Inflation data released on Wednesday confirmed what most market watchers already expected: price increases in December stormed at the fastest year-on-year pace since 1982. The CPI for December grew in line with expectations – 7%. While the number was not exceedingly high, traders were happy that it would not cause the FED to raise rates more aggressively than anticipated before. This has caused the 10-year Treasury yield to dip from 1.8% to 1.7%, bringing short respite to the market. Meanwhile, stocks rose early in the week but nonetheless closed a tad lower after disappointing bank results were released on Friday.

The major indies showed a downward trend: the Nasdaq shed 0.28%, while the Dow and S&P 500 lost 0.88% and 0.30% respectively. This marked the third negative week in a row for the Nasdaq which has come under pressure from rising rate expectations. Likewise, outperforming bank stocks fell after experts were disappointed with the results from major banks on Friday which resulted in their profit-taking.

With the 10-year Treasury yield retreating, the USD followed suit, falling back to 95 and thus lending some strength to precious metals. Gold rose back above $1,800 while Silver rose by 4%. Oil continued to stair-step higher last week, climbing by 7% to close at the $85 mark, last seen in October last year. Even though the USD is feeling stronger in Asian trading today, Oil still manages to climb higher to start the new week as it is already up by 0.4% and reaching $83.70. With supply of oil not increasing and demand remaining high, experts expect oil to climb towards $100 this year despite rate hike expectations.

Meanwhile, many investors expect the FED to start raising rates in March. The FED Chairman Jerome Powell did not provide any specific dates at his confirmation hearing before the Senate banking panel on Tuesday, but acknowledged that as long as current conditions persist, rate hikes are indeed on the way.

Markets are pricing a nearly 79% chance for the first quarter-percentage point increase to come by May, and see about a 50% chance the FED could enact four such hikes in 2022.

However some countries are not waiting to act. The South Korean central bank last week raised its benchmark rate by 25 basis points to 1.25% – the highest rate since March 2020, as it was before the pandemic – due to overwhelming inflationary pressures.

With the USD taking a breather, not only metals but also cryptocurrencies had a chance to bounce, with BTC finally being able to mount a recovery mid-week after going below the psychological $40,000-mark before that.

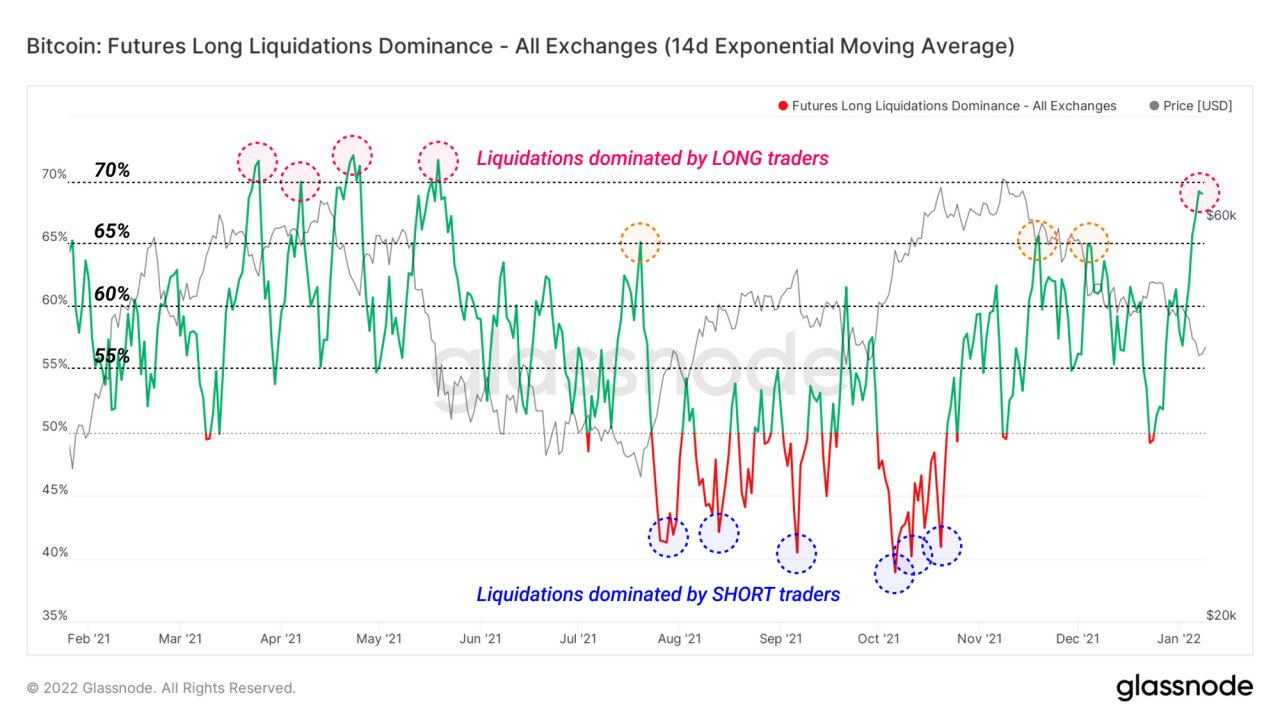

After the $40,000 mark was broken on Monday, approximately $343 million worth of futures positions had been liquidated as the BTC price first took a quick dive to $39,600 before rebounding within a couple of hours back above $42,000.

BTC long liquidation dominance hit 69%, the highest level since the deleveraging event in May 2021. Meaning that the majority of liquidations in futures markets over recent weeks were long traders attempting to catch the falling knife.

Reliable Metric Suggests BTC’s Bear Trend Could Be Over

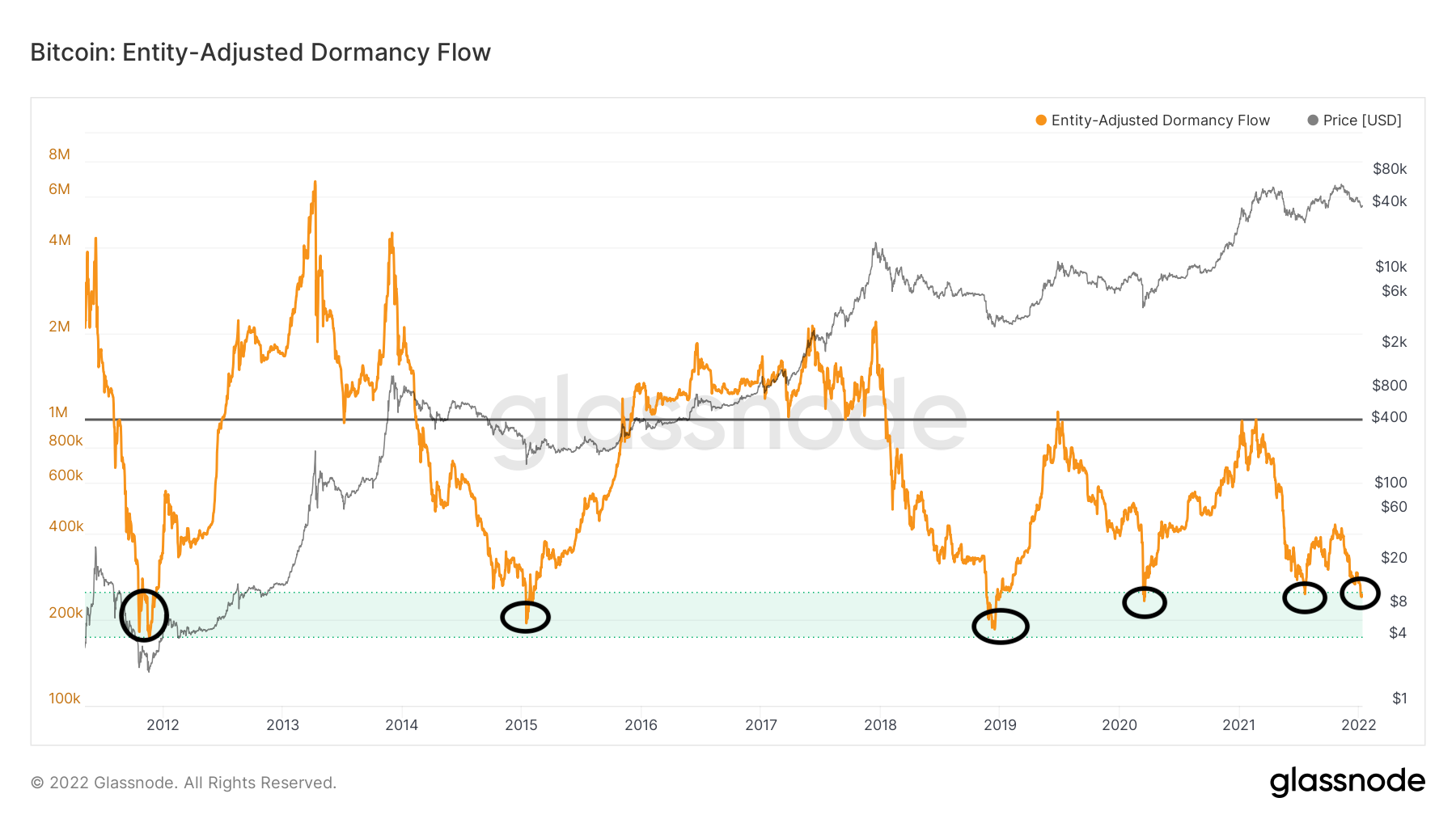

However, after a series of price drops, a historically reliable blockchain indicator suggested that BTC could be in the final stages of the bearish trend, having lost nearly 40% of its value in the past two months.

The entity-adjusted dormancy flow – the current market capitalization and the annualized dormancy value – has dropped below $250,000. Dormancy refers to the average number of days each transacted coin remained dormant or unmoved, in other words, it is a gauge of market’s spending pattern. Low dormancy flow indicates moments when market cap is undervalued in relation to the yearly sum of realized dormancy.

As shown in the diagram below, the area under $250,000 has marked major price bottoms in the past. And indeed, the bounce came after Wednesday’s inflation data, which propelled risky assets higher, making the BTC price bounce off the depths to $44,400.

BTC Miners Buying Instead of Mining

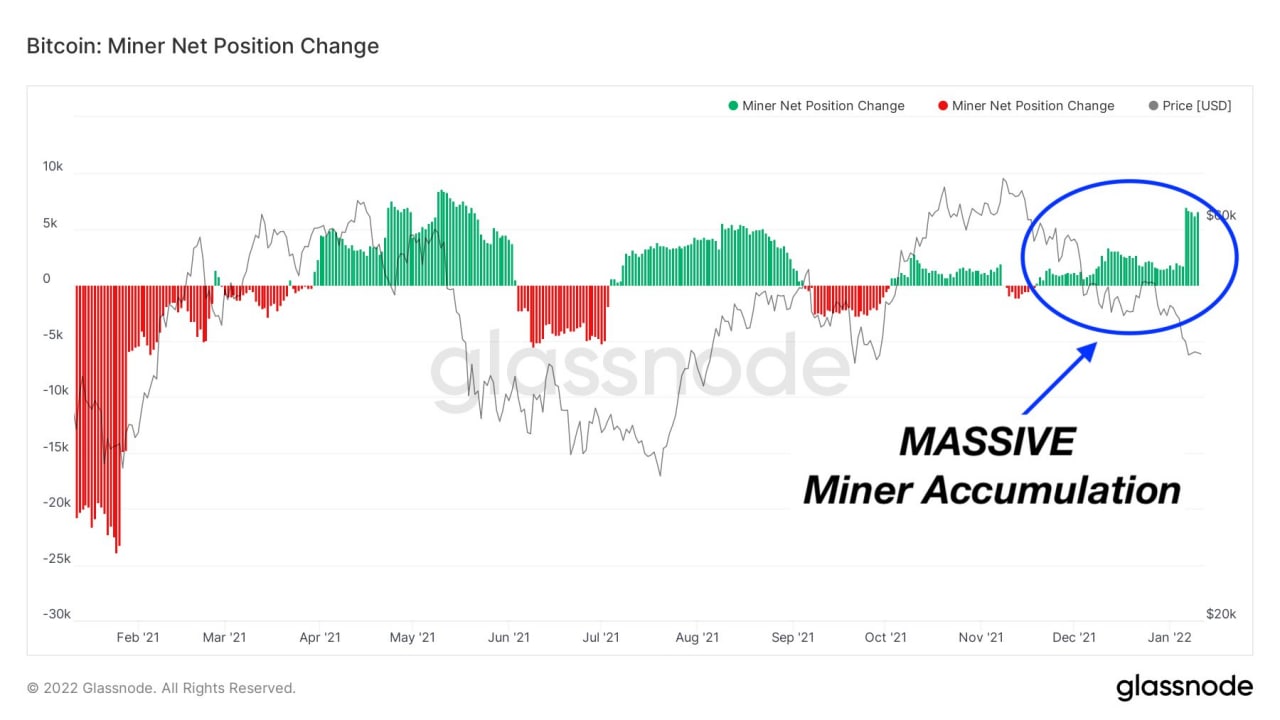

BTC mining firm Bitfarms announced that they had purchased 1,000 BTC worth $43.2 million last week. The purchase increased the publicly traded firm’s BTC holdings by 30% to over 4,300 BTC.

Bitfarms CEO said that with mining hardware prices remaining high, the dip in BTC price offers a good opportunity to move cash into BTC directly instead of purchasing hardware to mine more BTC. Bitfarms is not likely to be the only miner that took to accumulating BTC instead of mining it, as the data shows the fastest rate of BTC accumulation by miners since May 2021.

Capital City of Brazil To Add Crypto To Reserves

Apart from the miners, the 3rd largest whale also added 1,209 BTC last week at an average price of $42,800 each, making a total of $51.8 million.

This whale has added 15,839 BTC since Nov 12, and is only 643 BTC shy of what MicroStrategy has, making it possible to surpass them very soon.

On top of these buyers, another state has also joined the ranks of El Salvador by adding BTC to its reserves.

The mayor of Rio de Janeiro said on Thursday that he plans to allocate 1% of Brazil’s second-most populous city’s treasury reserves to cryptocurrencies.

According to Rio de Janeiro’s finance secretary, the city also plans to apply discounts to tax payments made with BTC to encourage people to use it for payment. This could be a precursor for the state to follow the steps of El Salvador making BTC legal tender in the state.

Low Stablecoin Borrowing Rate Signals Bearish Sentiment

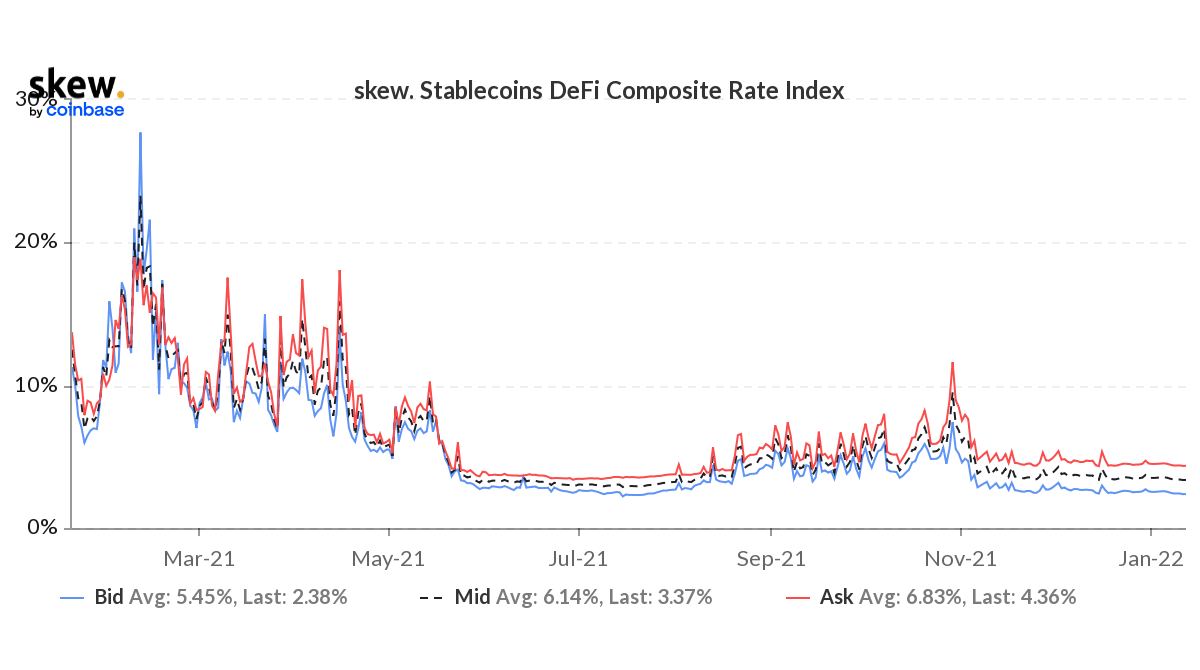

Even though crypto adoption is slowly growing in more countries, the price weakness of BTC and cryptocurrencies as a whole has put off speculative activities amongst traders, as can be seen in the low liquidation amount when BTC fell below $40,000.

A look at stablecoin borrowing rates also shows a low rate of borrowing, implying that traders are not borrowing assets to make crypto purchases. This low rate is usually a contra-indicator which could lend longevity to the rebound meaning that most traders are bearish. It is opposite to November 2021 when the high stablecoin borrowing rate led to the market selling off as the price of BTC fell from its high of $69,000.

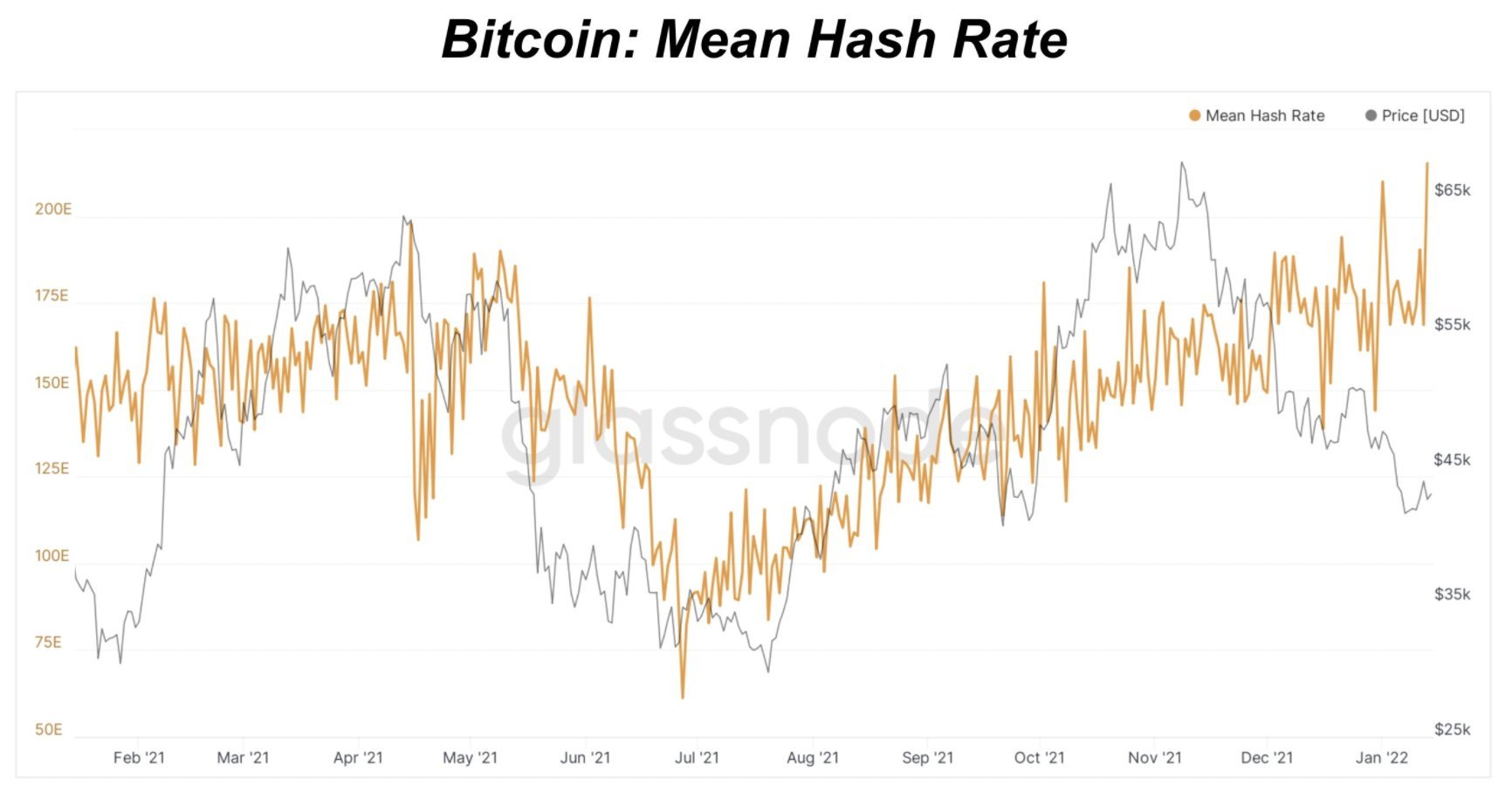

BTC Hashrate Makes New ATH

With the Internet restored in Kazakhstan last week, the hashrate of the entire BTC network exceeded 200 EH/s, reaching a record high. This positive development could restore traders’ risk appetite in the upcoming days as experts predict the growth up to 300 EH/s in 2022, signalling that the BTC network is getting more secure, inevitably leading to a rise in price with time.

Select Altcoins Show Signs of Life

It wasn’t just BTC showing signs of life as some altcoins did even better last week. Alternative smart contract Layer-1 blockchains, other than ETH, have been the current hot topic among investors looking to diversify their assets. FTM, ONE, ATOM, and NEAR – all made significant strides last week, each gaining more than 20% to become the new darlings amongst traders. The extent of the popularity was shown by a new nickname being introduced for the combination – FOAN. Just as the FAANG acronym was synonymous to represent the five favourite tech names, FOAN has now been coined to represent the four top performers in the market currently.

In order to not let the four coins take all the limelight, old dog DOGE also made huge gains from the get-go last week, rising five consecutive days since bottoming out at $0.14 on Monday. By Friday, DOGE was up by 50% going back to a high of $0.215 after Tesla added DOGE as a payment method for merchandise on its website. While this news had been previously telegraphed before, having it come into fruition brought cheers to traders who took the chance to scoop up the beleaguered token from its low price of $0.14, which was an 80% fall from its high of $0.74 made last May. With the DOGE-1 mission also set to take place in the upcoming months, the turnaround in price could put DOGE in a good position for better performances in the days ahead.

Another token to keep an eye on is LTC. Whale addresses have impressively accumulated 5% of the circulating supply of LTC within the last 15 weeks. Addresses owning between 10,000 to 1 million LTC have 10% more coins than they did just 3 months ago. Such accumulation usually leads to price increases in the not-too-distant future.

In the current moment however, as crypto prices did not manage to move higher during the weekend, traders have started to put out short positions in anticipation of price falls when the traditional markets open this week.

The funding rate for BTC has fallen into negative territory as more short than long positions are being opened. As leveraged traders congregate on short positions, a short squeeze may occur to wipe out the leverage to return funding back to neutrality. Hence, while not guaranteed, the potential of a short squeeze happening this week should not be ruled out.