering role as the first cryptocurrency.

Second, investors and consumers now have faith in Bitcoin because of its decentralized nature and strong security features, made possible by the blockchain technology at its core. Its reputation as a trustworthy and secure cryptocurrency has helped.

Additionally, Bitcoin is positioned as a digital asset with perceived scarcity and possible value growth over time due to its limited supply and deflationary monetary policy.

Furthermore, trading, investing, and converting Bitcoin into other cryptocurrencies are made simple by its liquidity and availability on a variety of cryptocurrency exchanges.

The existence of a thriving Bitcoin community, active development environment, and ongoing scalability and usability improvements have maintained Bitcoin’s position as a leading cryptocurrency.

The Origin and Evolution of Bitcoin Dominance

Throughout its history, the dominance of Bitcoin has changed, which has an effect on the cryptocurrency market as a whole. As the first and most well-known cryptocurrency, Bitcoin possessed almost absolute domination in its early years. Bitcoin dominance progressively waned as the market grew and other cryptocurrencies appeared.

The dominance of Bitcoin was 85.4% in February of 2015, demonstrating its dominant position in the market. Bitcoin’s market share, however, rapidly shrank as the sector experienced a rise in initial coin offerings. (ICOs)

Bitcoin continues to have the largest market capitalisation among cryptocurrencies despite growing competition. Despite the fact that its share has changed throughout time, it has also continued to hold a sizable amount of dominance.

The dominance of Bitcoin has effects on the overall cryptocurrency industry. A larger dominance % implies that Bitcoin dominates the market more strongly, which frequently denotes a more bearish outlook for the whole crypto ecosystem. On the other hand, a diminishing dominance percentage can signify a rise in interest in competing cryptocurrencies.

It’s important to keep in mind that a variety of factors, such as investor preferences, legislative changes, technology breakthroughs, and market sentiment, might affect Bitcoin’s dominance.

Key Events That Shaped Bitcoin Dominance

Numerous notable occurrences have impacted Bitcoin’s prominence and altered how the market views it and competing cryptocurrencies. Here are a few noteworthy occasions:

Emergence of Altcoins: Alternative cryptocurrencies, or altcoins, started to appear as the bitcoin market grew. In 2011, alternative coins like Litecoin began to compete with Bitcoin.

Initial Coin Offerings (ICOs): The rise of ICOs in the cryptocurrency industry raised the market capitalization overall and greatly expanded the number of new cryptocurrencies. As investors flocked to participate in ICO companies, this event led to a drop in BTC dominance.

Regulatory Developments: The market’s opinion of Bitcoin and cryptocurrencies has been impacted by a number of regulatory acts and statements made by governments.

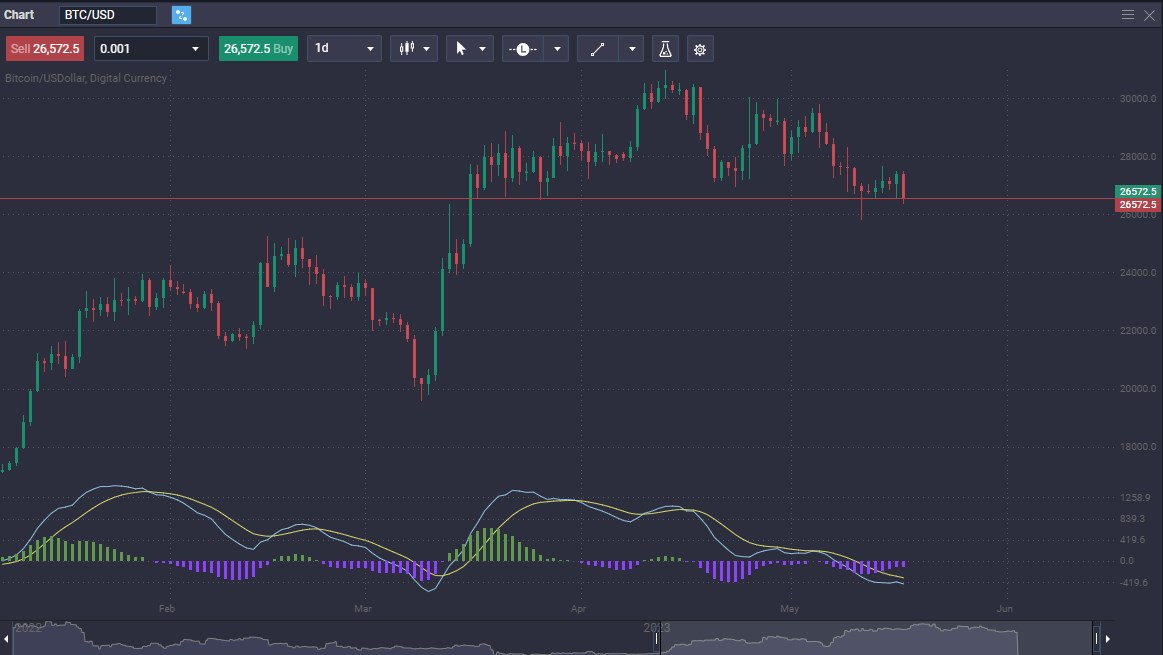

Market Volatility and Price Movements: Market perception and investor attitude can be greatly impacted by changes in Bitcoin’s price, particularly during bull runs or bear markets.

Institutional Adoption: The market for cryptocurrencies has gained more credibility as a result of the growing involvement of institutions.

Technology and Scalability Developments: The Lightning Network’s installation have helped Bitcoin overcome some of its technical restrictions and difficulties.

How to Calculate Bitcoin Dominance

Bitcoin dominance is calculated by dividing the market capitalization of Bitcoin by the total market capitalization of all cryptocurrencies and then multiplying the result by 100 to obtain a percentage. The formula for calculating Bitcoin dominance follows:

Bitcoin Dominance = (Bitcoin Market Cap / Total Crypto Market Cap) * 100

The higher the percentage, the more cryptocurrencies that will be lagging BTC on the whole normally.

Implications of Bitcoin Dominance on the Crypto Market

As a general rule, if Bitcoin shows dominance in the crypto markets, that is bad or smaller altcoins, as it shows an unwillingness of market participants to reach farther out on the wrist spectrum. The market cap of these smaller altcoins remains but a small fraction of the market cap that Bitcoin enjoys.

Bitcoin Dominance and Altcoin Seasons

When Bitcoin dominance is strong, it implies that Bitcoin has a larger market cap than other cryptocurrencies, pointing to a market mood is looking for safety. During these times, altcoin prices can find it difficult to acquire traction, and traders might decide to concentrate more of their portfolios on Bitcoin. On the other hand, when Bitcoin dominance is low, it suggests a larger market interest in alternative cryptocurrencies.

The correlation between Bitcoin dominance and altcoin success reveals previous instances of altcoin seasons. For instance, the ICO boom in 2017 significantly reduced Bitcoin’s market share as investors shifted their focus and resources to the burgeoning altcoin market.

How Bitcoin Dominance Influences Crypto Investment Strategies

Investors sometimes use Bitcoin dominance as a critical statistic to modify their market strategies. Investors may allocate of their portfolio to Bitcoin when Bitcoin dominance is high, suggesting a larger share of the market capitalization compared to other cryptocurrencies.

The Impact of Bitcoin Dominance on Crypto Market Volatility

Changes in Bitcoin dominance can have a significant impact on the volatility of the overall crypto market. Bitcoin dominance refers to the ratio of Bitcoin’s market capitalization to the total market capitalization of cryptocurrencies.

Conversely, when Bitcoin’s dominance decreases, it indicates a shift in market sentiment towards alternative cryptocurrencies, which can introduce greater uncertainty and volatility.

Bitcoin Dominance vs. Ethereum Dominance

Market domination is the percentage of the whole cryptocurrency market that a specific cryptocurrency controls. The actual market domination of Bitcoin and Ethereum at this time may vary, thus it’s vital to use the most recent information available from reliable sources. Ethereum’s market domination have ranged from 18% to 42%.

Is Bitcoin’s Dominance a Good or Bad Thing?

Pros and cons of Bitcoin’s dominance in the crypto world can be summarized as follows:

Pros:

- Even in places without conventional banking systems, Bitcoin enables a decentralized and open financial system that is 24/7 accessible worldwide.

- Compared to conventional banking institutions, Bitcoin enables faster and less expensive international money transfers.

- People’s perceptions of bitcoin as a store of value and its potential appreciation over time are influenced by its first-mover advantage, widespread acceptance, and brand recognition.

- Bitcoin dominance is a helpful statistic for comprehending market trends, spotting bull or bear markets, determining the seasons of altcoins, and gauging investor emotion.

Cons:

- Bitcoin’s price volatility can be risky for traders and investors because it can suffer large price swings in a short amount of time.

- Bitcoin’s proof-of-work consensus process necessitates energy-intensive mining activities, raising questions about the impact of this technology on the environment.

- Bitcoin transactions are irreversible, which means that once they are completed, they cannot be reversed.

Future Predictions: Will Bitcoin Maintain Its Dominance?

According to most experts, Bitcoin’s first mover advantage, brand awareness, and widespread acceptance will help it maintain its dominance. The impression of bitcoin as a digital asset with potential value growth over time is influenced by its well-established status as a store of value and its finite supply.

It’s crucial to remember that the bitcoin market is dynamic and ever-changing. Market dynamics can be impacted by the emergence of new technology, changes in regulations, and the emergence of creative ventures and use cases.

Additional Resources for Tracking Bitcoin Dominance

Here is a list of recommended resources, tools, and platforms where readers can track Bitcoin dominance in real-time:

- Nomics: Nomics provides a range of cryptocurrency statistics and offers information on various crypto coins, including Bitcoin.

- Bitcoin.com: Bitcoin.com offers several online tools, including blockchain explorers, to track and chart Bitcoin’s network activity.

- CoinGecko: CoinGecko is a desktop application available for Mac and Windows platforms that provides real-time information.

- Chainalysis: Chainalysis is a blockchain data platform that offers insights into cryptocurrencies that traders use often.

- Inspector: Inspector is a search and visualization tool for investigating cryptocurrency transactions.

- CoinMarketCap: CoinMarketCap is a popular platform for tracking cryptocurrency prices, rankings across exchanges, and trading pairs.

Conclusion: The Dynamic Nature of Bitcoin Dominance

Paying attention to the entire crypto market cap is diffuclt at times, so by monitoring the market cap of BTC, and the BTC dominance, you can get a gauge of where the market may go in general. BTC dominance is generally a sign of fear, and a flight to quality.

If BTC dominance starts to fade, it can lead to altcoin market cap increases, but it can also lead to a general run from the crypto market. Following not only the Bitcoin dominance chart and the overall crypto market cap, but also other risk assets in other uncorrelated markets can give you a handle on sentitment as well.

What happens when BTC dominance is high?

Typically this means that most of the other coins are going to suffer if Bitcoin is a large part of the total market cap. This means that risk tolerance by crypto market participants is low.

What will happens if BTC dominance goes down?

When BTC dominance starts to wane, this typically will mean that the risk appetite of cryptocurrency market traders is high, allowing investment in other small coins.

How does BTC dominance increase?

By adoption, fear, and use case scenarios.