Introduction to Yield Farming Crypto: The Hottest New DeFi Trend

During the cryptocurrency bubble of 2017, the buzzwords at the time were simply crypto, blockchain, or maybe ICO – short for initial coin offering. Today, however, its a completely different landscape, proving just of fast the emerging technology and digital asset class evolves.

New buzz words are piquing the interest of crypto investors of new and old, eager to find out what all the hype is behind recent trends like DeFi, swapping pools, and yield farming. These hot new trends have reignited interest in the cryptocurrency market and have helped bring Bitcoin, Ethereum, Ripple, EOS, and Litecoin out of the bear market.

Few crypto assets have benefitted from the decentralized finance trend as much as Ethereum. Tokens built on Ethereum are central to the new crypto farming craze, as we’ll explain in detail in this guide designed as a primer for DeFi, and a deep dive into all the yield farming crypto has to offer.

What Is Yield Farming?

Yield farming is a booming new trend in the world of cryptocurrencies, stemming from an already burning hot trend of decentralized finance applications.

Decentralized finance, or DeFi for short, is a peer-to-peer, crypto token-underpinned alternative to traditional financial services and different products such as lending, borrowing, and earning yields from holdings. Like cryptocurrency technology itself, these decentralized finance applications, also called Dapps, don’t require a bank or central authority to keep the network in operation.

These newer tokens, most often built on the Ethereum blockchain as ERC20 smart contracts, are designed to function in a variety of ways. Yield farming is one of the newer terms to hit the crypto industry, but its all anyone has been able to talk about since. To many crypto investors, it feels like generating capital out of thin air, but there is, of course, always a catch to such profitability.

Specifically, high yield farming is the act of farming for the best yields by investing crypto tokens in a DeFi market. Users can lend out ETH or other ERC20 tokens on platforms like Aave, Compound, and more. This process of farming ETH results in earning either a fixed or variable interest rate, depending on the DeFi smart contract.

Where Did Yield Farming Start?

The two most dominant lending and borrowing DeFi protocols are Aave and Compound. Compound kicked off the trend after its launch in summer 2020. From that moment on, DeFi assets and all of the crypto market surged and reached new highs. Several DeFi tokens rallied more than one thousand percent.

Those who use the Compound protocol for lending and borrowing earn COMP governance tokens. This process proved profitable for early users, sparking an entire trend of coins dedicated to the same idea.

Balancer, Curve, and several others joined the party late but were able to also share in the widespread success of the DeFi market.

Crypto users have also since learned how to maximize profitability from these protocols as the space develops. Some more advanced strategies involve staking tokens across several different decentralized protocols to farm for the most significant possible yields.

What Is DeFi: The Emerging Industry Of Decentralized Finance

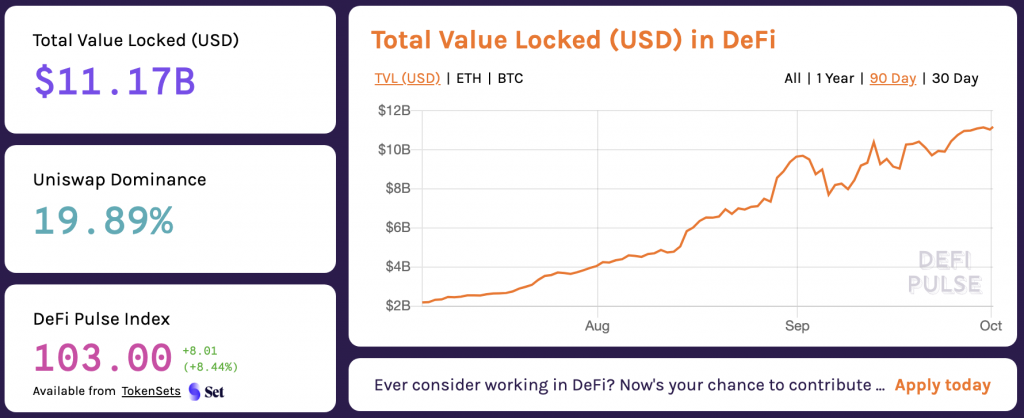

As of the time of this writing, the total USD value locked away in DeFi applications has achieved a milestone of $11 billion dollars. The number just broke over $1 billion at the start of 2020, showing 10x growth in thanks to the growing trend of borrowing, lending, and farming cryptocurrency.

DeFi itself is wide-sweeping, and therefore somewhat challenging to define. At its core, it is merely short for decentralized finance, which is a new financial technology built through smart contracts over the Ethereum blockchain that removes the need for third-party intervention.

The goal of this growing industry is to do away with financial intermediaries like banks and other financial institutions. Removing central authorities prevents points of failure and distrust.

These decentralized protocols can be coded a number of ways via smart contracts on Ethereum.

The most common DeFi applications are:

- Yield Farming – Searching for a farmers yield in crypto tokens isn’t as difficult as it first was, with several competitors now at this point. Lending or staking tokens yielding more and more cryptocurrencies in one of the key processes in yield farming tokens.

- Lending – These types of decentralized protocols match borrowers and lenders. Lenders earn additional cryptocurrency tokens in exchange for putting their crypto holdings on the line to be lent out to others. The higher the demand for borrowing, the higher the farm yield and total value in tokens accumulated.

- Borrowing – Borrowing is the other side of the coin. Those who borrow crypto tokens for one reason or another must access a DeFi platform to do so.

- Decentralized Exchanges – DEX platforms are exchanges that work by interacting directly with an Ethereum-based wallet app so that users retain ownership of any private keys associated with the crypto tokens held. This is slowly but surely becoming a preferred way to trade tokens thanks to DeFi.

- Stablecoins – Stablecoins are typically backed 1:1 by a corresponding asset to maintain consistent pricing parity with the dollar. Because there is little fluctuation in these coins, they offer crypto investors a safe haven during especially volatile periods of price action.

- Liquidity Mining – Liquidity mining is a new type of way to earn cryptocurrency tokens. By offering liquidity into liquidity pools like Uniswap and others, users can earn governance tokens.

- Prediction Markets – Prediction markets are useful in presenting possible outcomes for future events.

- Marketplaces – Peer-to-peer marketplaces that rely on an ERC20 token for utility are also categorized as DeFi applications, including the Covesting copy trading platform and the COV ERC20 token.

What Are Tokens? All About Ethereum-Based ERC20 Altcoins

Tokens are cryptocurrency smart contracts tokenized on the Ethereum blockchain. These tokens are often ERC20 tokens and can be coded to perform a number of unique types of transactions. These tokens are used for much more than just payments.

Tokens represent ownership or governance over a protocol, and can be swapped, traded, or sold, just like any other cryptocurrency altcoin or otherwise.

Because any developer can launch new tokens and projects, investors can strike it rich by getting in on the ground floor on what feels like a startup, all without the legal paperwork, for example.

What Is Liquidity Mining? Another Hot New DeFi Buzzword

Liquidity mining is a community-focused approach to automated market making, where a token issuer or liquidity pool provider can reward users for providing liquidity via ETH or other tokens to a pool protocol.

Why Is Yield Farming So Popular? Profits

Although this guide has thus far fully explained what DeFi is and what yield farming crypto is, it still may not be clear as to why it has suddenly become so popular.

For one, the popularity is due to the unfamiliar term catching the wind, and crypto investors curiosity being piqued as they read about the profits others are making off the new buzzword and trend.

It is also popular because it is a way for crypto investors to earn passive income and revenue by lending out or staking tokens that they were already holding anyway.

They initially became famous as a way to make back some money bit farming after losing so much money in the bear market, but eventually, valuations of these tokens started to rise alongside the booming trend, and prices rose out of the bear market. It even helped Bitcoin rise above $10,000 and Ethereum rise to just under $500.

How Does Yield Farming Work?

Yield farming is proven effective, but it is essential to pay attention to rates, and there is still a risk of capital loss. Early rates for BAT, for example, reached as high as 45% APY, so clearly it works.

If it didn’t work, it wouldn’t be anywhere nearly as popular it the trend has become. However, it is understandable for it to seem too good to be true and must be seen to be believed. Still, many crypto investors have made a ton of money over the last several months earning passive income this way.

How And Where To Farm For Enormous DeFi Yields?

New platforms where crypto investors can farm for increasingly better yields are popping up each new day, and because the DeFi trend is so strong, there’s bound to be plenty more copycats where those came from.

While it is alluring for investors to seek out new DeFi tokens in search of the next big thing and next major investment, analysts say that focusing on the early projects with real world value already is the wisest choice.

Where you farm requires searching around for the best APY, and because this changes so frequently, this guide would be doing a disservice in pointing you to just one platform based on a current rate right now.

What we can tell you is that in order to be profitable in yield farming, a large amount of capital is required. Between high ETH gas fees due to Ether being used to fuel transactions, it may not be worth it unless you are dealing with substantial capital. Users who try to start with $1,000 or less may end up losing money instead. Some users recommend using as much as $60,000 in capital to truly be successful and earn a positive daily ROI.

The more capital pooled, however, the larger the profitability and APY possible.

Security From Financial Risk

Sadly, there is no complete security from financial risk when it comes to DeFi, traditional finance, or money at all. Carrying a dollar in your pocket poses some sort of chance of losing it. As we’ve pointed out in DeFi and yield farming, unless you are using a ton of capital, the risks can outweigh the benefits.

Removing central authorities does remove the risk of an institution going under or locking down your funds due to one reason or another. But there’s no way to alleviate all financial risk associated with yield farming, DeFi, crypto, investing, or anything related to finance.

Yield Farming Liquidity Pools

Lending is one way to farm for crypto token yields, but automated market maker platforms offering liquidity pools for investors to pool money into can also bring a yield in governance tokens given as a reward for providing liquidity.

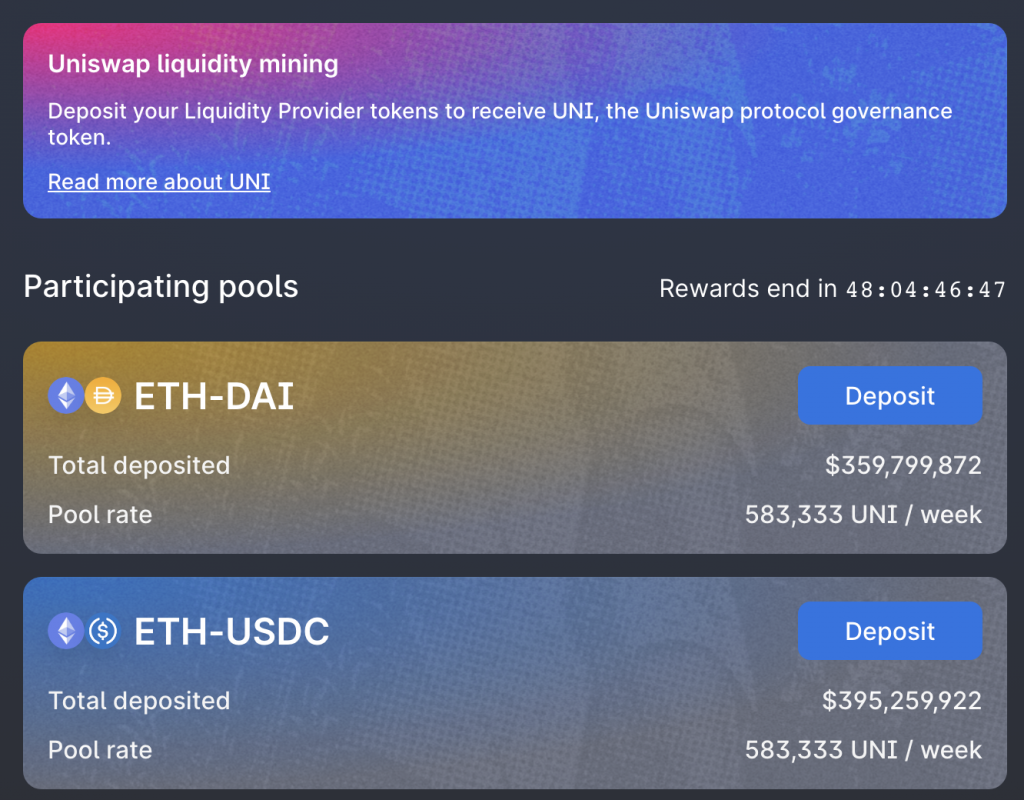

These liquidity pool providers have become extremely popular in recent weeks, causing Uniswap to rise to the DeFi dominance list, with the most considerable amount of total ETH and USD value currently in use in its protocol.

Uniswap recently introduced its UNI token, which was rewarded to early users who provided liquidity to the platform before September 1, 2020. Users who did this were given 400 UNI tokens to claim by connecting an Ethereum-based wallet like Meta Mask to Uniswap.

Yield Farming Platforms And Protocols

The number of yield farming platform and decentralized protocols offering this hot new trend is growing by the day. Be sure to check back frequently for future updates to this list, but for now, here are the most reliable and well-known DeFi protocols offering yield farming or some soft of benefits where more crypto tokens are earned:

Compound Finance (COMP)

Compound is an ERC20 token and software by the same name, operating on the Ethereum blockchain powering a distributed network fo competitors acting as a replacement for a money market.

Compound utilizes a number of crypto tokens to enable lending and borrowing without the need for a bank or third-party. When users borrow or lend using the Compound protocol, they are awarded COMP governance tokens.

Users can loan out any crypto that Compound offers, and borrowers can borrow up to the amount of their collateral but are at risk of being liquidated if the assets they borrow become more valuable than the collateral token value used.

The current circulating supply of COMP tokens is 3.3 million out of 10 million possible max supply total.

MakerDAO (MKR)

Maker (MKR) is a token for Maker the protocol, backed by ETH. DAO stands for decentralized autonomous organization, and Maker acts as the backbone of a bank, underpinned by a fractional reserve system build on a stablecoin called DAI.

Maker has a total fixed supply of just 1,000,000 MKR tokens and is an ERC20 token build on Ethereum, like many other DeFi protocols.

Synthetix Network Token (SNX)

The Synthetix Network is a token trading platform built on Ethereum, and the SNX token is an ERC20 token supporting the protocol. The platform lets crypto traders place bets on all types of assets available as ERC20 tokens, offering DeFi derivatives trading.

There are 125 million SNX tokens in circulation out of just over 200 million total max supply.

Aave (LEND)

Aave, like its crypto ticker symbol LEND, suggests it is a protocol designed for decentralized lending and borrowing of crypto tokens over the Ethereum blockchain. The protocol’s success story is due to its flash loans – a type of uncollateralized DeFi loan.

Uniswap (UNI)

Uniswap is one of the newer DeFi protocols but is already the top platform in the space based on total value locked up in USD and ETH. Uniswap exploded in popularity as new tokens were launched left and right in August 2020.

Users of the platform reported making a fortune off early investments, while those late to the bandwagon got severely burned by food-named tokens like Hot Dog, Pizza, and more.

Eventually, Uniswap launched a governance token of its own to enormous interest. 400 UNI tokens were awarded to any users of the platform that connected and Ethereum-based wallet to Uniswap before the end of August.

Users had to log into Uniswap, connect the same Ethereum wallet, and pay ETH gas fees for fuel for the transactions to access the UNI contract and claim their free crypto.

When it was launched, it quickly reached prices of $3 per token. There are now over 60 million UNI in circulation, with a max supply of 1 billion.

Curve Finance (CRV)

Curve Finance is a DEX liquidity pool built on Ethereum made for stablecoin trading. Because Curve Finance essentially acts like a Uniswap, but for stablecoins only, there is extremely low slippage when swapping coins and lending and borrowing tokens.

There are over 69 million CRV tokens in the wild, with a max supply of 1,337 million tokens.

Balancer (BAL)

Balancer is a decentralized protocol for programmable liquidity and non-custodial portfolio management. Its an automated market maker platform where users can earn fees on their idle ERC20 tokens. It works very similarly to Uniswap or Curve.

There are currently 8.2 million BAL tokens in circulation, with a max supply of 100 million.

Yearn.Finance (YFI)

Yearn.Finance is yet another DeFi protocol, but this one interestingly aggregates lending services like LEND, COMP, and more to optimize token lending.

What makes Yearn.Finance even more appealing is the fact there is a max supply of just 30,000 tokens, making the asset even more scarce than Bitcoin itself. It is also significantly more valuable already than Bitcoin, making it the most expensive crypto token in the entire market, just months after its debut. That’s how hot the DeFi space has been.

Conclusion: Is Yield Farming Crypto The Best Way To Profit, Or Trading With Flurex Option?

Yield farming crypto is clearly a profitable trend, or no one would be doing it. You now know all there is to know about DeFi, yield farming, and more thanks to this detailed guide. We’ve gone over all the different platforms and protocols, and what is required to profit from doing so.

However, there is always a risk when it comes to cryptocurrencies and even DeFi. Just like the ICO boom, DeFi could just as quickly be stopped by the SEC, going after token creators and their teams. If this happens, there is no DeFi token that will be safe aside from Ethereum, which always weathers the storm. Other crypto assets, like Bitcoin, Litecoin, EOS, and Ripple, will do just fine if this happens.

Investors can profit from these more reliable cryptocurrencies by trading them using CFDs on Flurex Option. This alternative solution to DeFi brings more reliable ROI and doesn’t involve riding any bandwagons to bring opportunity to users. Registration takes just a few clicks and a few minutes. Try Flurex Option today.

What Is DeFi Yield Farming?

DeFi yield farming is a new trend where users scan several decentralized liquidity pooling protocols or lending platforms, searching for the best possible interest rates to near passive income on idle crypto assets just sitting in a wallet anyway. It allows users to compound gains and earn even more money than otherwise possible with just holding cryptocurrencies.

How To Farm Cryptocurrency?

Farming cryptocurrencies involves staking or lending and borrowing ERC20 tokens on any of the various DeFi platforms built on top of the Ethereum blockchain. Those who stake, lend, or borrow, or interact with a protocol in some way, earn rewards in governance tokens, and more. Users can also swap liquidity this way and profit from price fluctuations.

Can You Still Make Money From Cryptocurrency?

Making money from cryptocurrency these days seems to be easier than ever, according to DeFi applications and tokens. But choosing the right investment or protocol to swap on is never easy, and as users of Uniswap learned, several hot new projects ended up being scams.

Why Is Ethereum So Important To DeFi?

Most DeFi applications and protocols are built on the Ethereum blockchain, making it vital to the overall DeFi movement. And because most DeFi tokens are ERC20 tokens running on Ethereum, it has increased the demand for ETH due to its use for gas fees to send tokens created on Ethereum.