One of the hottest sectors of investing/trading over the last several years has been cryptocurrency. You often hear the term “fiat currency” along with “cryptocurrency.” This article will discuss the differences between the two and the strengths and weaknesses of both types of money.

What is Fiat Currency?

Fiat currency is a term used to describe the money you use on a day-to-day basis. The US dollar, Euro, Japanese yen, and almost all other modern currencies are a form of fiat currency.

Fiat currencies get their value from the government’s economic power backing them. The fiat currency is different from an asset-backed currency, which has its value derived from some type of underlying asset. If a currency were based on gold, it would be an asset-backed currency. Since the Great Depression, the monetary system around the world has favored fiat.

What’s the Background of Fiat Money

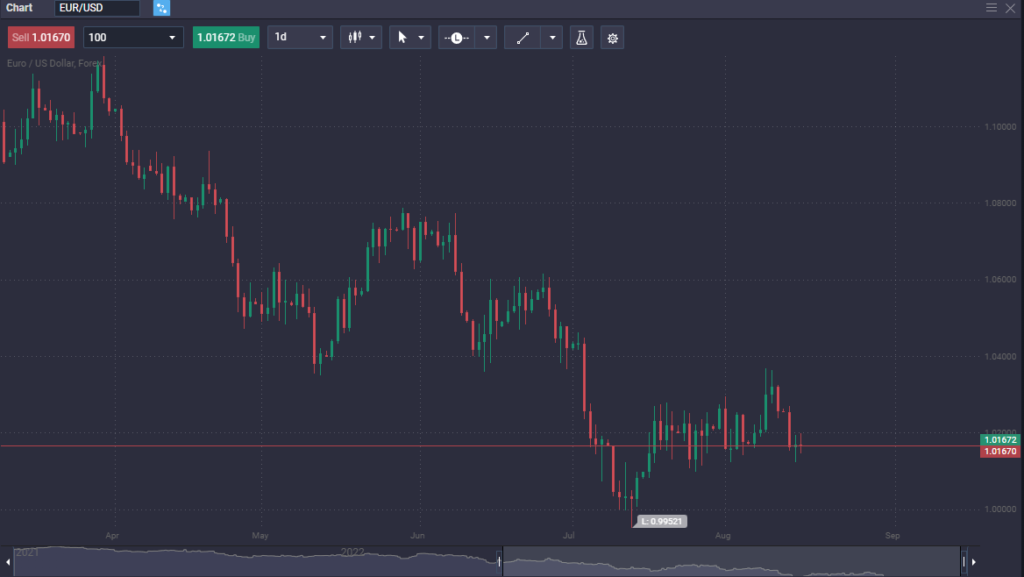

Trading the world’s 2 largest fiat currencies, the Euro and US Dollar at Flurex Option

The background of fiat money is a bit complicated, but the initial use of fiat money came in China, as the Chinese started to issue coins and paper backed by certain commodities. People could use these easily transportable coins or paper to pay for goods and services, which is much simpler than the bartering system that people had been accustomed to.

For quite some time, national currencies were backed by an asset, typically silver or gold. The United States used to have dollars redeemable for either of those metals. Still, during the Great Depression, the Emergency Banking Act of 1933 eliminated the possibility for citizens to redeem dollars for either metal.

In 1971, Richard Nixon took the United States off the gold standard. The dollar became a fiat currency, as it was no longer backed by anything of substance. Fiat currency is based upon confidence, not necessarily anything supporting it. (In theory, the Federal Reserve is required to hold collateral equal to the value of all dollars in circulation.)

However, recently we have seen an explosion in government spending worldwide. This is typically the beginning of the end of the fiat cycle, as we have seen the same thing happen in previous empires. This is where people became interested in something with a limited supply, such as Bitcoin.

How Fiat Currencies Work

The definition of fiat comes from a Latin word that means “a formal authorization; a decree.” In other words, fiat money refers to an order by the government that makes those currencies valuable and legal tender. That being said, there is no underlying story of gold or silver to give fiat currencies any material value.

The fiat currency is backed by the authority of each government that issues it. The Federal Reserve uses an expression that the US dollar is supported by the “full faith and credit of the US government.” The problem, of course, is that they are not backed by anything. That’s simply a sentence. If the general public loses confidence in a currency, that’s the end of the game.

Fiat money is much more susceptible to inflation and deflation as governments can print as much as they want. For example, there is nothing to stop Norway from printing an unlimited amount of Norwegian krone. It all comes down to whether or not the public has that currency.

Why Does a Fiat Currency Have Value?

In the past, when currencies were asset-backed, the US dollar was backed by gold and silver. However, as the United States went off the gold standard for domestic transactions in the 1930s and ended international conversions in 1971, the US dollar became a total fiat currency.

The Federal Reserve is required to hold collateral equal to the value of dollars in circulation, using government debt to back those dollars. The US dollar has value for only a couple of reasons, which include because the US government says it does and because investors and lenders believe that the US government will repay its debts. (Ironically, with more of the same currency that they can print whenever they want.)

What is Cryptocurrency?

Trading the biggest crypto, Bitcoin at Flurex Option

Instead of using physical money, cryptocurrency exists in a public and online database that records transactions. Cryptocurrency is a digital currency or asset that acts as a medium of exchange and is secured by cryptography. Its beginning was as a peer-to-peer electronic cash system. Unlike a bank in the case of a typical fiat transaction, cryptocurrency does not need intermediaries to validate transactions.

Cryptocurrency is also not controlled by a government or central bank. Fiat currency can be printed anytime; however, cryptocurrency has a fixed supply. For example, Bitcoin has a fixed supply of 21 million. Because cryptocurrency is not regulated or backed by a government, it does tend to be much more volatile than fiat. This leads to the question of “How volatile would fiat currency be in a truly unregulated market?”

The Background of Cryptocurrency

To understand the use of cryptocurrency, you need to get a bit familiarized with the background of cryptocurrency on the whole. As it is a new asset, there are still many questions by most investors or traders.

How Does Cryptocurrency Work?

There are thousands of digital currencies that people can get involved in. While most people know the name Bitcoin, there are other big names in the financial arena, such as Ethereum, Shiba Inu, XRP, Solana, and Binance Coin, just to name a few.

There are also known as “stablecoins,” such as Tether, pegged to a specific value, typically measured in fiat currency. For example, Tether is pegged to the US dollar, meaning that it has the same value in the digital world. Stable and can also be pegged to other assets such as gold or oil, allowing entities to interact in assets that never leave the blockchain.

Many industries worldwide accept crypto as payment, although it is still a tiny part of the financial market. One of the significant advantages is that there is a public record of the transaction, and international transactions are done much quicker.

What Gives Cryptocurrency Value?

Many different things can give a cryptocurrency its value, but in general, only a few things control most of the price and value movement. The first thing, of course, is whether or not it is being adopted. At this point, most of the pricing in your average cryptocurrency is based upon what could happen, not what has happened. Adoption is still very low with most currencies.

Purpose and functionality can go a long way as to whether or not there is demand for crypto.

For example, small market crypto used for a very niche and specific transaction may not have a lot of value, as there won’t be much in the way of demand. However, if it’s used as a daily payment by quite a few people and can do it quickly, it has much more utility.

Branding comes into play like any other business. Unfortunately, Tweets by people such as Elon Musk, Mark Cuban, and many others can throw things into disarray regarding crypto. This is because the markets are still relatively mature, so there is a lot of noise from other actors.

One of the easiest ways to understand whether a cryptocurrency will have value is how many tokens are available. For example, Bitcoin is limited to 21 million coins. On the other extreme, Dogecoin has an unlimited amount of possible coins down the road. In other words, Dogecoin is already inflationary by its very design. This is why Dogecoin has yet to break $1.00, while Bitcoin has reached well over $65,000 at its 2021 peak.

Fiat Currency vs. Cryptocurrency

Comparing fiat currency versus cryptocurrency is the person you need to do to understand whether the value proposition in the cryptocurrency world is for you. While there are some similarities, the reality is that the two forms of money are extraordinarily different.

Fiat vs Crypto for Payment

Some maximalists argue that cryptocurrencies will someday take over fiat money as the primary mode of payment. This is because they offer relatively instantaneous transactions and some cases. They also argue that if trust vested in fiat currency is in the government backing it, trust vested in crypto has to do with trusting the blockchain.

Cryptocurrency has not taken off as a medium of exchange in the way that many people had hoped. While some businesses accept crypto as payment, most transactions globally are made with fiat currencies.

One of the biggest criticisms of cryptocurrency is volatility. After all, in 2021, you could have paid a whole Bitcoin for an automobile, with the vendor treating that as the same value that $60,000 would have. However, less than a year later, that same Bitcoin is only worth around $20,000. When an asset is that volatile, it makes any significant transactions through business almost impossible.

Fiat vs Crypto as Store of Value

Cryptocurrencies like Bitcoin have tried to behave more like a store of value, such as precious metals have. After all, some cryptocurrencies like BTC have a limited amount that can be “mined,” in this case, 21 million.

At the same time, the US dollar has a potentially limitless supply. Several trillion dollars’ worth of paper currency are outstanding worldwide, and the Federal Reserve balance sheet has been exploding for years. Fighting the Great Financial Crisis and the pandemic have both because the Federal Reserve to expand its balance sheet to dangerous levels.

Many speculators and investors have put money into the crypto market in to hope that the coins they buy will maintain their worth or perhaps even increase significantly in value as the printing of fiat currency continues to be out of control.

Central Bank Digital Currencies (CBDC)

One development that could be particularly interesting is the work being done with Central Bank Digital currencies (CBDC), virtual currencies that a central bank creates. While some people like this idea, it’s also a bit of an oxymoron because cryptocurrency is decentralized and does not have authority backing them. 80% of central banks worldwide are researching how to “print digital currency.”

What Are the Advantages of Cryptocurrency?

To try and evaluate cryptocurrency, you need to understand its advantages and what it does for the end user. There are multiple advantages to using crypto, including some of the following, which are the most quoted by enthusiasts.

Cryptocurrencies Are Digital, Global, and Fast

Digital currencies are excellent for cross-border payments because they can be transferred quickly and easily between a couple of accounts. This makes them ideal for online businesses, e-commerce platforms, and multinational corporations doing cross-border deals.

If you make cross-border payments often, the speed of the transaction can mitigate some of the risks involved in fiat transfers, which can take several days. Furthermore, the fees for digital payments are much less than traditional transactions.

Cryptocurrencies Are Pseudonymous to a Point

One of the arguments for cryptocurrency use is that they are pseudo-anonymous. That might still be true to a point. Still, several high-profile arrests have been made of terrorists and money launderers from government agencies, so although your actual name is not necessarily on a wallet, transactions can be traced by those who genuinely take the time and have the technology.

Cryptocurrency Security

Cryptocurrencies use blockchain technology, which is decentralized and widely distributed. This means that all transactions on the blockchain are recorded and can be verified, making them tamperproof. This makes cryptocurrency much more secure than other forms of finance.

Once a transaction has been made, it cannot be reversed. This helps prevent fraud by nefarious actors, as immutability limits the potential.

Crypto Transactions Are Fast

Cryptocurrency transactions are quick, much quicker than typical fiat transactions. Some cryptocurrency transactions can be verified and processed almost instantly, depending on the network. E-commerce is especially suited to this aspect of cryptocurrency, as cross-border payments can be done and finalized in the blink of an eye.

What Are the Disadvantages of Cryptocurrency?

While many believe that cryptocurrency’s future is robust, nothing is perfect, and cryptocurrency will be no different. Some of the following issues are significant problems for the space currently.

Cryptocurrency Is Volatile

Cryptocurrencies are extraordinarily volatile. Several massive selloffs have been in some of the most widely accepted crypto markets, such as Bitcoin. In 2021, Bitcoin reached just below $70,000 before cratering in just a few months. Bitcoin lost well over 60% in short order. As long as cryptocurrency continues to be that potentially volatile, a lot of people will shun using them.

Cryptocurrency Is Unregulated

One of cryptocurrency’s biggest appeals is that governments do not control it. However, that also means that much of the cryptocurrency space is entirely unregulated. Because of this, it may be almost impossible to accept cryptocurrency if you are a company that deals with many anti-money laundering regulations.

Beyond that, there have been a lot of Ponzi schemes in the crypto markets that have gone unpunished because, quite frankly, most people are not sure exactly who would regulate some of these transactions. It is still the “Wild West” of the financial world.

Cryptocurrencies Are Not Widely Accepted

Currently, cryptocurrencies are not widely accepted as a form of payment. This means that you probably will have trouble finding businesses to take your crypto for payment, making it impossible to use as your primary form of payment.

This may change over time, but the cryptocurrency world is very much in its infancy. Hence, the adoption of crypto for payment is probably the essential factor to pay attention to.

What Are the Advantages of Fiat Currency?

While many futurists and traders believe that fiat currency is in trouble, the reality is that there are a lot of advantages to using it. The Forex market churns $5 trillion in transactions daily alone. Some of the most apparent benefits are listed below.

Fiat Is Regulated

Fiat currencies are regulated. Businesses can accept fiat currencies without concerns about compliance with the law. Beyond distribution, they are widely available and, of course, have a long history of acceptance.

Fiat Is Widely Accepted

One of the most significant advantages of fiat currency is its widespread acceptance. In other words, you will not have issues finding somebody willing to accept US dollars in the United States or most places in the world, for that matter. If you are in Germany, Euros are accepted everywhere, just as the Japanese yen is accepted in Japan.

Contrast that with Bitcoin, which, although widely known, is not always accepted. The biggest hurdle to crypto at the moment is adoption.

Fiat Is Stable

Fiat currencies are typically much more stable. As a general rule, a move of more than 10% in a year is considered to be extreme for a currency. The consistent value of a currency means that businesses can rely on access to a consistent amount of funding, leading to the ability to plan and forecast for the future.

What Are the Disadvantages of Fiat Currency?

While fiat currency is the most common currency in the world, that does not mean there are no issues. There are some significant disadvantages to using fiat currency, including some of the following problems.

Fiat Payments Can Be Slow

One big complaint about fiat currency is that it can take quite some time to process payments. If you are running a digital business and want to accept bank transfers from customers, you may have to wait several days for those transactions to clear.

Fiat Can Be Inflated

Fiat is subject to inflation because central banks and governments tend to print more money. This has been seen throughout history and has been the case over the last several decades. If you are running a business that sells online products and wants to accept fiat payments from your customers, you may need to be cautious as inflation can destroy purchasing power.

Fiat Is Government Controlled

Fiat currencies are government-controlled, meaning governments can change the rules anytime. The government can shut down access to your funds, which can be a big problem for businesses that wish to process transactions quickly.

One extreme example was seen in Canada recently, as protesting truckers suddenly found access to their bank accounts blocked by the Canadian government. This is one of the totalitarian aspects of fiat currency that cryptocurrency is supposed to get rid of.

What Would Happen If Cryptocurrency Replaced Fiat?

To begin with, the most likely scenario is that cryptocurrency does not replace fiat; instead, central banks use their cryptocurrency to replace fiat. However, as cryptocurrencies transcend borders and regulations, this will have positive and negative effects.

As they are not controlled or influenced by central banks in the same way as fiat currencies, this could help influence inflation in the future. Decentralization removes a lot of the tools of the central bank, such as interest rate control and open market operations.

There is no real way to know what happens if cryptocurrency finally replaces fiat. As things stand right now, the International Monetary Fund recommends against adopting cryptocurrency as a primary national currency due to price volatility. However, if that issue gets solved, it would go a long way toward making this a reality. It should also be noted that the IMF has its interests at play in that statement as well.

What Does the Future of Currency Look Like?

You can already exchange your cryptocurrency for fiat currency through exchanges or other cryptocurrency users. The blockchain and cryptocurrency use cases are still up in the air, and acceptance needs to grow. The more crypto is used and understood, the more value it could have as a means of exchange.

Several scenarios could emerge; quite frankly, anything at this point is probably speculation. Under the best circumstances, people would embrace cryptocurrency to the point where fiat currency is eliminated. The government would be forced to recognize it is legal tender, and fiat currency would cease to be used. However, this is likely not the case because he gives up quite a bit of governmental control.

A second scenario could be a hybrid between digital assets and fiat currency. This is already being explored by multiple countries worldwide in the form of central bank digital currencies. This is probably the most likely scenario because it gives the convenience of digital currency and the ability for the government to control payment options and, worse yet, behavior. (See Canada.)

A third scenario could be that society completely rejects cryptocurrency. This is a possible scenario, but that does not look as likely as the second scenario. The reality is nobody knows what’s going to happen, which is part of what makes the price so volatile.

Conclusion

The most important thing to keep in the back of your mind when investing or trading cryptocurrency is that you are speculating on a new asset. Simply put, this is not something that people understand entirely, nor do they know where the future will be for this asset.

Bitcoin is much different than investing in something like copper or oil. After all, we already know the use case scenario for those assets. The most likely outcome is that cryptocurrency will survive but perhaps be used in a way we don’t understand or even recognize.

Because of the uncertainty, crypto should probably be just a tiny percentage of your portfolio. Luckily, Flurex Option offers not only cryptocurrencies on the platform but also indices, fiat currencies, and commodities via the CFD market. This allows the trader to take advantage of fluctuations in markets such as Bitcoin, Ethereum, or Dogecoin when opportunities arise or simply forgo trading them and trade oil or the British pound if those markets are moving. Diversification will continue to be essential between the cryptocurrency you hold and the other assets you hold.

Is fiat better than cryptocurrency?

There are many reasons to believe that specific cryptocurrencies are better than fiat currencies, but it is far too early to make that argument. One of the biggest problems with cryptocurrency is the lack of adoption.

What is the difference between crypto and fiat?

Cryptocurrency has a network, usually a blockchain. Fiat currency is simply digits that are exchanged back and forth either electronically or in a physical form that is recognized as a store of value.

What does fiat mean in crypto?

Most crypto enthusiasts consider anything backed by a government as being fiat.

Is crypto considered fiat?

No, it is at least somewhat limited in most networks, which means that it is not fiat.

Will crypto overtake fiat?

Realistically, probably so. However, it’s more likely than not that some type of central-bank digital currency ends up being the replacement for typical fiat. That said, nothing will keep them from printing unlimited crypto.

Is crypto more efficient than fiat?

It depends on the crypto you are speaking of. Crypto is getting faster and more efficient, but electronic payments are a field in which crypto is still trying to catch up with more prominent players such as Visa and MasterCard.

How do you turn a fiat currency into crypto?

You don’t turn a fiat currency into a cryptocurrency per se, but you can buy cryptocurrency with fiat currency on most exchanges.

How is Bitcoin better than a fiat currency?

There is a limited supply of Bitcoin. There will only be 21 million created, bringing in a lot of built-in scarcity. Bitcoin will have no value. One question to ask is whether adoption will make that scarcity matter.

What happens when fiat currency collapses?

History has shown that when a fiat currency collapses, there is typically a new one that replaces it. Quite often, they will start as being somewhat asset-backed, but as economic expansion would require more and more assets backing the currency, eventually Fiat becomes a more palatable option.

Why can't cryptocurrency replace fiat currency?

Governments are actively working against replacing fiat currency with cryptocurrency, so that would be the first issue. Beyond that, you would have to have massive adoption by the general public to make that happen.