US stocks had a massive week that resulted in the S&P 500 gaining 6.1%, the Dow notching 5.5% higher, and the tech-heavy Nasdaq Composite surging 8.1%. Most of the action came in the second half of the week after the FED only raised 25 bps, quelling fears that the FED would be too hawkish. The Dow jumped 500 points in relief rally after the rate increase on Wednesday after several days of losses in US stocks, while the 10-year Treasury yield eased back a little to 2.15% after rising for two weeks in anticipation of higher rates ahead.

While the FED meeting was one of the major factors behind the rally in US stocks, in Asia, the China and Hong Kong indices were already trading much higher after the Chinese government intervened to support the markets. On Wednesday Asian time, the Chinese government vowed support for its ailing stock market, which led the Hang Sang Index (HSI) to its largest one day rise since October 2008. The HSI finally reversed 30 consecutive days of losses to clock an 8.5% rise by the end of Wednesday, and continued to rise sharply after the FED meeting. After taking into account the bruising start of the week where it fell a further 10%, the HSI has risen by 6% for the week.

Russia avoiding a default also gave investors reason to cheer as the contagion to the global financial markets could be avoided for now. Russia on Thursday reportedly made a $117 million bond payment in dollars, thereby avoiding what would be a historic foreign currency debt default. This has further sent risky assets like stocks climbing.

With risk-on back on the front seat, safe havens and commodity prices took a backseat. Oil fell below $100 the first time in weeks as the unwinding of positions in the oil and commodity complex continued. Progress in peace-talks between Russia and Ukraine, as well as the anticipated slowdown in demand from China due to its renewed COVID lockdown has led Oil back down midweek, before a late week bounce managing to bring Oil prices back above $100 again in a roller coaster ride. Brent closed the week at $107.80 and Crude Oil closed at $103 after rebounding strongly on the last two days of the week after reports out of China suggested that the COVID lockdown in China was fast easing, and has opened the new week continuing to inch higher, with both Brent and Crude up around 3% each in early Asian trading on Monday. Brent is closing in on $110 while Crude is above $106 at the time of writing.

While Oil prices managed to rebound, precious metals eased lower, with Gold losing 2.5% and Silver pulling back to below $25 last week, and continuing to consolidate in early Asian trading on Monday.

Trading like a risky asset ever since the rebound in 2020, cryptocurrencies also edged higher after the FED meeting. BTC finally managed to hold above $40,000, gaining 10%. ETH did even better, climbing 20% to overshadow BTC in percentage gains. Revelation of a well-respected crypto fund buying a large amount of ETH straight after the FED meeting managed to help salvage investor confidence in ETH, which has been lagging behind its major competitors like LUNA and AVAX in terms of percentage gains.

Trade LUNA and AVAX with leverage

Signs Of Rebound Since Early Week

The beginning of the week ushered in good news for crypto holders as the EU voted against banning crypto mining, instead, crypto could be added to the EU taxonomy for sustainable activities, meaning crypto miners could be subjected to a higher tax to compensate for the higher carbon footprint from mining.

While not directly impacting the trading of cryptocurrencies, the acceptance of mining as a viable business in the EU would make cryptocurrency a legitimate asset class within the EU.

Crypto investors seemed to like the news, as BTC/USD rose around 6% from $37,500 to almost $40,000 when the news was released, before pulling back to $38,000 immediately. However, on Tuesday night US time, the price of BTC shot up again by 5% through $41,000. While the reason of the sudden spike was unknown, it nonetheless caused liquidations of about $70 million within one hour, before price started falling back again in the hours after.

Rumours surfaced soon after that the price swings were a result of Russian billionaires selling BTC from their accounts to subsequently rebuy using proxy accounts in Dubai. However, these are unverified rumours and no one really knows if this indeed happened.

After the FED meeting where the FED raised interest rate by 25 bps, BTC again bounced off an initial knee-jerk drop to rally back above $41,000, leading the rest of the market back higher. This time, BTC managed to hold on to its gains and maintained around $42,000 throughout the weekend.

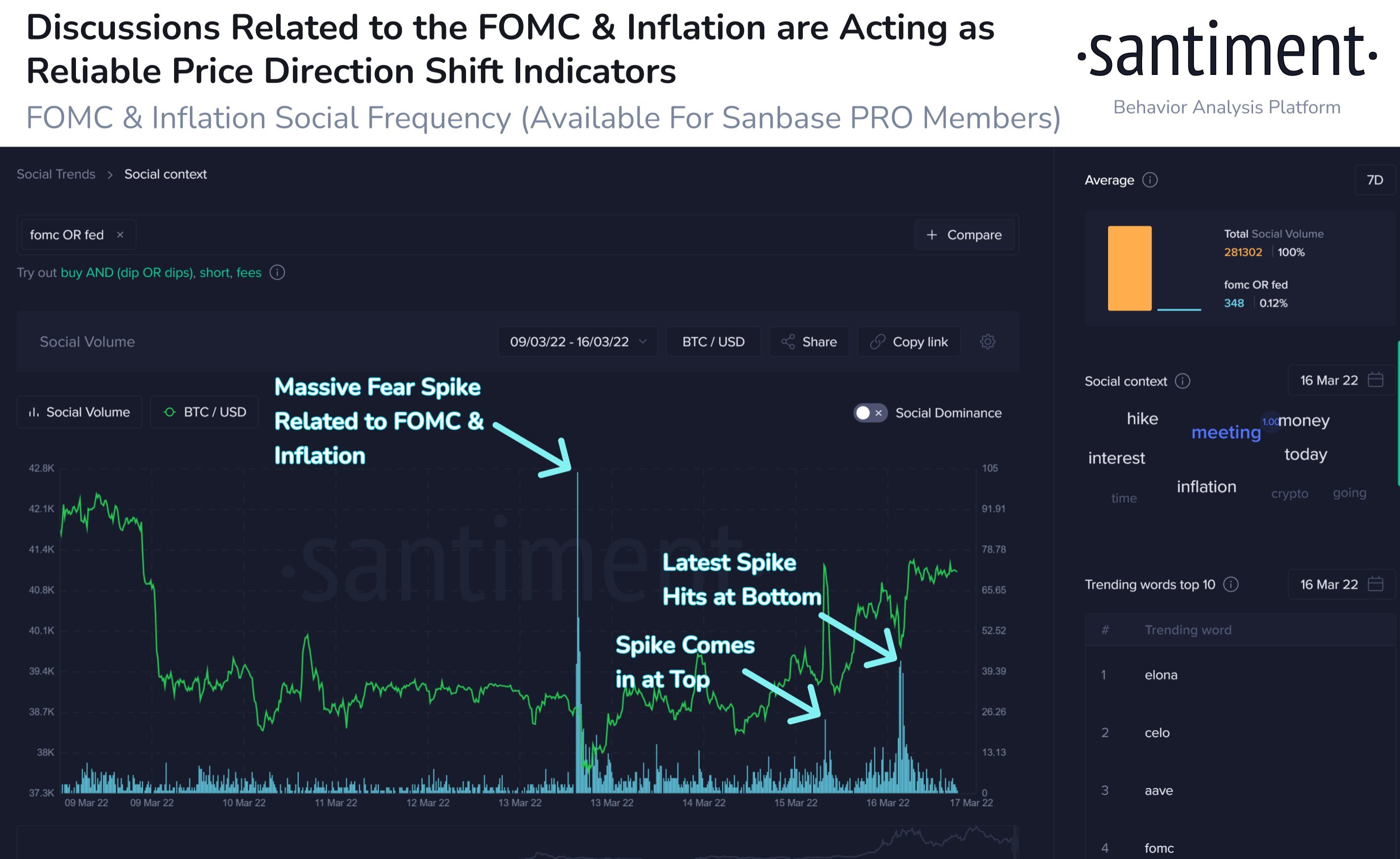

A check on social media revealed that the rebound could be a relief rally after overblown fears about the FED rate hike ahead of the meeting. The pent-up pressure was released following only a 25-bps rate hike and a not as hawkish FED.

Large BTC Withdrawal Underscores Strong Demand

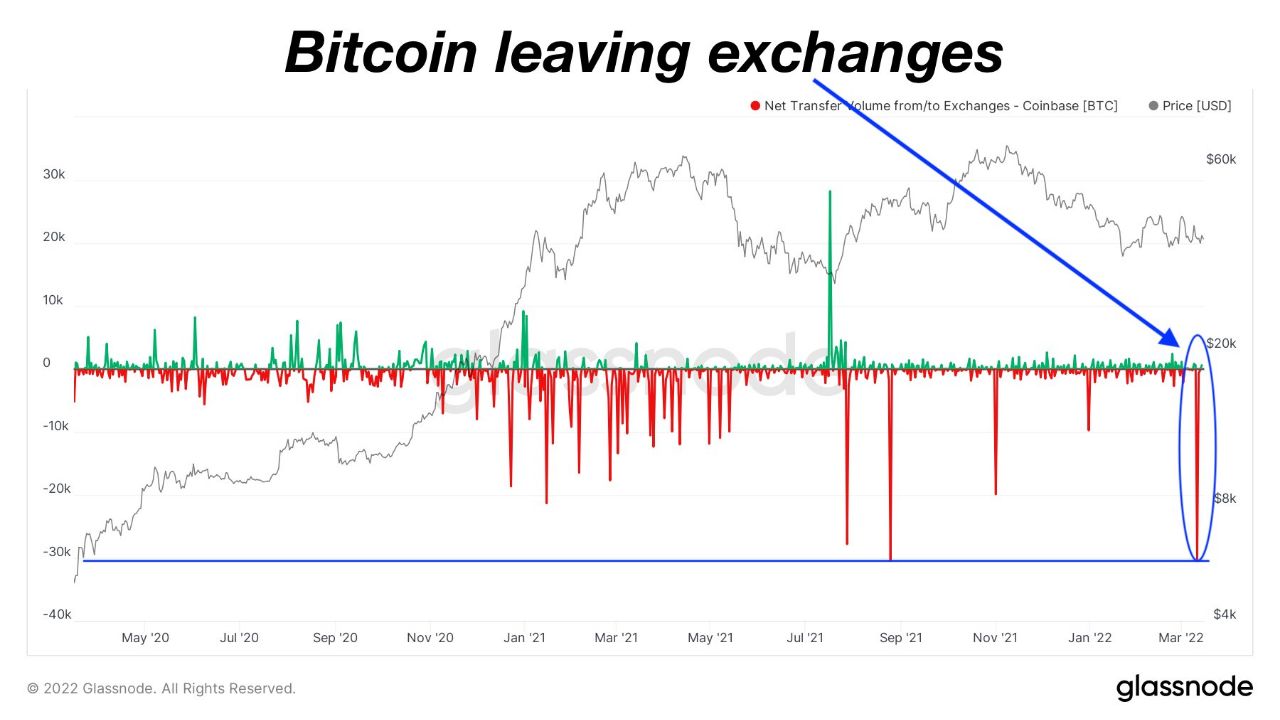

The bounce in the price of BTC following the FED meeting could have been anticipated if we were to study BTC metrics in the early week. On Monday, more than 30,000 BTC had been removed from exchanges, with the bulk of it from US exchange Coinbase. This was the second biggest day of withdrawals in 2 years and with it happening just before the FED meeting could indicate demand for BTC as a USD hedge by some large institutions.

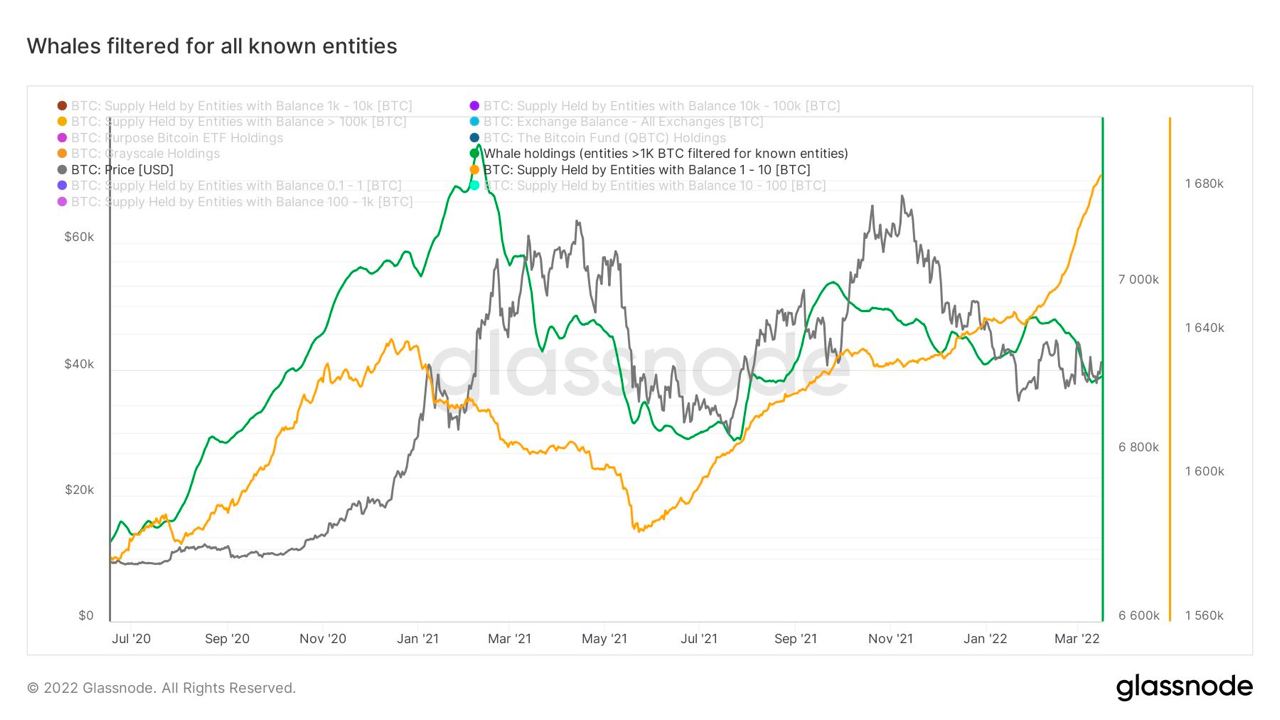

Other than big buyers, the month of March also saw a huge spike in the number of smaller BTC stackers. The number of smaller whales with 1 to 10 BTC have surged significantly in March, which could be investors buying BTC as a wealth preserving asset as a result of the current geopolitical tensions between the world superpowers.

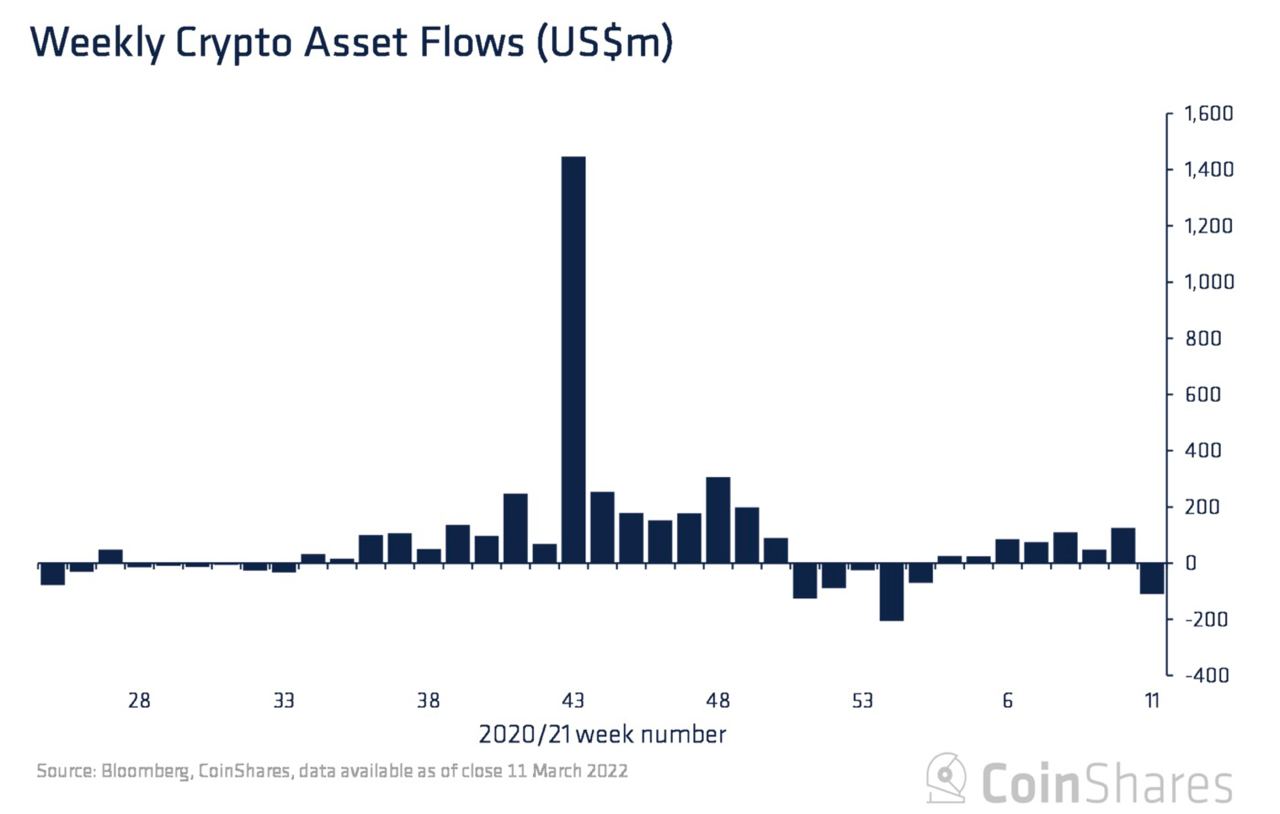

Crypto Funds Saw First Outflow After Executive Order

Even though flows in the spot market were positive, crypto managed-products saw outflows. Crypto fund products saw outflows totalling $110m the week before, following a 7-week run of inflows. While not exactly a large figure, the significance of this was that $80m of the outflows came from North America, suggesting that they could be a response to the Executive Order signed into force by US President Biden. However, since this is a laggard statistic, the outflow may not be very meaningful since it happened a week ago, before the FED rate hike.

ETH Sees Big Fund Purchase Before Surge

A big ETH purchase by Three Arrows Capital was made on Wednesday immediately after the FED meeting. According to data, 40,500 ETH was transferred to Three Arrows Capital on what seemed to be a huge block trade. The news sparked a small rally in the price of ETH, where it managed to overtake BTC in terms of percentage gains in the 12 hours following the transaction.

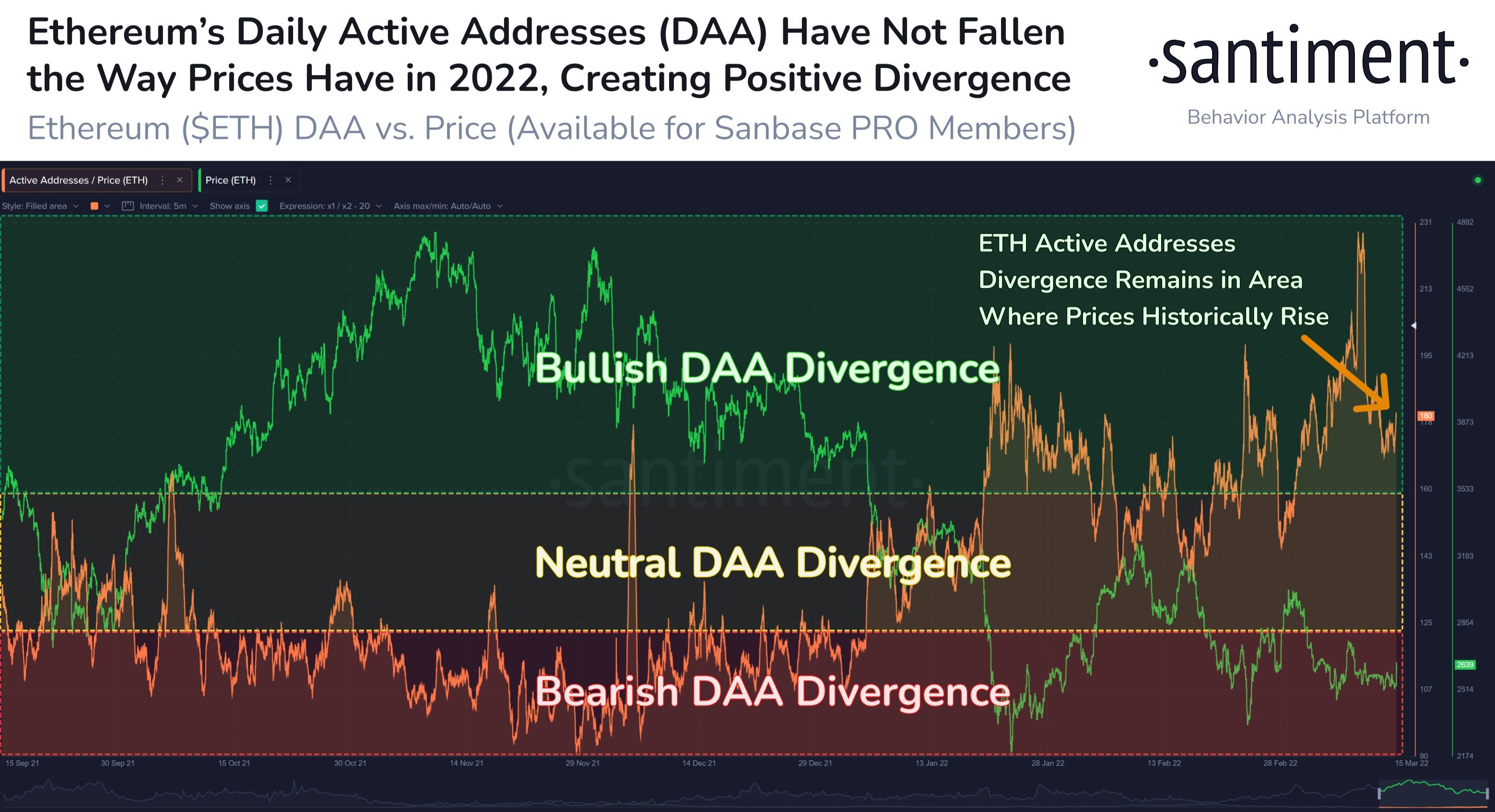

Just before the large purchase, ETH metrics have showed a positive divergence where active addresses remained high vs the price of ETH. This means that ETH’s utility has remained steady these past 4 months even when its price has fallen by 35% over this period. With the number of unique addresses interacting on the ETH network remaining in bullish territory, it was only a matter of time that its price would rise. Perhaps this was the reason why the fund decided this was the right time to load up on ETH.

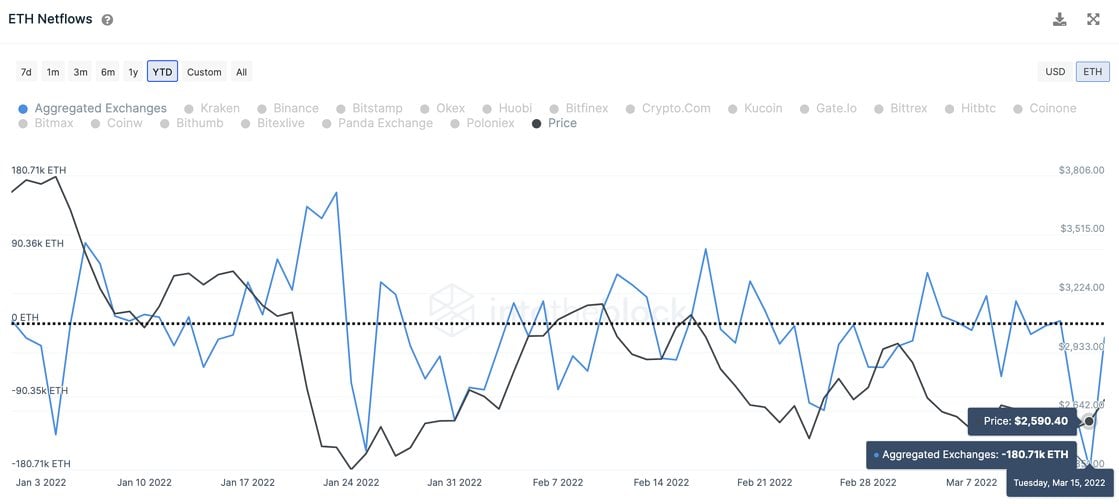

There could be another reason for the purchase as well because even before the purchase by Three Arrows Capital, a huge volume of ETH was removed from exchanges on Tuesday in what was the largest single-day withdrawal of ETH since October 2021.

A total of 180,700 ETH had been withdrawn from centralised crypto exchanges on Tuesday. Could these movements be a sign that good news may be forthcoming from the ETH blockchain? While this may not necessarily mean that the Merge is imminent, this kind of large whale purchases nonetheless make traders very excited over what is to come. The last time such big withdrawals was observed in October 2021, the price of ETH rose 15% over the following ten days.

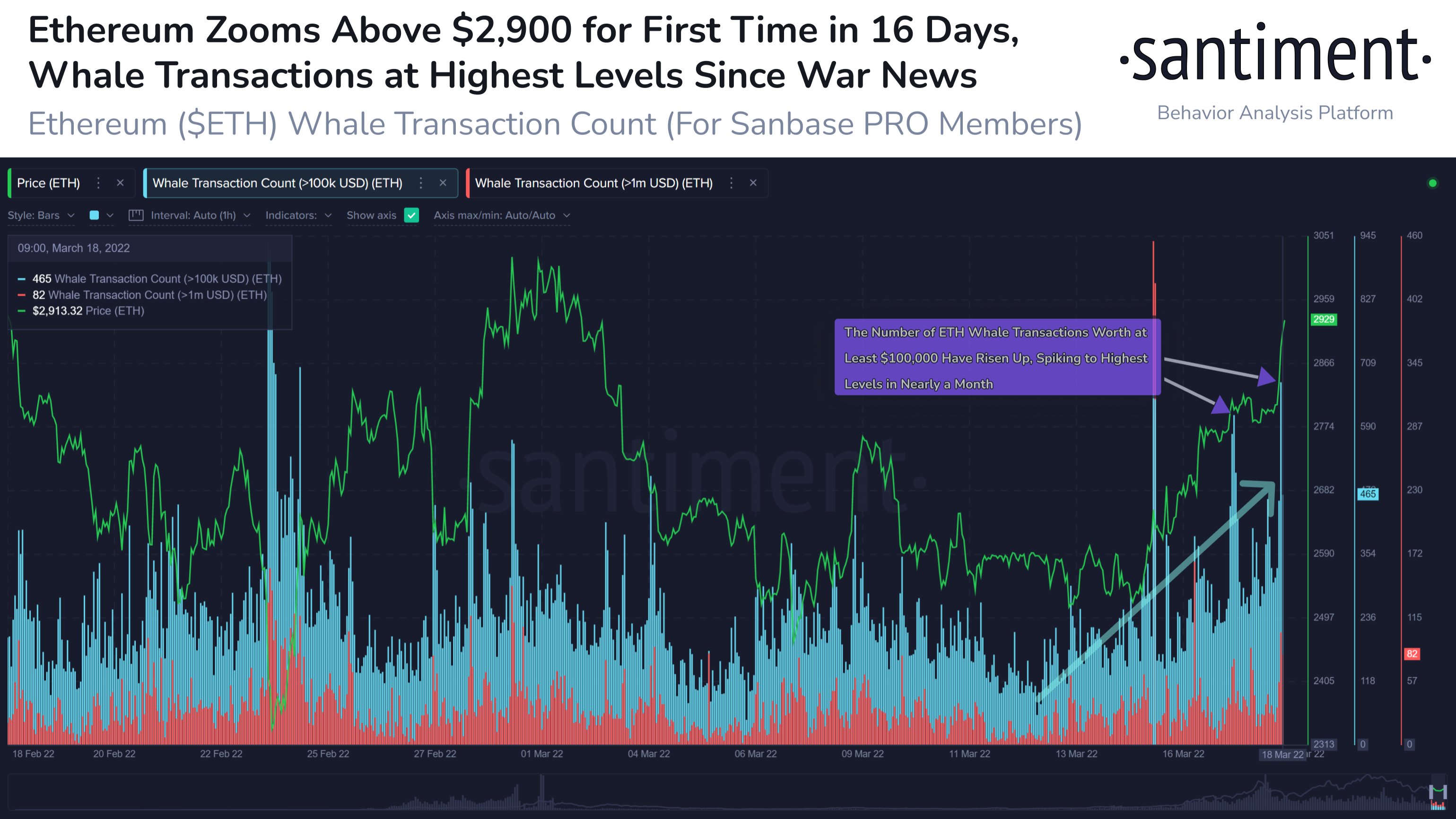

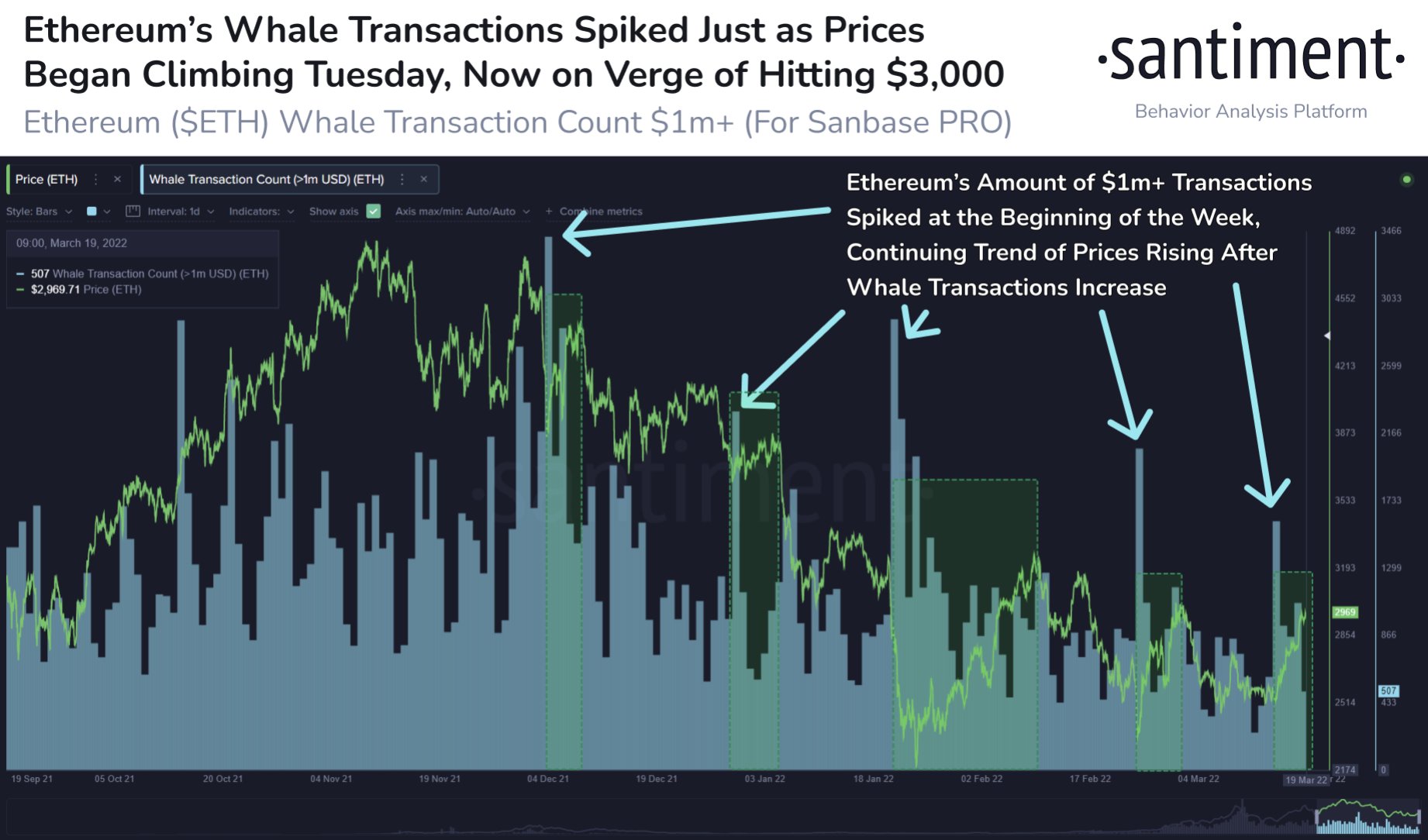

Indeed, in the days following the large withdrawals, the number of whale transactions involving more than $100,000 worth of ETH went to the highest level since the onset of the Ukraine war. Friday itself saw more than 7,000 transactions worth more than $100,000 each take place on the blockchain.

Transactions that are worth more than $1 million in value has also seen a similar surge.

The number of large transactions could imply that either large purchases was happening, or that activity on ETH DeFi started to surge by a great deal last week as the gas price on ETH has dropped significantly in recent days. Either way, this bodes well for the price of ETH moving forward.

SOL Could See Better Times Soon

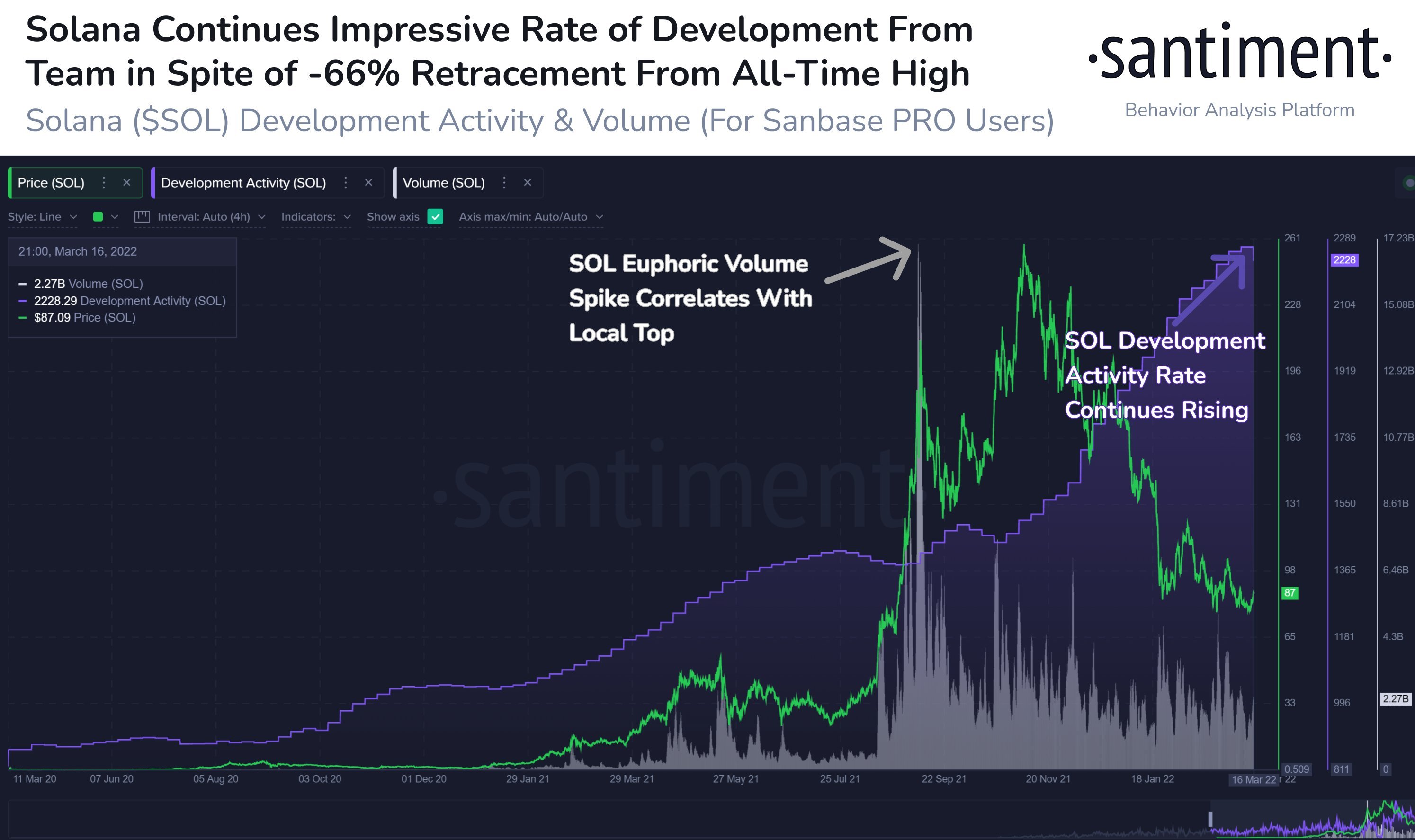

As we analyse ETH, we should not forget to also take a look at its close competitors. One token that has been closely compared with ETH is SOL. Even though SOL’s price has fallen some 66% off its high made last November, developer activity on the chain has consistently been rising, a sign that many developers are working on improving the blockchain and building more projects on it. Rising developer activity is often times a precursor to a rise in price as improvements in the blockchain and having more products could increase utility and usership of the blockchain, which eventually translates to increased demand and inevitably raise the price of a token. Hence, do keep SOL on your radars and watch for an increase in trading volume with a corresponding rise in price to confirm a price reversal.

Do keep SOL on your radars

With competitor blockchains like LUNA, AVAX and ETH taking turns to set price rallies over the past two weeks, the chance of SOL playing catch up to them is high. Hence, it may serve traders well to keep this previously very popular token on their radar screen as there appears to be a rotational play going on with the smart contract blockchain tokens.