Governance tokens are cryptocurrencies used to represent voting on a blockchain, distributing the power of making significant changes from a centralized structure to the entire community. Governance tokens are one of the unique assets in the crypto sphere.

What are Governance Tokens? – Definition & Meaning

Governance tokens are cryptocurrencies that represent the voting power of a blockchain project. They also represent the main utility of DeFi protocols as they distribute powers and rights to the users of the ecosystem via these tokens.

There are many uses for governance tokens, as it allows community members to use them to influence the plans and characteristics of a protocol directly. The most common uses will be to vote for different fee structures, implement UI changes, change the reward distribution, revise the development fund, and many standard functions.

Although most of the tokens on DeFi are governance tokens, they are not necessarily limited to just voting. Governance tokens can also be used to stake it, take out loans, and perhaps even earn money via yield farming, depending on the ecosystem.

How does blockchain governance work?

Blockchain governance will work differently in different ecosystems, but there are a handful of groupings you can think of when it comes to implementing it. Governance tokens are a significant part of the crypto ecosystem and are more likely to become much more prominent as time goes on. The following types of governance are by far the most common.

Top-down Governance

Top-down governance, or what you may think of as traditional governance, is power structured in the shape of a pyramid. In other words, there are bigger decision-makers at the very top, followed by a group of underlings to execute new development.

These are some of the most efficient governance structures, especially in large communities. After all, considering everybody’s opinion when there are tens of thousands of voting members is very difficult. The organization and execution of everybody’s wishes would become impossible, so much like in the real world, a few members are elected to represent everyone.

However, sometimes the power is accumulated in the hands of the chosen few. This may not be very inclusive of those looking to get involved in the ecosystem and work against everything crypto stands for. In other words, a “top-down governance” situation typically is not a crypto ecosystem that investors like.

Off-Chain Governance

In an ecosystem that uses off-chain governance, there is a mix of non-chain executions and off-chain decision-making. In other words, decisions are made away from the blockchain, discussed at conferences, or with written proposals, and then executed on the blockchain in a separate process.

This is the politics of the real world and brings analog issues into the blockchain, meaning that you have outsized power. Most of the power lies in the hands of developers and large holders.

On-Chain Governance

On-chain governance allows for decisions to be discussed informally by the entire ecosystem and allows all stakeholders to express their opinions. Proposals are accepted or rejected via governance tokens, allowing holders to vote on major decisions and have them weighed directly in proportion to their holdings and stake in the project.

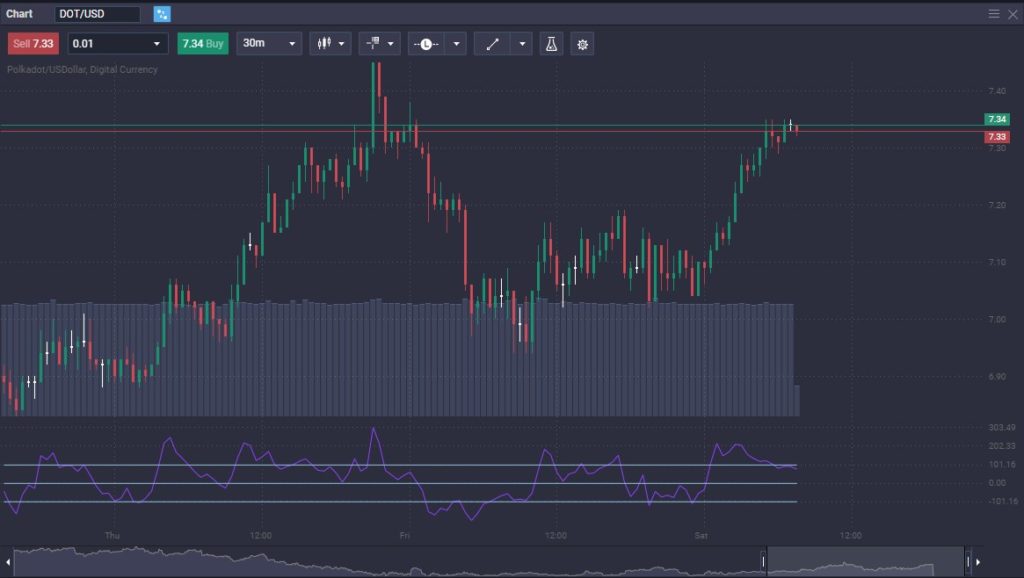

All changes in an on-chain governance ecosystem are coordinated on the blockchain network and are approved or rejected proportionally by anyone holding a governance token. Unlike off-chain governance, the decision is not in the hands of very few. However, the more of the governance token you own, the more votes you have. Examples of this type include Polkadot, Decentraland DAO, and Yearn Finance.

Why do Governance Tokens Matter?

Governance tokens allow everybody to have a voice in an ecosystem. Any system that allows everybody to have a say becomes the ultimate democratic experiment. Developers don’t necessarily have to make hard choices; they can interact with community members to find out what is wrong with the project. In other words, everybody is involved in growing the project and perfecting it.

This type of governance allows users to bring change to smart contracts. Because of this, if the project’s ledger gets attacked, funds get stolen, or if there’s any other malicious activity, neither the users nor the developers are forced to fork to a different network.

Governance tokens matter because they represent true decentralization. They are not pre-mind, and the decision-making process is limited to those who have an actual interest in a platform. They can be thought of much like shareholders in a corporation.

What Are the Applications of Governance Tokens?

The significance and application of governance tokens will vary from ecosystem to ecosystem, but in general, there are plenty of similarities between many. The most common applications include some of the following:

- Voting on fees associated with network transactions

- Ensuring the best practices for implementation of user interface modifications

- Changes in reward distribution from transaction fees

- Revisions in developer funds

- Staking and taking out loans

- Yield farming

Governance Token vs. Utility Token

Utility tokens are similar to governance tokens in that they allow users to vote on token listings on an ecosystem or minor decisions. The governance token provides much more individual power, creating loans, staking, transaction fees, etc. One of the best ways to look at this is through the prism of governance tokens being an upgraded version of a utility token. The utility token is most often used to pay fees on a system.

Where Does the Value of Governance Tokens Come From?

Governance tokens can be extraordinarily valuable. Liquidity mining, lending, and staking make governance tokens very valuable, as the ability to benefit from decentralized finance continues to attract massive inflows of trading capital.

Speculation is one of the biggest drivers of value in the crypto markets. Still, as time goes on, most of these governance tokens will likely become even more valuable as it becomes much more commonplace for people to do financial transactions on DeFi platforms.

Examples of Governance Tokens

Governance tokens are found in multiple ecosystems and can serve a whole host of different uses. Each ecosystem tries to address a specific problem, but it should be noted that most of these involve some type of decentralized finance.

Maker DAO (MKR)

MKR, the governance token of MakerDAO, is popular as it is one of the biggest web3 lending platforms. MKR token holders can express their votes on proposals for changing economic rules in MakerDAO governance.

MakerDAO is a peer-to-peer lending platform, eliminating the middleman such as a financial institution. The users collateralize loans with ETH via a smart contract, allowing them to repay the loan and gain control of their ETH again. This is especially useful for those who want to hold on to crypto assets for the long term but borrow against them in the meantime.

Uniswap (UNI)

UNI, the governance token for the Uniswap protocol, is one of the most popular tokens. Token holders can vote for the future of the ecosystem. Developers have tight control over the future direction of the project.

Yearn.Finance ($YFI)

$YFI, the native token of the Yearn.Finance project is a popular governance token among traders. The protocol has the advantage of complete decentralization, as developers behind the $YFI governance token have focused on allocating control to the community. The token also implies that the development team emphasizes the possibility of creating a completely self-sufficient DAO or Decentralized Autonomous Organization.

Ethereum Name Service (ENS)

ENS, the governance token for Ethereum Name Service, is an excellent example of a governance token that shows promising rewards to those who are early adopters. This project airdropped tokens at the end of 2020, causing significant hype in the crypto and web3 space. Early adopters have received exceptional rewards for their support, and the ecosystem has further plans to reward them.

ENS hopes to provide a solution to solve naming conventions in the crypto space. Instead of remembering long strings of characters for wallets and addresses, ENS hopes to simplify the process.

Compound (COMP)

COMP, the ERC-20 utility token running on Ethereum in the Compound ecosystem, allows holders to vote for changes to the network via the compound governance dashboard for this very popular DeFi lending/borrowing platform. Compound also is well thought of as it allows users to stake their digital assets and lend or borrow specific cryptocurrencies. Some of the most common ones include ETH, DAI, ZRX, USDT, USDC, BAT, and many others.

What Are the Advantages of Governance Tokens?

There are numerous advantages of governance tokens, including, but not limited to the following:

- Decentralization: Governance tokens are one of the main tools developers can use to make a decentralized financial protocol. Without these tokens, projects would have no way to control smart contracts. Using tokens instead of having the power in the hands of just a few people makes it fairer and more equitable.

- Collaboration: Collaboration opens up the possibility of voting for holders. When users can vote on the issues of the ecosystem, they are incentivized to become active with other community members.

- Community involvement: Governance leads to communities having much more involved members, as they have both reasons and the ability to steer a project’s path and direction.

- Efficiency: Governance models make it easier for developers to arrive at concrete answers and implement changes that are deemed necessary by the community.

What Are the Disadvantages of Governance Tokens?

Although there are multiple advantages of having governance tokens, there are a few disadvantages as well, including:

- Whales: One of the biggest problems the crypto has is the emergence of “whales,” or people with massive amounts of a token exerting stronger than normal influence.

- Selfishness: Some people will vote for purely selfish revisions, not necessarily for the good of the community. There will always be selfish actors who vote on decisions that only benefit themselves.

- No accountability: There is no clear accountability with a democracy-based governance model. If one chooses to vote detrimentally, they are free to do so.

How to Get Governance Tokens

Governance tokens can be purchased in an exchange like many other crypto assets. The governance token acts like any other coin in the cryptocurrency markets, as you can store them in a wallet, stake them, or trade them. However, if you are simply looking to speculate on price appreciation or depreciation, you can use a CFD to benefit from price movement. Flurex Option offers CFDs on many governance tokens, allowing you to get in and out of the market without the hassle of custody.

What is The Future of Governance Tokens?

The future of governance tokens is wide open. There is a lot of uncertainty out there, and possibilities abound. There are concerns regarding regulations, as the SEC is actively looking at which tokens will be considered securities. (As of 2022, Gary Gensler stated that very few crypto-assets should be considered. However, this could change at any time.) Other regulatory bodies around the world are doing the same type of research.

Governance tokens will almost undoubtedly be a mainstay and a crucial component of ecosystems going forward, as long as there is demand for user-owned networks. Governance tokens are also going to be essential for the world of decentralization.

Conclusion

In conclusion, governance tokens are crucial for operating a decentralized network, which ultimately is the goal of most crypto enthusiasts. It allows voting, staking, and yield farming, which is also a considerable part of the crypto market. In this sense, governance tokens will continue to be essential and, therefore, should carry a significant amount of value over the longer term.

However, governance tokens will also rise and fall in value with the use of a particular blockchain, so in a sense, you can think of them as a barometer of popularity. If a blockchain project becomes extraordinarily popular, the governance token should have more value based upon yield alone. Looking at this ecosystem feature, it’s worth noting that the more popular the blockchain, the more valuable the governance token will be.

However, if a blockchain starts to lose its popularity, then governance tokens will more likely than not fall in value. The entire crypto market has been in flux over the last couple of years, as traders are still trying to figure out what they will be doing. That being said, the only way to truly influence your favorite ecosystem is to be able to vote on that ecosystem, thereby making a governance token quite powerful.

What is a governance token example?

Cardano, Nexo, and Solana are all examples of governance tokens, as they allow you to stake and vote on the ecosystem.

Are governance tokens worth it?

Yes, as they quite often come with other benefits beyond voting. Yield farming and staking for rewards are two common benefits.

How much are governance tokens worth?

Like any other asset, they are set by a market price, assuming they can be traded.

Can you make money with governance tokens?

Yes, those who hold governance tokens can make money by staking and earn money by yield farming.

Is Ethereum a governance token?

Yes, it is. However, it should be noted that the process of proposing changes is done off-chain.

Are governance tokens fungible?

Most are, but this will depend on the exact application being discussed.

Can you sell governance tokens?

It can depend on the project, but in general, yes, you can.