If you have been trading crypto, you certainly have heard the terms “crypto bear market” and “crypto winter.” Ultimately, this is a situation where the market sells off quite drastically, but understanding it can lead to opportunities that traders can take advantage of.

What is a Bear Market in Crypto?

When you hear the term “bear market,” it typically means that a market has dropped by over 20%. This harkens back to Wall Street, which uses the term bear market to describe when large amounts of losses have been realized. That being said, the term itself does not mean much; it’s just the way to determine that the market is in a downtrend.

For example, you need to keep in mind that crypto is much more volatile than stocks. So, for the S&P 500 to drop 20%, it’s a much more significant move than something like Bitcoin. That being said, as the crypto markets mature, you should see less of these volatile moves. Simply put, the larger crypto market should begin to act like stock markets, as large amounts of institutional money flow into the sector.

Generally, a bear market in crypto means we have been falling for a while. It does need to lose at least 20%, but there is nothing magical about that particular level, only that it is a traditional gauge.

The Causes of a Bear Market

Ethereum bear market, on the Flurex Option platform.

There are multiple reasons why a market may turn bearish. Traditionally, bear markets in history have had some similarities, but crypto is slightly different from traditional markets. This is because crypto is especially sensitive to risk appetite. When there is much fear out there, large institutional traders have no interest in trading something like cryptocurrency, which is volatile under the best circumstances. In this environment, traders typically look for safer assets, such as a stock that pays dividends and has been around for decades.

Another reason they may avoid crypto is that they are much more comfortable buying bonds. After all, if you can get a guaranteed return in a relatively low volatility environment, it becomes much more palatable than trying to time the change in the overall attitude of the cryptocurrency.

One of the main reasons that there have been bear markets in crypto has been simple growing pains. Adoption is not taking off like once thought, so it takes less negativity to get the market moving to the downside. This is especially true with the smaller altcoins, which have a low volume to begin with. For example, if there is a lot of risk aversion, most people are unwilling to buy something like Dogecoin.

Phases of a Bear Market

You need to be aware of a couple of stages during a bear market, as they don’t happen in one move. That being said, the market will likely continue to see phases you can identify if you know what to look for.

The Selloff

The first stage of the bear market is gradual after making all-time highs or something close to it. It speeds up and gets more aggressive as the crowd realizes something is wrong.

The Bounce

The market does not go down forever. The market has turned around at this point to give the buyers some hope, and it’s not overly surprising to see a bit of a bounce as people may not be wholly convinced that the market is going to sell off drastically and perhaps the situation “is not as bad as people thought.”

Capitulation and Final drop

The market starts the selloff drastically again as people realize something is genuinely wrong. Capitulation is when everybody leaves the market all at once, which usually causes a massive spike to the downside. At that point, the market may have run its entire course for the bears. It’s worth noting that an actual market reversal to turn around and put people back into a crypto bull market takes time, so typically, after this phase, you see a long sideways consolidation, sometimes thought of and referred to as an “accumulation phase.”

Why is the 2022 crypto winter, unlike previous bear markets?

There are several reasons why the 2022 crypto winter differs from previous bear markets in cryptocurrency. The first one is just simply the amount of money involved. There are a lot of institutional players involved in cryptocurrency now, so in and of itself, that makes it a different dynamic.

Remember, most of these funds are beholden to investors, so they do not take unnecessary risks. This means the institutional money may be on the sidelines longer than anticipated. In the past, Bitcoin and other crypto markets were supported mainly by retail traders, so it took a lot less to get things moving again.

Central banks worldwide continue to tighten monetary policy, which takes many risks off the table. Because of this, until the Federal Reserve pivots from its hawkish behavior, an asset like crypto will not perform very well, as it is far out on the risk curve. Ironically, while crypto was supposedly going to get people away from the traditional banking system, it found itself waiting on the Federal Reserve.

Common Mistakes to Avoid During a Crypto Bear Market

There are several common mistakes that you can make during a crypto bear market. This is mainly because crypto has a habit of going on a bull run for years at a time, and therefore people are trained to buy dips and always look to the upside. The reality is that there are a lot of different things that move the market, not just simple “hype.”

Panic Selling

“Panic selling” refers to selling a market immediately when prices start to move against you. This is a tricky topic because the needs are also known to crash. Panic selling means you are just selling out of fear instead of selling out of a trading plan. The primary way to avoid this is to understand where you want to be out of the market and set stop-loss order.

Overtrading

Overtrading is a killer. This is true not only in a crypto bear market but in a crypto bull market. In other words, there’s no time to press buttons like in a videogame. Unfortunately, many retail traders get involved in overtrading because they only focus on the potential gain. The reality is that trading is complex and needs to be approached with respect.

There is no “line in the sand” when it comes to determining when you are overtrading, but quite frankly, it’s one of those things that you will know when you see it. Crypto is difficult to scalp on low time frames, so as a general rule, it almost always involves traders working with those charts. Furthermore, if you find yourself taking trade out of boredom, that’s also a sign that you are overtrading.

Leverage

Be cautious with your leverage because bearish crypto markets tend to have massive bounces from time to time. Some of the most brutal rallies happen in bear markets, which is not unique to crypto because you see that in almost all markets. Short-covering rallies and people being concerned about theoretically “losing an unlimited amount of their account” means that a spike in price tends to have a knock-on effect.

By keeping your position size reasonable, you can benefit from the move lower, but you are not taking unnecessary risks trying to get rich overnight.

How to Survive a Crypto Bear Market: Investment Strategies for Bear Markets

There are a few basic strategies you can employ to survive a crypto bear market, and you can even profit from this situation if you know what you are doing.

Stake crypto

One of the easiest things you can do is stake your crypto. This will depend on the coin that you are holding, but many of them allow you to stake in pools to earn interest. If you plan on keeping your cash long-term, this is a way of mitigating some of the losses and eventually making a more significant gain as you own more of that crypto in the future.

Shorting

“Shorting,” or betting on the price of an asset falling, is a great way to earn during a bear market. It’s probably one of the most aggressive ways of trading with the trend. You must do it on a futures platform if you are trying to short actual coins. You essentially borrow coins from one place and sell them to another. You eventually repurchase them, returning them to the original party you borrowed from. Assuming you correctly guessed the direction, you return those coins and keep the difference.

That being said, it’s much easier to do it in the CFD market, which is the contract-for-difference market offered at Flurex Option. This is a simple matter of pressing a few buttons and collecting or losing the difference between the entry and exit prices.

Diversify your crypto portfolio

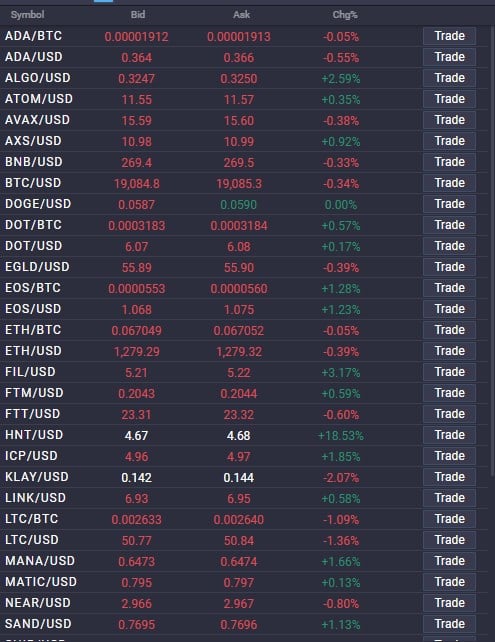

Just a handful of the numerous cryptocurrencies available at Flurex Option.

Diversifying your crypto portfolio is a great way to mitigate some of the problems with the bear market because some crypto is much more stable than others. In a bear market, you want to own the most significant coins because they will hold up the best under most circumstances. You can also move your holdings into stablecoins, which should stay extraordinarily calm. By mitigating exposure to small markets, you typically perform better.

Understand and utilize technical indicators

Technical analysis can go a long way in telling you which way the market may be moving. Using technical indicators can give you a bit of a “heads up” as to when a market may be changing momentum or when that momentum might be accelerating. Understanding technical analysis can help you time trades in any market, so it’s a good skill to know.

Conclusion

Bear markets in crypto tend to be quite vicious, but you can say the same about any asset. The big difference in crypto is that it is volatile under the best circumstances, as the markets are still new. That being said, there are many things that you can do to make it a good situation.

The first thing, of course, is that you can trade CFDs right here at Flurex Option. This allows you to short-sell a cryptocurrency without having the hassle of being involved in futures markets, nor do you have to take delivery of anything. It’s simple to press a button and close out the trade to make a profit or cut your losses.

If you are a longer-term holder of crypto, you can do a few things to mitigate some of the losses. For example, you can diversify your crypto portfolio by having more stablecoins than riskier assets. Perhaps you put a certain amount into Bitcoin, the biggest coin out there. In a more challenging environment, you want to stick with less volatility, reversing things when the market becomes much more positive.

You can also use technical indicators to understand what the market may or may not be doing. It can give you a “heads up” on the market’s momentum and when we may see a trend change. Perhaps even more importantly, money management is crucial as it can keep you from “betting the farm” on one particular market, exposing your portfolio to extreme risks. In short, it’s about diversification and a bit of temperance to keep your account more stable.

Is crypto in a bear market?

As of 2022, yes, crypto is in a significant bear market.

How long does a bear market last for crypto?

Bear markets have no specific timeframe, but they can often last for a few years.

How does one profit from a bear market?

The easiest way to profit from a bear market is to short-sell a cryptocurrency short. While you can do it through futures markets on some exchanges, the easiest way is through the CFD or contract-for-difference market. This is where you can speculate on the price going up or down without taking the actual delivery of crypto itself. This simplifies the process, and with Flurex Option, you have leverage that can increase your position size, thereby increasing potential profits.