It’s essential that you use a stop loss when trading crypto. It would be best if you used a stop loss when trading any financial instrument. Still, crypto is extraordinarily volatile, and therefore you need to ensure that any time you’re mistaken, it will only cost you a small percentage of your account.

What is Stop-Loss in Crypto Trading

A stop loss in crypto trading is an order that tells the broker when you no longer wish to be involved in the market. You set a stop loss value at a specific price, and when that price gets triggered, the broker will exit the trade. This is an automatic process that is done quickly on modern platforms.

How does a stop loss order work?

A stop loss order is an order you place through your platform that tells the broker when you choose to exit a position, ostensibly to protect against losses. The stop loss order is one of the most crucial tools when trading crypto because the market is volatile. By setting a reasonable stop loss value, you are expressing to the broker when you no longer wish to be exposed to the market.

Once you place the order, a trigger price puts things into motion. If that price hits, the broker is instructed to close out your position. You can set limits on orders, but the concern is that if you do not get the exact price you asked, you could find yourself still in the market.

This is why setting a stop loss value that makes sense is the most important thing you can do, understanding that there could be slippage in an exceptionally fast-moving market.

Stop-Loss Types

Using a stop-loss order is crucial when it comes to trading any financial market, but this is especially true when it comes to trading crypto. This is because crypto is extraordinarily volatile, and you can find yourself in trouble rather quickly if you do not pay close attention to your position.

That said, news can happen anytime in a 24/7 market, so even if you are watching the charts, you could see a massive move against you. Using a stop-loss order is crucial, but you should be aware that traders will use a few different types of stop-losses.

Full

A complete stop-loss order tells the broker to exit the entire position once a specific price has been hit.

Partial

A partial stop-loss order tells the broker to exit a particular portion of the trade once a trigger price has been hit. For example, if you have $10,000 worth of crypto in a position, you may wish to tell the broker to exit half of that if a specific price is hit. This would be a partial stop-loss order, as you still have some of your original position in play.

Trailing stop loss

A trailing stop-loss order is one that you can send to your broker that has a few special conditions attached to it. Let’s say you send your broker a trailing stop-loss order of $5. This means that the stop-loss order is $5 away from the opening price. If the market rises from here, once it gains more than $5, the stop loss order follows the tick for the tick on a high watermark basis.

In other words, the market needs to move one tick higher to drag the stop loss one tick higher. If the market were to move $10 in your favor, your $5 trailing stop loss would now be at breakeven. If the market pulls back to $9.75 above its entry price, your $5 following stop loss would still be at breakeven. This is because it only moves when the market makes a fresh high in the case of a long position or a new low in the case of a short post.

Why are Stop-Losses Important when Trading Crypto?

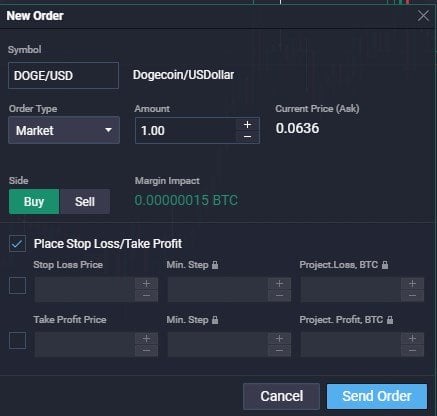

Setting a stop loss order on the Flurex Option platform.

You should always use a stop loss order when trading anything, but it’s especially true when trading crypto. Your stop loss order will protect you from losing too much of your account. After all, not all trades are profitable, so you need to realize when it’s important to “cut your losses.” Trading crypto is incredibly volatile. Therefore, losses can get out of hand if you do not know when to leave the market. Stop loss orders also allow you to manage risk without having to constantly monitor a trade.

Setting a stop loss order with every trade is essential. This will keep you from losing massive amounts of money and keep you in the game. It’s one thing to lose 1% of your account; it’s an entirely different story to lose 20%. Risk and money management are two of the most important skills that any professional trader will have.

When is a Stop-Loss Used?

A stop loss order should be placed with every trade you put on. This is because markets can move based on headlines, which can come anytime. This is especially true with markets like crypto that are open 24 hours a day.

Regarding the order being executed, a trigger price causes a reaction. For example, you could say that if Bitcoin drops below $20,000, you wish to exit the market. If Bitcoin does touch that price, the stop loss order will cause you to leave the market. This keeps your losses defined ahead of time and signifies to the broker when it is time for you to exit your position.

What Are the Advantages and Disadvantages of a Stop-Loss Order?

As with anything, there are advantages and disadvantages to using a stop loss order. The following are a few examples of the pros and cons of using one.

Advantages

There are many advantages to stop loss orders, not the least of which would be protecting your account. Using a stop loss order lets your broker know when it’s time to exit a position based on it going against you. You set the stop loss order ahead of time, and the platform will do the rest.

One of the most significant advantages of placing a stop-loss order is that you will have it automatically execute once the trigger price is reached. This means you do not have to be sitting there watching the market the entire time.

Furthermore, a stop loss order allows you to define your maximum risk ahead of time, enabling you to practice proper money management.

Disadvantages

There are almost no disadvantages to using a stop loss order. However, sometimes it seems like the demand is working against you, or maybe the market is. This generally is felt when a market moves against you, only to turn around and go in your favor. It sometimes will hit your stop loss along the way and therefore take you out of the market.

This is part of the risk you are taking by being a trader.. Just be aware that a sudden news release or slip in demand can take you out. You must have a reasonable stop loss value when placing the order. You do not want the stop loss value to be too tight in comparison to current market conditions – you want the market to be able to move a bit. The idea is that you only exit when you are proven incorrect.

How to set Stop-Loss Targets

Setting the stop loss order is easy. When you choose to place a trade, you can put in your stop loss price at that time. You can modify an order by right-clicking it and changing that parameter. Once you do that, you send the order, and the platform does the rest. This is a standard feature on almost all trading platforms.

Tips for Crypto Trading: Stop Loss Examples

While the possibilities are limitless, there are a couple of fundamental fundamentals to placing a stop loss when trading crypto or any other market.

The first strategy is to place a stop loss order below the most recent low or high, depending on the market’s direction. The chart below shows that the most recent low in Cardano was near the $0.495 level, as shown by the yellow line. In this example, you could be a buyer of ADA, placing a stop loss at that yellow line. This is a fundamental approach to the market, suggesting that if we break down to a fresh, new low, the market analysis is wrong, and Cardano should continue to fall.

ADA/USD chart on the Flurex Option platform.

Another strategy might be to use the Average True Range. This indicator measures the average range of movement for an asset during the last X amount of candlesticks, with the default being 14. In the example of Bitcoin underneath, you can see that the Average True Range is roughly $900. You could place a stop loss at 1.5 times ATR, making it $1350 below the entry price.

If the stop loss gets hit, it becomes evident that your analysis was incorrect. This is a mechanical way of placing stop losses as it measures volatility through mathematical equations. Furthermore, ATR is calculated on each candlestick, meaning it works on any timeframe. It’s just a matter at that point of knowing how much you wish to risk per trade.

BTC/USD chart with the ATR indicator on the Flurex Option platform.

Can I use a stop loss order on Flurex Option?

Yes, the world-class platform at Flurex Option allows for stop-loss placement. When you purchase any asset on Flurex Option’s world-class platform, there is always the choice of adding a stop loss.

Conclusion

No matter what you are doing in the market, be it crypto, longer-term trading, scalping, or any other activity, a stop-loss is crucial. You never know when news can hit or some “whale” jumps into the pool. Protecting your trading capital is the essential thing you can do when trading. Using a stop-loss order is by far the easiest way to do it.

While money management is a more prominent topic involving the amount of money you are risking per trade, etc., it is the stop-loss that is at the very basis of your actions. It would help if you were never put in a position without one because it will let you know when your analysis has been proven incorrect and will allow you to survive over the longer term. History is full of traders who went “all in” on a trade and were wiped out.

How do you use stop-loss in crypto trading?

You use a stop loss order to protect losses in your account. You determine where your trade analysis will be proven wrong and then set the demand for your position to exit the market at that price. By doing so, you protect your account, limiting losses.

Is putting stop-loss a good idea?

Simply put, not using a stop loss is a terrible idea. Remember that markets change; therefore, if your stop loss is not in place, you could lose your entire account.

What is a good stop loss for crypto?

There are multiple ways to place a stop loss, but most people will use the latest swing high or swing low, depending on their trading direction. In other words, if you are buying a cryptocurrency, looking for the newest swing low and putting your stop loss underneath is a common tactic.

What is the best stop loss strategy?

There is no “one-size-fits-all” type of strategy that people use. However, market structure is the most common in swing highs and lows. Other people might use an indicator known as the Average True Range to determine how far the stop loss needs to be. For example, if the crypto you are trading has an ATR of $10, that means that every day it averages a move of $10. In that scenario, many traders would put a stop loss of at least that, if not twice that.