Ethereum and Polkadot are two of the biggest cryptocurrencies and are trying to accomplish very similar goals. The difference is subtle in some ways and massive in others. Ethereum 2.0 transactions per second speed have made up a lot of the difference in speed, but there are also security concerns to consider. We will differentiate these two popular ecosystems in this article.

Ethereum: The basics

Ethereum is a major player in cryptocurrency, as many of the best-known projects are built on top of it. To understand any value proposition of holding the coin, you need to know how the network is used and where it is going in the future.

What is Ethereum, and how does it work?

Ethereum is a decentralized blockchain platform that allows for a peer-to-peer network that facilitates secure execution and verification of application code, known colloquially as “smart contracts.” This will enable participants to transact without needing a trusted third party or central authority. One example would be the potential to allow for stock trades without a broker, as there would be no need for an intermediary. If the smart contract parameters are met, the transaction is made. If they are not, then it never happens.

Advantages of Ethereum

One of the most significant advantages of Ethereum is its track record. Many of the cryptocurrency worlds do not have the same track record and work history that Ethereum does. Ethereum also enables the building and deploying of smart contracts and decentralized applications without downtime, pride, control, or even interference from a third party.

Ethereum has a programming language called Solidity, which is straightforward for developers. It also has the advantage that many other tokens have been built on top of it.

Disadvantages of Ethereum

The most significant disadvantage of Ethereum is that investing in it can be risky. That being said, it has gone through 2 major downturns and survived, so it certainly has a significant amount of wherewithal built into it. The other major disadvantage is that it has a bit of a scalability issue, which limits the number of transactions per second compared to other platforms.

Polkadot: The basics

To make any type of investing decision between the two coins, you will need to understand how Polkadot works, as well as know its advantages and disadvantages of it.

What is Polkadot, and how does it work?

Polkadot is a blockchain that is designed to support other blockchains. It’s a crypto platform that is a network made of other independent blockchain systems. Polkadot’s job is to connect these blockchains and allowed transactions between them.

Polkadot is an improved version of Ethereum and was launched in the spring of 2020. Polkadot was the brainchild of one of the co-founders of Ethereum. Polkadot offers a foundation on which other crypto projects can build, offering security right out of the box. Polkadot is a “Layer 0 blockchain”, while Ethereum is called a “Layer 1 blockchain.” Polkadot has its native token known as “DOT,” which is used to facilitate transactions.

Polkadot allows various blockchain systems to communicate with each other, solving a significant problem with adopting multiple platforms. For example, you may have a blockchain for a specific industry that wishes to speak with a vendor with its blockchain. Being in the Polkadot ecosystem can communicate safely without exposing data. Each blockchain is a “parachain” when you have an enclosed blockchain on the Polkadot ecosystem.

Advantages of Polkadot

The framework of Polkadot is modular and allows developers to choose specific components to best suit their needs. Developers can launch chains and applications leveraging a shared security model without worrying about attracting validators or mining nodes to protect the chain.

These blockchains on Polkadot are known as “parachains” and use bridges to connect with external networks like Bitcoin and Ethereum without exposing their data to them.

Disadvantages of Polkadot

One of the most significant disadvantages to Polkadot is that it is committing to other general-purpose blockchain networks for smart contracting, such as Cardano, Tezos, and Cosmos. Unfortunately, hackers have exploited code vulnerabilities several times, draining millions of dollars before being stopped.

Another major disadvantage to Polkadot is that there is only a limited number of parachain slots available, and they are auctioned off, meaning it may be costly to join.

Critical differences between Ethereum and Polkadot

While both of these ecosystems are interesting, and the coins that power them are attractive to many investors, you need to understand that there are some key and crucial differences between Ethereum and Polkadot.

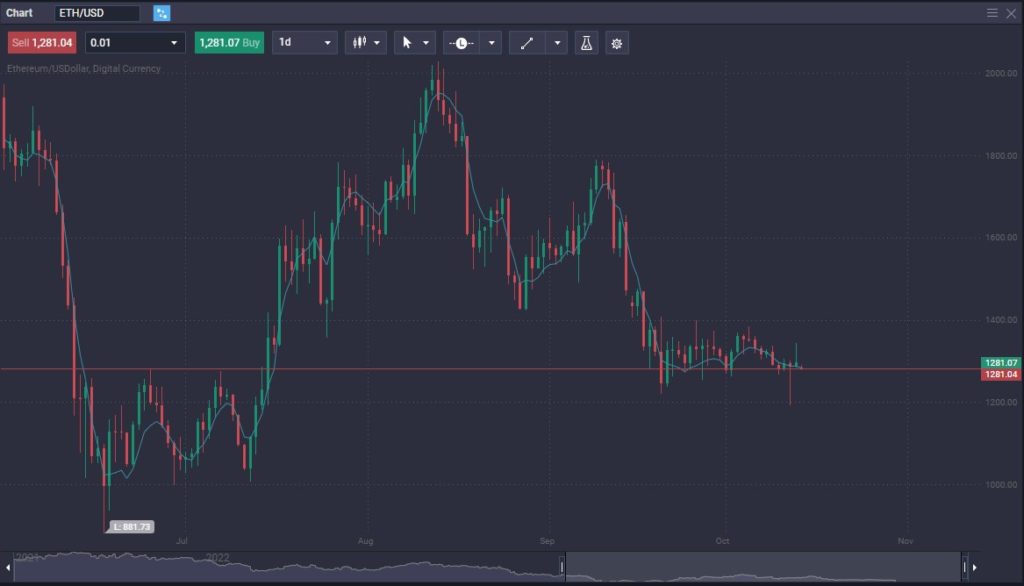

Ethereum trading on the Flurex Option platform.

Value

Both of these coins offer a significant amount of value, but as with everything else, it will come down to the adoption of the ecosystems. While Ethereum is highly regarded and has massive adoption, Polkadot is still in its infancy. Furthermore, Polkadot has to worry about the limited amount of slots available for parachains and will have to continue to see sharding to fulfill needs. Nonetheless, it’s a bidding process that might price many potential customers out of the market.

More likely than not, both of these ecosystems will thrive, but Ethereum will almost certainly be the bigger of the two for the foreseeable future. Polkadot is more likely to be very specialized, but time will tell.

Evolution

The evolution of these networks has similar back stories, as Gavin Wood, designer of Polkadot, was one of the co-founders of Ethereum. Regardless, Polkadot is still in its infancy and has experienced two significant hacks. Ethereum has recently evolved from a proof-of-work blockchain to a quicker, cheaper, and more ecologically friendly proof-of-stake blockchain in 2022.

Ethereum has a five-year head start on Polkadot, has several other ecosystems running on top of it, and has been proven effective. Because of this, it’s much easier to assume Ethereum is much further along its evolution than Polkadot.

Coin Limits

There is no maximum coin limit for Ethereum nor a limit on Polkadot. However, if you think about it, it does make a certain amount of sense that these coins would be inflationary because they are more often used for gas fees than anything else, and as a result, the bigger the network gets, the more these coins will be needed to pay those fees.

What Makes Polkadot and Ethereum Similar?

It’s worth noting that although they are two different investments, there are certain similarities between both Polkadot and Ethereum. After all, Polkadot was designed as an improvement on Ethereum, so a certain amount of overlap would be expected.

Mining Process

While both ecosystems use proof-of-stake, Ethereum just switched over. It used to be that you could mine Ethereum, but now they both have the same process. This is much more efficient, uses much less energy, and both have pools you can join to help with the network and increase your holdings.

Less Energy

Both networks use less energy than the grandfather of them all, Bitcoin. By switching over to prove-of-stake, Ethereum has brought down massive energy usage. Of course, with Polkadot having a very similar process, it has never had an enormous energy footprint.

Staking

You can stake both coins, earning rewards in that same coin to help validate transactions. Both are proof-of-work consensus, so they are very similar in this area.

Polkadot vs. Ethereum: Comparison

To understand the differences and similarities between Polkadot in Ethereum, you need to understand some basic facts. This table will give you a “high-level overview” of both ecosystems.

| Feature | Ethereum | Polkadot |

| Date Founded | 2015 | 2020 |

| Ticker | ETH | DOT |

| Market Cap | $156.6 billion | $7 billion |

| General Purpose | Smart apps and gas fees | Connecting blockchains |

| Mining Standard | Proof-of-stake | Proof-of-stake |

| Maximum Available Supply | unlimited | unlimited |

| How Is the Currency Used? | Smart apps and fees | Communication between networks |

| What Influences the Value? | Network growth | Adoption by parachains |

ETH vs. DOT: Historical Price Action Reviewed

The price action history between Ethereum and Polkadot is drastically different. While they both tend to move with the overall attitude of cryptocurrency, the heights reached by Ethereum far outshine Polkadot. After all, the Ethereum market has reached just above $4800 but has since plunged along with the rest of cryptocurrency. Ethereum is the second largest cryptocurrency in the world, following Bitcoin. (Tether is a stablecoin, so while it is technically bigger than Ethereum, it shouldn’t be thought of in the same breath.)

On the other hand, Polkadot max out at just underneath $54. It has collapsed along with the rest of crypto as the markets entered a severe “crypto winter” in 2021.

Ethereum vs. Polkadot: Which one is the better investment?

It’s pretty evident that Ethereum would be the better investment at first glance, just because the size of the network is so much bigger, and Ethereum is being adopted much quicker. Furthermore, it’s also worth noting that many other ecosystems are built on top of Ethereum. Therefore it would take quite a bit of shakeup in the crypto industry to see Ethereum fall apart.

That being said, it’s not necessarily a situation where you have no reason to own Polkadot. After all, the ability of wholly enclosed blockchain ecosystems to communicate with each other is a significant problem for adoption. However, the amount of parachains is somewhat limited and could even become extraordinarily expensive due to the bidding process, which could keep a bit of a lid on Polkadot. A lot of this will come down to Polkadot sharding and Ethereum sharding as well, as this will allow Level 2 to function quicker on Ethereum. This will continue to be one of the main battles between the two.

Conclusion

Both ecosystems have significant benefits and beneficial properties for the crypto world. After all, Ethereum is the backbone of numerous decentralized finance projects, NFT marketplaces, smart contracts, decentralized applications, and many other possibilities. Ethereum itself is going nowhere, and it has recently upgraded the network to become cheaper and much more energy-efficient, arguing for more adoption.

On the other hand, Polkadot does offer an exciting value proposition because it allows for the secure exchange of information between 2 blockchains without exposing the users to nefarious actions via transactions. However, Polkadot has been hacked twice, costing millions of dollars. Because of this, Ethereum will continue to more likely than not lead Polkadot, but Polkadot might find itself in a niche type of situation, which of course, will remain to be seen. There are numerous potential applications, such as banking, that Polkadot could be used for, but it is still far too early in the lifecycle of this ecosystem to honestly know.

While all cryptocurrency is speculative, it’s a safe bet to assume that Polkadot will be a much more speculative trade than Ethereum. Because of this, it may be wise to own both in your portfolio, but you should position the size accordingly.

Is Polkadot built on Ethereum?

No, it is not. However, it was the brainchild of Ethereum cofounder Gavin Wood.

Can Polkadot surpass Ethereum?

Anything is possible, but a limited number of potential parachains in the near term keeps growth somewhat limited. That being said, Polkadot suggests that sharding will continue to build out the number of slots available.

Is it worth it to buy Polkadot?

Polkadot can be worth buying, but it’s like the rest of the cryptocurrency market; it’s very speculative. You should never invest any more than you can afford to lose, and you must be willing to deal with massive swings in value.