Elon Musk has gone from crypto’s knight in shining armor, exposing millions to Bitcoin and even accepting the coin for his electric cars to somewhat of a pantomime villain in the digital currency space. His viewpoints on the crypto remain confusing and convoluted, and this is causing chaos with the price of Bitcoin and other cryptos.

This week also saw several cryptic messages from Musk on Twitter that tanked the crypto markets two times. Musk put up a heartbreak emoji with a BTC logo that frightened lots of crypto traders who panic-sold, sending the crypto market in a tailspin after prices started recovering earlier in the week.

Tweets from Musk continue to send individual stocks flying, this time, his tweet about the viral YouTube song “Baby Shark” has boosted the stock of Samsung Publishing, sending it up as much as 10% to 49,000 won ($44) in South Korea. It lost some of those gains later, but still closed up some 6%, its best day in nearly a month.

Wall Street closed the week on a higher footing after a worse-than-expected NFP jobs report showed that the US economy still needs the Fed to remain accommodative, completely wiping out fears of a rate increase. This comes on the back of several Fed speakers who further assured the markets with their dovishness. The 10-year Treasury yield fell to 1.56% after the jobs report, sending stocks and risky assets higher.

Tech stocks helped the S&P close flat after a late-week surge on Friday, while Nasdaq closed also pared losses made on Thursday to close the week unchanged. Only the Dow managed to close higher by 0.5%. Volumes were still not back to pre-holiday levels as summer season started to kick in, with investors mostly remaining side-lined. “Reddit stocks” thus took the limelight, with favorites like AMC putting in daily gains of up to 100% as the channel gathered their community to start buying again.

So, while some in the stock market celebrate Musk’s Twitter antics, most in the crypto community weren’t as amused as Gold and Silver also retraced but managed to recoup their losses after Friday’s jobs report to end the week a tad lower. Oil was the best performer, gaining 2% after breaking out of its $68 resistance on track to hitting $70.

However, commodities are opening the new week a tad lower, on the back of a slightly stronger USD after former Fed Chair Janet Yellen mentioned on Sunday night that a Fed rate hike would be a “plus”, confusing market participants over the message that she was trying to put across.

Week Of Positive News Sees China Water Down Its Own Crypto Ban FUD

Post Fudding the market about banning cryptocurrencies, China has come out to clarify their actual stance. China state media now claims that the Chinese government says people have the freedom to trade BTC at their own risk, and that it was only “going after” rampant market manipulation and crypto scams.

Other good news includes Google’s change in tone towards cryptocurrency advertisements. Google has banned all crypto-related advertisements on its platform since 2017, but is now lifting this three-year-old ban for businesses that meet certain requirements. However, advertisers still can’t promote ads for ICOs or DeFi trading protocols, trade signals, investment advice, and affiliate sites relating to crypto referral programs.

Another positive spin is adoption-related, with the country of El Salvador the first country in the world to declare BTC as legal tender. El Salvador cites this move as necessary to mitigate the negative impact from central banks’ prolific printing of money. While the news does not seem like a big deal, El Salvador’s move could open the door to more acknowledgment from other countries that are suffering from hyperinflation and may also raise the possibility of central banks acquiring and keeping BTC as part of their reserves.

Crypto Funds Sees Inflow After Two Weeks Of Outflows

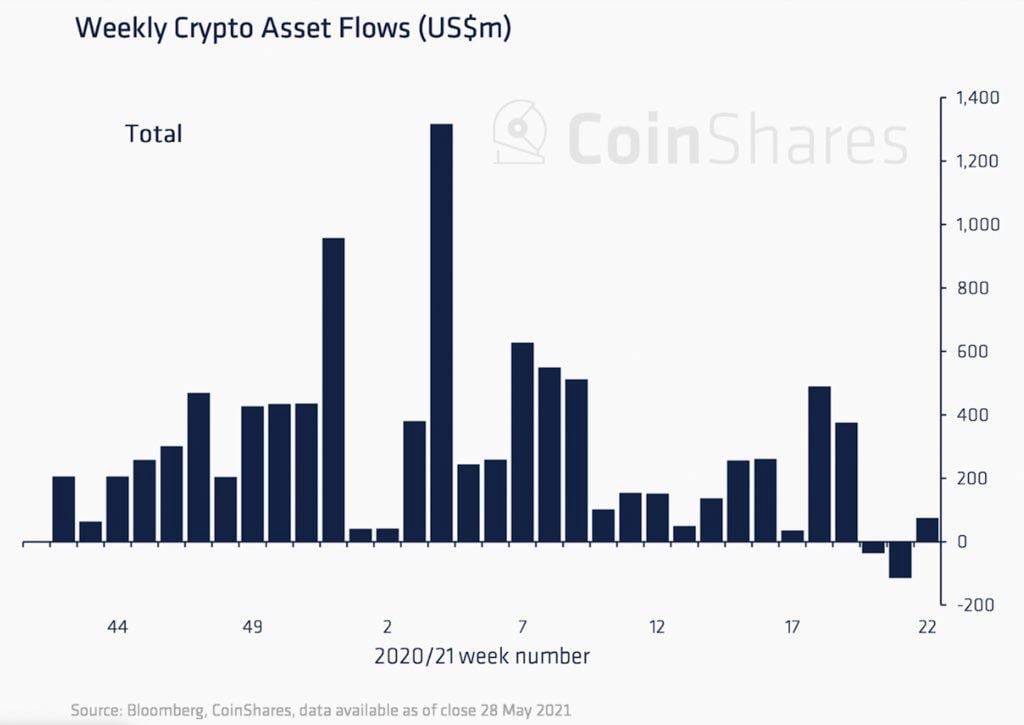

After record outflows during the crash over the past two weeks, cryptocurrencies are finally showing inflows again. Cryptocurrencies posted inflows last week after hitting record outflows the previous two, as investors took advantage of price declines in the market, data showed.

Inflows into crypto investment products and funds totaled $74 million last week. That followed record outflows of $151 million the previous two weeks, representing 0.3% of assets under management. While the inflow is still small compared to the norm, the inflow is a welcome improvement after the largest ever outflow witnessed in the week before.

BTC Hashrate Recovering Post China Power Outages

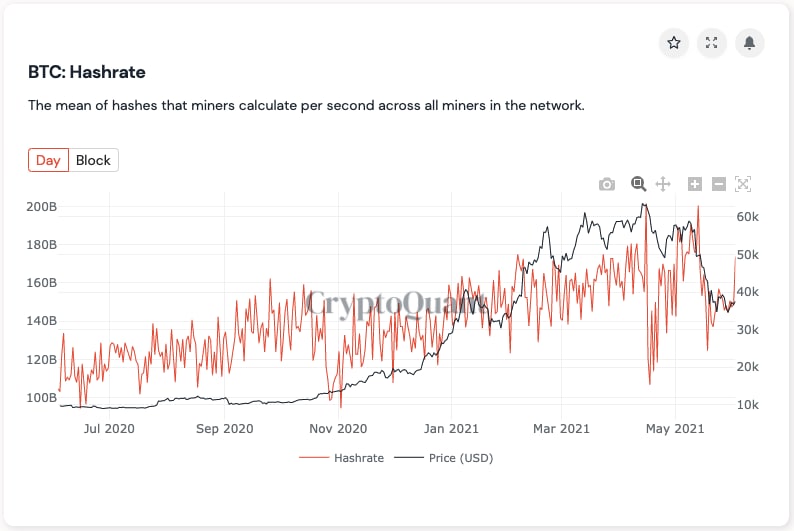

BTC hashrate is recovering after the Sichuan power cut debacle two weeks ago which again caused the BTC hashrate to fall. However, BTC hashrate has since recovered again back to April 2021 levels. The fall in hashrate has been one of the key reasons why BTC price suffered a setback mid-April to-date. Unless another major power outage occurs again, the stabilization of BTC hashrate back to normal levels should help price recover in time to come.

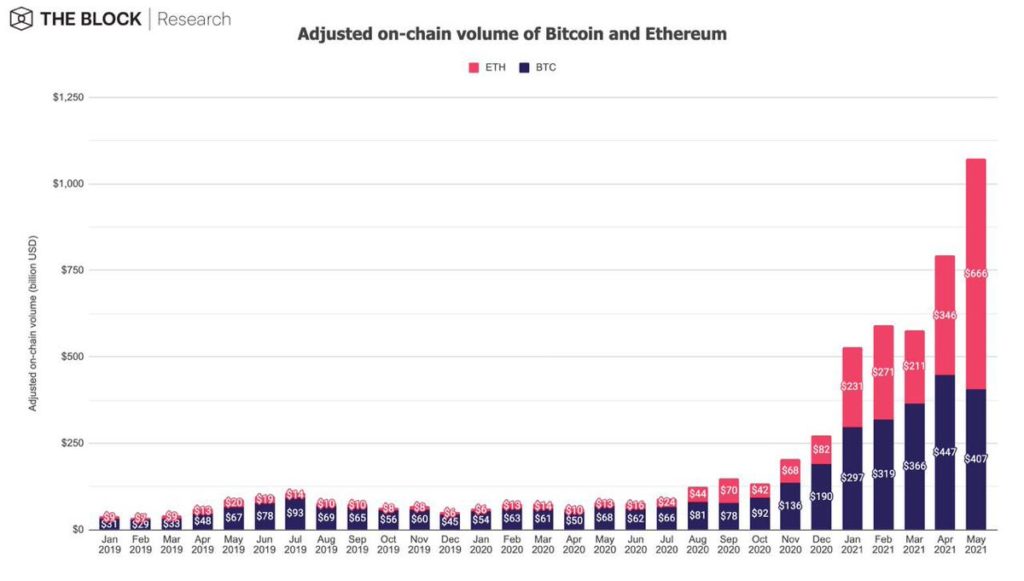

The lackluster movement of BTC has prompted traders to move on to other altcoins, with ETH becoming the most popular alternative as evidenced by the on-chain volume growth of ETH. ETH on-chain volume continues to grow at a greater rate than that of BTC, with the gross volume of ETH exceeding that of BTC for the first time in May.

This phenomenon could be caused by ETH whales accumulating large amounts of ETH during the May dip. The top 10 ETH whale addresses are creeping towards a new milestone in terms of supply held. Currently holding 19.08m ETH, these top addresses are closing in on the ATH of 19.25m ETH held three weeks before the price skyrocketed above $4,300. Can this be a sign that ETH price could be surging again soon?

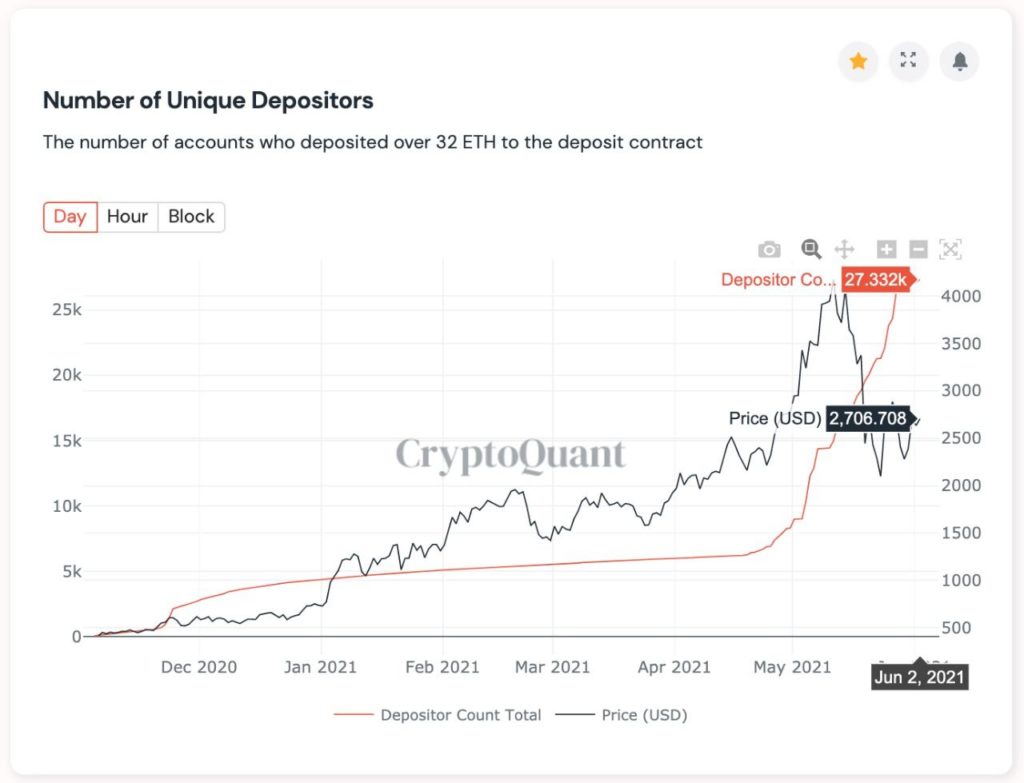

Another explanation of the high volume seen on-chain in ETH could also be gas fee-related. ETH whales have rapidly increased the movement of ETH after the recent price fall also sent the gas fee of using the ETH blockchain plunging around 90% from its peak. Deposits to the ETH 2.0 contract address have continued to increase since the price drop makes sending ETH for staking costing a lot less. Since its price dip, an increasing amount of ETH has been staked on the ETH 2.0 contract, with a total of 4.5% of ETH circulating supply now locked in ETH 2.0. The number of unique validators has increased sharply to 27,332, staking a total of 5.23 million ETH.

While current metrics seem to be painting a prettier picture for ETH than for BTC at the moment, the situation remains fluid and could change anytime, especially when the news about El Salvador making BTC legal tender only came on Sunday.

Ripple Scores a Point But Jed’s Selling Keeps Lid on XRP Price

Ripple has scored another win in its ongoing legal battle against the SEC as the court has denied the SEC access to Ripple’s legal advice. Judge Sarah Netburn ruled last Sunday to deny the SEC’s motion to compel Ripple to produce memos discussing XRP sales with the firm’s lawyers. The price of XRP jumped around 20% on the news back above $1.00 but succumbed to selling pressure after the market retraced. Further to this, the price of XRP has also been under intense selling pressure from Jed McCaleb, the former CTO of Ripple, who sold over 400 million XRP in May.

Jed left Ripple to work at Stellar in 2014, but had been allocated 8 billion XRP as compensation for his work. Jed had been regularly selling his XRP since then and his action will continue to put pressure on the price of XRP. Jed is rumored to have 700 million more XRP that he can sell, which could be over in another two to three months should he sell with the same magnitude as he did in May.

In the meantime, Ripple has filed a motion to compel the SEC to disclose internal documents regarding how the SEC deemed BTC and ETH to not be securities. The SEC has repeatedly failed to produce the documents despite being advised by the Court to do so. Should the SEC continue to fail to comply, the court could impose a monetary fine on the SEC, or better still for XRP investors, dismiss the case entirely. Dismissing the case entirely after having come to this stage, however, remains only as a remote possibility, but is not improbable, depending on how the SEC responds.

Other interesting news was the Coinbase listing of DOGE. DOGE flew up 50% back above $0.40 on the news, but subsequently pulled back to $0.36 on broad market selling due to the series of cryptic Elon Musk tweets.

The broad crypto market is still languishing from China and Elon FUDs, with most altcoins still drifting lower as the market awaits a fresh catalyst that can send prices breaking away from the current stalemate.

About Kim Chua, Flurex Option Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Flurex Option. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Flurex Option recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.