Technical analysis (called TA for short) is a subjective study that combines statistics with patterns that must be recognized by the naked eye. If that eye is untrained, technical analysis can appear to be less valuable, or even witchcraft. It is imperative to learn the basics and building blocks of technical analysis to begin to discover its endless value.

Here’s what to look at to be on top.

What Is Technical Analysis?

Technical analysis is the study of price action, chart patterns, trends, volume, indicators and more, which analysts, investors, and traders can then use to help predict future market outcomes or prive movements with some degree of accuracy.

Because there is some subjectivity to the practice, patterns can fail, and results can vary, it can only be used to increase the probability of a profitable trade, not guarantee it.

How Is Technical Analysis Used In Cryptocurrency?

In cryptocurrencies, technical analysis is used for a variety of reasons all of which support crypto trading and investing, including:

- Predicting short and long-term price valuations

- Understanding the direction of trends

- Finding logical points where trends may reverse

- Outlining support and resistance levels

- Discovering price patterns

- Predicting possible outcomes

- Developing and deploying strategies to protect capital

- Gauging crowd sentiment

- Speculating over markets

- Making a profit on price action

The Idea Behind Technical Analysis

The idea behind technical analysis is that these patterns and signals actually represent human behavior playing out on the price chart. Investors and traders are human, and while today there are many bots out there or algorithmic traders that use automated chart signals, even those focus on historical patterns that still make up the foundation of technical analysis.

Humans tend to become overly emotional – especially when it comes to fear and greed. Fear and greed drive the price action in financial markets, and to a lesser extent, supply and demand. Greed fuels demand, and fear unlocks supply into the market. However, these human behavioral patterns are predictable.

Fear and greed drive the price action in financial markets, and to a lesser extent, supply and demand.

For example, according to Edwin “Sedge” Coppock and his early research related to managing his church’s investments, a bear market will last around the same length of time it takes for a person to get over the bereavement of a loved one. The studies came in at between 11-14 months. Bitcoin bottomed a full 11 months after the peak in 2017, and the new bull trend began exactly at 14 months. Could this be a mere coincidence, or is this a practical example of the relationship between human behavior and technical analysis?

Why Does Technical Analysis Work In Crypto?

Technical analysis works better in crypto than many other asset classes, but why? Crypto assets like Bitcoin and Ethereum are becoming more mainstream over the last year or so, but still remain highly speculative assets. Speculative assets are more challenging than say the stock market to assign a reasonable and realistic valuation to.

Stock share prices often respond more to fundamental changes in quarterly revenue reports, for example, as the share prices are tied to company performance. Real-world data exists that analysts can use to give stocks a valuation. On-chain crypto fundamentals are still in their infancy, by comparison.

Because speculative assets like crypto lack this fundamental layer, investors are left to then guess, or speculate of what might happen in the future. It also means that price action is fueled even more so by human emotions than other assets, which causes cryptocurrencies to respond more favorably to the practice of finding price patterns and more.

Price action is fueled even more so by human emotions than other assets.

Technical Analysis Vs. Fundamental Analysis

Both technical and fundamental analysis are ways to find an asset’s intrinsic value. Technical analysis focuses on the price action, trend, and more, by using technical indicators and oscillators, chart patterns, volume, and more. But it only provides one half of the picture.

In traditional investing and trading, there is technical analysis and fundamental analysis as we touched on briefly above. Fundamental analysis is broken down further into qualitative and quantitative. Qualitative is more about personal beliefs and gut instinct, such as buying a stock because you find the CEO to be a strong entrepreneur and leader. Quantitative looks at statistical data, such as company revenue and expenses, and much more.

In crypto, fundamental analysis rarely involves a company, and instead looks at the health of the underlying blockchain network. On-chain analysis can also look into trends of BTC or other crypto holders by examining wallets, the amount of value they store, how much moves across the network, and many other metrics.

Limitations Of Technical Analysis for Cryptocurrency

Technical analysis is never a guarantee of profits. Analysis is also a lot easier than actually getting into position and putting a strategy into practice. Markets move quickly, and proper attention must be paid to risk management. For example, no trade should ever be made without a stop loss level chosen and a target in mind.

Doing so can prevent unwanted drawdowns and ensure profits are booked. Otherwise, emotions can get the best of even the best investors and traders.

What To Understand Before Doing Technical Analysis In Crypto Market

Just like everything else in the world, practice makes perfect. Also, less is more. Those new to technical analysis often overdo it with the number of lines drawn and indicators used. Relying on too many tools can lead to mixed signals or confirmation bias.

Using the fewest tools possible and relying on only a handful of properly back tested strategies will always outperform the noise trader with a messy chart. Otherwise you could get stuck in a state of chart analysis paralysis.

It is also important to understand that there are no guarantees, and technical analysis is only used to increase the probability of success, and provide data related to risk management and trends.

Technical analysis is also an always-evolving study. A good technical analyst is like a detective, adding new evidence to the chart as it is uncovered. An analyst must also be willing to ditch previous data as new information is uncovered and previous ideas are invalidated.

Crypto Technical Analysis Tools

Technical analysis works best when focusing on the basics or the so-called building-blocks of TA. Mastering the signals these foundational tools provide, is the first step in becoming profitable. Only then are more advanced tools recommended.

Japanese Candlesticks

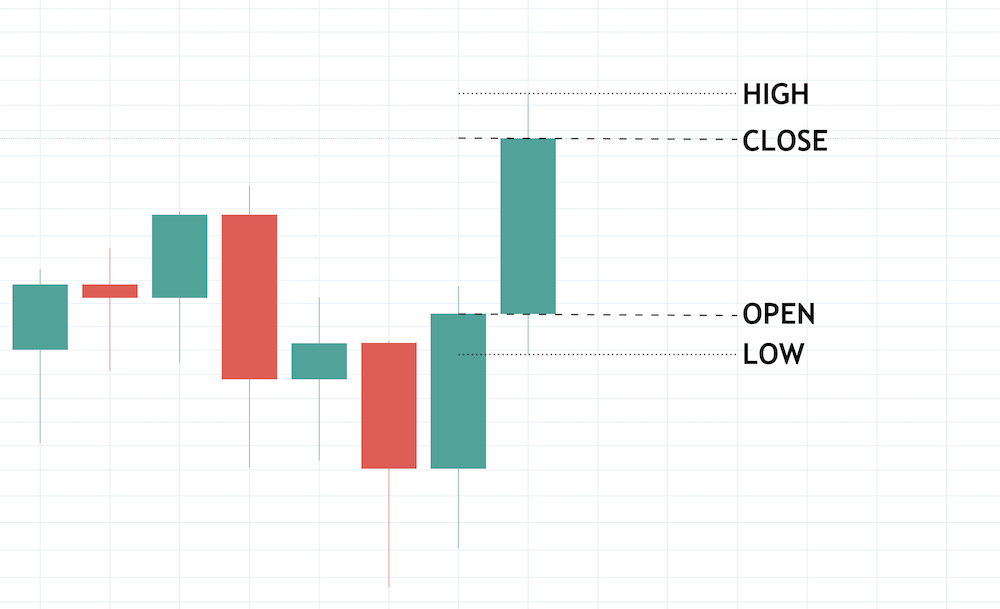

Crypto price charts or the price charts of traditional assets are either displayed as a line chart that rises and falls to represent the current price action, or the price action is depicted using Japanese candlesticks.

These candlesticks provide additional data to an analyst, such as the open, high, low, and close of each trading session. Each candlestick is just one session of whatever particular timeframe being viewed.

Individual candles or candlestick patterns in a sequence can give an analyst a wealth of information about the market and its participants. Candlesticks can even be used to spot trend reversals and other points of indecision.

Uptrends And Downrends

Markets are cyclical, and move in either uptrends or downtrends. Larger uptrends and downtrends are referred to as bull or bear markets, however, these uptrends or downtrends can occur on any timeframe, no matter how larger or small.

By definition, an uptrend is a series of higher highs and higher lows, and a downtrend is a series of lower lows and lower highs. Uptrends and downtrends often form channels, in which the price moves steadily toward a bottom or top, where the trend will reverse.

Time Frames

An uptrend on a higher time frame can have a short term downtrend in it. For example, if Bitcoin is trending on the weekly or monthly time frame, a 15-minute or 4-hour downtrend could provide some correction, but would have minimal impact overall to the greater trend.

Low timeframes shouldn’t be ignored, however, as all reversals must start from the lowest of timeframes. It is important in this case to treat all time frames with equal respect and understand how smaller time frames can influence larger ones, and vice versa.

Support And Resistance

Support and resistance are areas of interest and where orders are ready and waiting in abundance. This can be an area where strong price action took place in the past, a Fibonacci ratio, a rounded number, or other.

Investors and traders are advised to buy support and sell resistance until either side breaks. A breakout sometimes returns to the resistance or support level to retest it and confirm it, before moving on to a measured target. Support and resistance levels also give traders and investors an idea on where to place stop loss orders, or where to take profit.

Moving Averages

Moving averages smooth out rolling data and turn it into a visual tool. Moving averages are based on a specific period, most commonly 20-period, 50-period, 100-period, and 200-period.

Moving averages can supply signals on when to buy or sell, act as support or resistance, and more. For example, a golden cross can occur when a short-term moving average crosses above a long-term moving average and is usually a signal of greater price appreciation ahead.

Relative Strength Index (RSI)

The Relative Strength Index is a market strength-measuring oscillator that can reveal to analysts if an asset is overbought or oversold. The idea behind the tool is that when an asset reaches above a reading of 70 or below 30 it is overbought or oversold. When this occurs, it also suggests that a reversal could be near.

The RSI is an important indicator for analysts, as it can reveal divergences between price action and the underlying market strength. If price makes another high, while the indicator doesn’t, this is called a bearish divergence and could tip an analyst off that a reversal is possible.

Other popular tools include the Stochastic oscillator, MACD, Ichimoku, Bollinger Bands, and more.

Trading Volume

Technical analysts have two data sets to work with that other indicators and tools are derived from: price and volume. Trading volume represents the total shares of an asset traded on any given day at any price – both buying and selling.

Trading volume is said to precede price, meaning that technical analysts can often see trends changing in volume before the corresponding reaction happens in price action.

Market Cap

There are two ways a technical analyst will consider the market cap of cryptocurrencies.

First, the average crypto enthusiast should focus on assets currently listed in the top ten largest cryptocurrencies by market cap, which should help to reduce some of the risk related to more obscure cryptocurrencies. The current top ten is as follows.

Next, analysts can look at the total cryptocurrency market cap as a whole to gain insight into the overall market trend, and not just one individual asset. A rising tide lifts all boats, so if the total crypto market cap is breaking out, as the picture below reveals, it is likely the rest of the cryptocurrency market will soon follow.

Combining It All To Make A Trading Strategy

At this point, you should have an idea of how to put together a trading plan using what’s listed above, using an award-winning trading platform like Flurex Option.

After selecting an asset from the total cryptocurrency market top ten, it is time to start looking at the trend and where a support level or resistance level might lie. Patiently waiting for a reversal candlestick on high volume at resistance line or support line could make for an ideal entry. The RSI can confirm the single with a divergence, and a crypto trader can double-down on the position when there is a crossover of the moving averages.

All of these tools and more are available as part of Flurex Option’s free technical analysis tools offered to all users within the account dashboard.

Cryptocurrency technical analysis is a subjective and confusing practice, leaving many questions left unanswered. To clear up confusion, we’ve put together this handy FAQ.

What Is Technical Analysis In Cryptocurrency?

Technical analysis in crypto is the study of crypto market prices, volume, momentum, and more, to decide if the market is bullish or bearish. It can also be used to predict possible future outcomes, find support and resistance levels, and much more.

Is Technical Analysis The Same For Crypto?

Technical trading is the same no matter the coin, token, or the asset class, which is what makes technical analysis so valuable to crypto investors, compared to on-chain data which isn’t yet fully understood.

Is Technical Analysis Applicable To Cryptocurrency?

Despite the substantial volatility, technical analysis applies well to crypto and should be done before any investment is made as it can help to forecast future prices. Never invest more than you can afford to lose.

How Do You Analyze Cryptocurrency?

By researching a technical chart to make a prediction on future price movement based on the current market sentiment, trading activity, and more. Analysis trading can maximize profitability and minimize the notorious risk associated with the digital currency market.

Which Crypto Chart Is The Best For Analysis Right Now?

Currently, Bitcoin charts offer the most opportunity for chart pattern recognition due to the longest price history to review and compare. Bitcoin was the first ever cryptocurrency and has the price chart with the most available price history for analysis.