The end of the year has quite often spelled big gains in the cryptocurrency space, but the final week of 2021 bucked that trend as continued dips through December seemed to push things bearish. The final week saw the price of Bitcoin fail to hold onto its small gains earlier in the week.

The entire month of December left Bitcoin down nearly 20 percent, and this was at the same time that the traditional stock markets were celebrating the end of the year with some of their own impressive gains.

Many feel there is evidence that the pressure from China on the crypto space is helping this bearish trend develop. However, there is also on chain data that shows the more experienced hands and bigger Bitcoin whales are seeing this as an opportunity to accumulate more Bitcoin at a reduced price.

While crypto has been flailing in December, in the last trading week of the year, stocks continued inching higher until the final two days where traders took profit before the long new-year holidays. For the week, the Dow gained 1.1%, the S&P 500 increased 0.9%, but the Nasdaq ticked 0.1% lower.

Despite a mixed closing, the month of December was a positive month, while the year 2021 was even better in comparison. The S&P 500 rose 26.89% in 2021 and notched 70 record closes this year, the second-highest annual tally behind 1995′s 77 closing highs. The Dow and Nasdaq weren’t far behind either, making gains of 18.73% and 21.39% respectively, making it the third straight year of rises.

The markets were boosted last year as the global economy began its recovery from the 2020 COVID lockdowns, while the FED maintained supportive measures first implemented at the onset of the pandemic. Moving forward into the new year, traders’ minds will continue to be focused on COVID, economic growth, company results, as well as FED actions with regards to interest rates could take centre stage.

When traders are back this new week in the new year, focus will immediately turn to the FED minutes to be released on Wednesday as well as the employment numbers out on Friday.

With Inflation fears appearing to have ebbed, the USD fell on the last trading day of the year, giving a chance for oil and precious metals to move higher into the new year. Gold gained 1.5% in the last week of the year and looks poised to start the new year continuing higher, while Silver was 3% higher in the same period.

Oil also gained 3.5% last week on the back of the weaker USD. For the year, Oil managed to stage a fantastic rebound from the depths it fell into in 2020 due to COVID. In 2021, Brent ended up 50.5% for the year, its biggest gain since 2016, while Crude posted a 55.5% gain, the strongest performance for the benchmark contract since 2009.

As Asian traders stream back in after the new year today, the USD is gaining back some strength, causing precious metals to inch back a little. However, the markets will need a couple of days to settle back in and moves today may not be indicative of future direction.

Things have not been as rosy over in the cryptocurrency space, be it for the closing of 2021 or the opening of the new year, with the price of BTC not able to hold onto its early last week gains. December had been a negative month for BTC, even when stocks were faring well. BTC lost around 18% in December at the same time when stock indices staged an average 5% gain, and continues to be under pressure in the first month of the new year.

Final Leg of China Ban Pressuring Bitcoin Price

After the brief weekend rally that sent the price of BTC back above $50,000, sellers from Asia immediately took the opportunity to sell the moment traditional markets opened. Some market watchers attributed this weakness to the China ban on cryptocurrency, as 31 December was the date where all crypto exchanges would have to stop all forms of service to users based in China. Some investors may have waited till the very last moment to sell their crypto holdings. One such investor was Justin Sun, the founder of Tron blockchain.

Rumours that Sun sold around 165,989 ETH ($592 million worth) at Binance on Wednesday scared a lot of traders who subsequently dumped ETH ahead of him, causing ETH to dip below $3,600, dragging BTC to also drop below $46,000 at one stage on Wednesday, liquidating around $400 million worth of positions.

Sun subsequently said that this move was the internal deployment of wallets, and regardless of ETH, TRX, and the entire blockchain industry, he is highly optimistic and will continue to build. Indeed, the deadline of the last installment of the China ban is now behind us and will no longer have a significant impact on crypto prices.

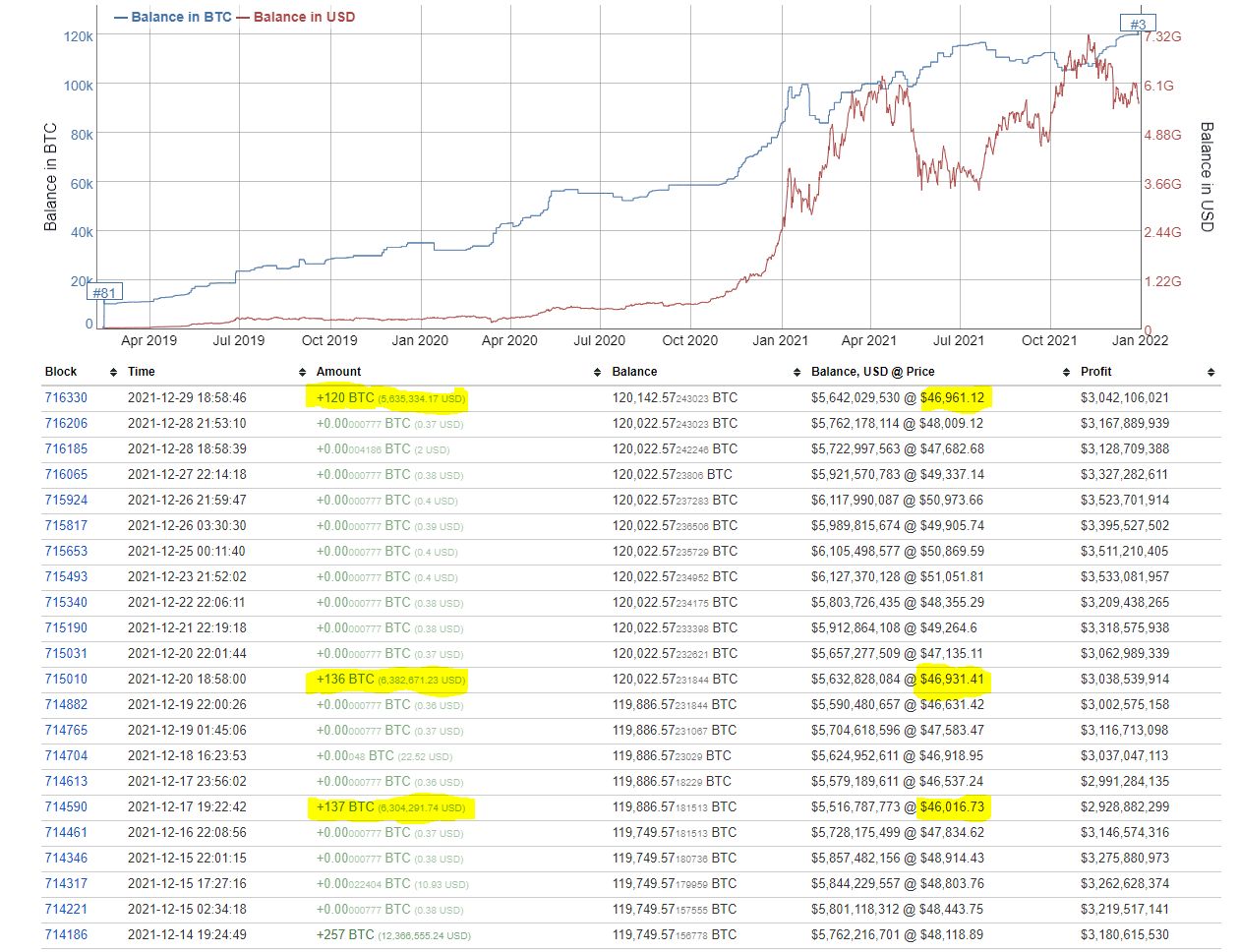

Top Bitcoin Whales Continue to Accumulate

While news of Justin Sun selling his ETH may dampen market sentiment, investors can take delight that the third largest BTC whale has taken the dip to accumulate more BTC again. On Wednesday, when the price of BTC fell, this whale bought another 120 BTC at the price of $46,961 after he last bought on the 17 and 20 December.

Other than this whale, another BTC proponent, MicroStrategy, has also taken the dip to purchase more BTC. On 29 December, Michael Saylor took to his twitter account to announce that MicroStrategy had purchased an additional 1,914 BTC for $94.2 million in cash at an average price of $49,229 per BTC.

This purchase takes the total holdings to 124,391 BTC acquired for a total of $3.75 billion at an average price of $30,159 per BTC. The current market price of the stash stands at around $5.8 billion, meaning MicroStrategy is making paper profit of around $2 billion.

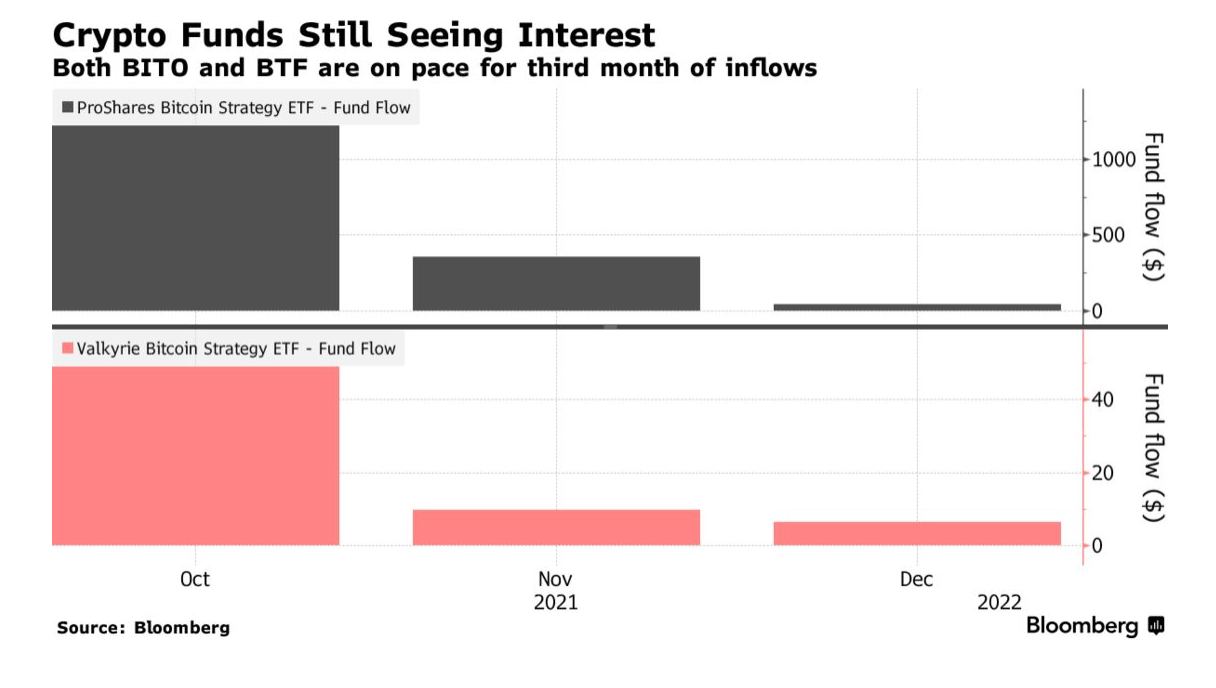

Other than whales regularly accumulating in the spot market, futures-based ETFs in the USA also continued to see inflows in December. The first two BTC ETFs launched in the USA are still getting fund inflows despite the lacklustre price action of BTC. This shows that investors are still interested to buy BTC, albeit with inflows having fallen from their October launches.

Tax Selling Another Reason For Crypto Weakness

Another reason for crypto’s poor performance in December could be due to wash sales, where an investor sells his asset at year-end at a loss to avoid paying capital gains tax and subsequently buy it back again once the new year arrives. While wash sales are not allowed in other asset classes, it is not banned for crypto.

Even though many long-term investors of crypto may not have losses, new crypto investors who entered the market after May 2021 may be sitting on paper losses which they could use to their tax advantage by selling in December and buying back in January. We will know if December’s weakness was in part caused by this phenomenon in the days ahead since we have already entered the new year.

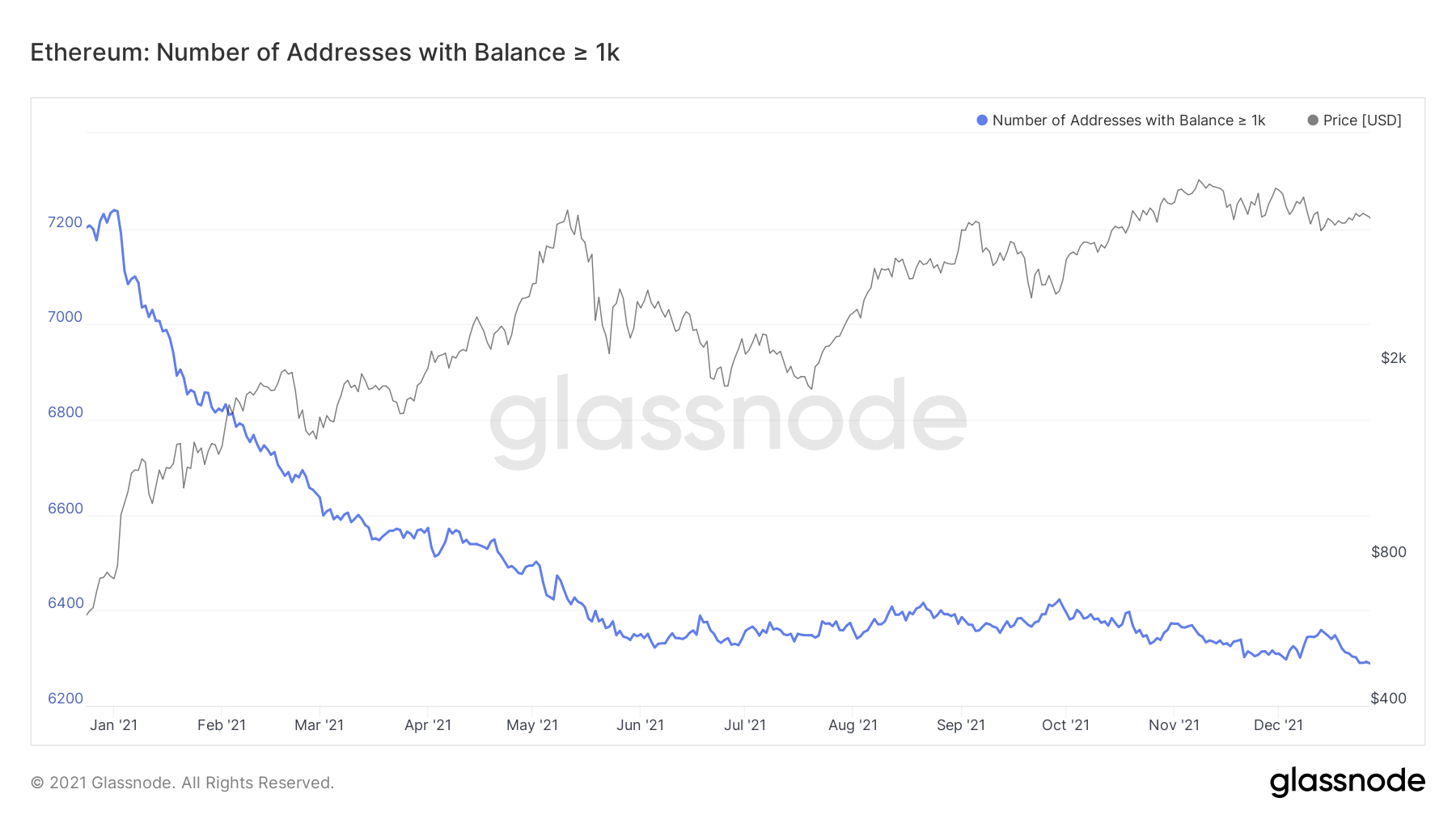

ETH Whales Reducing Their Ethereum Holdings

Other than Justin Sun, other ETH whales have also been reducing their ETH holdings as the number of ETH whale wallets have been on the decline this year. The number of ETH wallets with more than 1,000 have been on a steady decline this year, falling especially sharply in the second half of December.

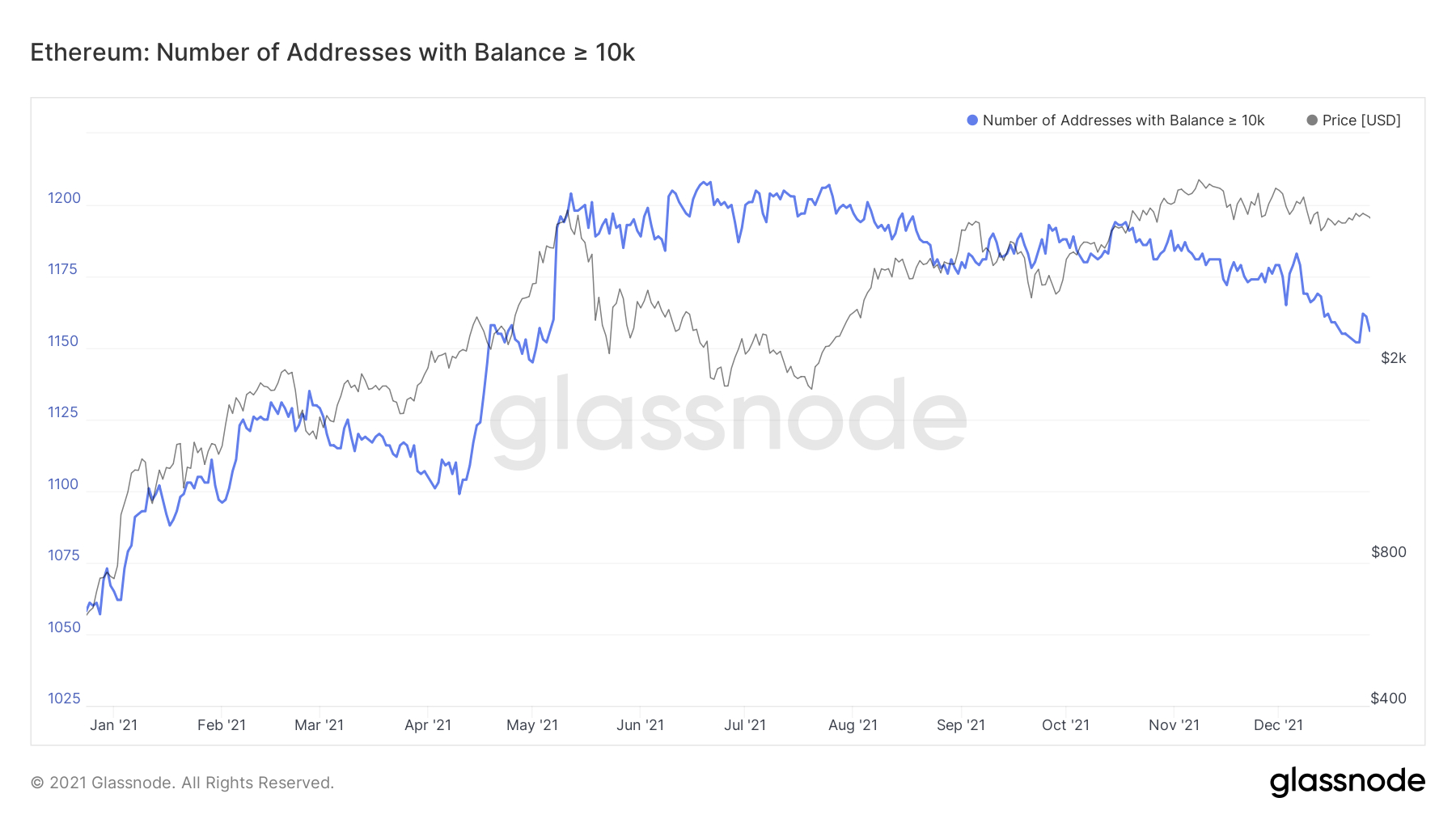

Even the number of larger whales who hold at least 10,000 ETH have fallen this year by around 4.5%.

As the number of these so-called whales drop, it reflects an ongoing selling trend among the richest ETH wallet owners. This could be negative for the price of ETH in the near-term as whales like Justin Sun continue to dump, and traders may also be taking the opportunity to short ETH.

The overall crypto market has remained range bound in quiet trading over the New Year weekend and may continue to be so as the first week of the new year arrives since many traders could still be on the side lines, not taking any new positions until they see how the market reacts in the first few trading sessions.