Bitcoin has again shown its dominance in bossing the cryptocurrency market once again. The major coin has managed to break a new all time high again as its price went surging above the $60,000 mark.

However, with such a spike, an expected drastic correction followed as the price of bitcoin fell back some $5,000 to around $56,000. This correction may seem major, but it seems like the bottom of it may have already been reached.

This good news in the cryptocurrency space with Bitcoin hitting a new all time high has had a spill over to the smaller coins as most of the top 20 alts also rose up. However, where there has been real movement is in the NFT front. NFT fever has gripped the world and coins associated with these projects are soaring.

It is not only the cryptocurrency space that is on a tear away as the traditional markets have also rebounded, mostly on the news of the final approval of the $1.9 trillion stimulus bill. In Europe, there have also been major policies in place as the ECB has allowed for more money printing which has also helped those market rises.

Rebounding Last Week

It was a week for rebounds, as both traditional and crypto markets rebounded last week after selling off the week before. In the traditional market, the tech selloff saw a respite as Nasdaq rebounded off low of 12,200 to 13,000 after US 10-year Treasury yields tapered off lower to 1.5% on the back of lower-than-expected CPI numbers, easing fears of inflation.

The final approval of the $1.9 trillion stimulus bill on Wednesday sent stocks higher, yields lower, and USD saw a small pullback after rising significantly the week before. A survey of retail investors saw them planning to put 37% of all stimulus checks into the stock market. With $1,400 in cash expected to go to individual’s bank accounts by early this week, the stock market is expected to go higher, followed by the cryptocurrency market, buoyed by “stimulus checks buying”.

The Dow benefitted the most last week, rising to yet another ATH of 32,817 on expectations of new money from stimulus checks to buy up stocks that may see improved earnings from the reopening of economies.

ECB Green Lights Faster Money Printing Which Bolsters European Markets

On currencies, the ECB left interest rates unchanged at 0% in its regular meeting, but the key takeaway that boosted markets was that the ECB mentioned that it will accelerate the pace of asset buying, which is good news for the markets since it means faster money printing.

Needless to say, the Euro50 Index rose to 3,847, a level not seen since the March selloff last year. The EURUSD initially fell on the news but recovered to above $1.19 due to the USD being weaker. The dollar index DXY retreated to around 91.5 after inflation fears eased off.

Gold and Silver gained some ground to close a tad higher than the week before on the weaker USD as well, but prices remain rather suppressed as interest in trading precious metals have fallen with the rise of cryptocurrency trading.

Gold and BTC No Longer Correlated

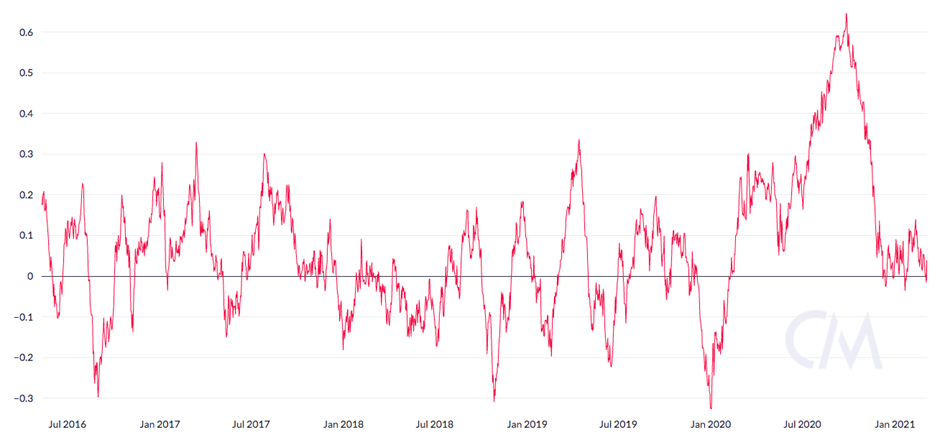

With BTC gaining adoption and Gold getting the cold shoulder by investors, the 2 assets are no longer correlated, with their correlation index dropping to 0, which means BTC will not be affected by the fall in Gold price, nor will BTC’s rise have a spillover effect on Gold price.

Gold and Bitcoin Correlation Chart, by Coin Metrics

Large Buyers Bought the Dip to Send BTC Price Rebounding

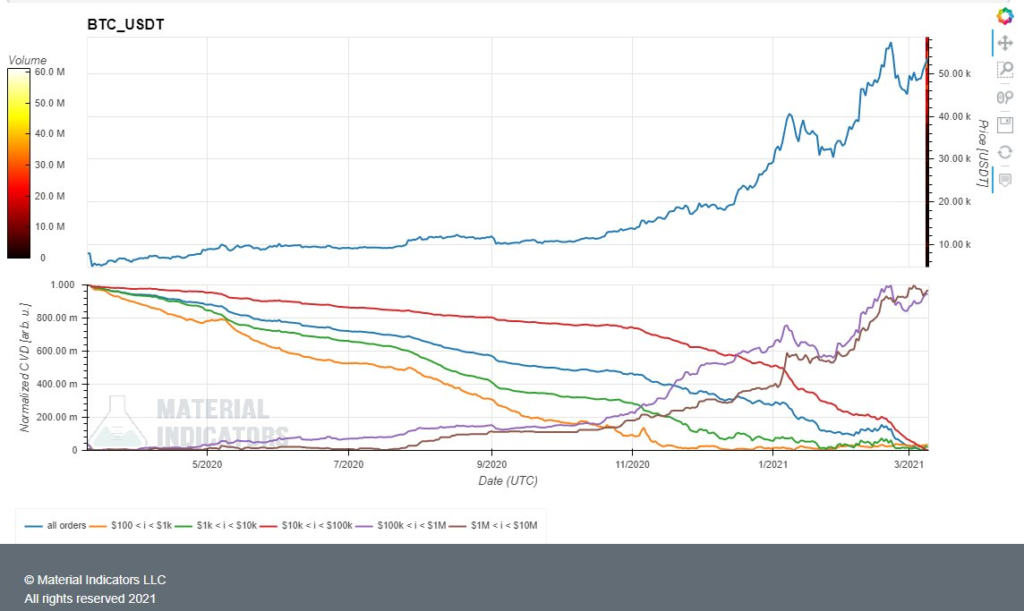

The cryptocurrency market was rife with action, led by BTC which saw a strong rebound that brought it very near its ATH of $58,300 as buyers were observed to accumulate on any dip early last week, a sign that adoption is gaining ground. Buy volume has spiked as large orders of $100,000 and higher on exchanges are observed to be at ATHs as more buyers entered to buy the dip.

A new batch of close to 12,000 BTC was seen leaving Coinbase Pro, which triggered the price of BTC to rebound strongly off $54,000, sparking off a rally early week which eventually led to BTC breaking ATH and smashing $60,000 for the first time on Saturday.

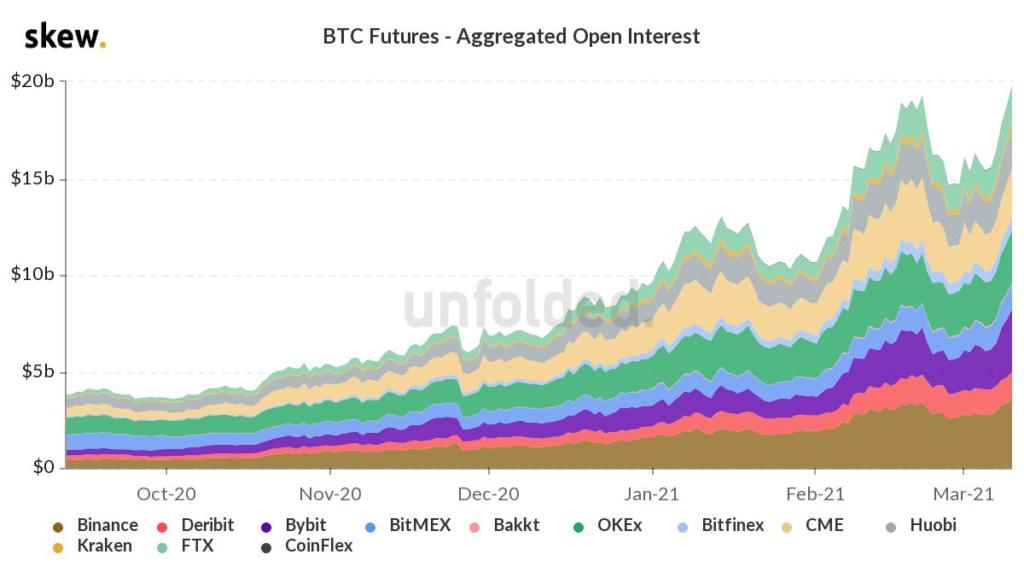

The surge in volume is also observed in the BTC Futures market, with Open Interest scaling yet another new ATH of around $19b after it hit a high of $17b in Feb.

Even traditional bank Goldman Sachs acknowledges that demand for BTC from their clients is rising, as it rushes to restart its crypto trading desk that had been cancelled in 2018 due to the bear market.

This time around, the purchases are getting larger in size. More large sized orders are a sign that institutions and corporates are the main buyers of the dip, as evidenced by yet another corporate announcing that it has jumped onto the BTC bandwagon.

Last Monday, Norwegian Oil Billionaire’s company Aker, which is listed on the Oslo Stock Exchange, announced that it has established a new business, Seetee AS, to tap into the potential of the cryptocurrency market.

Seetee will keep all its liquid investable assets in BTC and is starting with 500 million kroner ($59 million) in capital, which will be increased significantly over time. Seetee has since bought 1,170 BTC with the $59m.

This trend of large corporates buying BTC to keep as treasury reserve assets is picking up steam, and reinforces the positive price movement with each new purchase, pushing the price up by a notch.

According to data, the earlier a company buys BTC, the more money it makes, with Tesla’s BTC purchase in Feb already making more money than the company did for the whole of 2020. MicroStrategy meanwhile, says that it added another 262 BTCs to its stable, paying $15m for the new purchase, taking its total tally of BTC to 91,326, bought at an average price of $24,214.

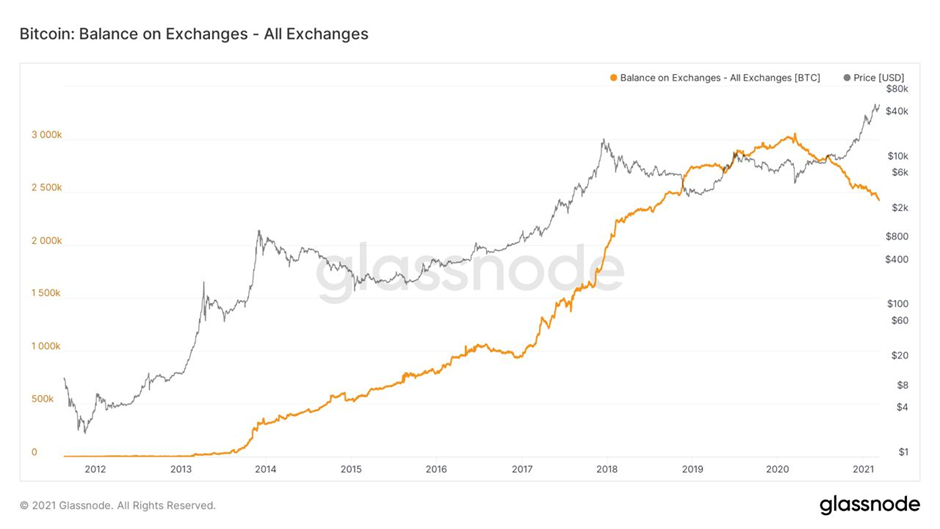

With each institutional purchase, the number of BTC stored at exchanges declines further, with the trend picking up steam and falling even further as the year progresses.

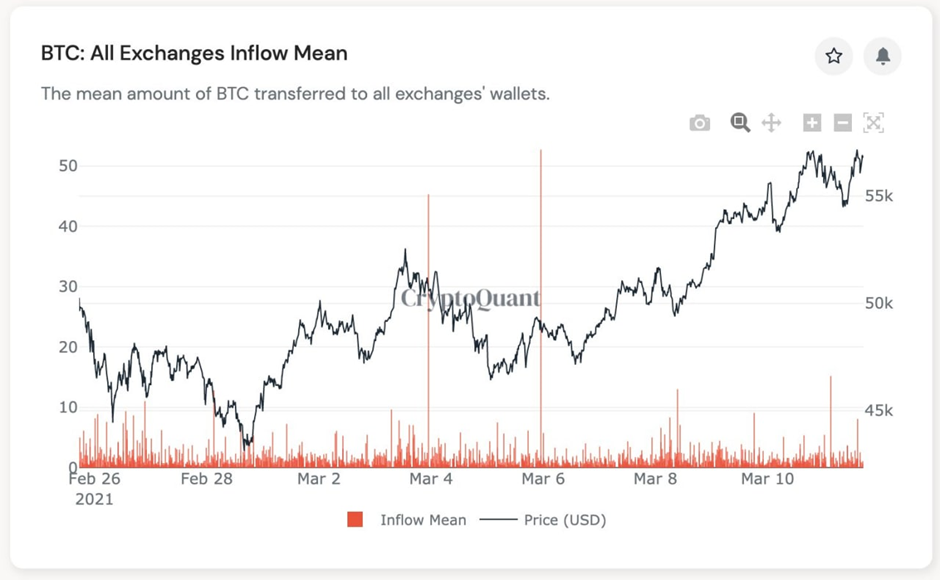

While demand is increasing, miners selling have abated as the mean inflow of BTC to exchanges have reverted back to normal levels, a sign that there will be less pressure on price.

According to a popular metric called the long-term hodler’s Spent Output Profit Ratio (SOPR), BTC price has not yet reached a critical area that suggests a reversal of its current upward trajectory. In the diagram below, after the HODL Ratio enters the red zone, usually a reversal ensues. However, we are still some distance away from touching the red zone as can be seen.

ETH Upgrade Talk Rises Price As Whales Scoop Up Supply

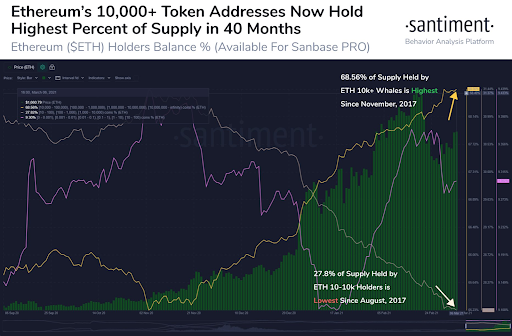

ETH also performed well last week, rising above $1,700 for the first time in 10 days. News of the impending launch of ETH’s token burning upgrade in July sent the price moving higher, with accumulation most notably seen in large whales owning more than 10,000 ETH.

As the price becomes higher, smaller whales holding less than 10,000 units are at lows not seen since August 2017, a sign that perhaps smaller whales are focusing on lower priced tokens to reap a higher percentage return as the bull market rages on.

Currently, most of the supply of ETH is held by whales holding 10,000 ETH or more, with them accounting for 68.6% of the total supply of ETH. Ability to stake their ETH in DeFi projects or ETH2.0 could be a reason why large holdings of ETH are getting popular.

With more ETH getting scooped up by large whales, and upgrades on the way, it is a matter of time that price breaks the $2,000 level.

The July upgrade in particular, will reduce the supply of ETH with time. Tokens paid as transaction fees will be burned instead of being paid to miners. This bodes very well for the future price of ETH.

Popularity of NFTs Sends Related Tokens Mooning Multiple Times

As the top 2 cryptocurrencies see higher and higher absolute prices, many traders have been lured to trade in other altcoins in the hope of making higher percentage returns with whatever trading capacity they may have.

This has created lots of opportunities in the altcoin market, with rotational plays and pump and dump action rife throughout the market. It is not uncommon to see sudden 50-100% price spikes in various altcoins lately, often without any news.

Last week saw some great action by MATIC, KAVA, ANKR, and CHZ. CHZ in particular, made spectacular returns last week, rising 12x from $0.08 to a high of $0.94, led by the popularity of NFTs.

While the current bull run is led by the surge in DeFi interest, the current craze is in Non-fungible Tokens (NFTs), as stories of record setting multi-million-dollar auction sales of crypto-art pieces get reported almost daily, the latest being digital artist, Beeple’s NFT being auctioned at Christie’s for $69m.

Thus, coins related to NFTs were snapped up in a mad rush, sending tokens soaring multiple times in just the last week alone. Other than CHZ, tokens like RARI, CHR, all made spectacular gains.

While such large movements make for big profit potential, traders do exercise prudence and be nimble to take profits whenever huge gains have materialised overnight, as the quick gains also see equally fast pullbacks. The fast gains of coins like KAVA, MATIC, and even the NFT ones like CHZ have since made rather large retracements in the range of 20-50%.

Regulators Back to Haunt Exchanges

One dampener in the party is that although the market is red-hot, regulatory obstacles are picking up again. On Thursday, Chinese social media giant Weibo suspended Huobi, OKEx and Binance corporate accounts out of the blue.

It is not clear what led to the seemingly targeted effort since Weibo can censor profiles and online content based on its own standard as well as under the direction of the Chinese government. Weibo only said these accounts have allegedly violated laws and its community rules but didn’t give further clarification.

This is the first known instance where three exchanges got targeted at the same time.

Huobi, OKEx and Binance are the most widely used crypto exchange platforms within the Chinese crypto community. The suspension appears to have caused some uncertainty among Chinese investors and the native token of all 3 exchanges fell between 3% to 15% in the aftermath.

In another twist, on Friday, the CFTC of USA announced that it has started investigation into Binance Exchange, the biggest crypto exchange in the world, claiming that it may have allowed US residents to trade derivatives on the exchange. Further to that, the CFTC is also investigating Binance’s KYC procedures and “other stuff”.

The revelation came like a bolt from the blue and sent prices quickly paring some gains on Friday. Altcoins seems most affected by the news as many coins are still trading lower than before the news broke. Only BTC didn’t seem bothered and continued to smash records by Saturday after a brief pullback on Friday.

However, as we begin the new week, BTC, as well the broad crypto market, is experiencing some panic-selling after the Indian government announced that it will fully ban cryptocurrency usage and trading in India. BTC has retraced below $60,000 and altcoins are falling to levels even lower than that on Friday.

The US FOMC policy meeting scheduled for Wednesday is also another risk event, where traders’ attention will be on what Fed Chair Jerome Powell says in his press conference with regards to monetary policy and the rising yield situation, especially after the passing of the $1.9 trillion stimulus bill which could better the already improved economic figures, which may then cause yields to rise even further.

This highly anticipated event will likely provide the near-term catalyst for the markets and should be put on trader’s radar this week to determine if markets will rebound to all-time-highs again, or that a deeper correction is on the cards.

About Kim Chua, Flurex Option Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Flurex Option. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Flurex Option recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.