US stocks finally notched a week of gain after falling consecutively for weeks ahead of the Memorial Day long weekend.

While the Fed minutes released on Wednesday indicated that officials are prepared to move ahead with multiple 50 basis points interest rate increases and may move policy into restrictive territory, data released on Friday helped sooth investor fears of more inflation that would require more rate hikes.

On Friday, the core personal consumption expenditures price index, the Fed’s preferred inflation gauge, rose 4.9% from a year ago in April, in line with estimates, and is a deceleration from March. This may be a sign that price pressure is easing, which could reduce the need for the Fed to act aggressively. The 10-year US Treasury yield fell below 2.75% as a result.

With finally a bit of good news, stocks rallied strongly on Friday to end up positive for the week. The Dow finished up 6.2% and snapped its longest losing streak of eight weeks, since 1923. The S&P closed 6.5% higher and the Nasdaq finished up 6.8%.

The US dollar saw the second week of decline on the back of the news, with the DXY losing another 1% against its peers. Gold and Silver were largely unchanged, with Silver adding about 0.2% and Gold flat for the week as the markets took on a risk-on mode. At the start of the new trading week, both metals are up around 0.4% as the USD is a tad weaker, by 0.2%.

A risk-on sentiment, coupled with a weaker USD, helped Oil finally break up from a long consolidation after US Crude data release showed that stockpile dropped to its lowest since September 1987. With both US crude and gasoline inventories continuing their decline, whilst recent altercations between the USA and Iran have rendered any JCPOA breakthrough largely impossible, analysts are anticipating another surge towards the $130-140 per barrel range this summer. Both WTI and Brent Crude rose about 5% last week, and is up another 1% today in Asian trading after the EU officials failed to agree on the Russian Oil embargo on Sunday.

Interestingly, cryptocurrencies, one key asset class that used to benefit from a risk-on play, did not move higher. In fact, even though the price of BTC has been mirroring that of stocks since 2020, the bounce in the stock market did not bring about a relief for crypto. On Thursday in particular, where the Nasdaq closed 2.68% higher, BTC fell 6%, and ETH dumped 11%.

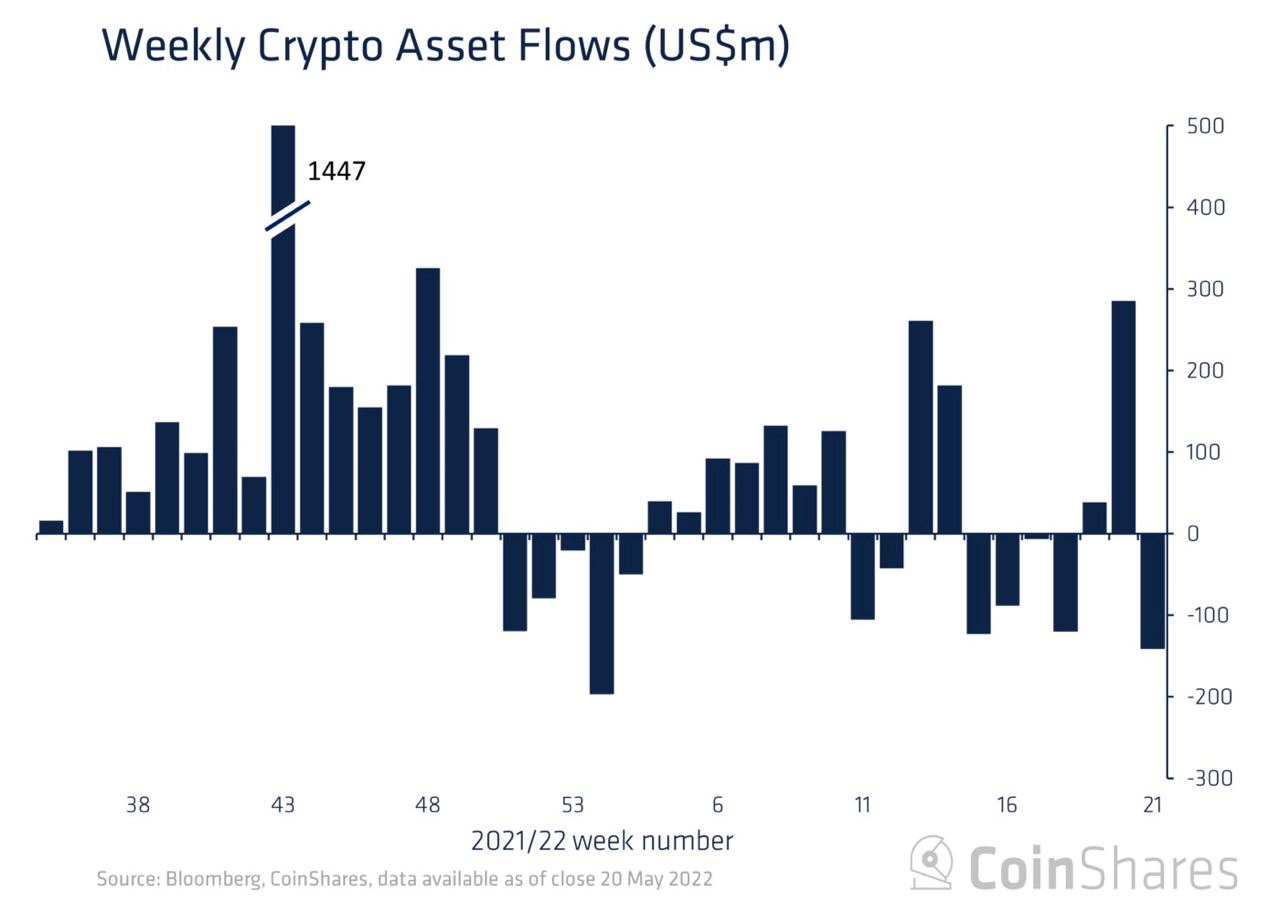

The persistent weak price action in crypto even when stocks are rebounding could spell further trouble for the nascent asset class as funds meant to move into crypto may otherwise now go into the stock market. Crypto fund movement shows that this could already be happening.

During the week of 23 May, crypto investment products saw outflows totalling $141 million, which has taken total assets under management to only $38 billion, their lowest point since July 2021.

The recent UST-LUNA debacle has regulators set sight on the asset class, calling for tougher regulation in the soonest time possible before more investors get hurt.

The ECB even said on Tuesday in a report that cryptocurrencies are largely unsuitable as an investment or a store of value. The central bank said if the current growth and market integration of cryptocurrencies persists, they could pose a bigger threat to the economy.

Statements made by the ECB has crypto experts predicting that the ECB could be targeting DeFi regulation very soon. The central bank singled out web3, citing platforms offering services similar to banks would likely need to comply with traditional regulations to avoid legal issues.

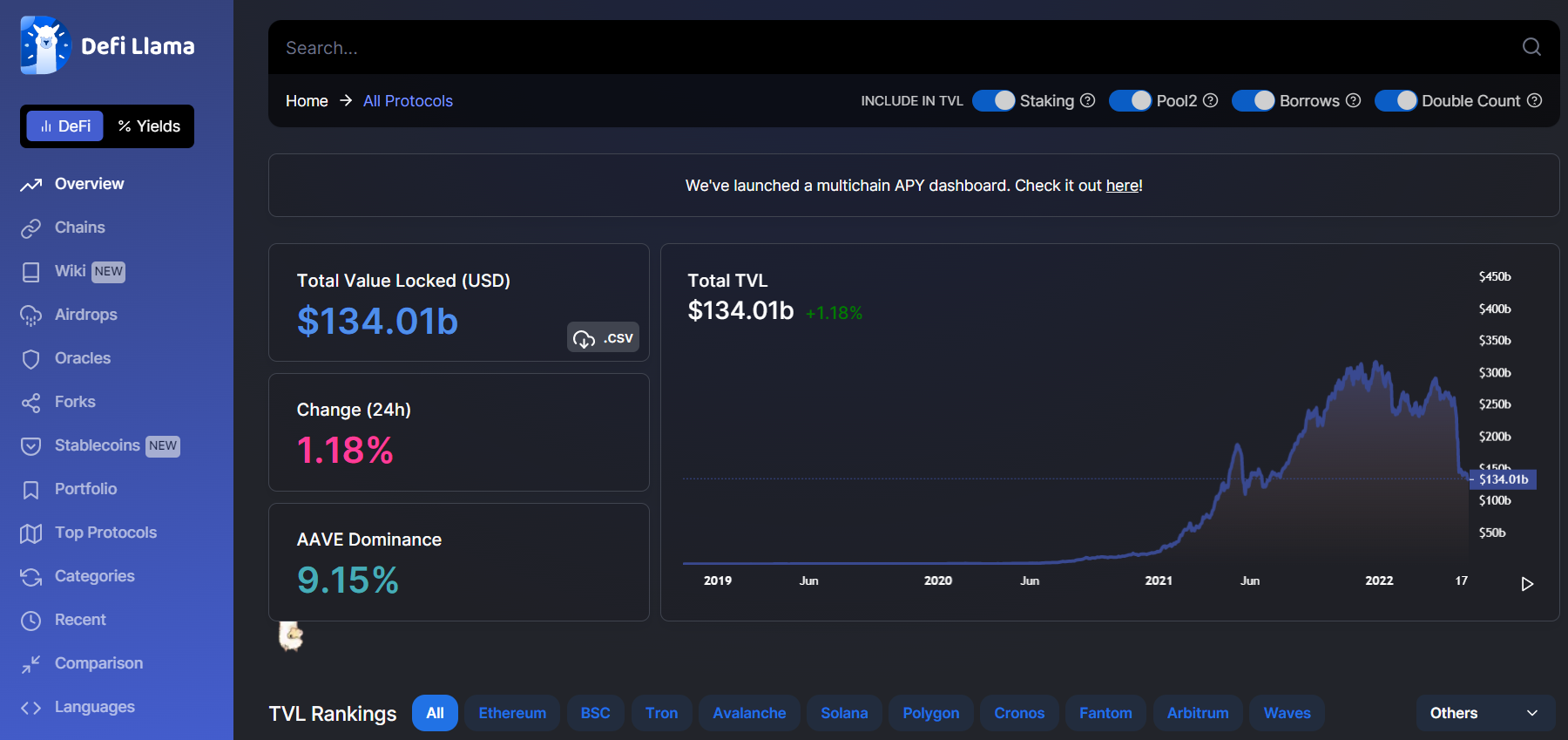

This has caused an exodus of funds out of DeFi, which can very clearly be seen from the fall in aggregate TVL at various DeFi platforms. DeFi TVL has fallen 50% when compared with May 6, before the Terra ecosystem value destruction started unravelling.

DeFi Exodus and Reorg Issue Caused 15% ETH Dump

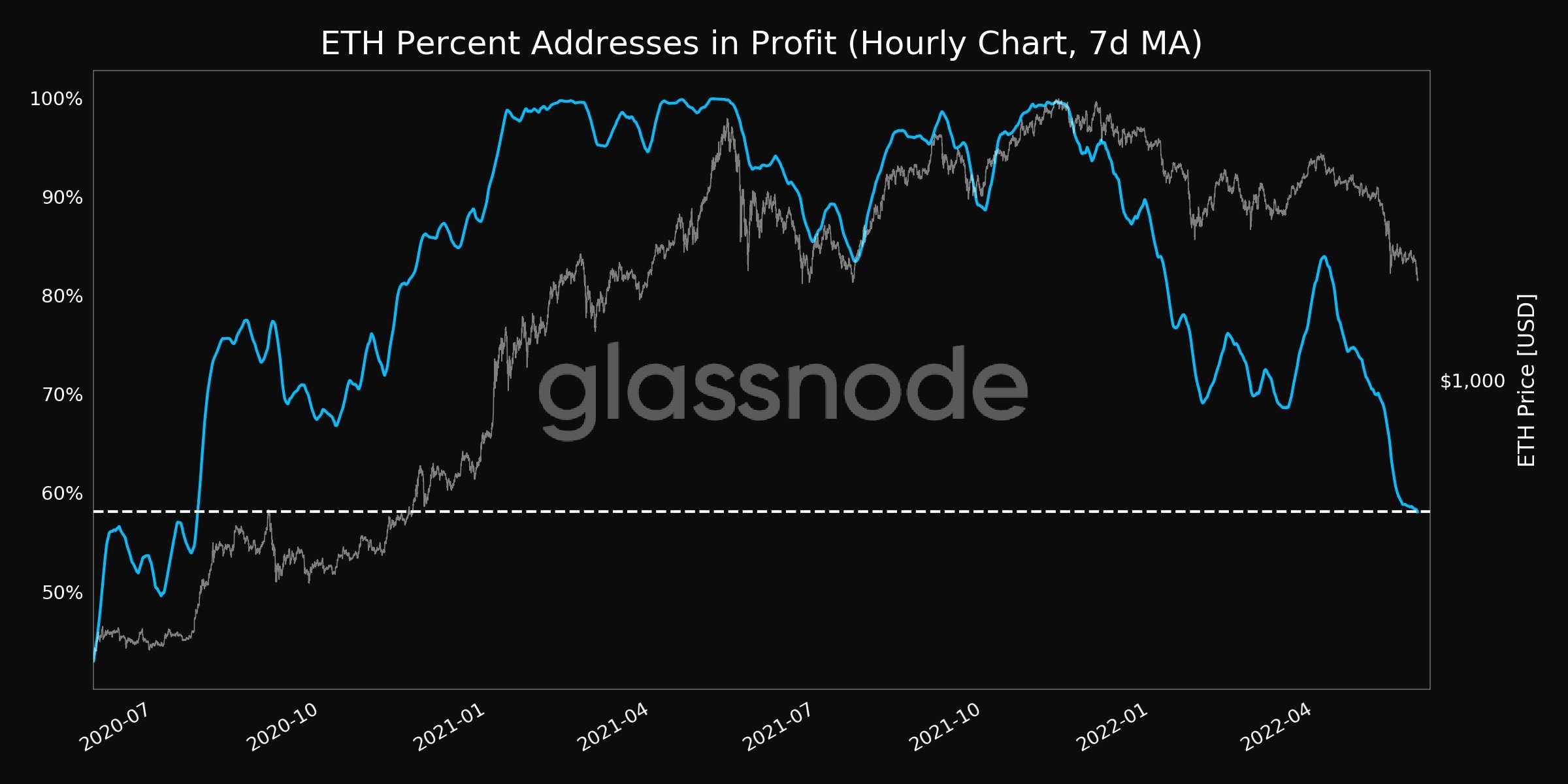

The fallout of UST-LUNA has dealt a huge blow to DeFi, which has directly hurt ETH very badly. The negative impact on ETH can be seen in its price, which has fallen 15% last week. Another factor that caused ETH to dump last week was a chain split in the new PoS Chain that caused investors to worry about the viability of the Merge. Late Wednesday, after developers working on the new PoS chain noticed a potential security risk that caused a “reorg”, the price of ETH dumped heavily, especially on Thursday, where it lost a whopping 9%. More than $236 million worth of long positions in ETH futures were liquidated in that move lower, double that of BTC, which saw $125 million in long liquidation on Thursday.

Compared to an all-time high of almost $4,900 in November 2021, ETH is currently down by almost 60%. As a result, a large percentage of ETH addresses are suffering from huge losses. According to the on-chain analytics, only 58.08% of ETH addresses are now in profit, which is the lowest level since July 2020.

While the situation has been brought under control by Friday, the incident may affect investors’ confidence in ETH for the short-term.

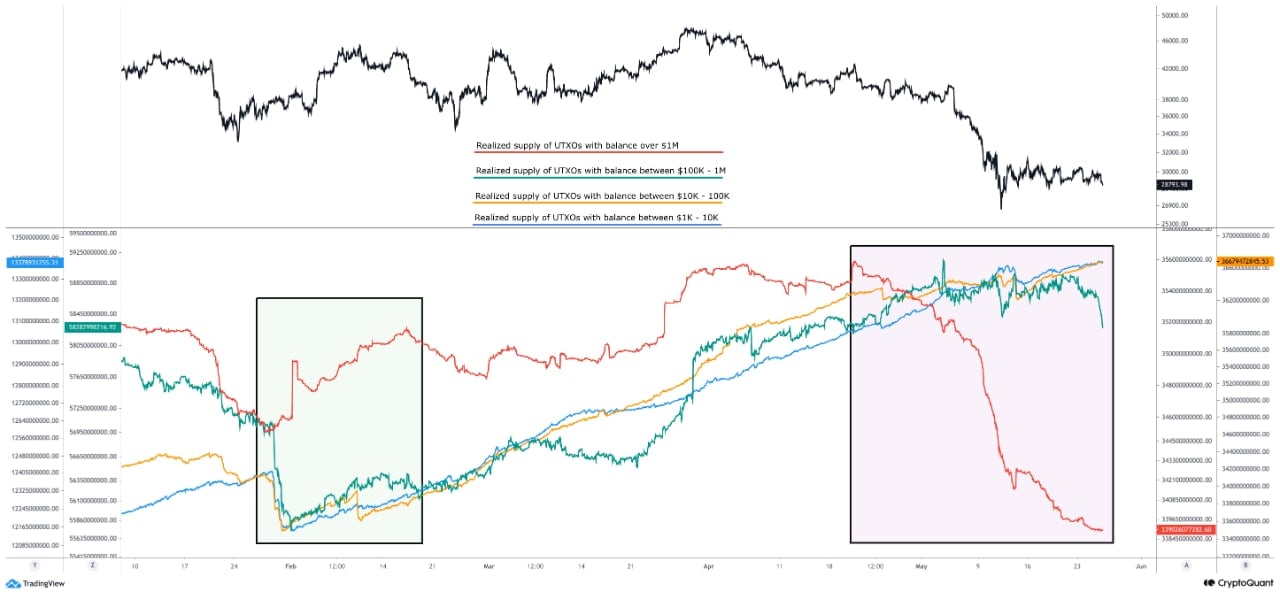

Things are not looking any better at BTC, as fresh data has revealed that many whales have dumped BTC at $40,000.

BTC Whales Dumped From $40,000

BTC whales with more than $1 million worth of BTC started dumping their BTC holdings since 5 May, which caused the price of BTC to tank from $40,000 to below $30,000 subsequently. While a large part of this dump could be from the LUNA Foundation, the start of the dump happened a few days earlier, which could mean that other BTC whales were also dumping. The good thing about this is that the dump appears to be tapering now, which means the selling pressure from these whales is largely over.

Small whales on the other hand, presumably retail and individual investors, have been the main buyers during the past week’s consolidation. However, until we see the BTC supply of large whales increasing to show that whales have started to buy again, there is a good chance that these retailers may turn sellers and capitulate should the price break lower again, thereby driving a down move that could be swift and sharp.

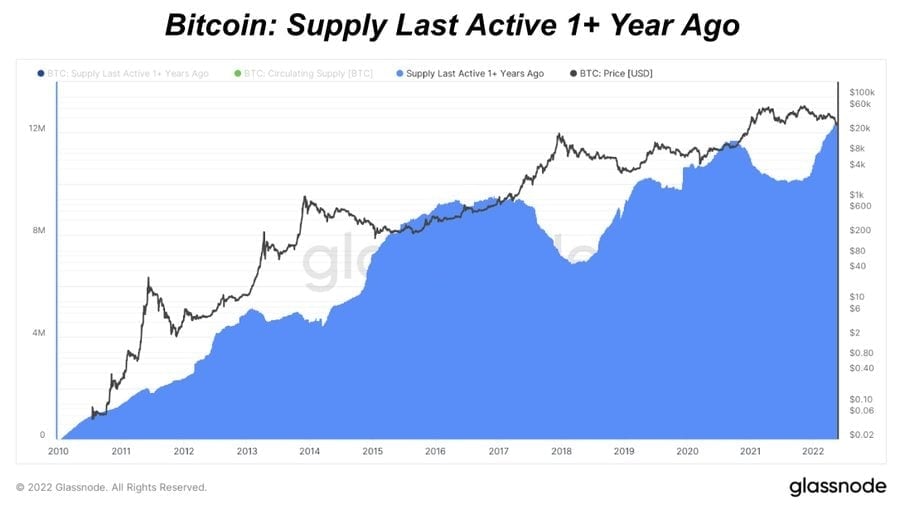

However, BTC supply last active more than one year ago shows that longer-term holders are showing no sign of capitulation as the number of unmoved BTC is still growing even when the price of BTC has retreated. As of current, more than 12 million BTC have not been moved in the last 1 year. If this number continues to increase, any pullback in the price of BTC may not be very significant. On the other hand, traders should take note when the number of such “old coins” start to decline as that would mean that long-term holders are selling their coins.

Hedge downside risk with leverage

An interesting report by JP Morgan may give investors the faith to hold their BTC for longer. While JP Morgan has been famous for bashing BTC throughout the years, the bank appears to have come out in support in its latest report, calling BTC a scarce asset with significant upside potential which can fulfil the dreams of many of its supporters by becoming an “alternative” currency similar to gold.

BTC Exchange Reserves Hints of More Dump

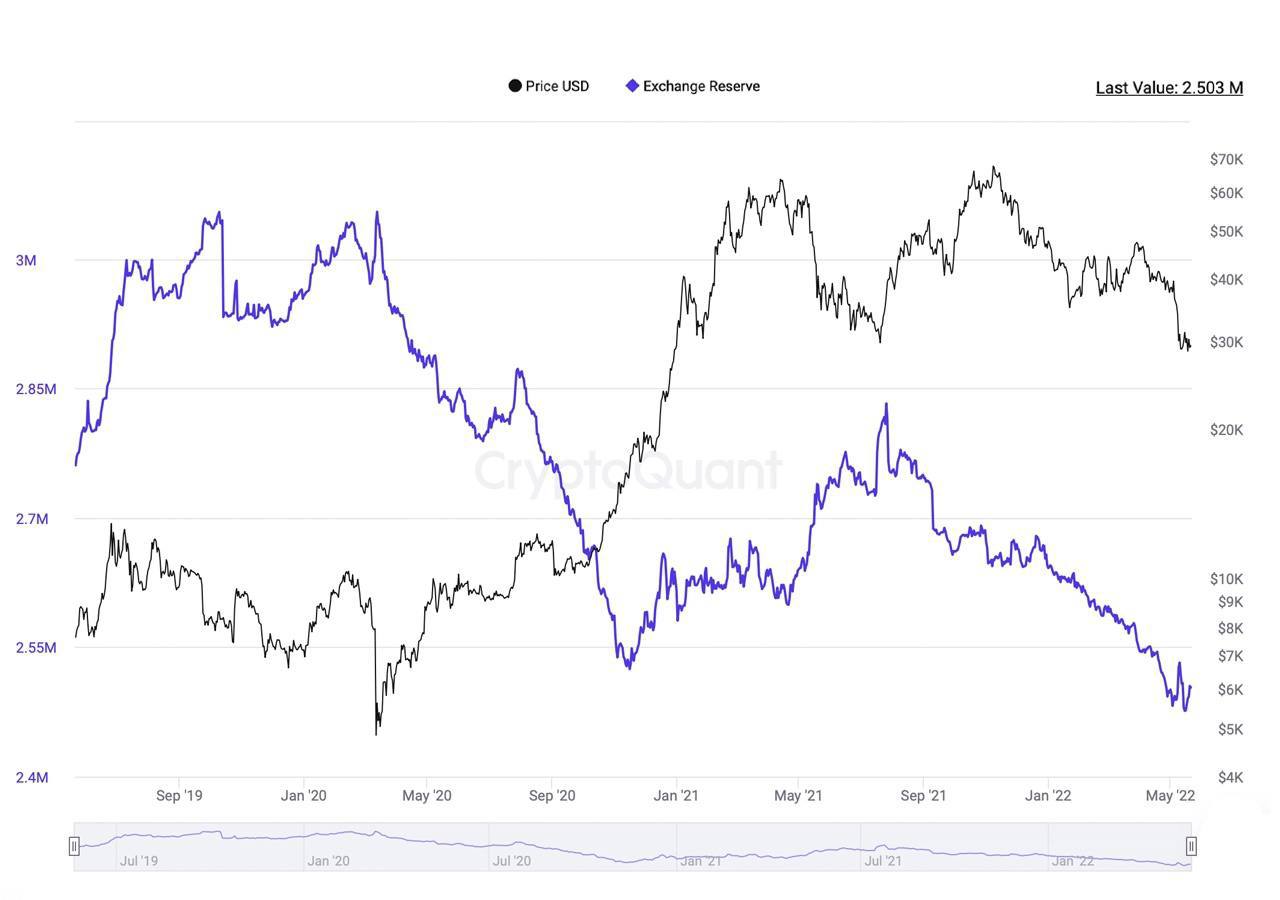

While BTC at $28,000 could be a bargain in the future, its near-term prospect continues to be shaky if one were to look at the latest exchange reserve.

After falling consistently in the week before, which shows buying activity, the BTC exchange reserve has started to increase slightly again towards to end of the week. This means that investors have transferred their BTC into exchanges to prepare for sale.

Hence, until the exchange reserves are back to a falling trend, BTC may not be out of the woods and could come under selling pressure in the days ahead. These investors may be waiting for a better price to sell in view of the stock market rebound.

XRP Sees Whale Accumulation

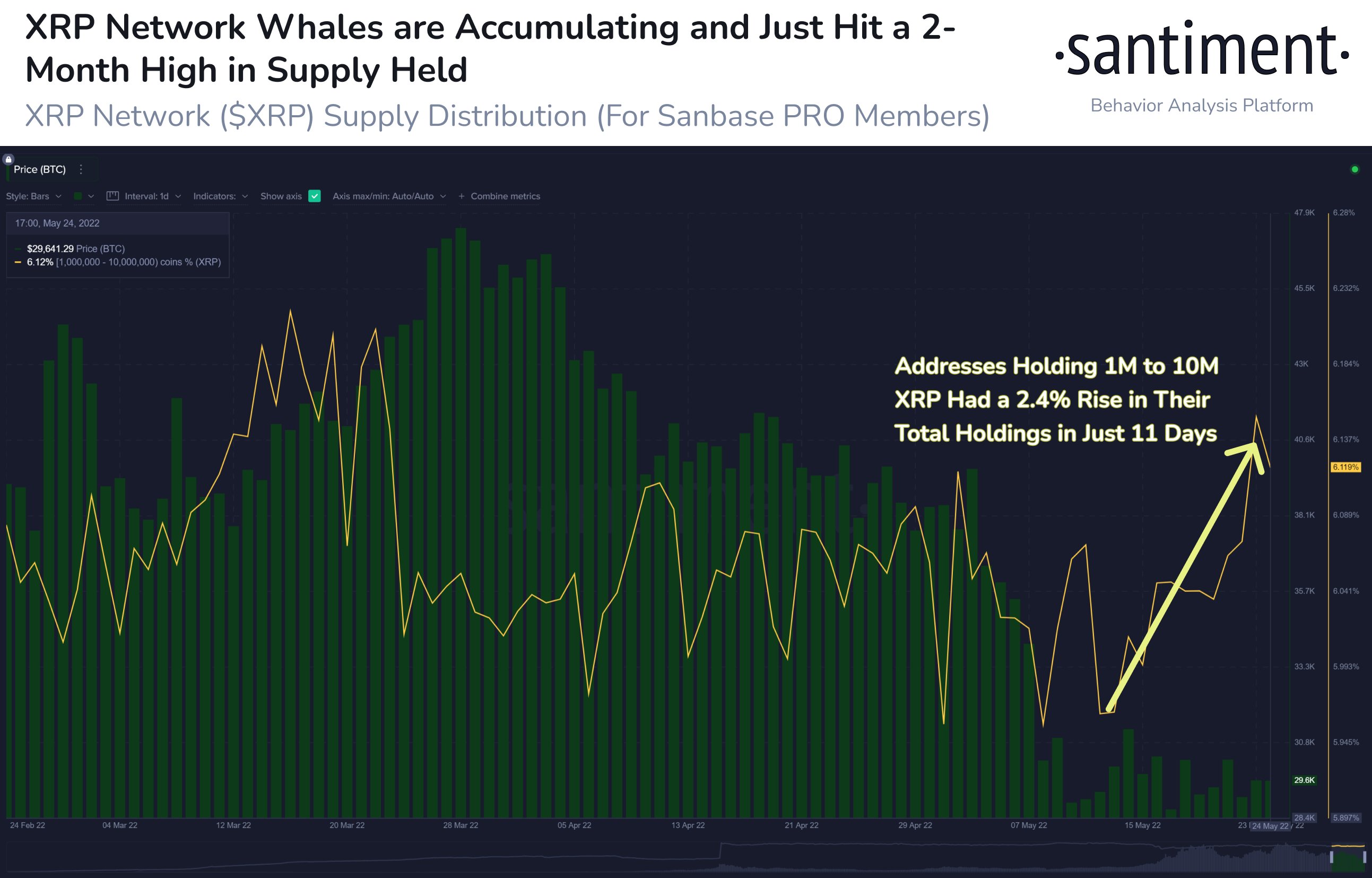

In spite of the current market lull however, XRP appears to be one of the more resilient tokens as its price has only fallen by about 35%, while most altcoins have fallen more than 50%.

Whales appear to be accumulating XRP as the market undergoes a meltdown. This may be a clever defensive play as the result of the Ripple lawsuit may influence the price of XRP more than the broad market. As the lawsuit has been progressing favourably for Ripple, whales may hope to accumulate XRP and sell at a profit should the outcome of the lawsuit send the price of XRP higher.

XRP whales holding between 1 million and 10 million XRP are collectively holding their highest percentage of the asset’s supply in 2 months. This is the most active tier of non-exchange holders, and currently hold 6.12% of all XRP. Could these whales be predicting a win for Ripple to be announced soon?

The DogeFather Signalling Market Bottom?

Another interesting token to keep a lookout on is DOGE. DogeFather Elon Musk announced over Twitter on Friday that following the footsteps of Tesla, SpaceX merch can soon be bought with DOGE, sending the meme coin jumping 9% in under one hour even when the broad market was reeling. This goes to show that the Elon Musk effect on DOGE is still not over, and the chance that the highly unpredictable tycoon could turn his attention back to DOGE after his failed bid to privatise Twitter is there. This gamble may turn out to be another interesting defensive play that traders may turn to in a market that is sorely lacking in inspiration right now.

Other than with DOGE, Elon Musk also appears to be up to new tricks again with BTC as crypto traders try to decipher his two of his Twitter posts.

The two posts involve a blue man sitting on a rock in what looks like the planet Mars. Elon first posted a man with his back facing us on 13 November last year, which happened to be when BTC traded near its ATH, while his new post on 28 May shows a front-facing man at the same place when the price of BTC was around $28,500. Crypto traders began to assume the front-facing man picture was a sign of a BTC bottom and spread the theory all over the internet. Interestingly, this has since led to a 6% rise in the price of BTC, with the leading crypto trading above $30,000 at the time of writing.

With the US market closed for Memorial Day on Monday, this feel-good rise in the crypto market could continue for a while until the traditional traders return on Tuesday to set the tone for the rest of the week.